The AI-powered stock analysis market is on a tear, with dozens of new products and features launching each year that could revolutionize your portfolio and transform the way you trade.

There are a lot of tools out there and it’s hard to wade through the clutter and decide which tools actually do what they offer to deliver on that promise AND won’t break the bank.

To make it easier for you, our dedicated team has done comprehensive research and tested the top 8 AI-powered stock analysis available in 2025. Over 5,400 words of pure affiliate marketing wisdom The complete guide that teaches you the core features, pricing models and general effectiveness of every single piece of software here to help you make sense in this crowded market! Whether you are a beginner or a professional these hand picked tools will allow you the freedom to invest in the stock market and help ensure your overall success.

Website List

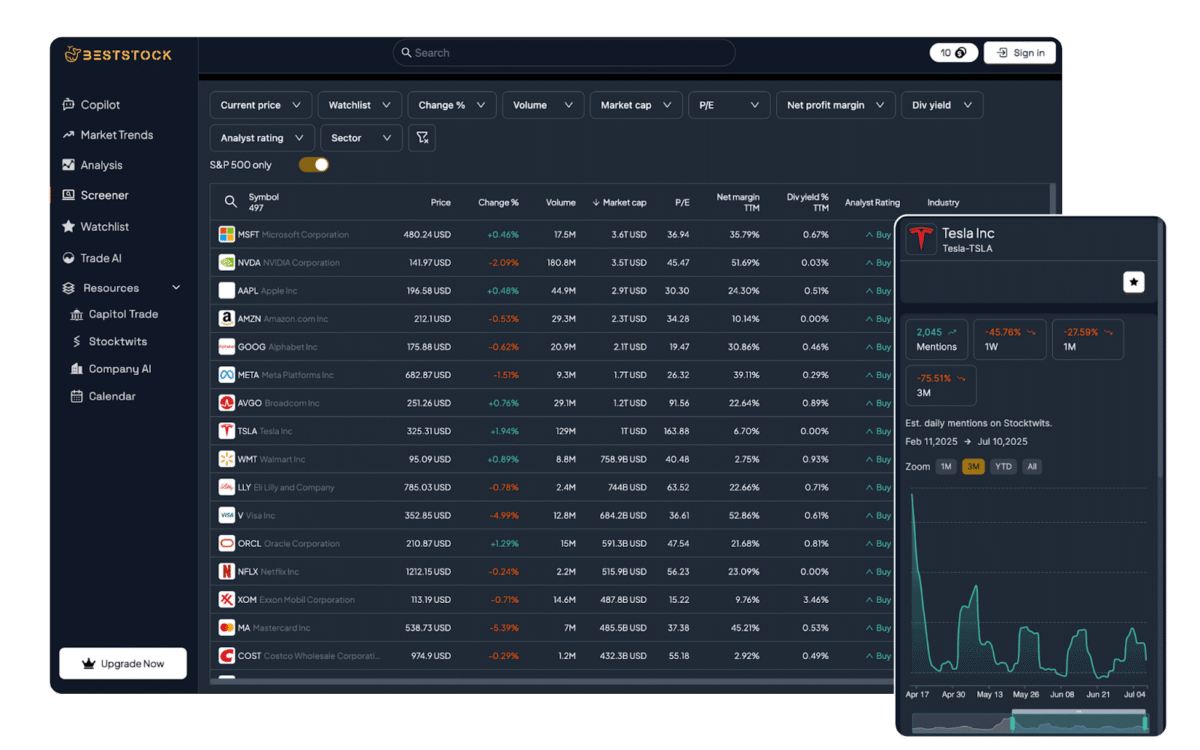

1. BestStock AI

What is BestStock AI

BestStock AI is an AI-powered stock analysis platform that assists investment teams in making better decisions using intelligent decision support via automated financial data processing and thoughtful analyses; focusing on research, it delivers actionable insights and comprehensive corporate financial intelligence for more informed, data‑driven decisions without tedium of manual work. With auto‑generated reports, market intelligence, detailed financials, BestStock AI empowers investors to act decisively—while it also includes a capital gains tax calculator which instantly estimates post-tax returns to help optimize trade timing and portfolio strategy.

