Key Takeaways

- Choose Cryptoworth for complex, multi-chain portfolios to gain an automatic edge in large-scale asset management.

- Connect crypto tax software via read-only APIs to automatically match transactions without sharing private keys or moving funds.

- Simplify the overwhelming process of tax season by using specialized tools that create confidence and ensure legal compliance.

- Note that the crypto accounting industry is a massive, highly competitive market now worth billions due to growing trader demand.

As tax season 2025 approaches, selecting the right crypto accounting software has become essential.

Research shows that nearly 80 percent of traders still struggle to understand how their trading activities affect their taxes. This knowledge gap has fueled a growing market for specialized tools, pushing the crypto accounting industry to a value of $4.94 billion last year and continuing to expand.

The cryptocurrency market operates around the clock, with prices changing in seconds. This constant movement makes accurate tracking and tax reporting a necessity. Among the leading solutions, Cryptoworth has gained notable recognition for its innovation and reliability. It was named one of the fastest-growing accounting products in G2’s 2025 Best Software Awards, standing out among more than 125,000 competitors.

Our team has tested over 2,000 finance and accounting platforms and published more than 1,000 detailed reviews. Based on this experience, I have compiled a list of the five best crypto accounting tools to help you stay organized and confident this tax season.

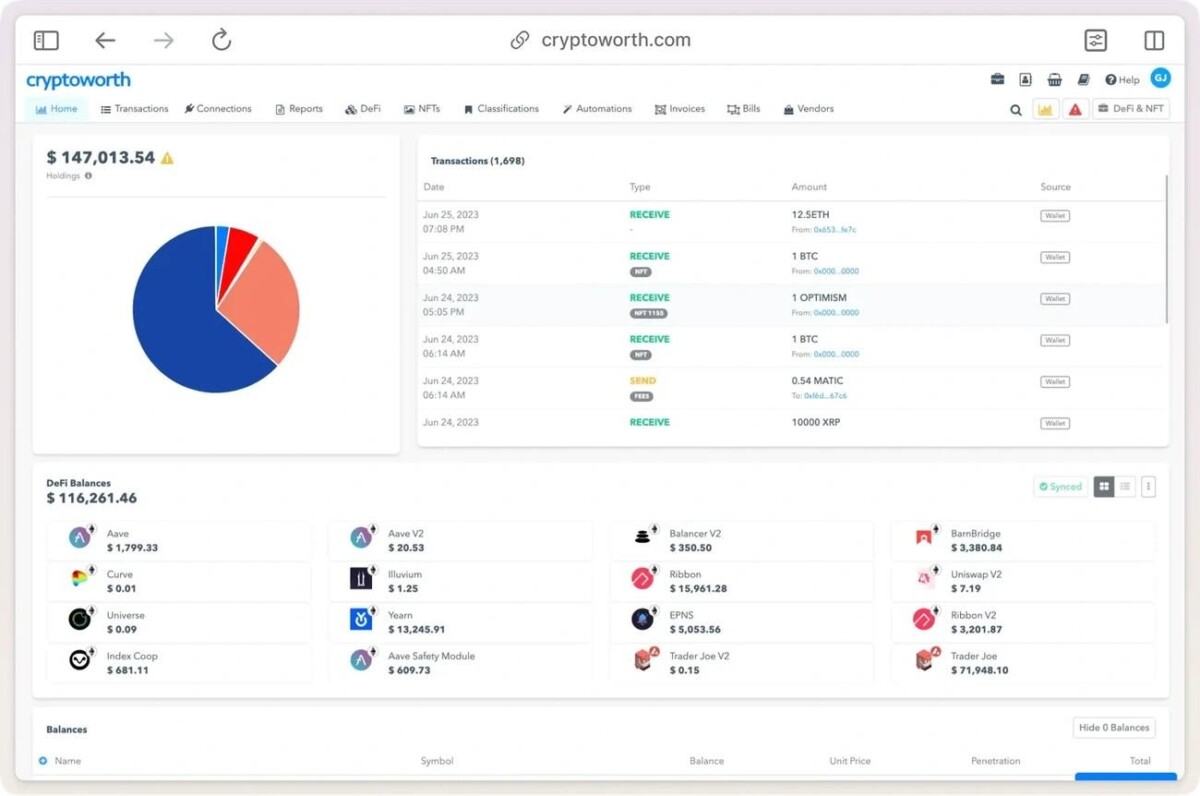

1. Cryptoworth

Cryptoworth is a detailed solution that helps businesses handle complex digital asset accounting. The platform has become a leader in crypto accounting and was named one of the fastest-growing accounting products in the G2 2025 Best Software Awards.