Features

- Financial analysis powered by AI which automates data crunching for expeditious actionable insights

- Full US stock financials and earnings transcripts for better investment decisions

- A state-of-the-art market intelligence platform that provides you with the latest data-driven insights and research through daily, curation reports on smarter investing

- Strong data analysis solutions enabling statistical, financial and business analyses for deep-dive studies

- Intuitive interface that increases research efficiency, and reduces the heavy lifting for investment professionals

Pros and Cons

Pros:

- AI-enabled financial analysis for faster data crunching and insight generation

- In-depth market analysis with direct access to US stock financials and earnings transcripts

- Automatically generated reports and tables improve workflow and decision-making around research.

- Low manual effort, time saving for investment teams

Cons:

- May be more expensive than a few basic analysis tools

- Click here for additional features available on the mobile app Some offline functionality may require a connection to the Microsoft Dynamics 365 server and may be limited based on size, data usage, and some actions such as scoring.

- Mobile app features might be more limited than desktop, hurting the user experience

2. LevelFields

What is LevelFields

LevelFields is a groundbreaking artificial intelligence software designed to change the way people trade stocks and options. Its mission is to give traders unmatched data, alerts, and analysis that support investment decisions. With subscription plans for both DIY traders and those who need help along the way, LevelFields enables users to refine their trading profiles and gain a competitive edge in the markets.

Features

- Customizable subscription packages to meet your investment needs easily, with Do-It-Yourself options and support from experts.

- Historical data for more than 1700 forex data (FX) pairs and cross rate dating back to 1 January 1999 can be downloaded to an Excel spreadsheet.

- Custom one-on-one training to ensure that you get the most out of our platform and its investment potential.

- Expert analyst alerts on key investment opportunities and trade positioning.

- A dedicated customer support to attend to you, answer your questions and queries during the trading period.

Pros and Cons

Pros:

- Unrestricted data and trends coverage with the Level 1 Plan for DIY users

- Level 2 Plan for added support, and personalized training

- Alert configuration to get only the news you want.

- Option to Level-Up operate by upgrading from Level 1 >toLevel 2– with a credit for the first month

Cons:

- Level 1 users lack human support and advanced training

- Can’t downgrade from Level 2 to Level 1, which is less flexible

- More diffusion for people that aren’t familiar with the advanced feature of the platform

3. Danelfin

What is Danelfin

Danelfin is a new generation way to help you manage your personal or business financials. Its primary role is to offer its users budget planning, money spending tracking and financial analyzing tools which ultimately help them understand how much they spend and on what so they can live healthy financial lives. Combining user-friendly features with cutting-edge analytics (available only to in-depth subscribers at no extra cost), Danefin provides real benefit, helping users save time and money even on the way to reaching their goals.

Features

- Maximum security to safeguard your sensitive information and keep your privacy.

- Personalized workflows maximizing efficiency and productivity

- Seamless to use with your favourite tools and platforms

- Customer support on demand to help you whenever you need it

- Ongoing improvements and updates based on user feedback for quality performance

Pros and Cons

Pros:

- AI generated stock scores which evaluate you the combined representation of the three signal categories into simple to understand rating.

- Meaningful factor decompositions display the drivers (momentum, volatility, sentiment, insider etc.) of the score in a transparent manner

- Up to thousands of percentage in returns backtested signal performance with hit rates and drawdown stats to analyze the historical profitability

- Daily monitoring updates and alerts allow users to react to rating changes and risk movements as they happen

- Easy to use, visual and great for a quick idea or portfolio check up

Cons:

- Strong historical pattern and quant signals with lesser depth of the fundamental analysis used for factors

- Model returns may degrade in a regime change or in news-driven events that are not deposited into features

- Insufficient tooling and potential data bias can detract from interpretability for power users

- Coverage and data freshness are likely to vary by market/ticker; micro-caps, or illiquid (over-the-counter) names less so

- Scores could also encourage over-trading if utilised without risk management or validation externally from any proprietary combination.