Cryptoworth’s value comes from knowing how to connect with over 190 blockchain networks and more than 1000 data sources. This wide network means you can track and manage all your digital asset transactions in one place, whatever blockchain they’re on.

The software merges with popular accounting systems like QuickBooks, NetSuite, Xero, and Sage. This makes financial reporting and balancing easier by bringing together traditional and digital assets.

The pricing works well for businesses of all sizes. The simple plan starts at $99 per month. For bigger operations, there are several tiers:

- Business Tier 1 ($300/month): Has ERP support, 150 connections, and handles up to 50,000 transaction lines

- Business Tier 2 ($600/month): Gives you 300 connections and 150,000 transaction lines with better support

- Business Tier 3 ($1000/month): Comes with multi-entity licensing and 500 connections

- Enterprise: Custom pricing with unlimited entities and connections

My analysis shows that Cryptoworth is perfect for businesses that want to simplify their crypto accounting, especially those with complex digital asset portfolios across many blockchains. It solves the biggest problems in cryptocurrency accounting and tax prep through its broad connectivity, automation, and great customer support.

2. Koinly

Koinly makes crypto tax preparation easy with its simple platform built for individual investors and small trading operations. The crypto bookkeeping software helps everyday users handle their tax obligations, unlike solutions made for big enterprises.

The platform connects to a huge network of data sources. It works with over 1000 direct integrations and more than 7,200 DeFi protocols while allowing unlimited CSV imports. Users can import their transaction data from many sources without sharing private keys. This keeps everything secure while capturing all data completely.

Koinly works through two main ways to import data:

- Read-only API connections for automatic synchronization

- CSV or Excel file imports for manual updates

Koinly’s smart transfer matching stands out as one of its most important features. The platform spots transfers between your wallets automatically. This stops these moves from becoming taxable events by mistake. Your original cost basis stays accurate across wallets, which you need for correct tax calculations.

The pricing comes with free and paid choices. The free plan lets anyone track their portfolio and connect unlimited wallets. But you need to upgrade to paid tiers to get tax reports:

- Newbie Plan: $49 annually with support for 100 transactions

- Hodler Plan: $99 annually supporting 1,000 transactions

- Trader Plan: $179 annually accommodating 3,000 transactions with expert support

Without doubt, Koinly ranks among the best crypto accounting software choices for individual investors and those with straightforward crypto portfolios. It combines extensive exchange support, international tax compliance, and an easy-to-use interface. This makes it valuable during tax season for anyone who wants to report their digital asset activities correctly.

3. CoinLedger

CoinLedger started in 2018 when three co-founders built a solution to solve their own crypto tax reporting problems. The platform (previously CryptoTrader.Tax) has grown into one of the top-rated crypto tax and portfolio tracking solutions that more than 700,000 investors use worldwide.

CoinLedger’s accessible design makes it different from other platforms. Users without technical or financial knowledge can handle crypto tax reporting. The platform connects to hundreds of exchanges and blockchains, so users can file their taxes in minutes instead of hours.

The platform’s detailed transaction classification system makes it special. The software sorts your activities automatically based on transaction type – whether you trade NFTs, stake on DeFi protocols, or earn rewards through exchanges. This system saves hours you’d spend sorting through complex transaction histories manually.

CoinLedger’s pricing follows a tiered model based on transaction volume:

- Free: Portfolio tracking and preview tax reports (no payment details required)

- $49: Up to 100 transactions

- $99: Up to 1,000 transactions

- $199: Up to 3,000 transactions

- Higher tiers available for more transactions

CoinLedger strikes the right balance among the best crypto accounting software options. It combines easy use with detailed features and professional support. The platform adapts to new crypto tax rules while making a once-overwhelming process easier for crypto investors.

4. ZenLedger

ZenLedger, a 6-year-old specialized tax-focused platform, has become a leader in the crypto accounting space since 2017. The software excels at cryptocurrency tax calculations and stands out as one of the most complete solutions for crypto traders and investors.

ZenLedger’s seamless integration with mainstream tax filing tools sets it apart. The platform works directly with popular online tax software like TurboTax and TaxAct. This makes it possible for investors to file taxes for their entire portfolio—including crypto holdings—on a single platform.

ZenLedger’s pricing tiers cater to different user needs:

- Starter: $49/year – Ideal for beginners with Bitcoin or Ethereum, supporting up to 100 transactions

- Premium: $149/year – The most popular tier, supporting up to 5,000 transactions with DeFi support, staking, and NFTs

- Executive: $399/year – Expanded to handle up to 15,000 transactions

- Platinum: $999/year – The top tier offering unlimited transactions and multi-user support, plus two hours of dedicated customer service

The platform’s recent partnership with MetaMask, the world’s leading self-custodial wallet, has boosted its capabilities. MetaMask Portfolio users can now access ZenLedger’s tax reporting tools with one-click imports. This integration lets users automatically import their MetaMask wallet transactions into ZenLedger, making crypto tax preparation much simpler.

These capabilities make ZenLedger one of the best crypto accounting software options, particularly for users who need complete tax reporting solutions for complex cryptocurrency portfolios across multiple platforms.

5. Ledgible

Ledgible stands out in the crypto accounting landscape with its professional-first approach to digital asset tax and accounting. This AICPA SOC 1 & 2 audited tax software will give a verified set of internal controls and industry-leading data security for institutions and professionals alike.

Ledgible strengthened its market position by partnering with Thomson Reuters. The company merged its digital asset tax expertise with the ONESOURCE Tax Information Reporting (OTIR) platform recently. This collaboration helps address new IRS requirements for Crypto Brokerage reporting, including the new Form 1099-DA that digital asset brokers must implement starting in 2025.

Ledgible’s core components are:

- Digital Asset Tax – Professional-first crypto tax software built for CPAs, tax professionals, and accountants that naturally connects with other systems

- Tax Information Reporting – Combines crypto data normalization with existing 1099 and TIR providers

- Digital Asset Accounting – Institutional-grade platform to optimize cryptocurrency operations for enterprises

- Digital Asset Data – Proprietary data layer that normalizes crypto data across post-trade systems

The system merges naturally with many accounting systems like QuickBooks Online, Xero, Netsuite, Advent Geneva, Wall Street Concepts, SEI, Eagle, and others. Users can keep all their records in one place, creating a unified approach to financial management.

Ledgible provides a secure, professional-grade solution that bridges traditional accounting practices and digital asset management. Its institutional quality, extensive integrations, and specialized features make it valuable for accounting professionals and enterprises with significant cryptocurrency operations preparing for the 2025 tax season.