4. TrendSpider

What is TrendSpider

TrendSpider is a powerful dynamic analytical platform designed to simplify trading Analitycs to provide traders with tools for autonational analysis. Its primary objective is to support trading decision through the use of complex algorithms, pattern recognition, and multi-timeframe analysis, providing a means in which traders can detect trending market conditions and take actions accordingly. TrendSpider seeks to make that technical analysis process easier so you can focus on what matters — improving your trading performances whether you’re new to the game or a seasoned pro.

Features

- State-of-the-art security measures to safeguard data and promote privacy

- Personalized dashboard system to meet the specific needs of the user

- Automated process flows that simplify operations and boost performance

- High level of compatibility with leading third-party platforms and applications

- Easy-to-use customer service features, such as video tutorials and live chat support

Pros and Cons

Pros:

- Strong attack under high load

- Full-functionality to cater for most user requirements

- Customer support is responsive and knowledgeable

- Affordable pricing plans for different budgets

Cons:

- Complicated to use interface, may take time to learn

- There are few provisions for configuring features to accommodate specialized requirements

- Some slight delay time during peak times

5. StockInsights

What is StockInsights

StockInsights is a state-of-the-art tool for value investors created by generative AI. Through instant access to public company filings, earnings transcripts and institutional filings it improves efficiency and productivity by saving time to users, allowing them more time to focus on a well-informed investment decision. With powerful analysts from various data sources, StockInsights provides investors an ease-of-use tool to navigate complex data and stay updated on their portfolio companies.

Features

- Artificial intelligence-fueled insights that distill complicated data for better-informed investment decisions

- Consolidated Due Diligence A more efficient, productive approach to research

- In-depth news and analysis of US and INDIA markets with actionable investment ideas.

- Seemless tracking of companies throughout your portfolio and get instant status updates on your investments

- Such generative AI capabilities help reveal deeper insights when you analyze across many datasets

Pros and Cons

Pros:

- Research capabilities for value investors are improved with AI-powered features

- In depth information from several datasets to perform due diligence efficiently

- Easy tracking of portfolio companies to stay up-to-date as an investor

- Created to increase productivity and decrease decision-making time

Cons:

- Minimal offering in the international market including US and India

- May take some time for users new to AI tools to get up to speed

- Subscription fees may be too high for retail investors

6. Finbox

What is Finbox

Finbox – Full Stack Investing Grab detailed financial metrics for all of the companies you follow including essential income statement and balance sheet metrics. It offers a range of valuation, modeling and research tools that help users make investment decisions with conviction. Through a blend of sound data and intuitive features, Finbox makes assessing stocks simple for everyone and leads the way in controlling your risk with disciplined decision making.

Features

- Strong security practices to ensure protection of your data and privacy, all the time.

- Dashboards that user be customize to a feeling experience

- Seamless compatibility with current tools and software to increase productivity

- Workflows that can be automated to help simplify the process and cut down on manual labor

- 24hour customer service to support you at anytime.

Pros and Cons

Pros:

- Strong features that cater to a broad spectrum of users

- Easy-to-use interface that eases new user boarding

- Strong integration with favorite third-party apps

- Updated and improved all the time, according to your feedback

Cons:

- Extra training may be necessary to make use of some of the more advanced features

- Offline access to limited users in low-bandwidth regions

- More expensive premium features than its competitors

7. AlphaInsider

What is AlphaInsider

AlphaInsider is a platform for trading strategies, open marketplace it connects traders and investors in a variety of trading styles. Its primary objective is to increase the user’s independence, delivering them original insights and approaches to trading that are community-driven ultimately improving their ability make informed decisions in the financial markets. AlphaInsider is a first of its kind trading platform, by building community and enable traders to collaborate, share knowledge and strategies. The goal is for everyone to improve their overall trading performance.

Features

- Advanced machine learning system that personalized and improved users’ experience

- Easy to use, easy navigation both for beginners and professionals

- Powerful project management features to help maintain a consistent workflow and high productivity

- Deep data insights and visualization for decision making

- Synchronisation across all of your devices for easy access wherever you are

Pros and Cons

Pros:

- Look to insider trading data Insider and selling-buying reports by executives and directors can telegraph conviction or caution.

- Aggregate Form 4 and similar filings into concise dashboards with filters by role, transaction type and size

- Ranks tickers by the highest/lowest average, maximum value, sum of values, best percentile rank and z-score yet to be eeeeee among all companies with an active insider-trading relationship.quantiles or Z-scores.

- Insider alerts and watchlists allow monitoring of key insider activity and unusual moves

- Custom research and backtesting workflows via integrations/exports to spreadsheets and APIs

Cons:

- Insiders could make some noisy or pre-arranged (10b5-1) trades which diminish predictability without deeper context

- There may be a delay between coverage and the current file times as well as intraday trading decisions not accounting for recent moves.

- Light in fundamentals or macro context relative to full-service platforms; insider data requires triangulation

- The strength of a signal varies across sectors, market cap and regime; micro-caps can exhibit spurious jumps

- There’s usually complex analytics, historical depth, and many more days of records behind higher-tiers.

8. StocksToTrade

What is StocksToTrade

StocksToTrade is an all in one traiding platform that was created to give you the tools needed to trade the stock market successfully. It provides a wealth of features including real-time news, trading guides, breaking news, level 2 quotes and advanced scanning tools geared to help you develop effective trading strategies and improve your portfolio analysis. StocksToTrade brings the best in educational content together with a suite of powerful trading tools to enable both elementary and advanced traders make better informed investment decisions possible.

Features

- Trading specific hardware for high efficiency and speed

- Custom built proprietary cold (for day traders) systems they have designed specifically for day trading benefits

- Robustness: Increased reliability to reduce instances of downtime and uninterrupted trading sessions

- Fully Compatible with all indicators and trading tools for MT4.

- In depth analysis and advice on the most suitable computiong solutions for your trading requirements

Pros and Cons

Pros:

- Extensive educational materials such as trading guides and beginner tutorials

- Variety of tools and strategies for trading different trading styles

- Real-time access to accurate and reliable market data including Level 2 quotes and stock scanners

- Fresh content and resources on topics relevant to today’s market

Cons:

- A very large amount of information to absorb for new traders

- Subscription fees could be higher than on simpler platforms

- Not enough emphasis is put into mobile app features and usability

Key Takeaways

- Do your homework before selecting an AI driven stock analysis software, as they don’t all provide the same level of accuracy and tools.

- Take your investment approach and budget into account when you are weighing apps, as some platforms may be a better fit for day traders vs. long-term investors.

- Where possible, begin with a free trial so that you can evaluate features and the user interface before you buy. This hands-on experience is invaluable.

- At first, read some feedback and opinions of customers like you, so you can get a more realistic view concerning its effectiveness in regards the predictions quality and user-friendliness.

- Keep an eye out for newer and better things in the world of AI stock analysis since technology changes fast and new tools might give a leg up.

- And don’t forget about community support and other resources, good help will increase your learning curve and over all experience.

- Take scale and future growth into account when choosing, make sure the tool can be adapted to your investment needs/strategies even as you grow.

Conclusion

In wrapping up this overview of the best 8 AI-powered stock analysis solutions, it’s apparent that a range of choices exist in the market to cater for differing investments strategies and predilections. The trick to making it work for you is to recognize what your specific financial needs are and choose the platform with the perfect mix of data analysis, user friendliness and affordability based on how you trade.

Whether you’re a DIY investor trying to optimize your portfolio, or a financial professional that wants better visibility into the market trends out there, these tested solutions are some of the best in class. Whichever platform you choose, they all have something to offer, from sophisticated predictive algorithms to easy-to-use platforms and strong customer support.