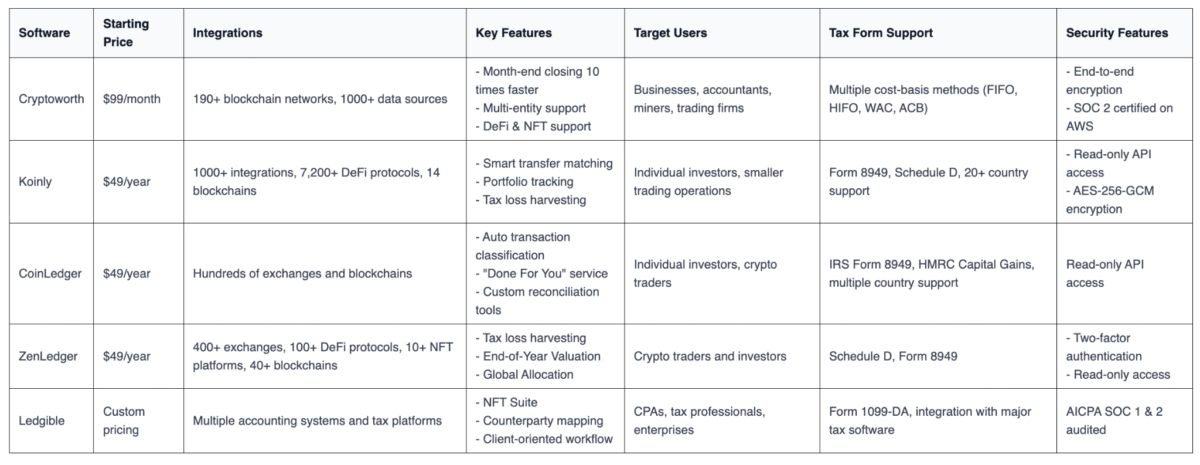

Comparison Table

Navigating the Future of Digital Finance

As digital assets continue to redefine how value moves across global markets, reliable crypto accounting tools have become essential companions for investors, traders, and finance professionals alike. Each platform featured here brings something unique to the table, from Cryptoworth’s automation and multi-chain power to Ledgible’s institutional-grade precision. Together, they represent a new generation of accounting solutions built for transparency, speed, and compliance.

Choosing the right software can make the difference between a stressful tax season and a seamless one. The best option depends on the size of your portfolio, the complexity of your transactions, and the tools you already use for financial management. With the right platform in place, businesses and individuals can track every transaction confidently and stay ready for the evolving regulations that shape the crypto economy.

Frequently Asked Questions

Why is specialized crypto accounting software necessary for tax season?

The crypto market is open 24/7, with quick price changes. This means you need constant, accurate tracking for all your digital asset transactions. Specialized software tracks these complex movements and automatically handles tax calculations. This helps you comply with regulations and avoid mistakes when filing.

How does Cryptoworth handle crypto transactions across many blockchains?

Cryptoworth stands out because it can connect to over 190 blockchain networks and more than 1,000 data sources. This wide network lets businesses track and manage all their digital asset transactions in one place. It does not matter which blockchain a specific asset is on.

Which crypto tax software is best for an individual investor with a simple portfolio?

Koinly is an excellent choice for individual investors and small trading operations. It offers a simple platform built for everyday users. Its free plan lets you track your portfolio, and its paid tiers are affordable for users with fewer transactions needing tax reports.

What is the most important feature that prevents double-counting taxable events?

Koinly features smart transfer matching, which is a key tool. It automatically recognizes transactions between your own wallets. This feature stops these moves from being accidentally counted as taxable events. This helps keep your original cost basis accurate across all your wallets.

Is it necessary to have financial expertise to use a platform like CoinLedger?

No, CoinLedger was designed with an accessible look and feel, so users do not need a financial background. The platform automatically sorts your activities based on the transaction type, like trading NFTs or staking rewards. This makes the complicated process of crypto tax reporting much easier.

How does ZenLedger simplify the final tax filing process for crypto traders?

ZenLedger is known for its seamless connection with major tax filing tools. It works directly with software like TurboTax and TaxAct. This allows investors to file both their traditional and crypto holdings on a single, well-known platform, simplifying the overall tax preparation.

What makes Ledgible a suitable choice for large enterprises and accounting professionals (CPAs)?

Ledgible is a professional-first platform that has earned the AICPA SOC 1 & 2 audit. This gives it verified internal controls and high-level data security. Its institutional quality, especially the new partnership with Thomson Reuters, makes it ideal for businesses and CPAs dealing with large, complex crypto operations.

Does setting up an API connection with my exchange give the software access to my funds or private keys?

No, you do not share private keys when connecting to these platforms. The common way to import data is through a “read-only” API key. This only allows the software to view your transaction data for tracking and tax calculation. It cannot access or move your funds.

What happens if I have many small transactions from DeFi or staking rewards during the year?

Platforms like ZenLedger provide higher tiers, such as the Premium or Executive plans, which support thousands of transactions (up to 15,000). If you have complex activities like staking or DeFi, you need a tier with a high transaction limit to ensure all activities are reported correctly.

For growing businesses, what advantage does Cryptoworth’s integration with ERP systems provide?

Cryptoworth can merge with standard accounting and Enterprise Resource Planning (ERP) systems like QuickBooks, NetSuite, and Xero. This helps businesses by creating a unified view of their finances. It makes financial reporting easier by combining traditional and digital asset records in one place.