We welcome you to use this guide as a starting place for learning, but keep in mind that the best resource is your own hands’ experimentation. The future of stock analysis with AI is bright and selecting the right solution today can put you onto years’ path to investment money rain). How does it work Well, these amazing new products you see here are some of the most exciting releases in trading…and now they can be yours! So don’t say no – find out more and take the first step towards trading with AI intelligence today.

Frequently Asked Questions

How do AI-powered stock analysis platforms actually help improve trading decisions?

These platforms use sophisticated algorithms to automate data crunching and complex pattern recognition that humans cannot do quickly. Tools like BestStock AI process vast amounts of financial data and news instantly, delivering actionable insights and clear stock scores. This automation speeds up research and allows traders to act decisively based on real-time information.

What is the most important factor for a beginner to consider when choosing an AI stock analysis tool?

The most important factor is finding a tool with an easy-to-use interface and strong educational materials. Platforms like StocksToTrade offer extensive tutorials and resources to help new traders understand the features and develop effective trading strategies. Starting with an accessible platform reduces the heavy learning curve and prevents new users from becoming overwhelmed by advanced tools.

Do AI stock scores, like those from Danelfin, include fundamental analysis of a company?

AI stock scores, such as those generated by Danelfin, primarily rely on strong historical patterns and quant signals, often focusing heavily on momentum, volatility, and market sentiment. While they combine various signal categories, they often have less depth in traditional fundamental analysis compared to full-service financial platforms. This means users may need to triangulate the AI score with external fundamental data for a complete picture.

Why is real-time data access, like Level 2 quotes, essential for active day traders?

Real-time data access, which includes Level 2 quotes offered by platforms like StocksToTrade, provides deep market insight beyond basic pricing. Level 2 data shows the full order book, which helps active traders see supply and demand dynamics, allowing them to anticipate short-term price movements. Having fast, reliable data is crucial for developing and executing effective, split-second trading strategies.

What is the primary difference between a platform focused on value investing versus one for day trading?

Platforms focused on value investing, like StockInsights, prioritize in-depth generative AI analysis of company fundamentals, filings, and earnings transcripts for long-term due diligence. Platforms for active day trading, such as TrendSpider, focus on pattern recognition, multi-timeframe analysis, and quick reaction to market momentum. The right choice depends entirely on whether your strategy is short-term or long-term.

Where can I find information about insider trading activity, and how reliable is it?

Insider trading data, which tracks buying and selling by executives and directors, is prominently featured on platforms like AlphaInsider. This data can signal confidence or caution but requires careful interpretation, as not all insider trades are purely predictive. Users should filter and backtest this data to account for noisy or pre-arranged (10b5-1) trades for better predictability.

Is it a myth that AI analysis tools are only for highly advanced or professional investors?

Yes, it is a myth. While many tools are designed for professionals, platforms like LevelFields offer personalized subscription packages for both “Do-It-Yourself” traders and those needing expert support. The market now includes many user-friendly tools that automate complex analysis, making sophisticated insights accessible to daily retail investors.

What practical actions should I take to evaluate an AI stock analysis platform before subscribing?

You should always start by utilizing any free trials that are offered to get hands-on experience with the platform’s features and user interface. Specifically, check the quality of the customer support (like the live chat on TrendSpider) and the ease of customizing features. This direct evaluation ensures the tool fits your budget and specific trading needs.

How can a platform help me control risk, which is a major concern when using AI signals?

Platforms help control risk by providing visualization, historical data, and backtested signal performance, such as hit rates and drawdown statistics. By using this information, you can analyze the historical profitability and potential risks of a specific strategy. However, the platform’s insights must always be used with your own external risk management and validation.

Which tools provide global market coverage beyond just the United States?

While many AI analysis tools focus heavily on the US market, some platforms extend their coverage to other regions. StockInsights, for example, offers in-depth news and analysis for both US and INDIA markets. Checking the coverage area is essential, especially for traders who hold or analyze international stocks and global market trends.