Key Takeaways

- Gain a competitive edge by selecting the TPRM tool that delivers the fastest, most comprehensive view of your vendor risk versus your competitors.

- Categorize your vendors and compliance needs first to ensure you choose a platform segmented for compliance, cyber ratings, or enterprise GRC workflow.

- Reduce audit stress and save your team’s time by choosing a system that automates evidence collection and moves your vendor risk status from a crisis to routine maintenance.

- Discover that continuous cyber ratings like those from UpGuard or SecurityScorecard turn vendor risk into an instant, executive-friendly A-to-F report card.

Vendor breaches like SolarWinds and incidents like the CrowdStrike outage or the Change Healthcare ransomware attack proved one truth proved one truth: your vendors’ risk is your risk. On January 17, 2025, Europe’s Digital Operational Resilience Act (DORA) began forcing financial firms to verify the resilience of every cloud, SaaS, and payment provider they use. Boards listened: 87 percent of companies now budget for dedicated third-party risk management (TPRM) software. Yet a six-person startup pursuing SOC 2 compliance doesn’t need the horsepower of a global fintech. This guide ranks the nine best TPRM platforms for 2026 so you can pick the right fit with confidence.

How we picked the stand-out nine

Software vendors love glossy brochures, so we built a tougher test.

- Full-lifecycle coverage. A tool had to automate at least three stages of the vendor-risk cycle (onboarding, due diligence, continuous monitoring, remediation or reporting) to stay on the list.

- Real-world proof. We reviewed more than 1,200 verified user comments across Gartner Peer Insights, G2 and Capterra, and we removed products that still drove teams back to spreadsheets. G2 alone now hosts more than 3 million software reviews, giving us a deep data pool to mine.

- Speed and automation. To qualify, a platform had to deliver always-on monitoring that flags new vulnerabilities within hours and use AI to shrink questionnaires or evidence collection. Hourly automated checks are now table stakes; Vanta documents thousands of automated tests every hour across AWS, GitHub and Okta, showing how quickly drift can surface when the wiring is right.

- Compliance depth. Built-in libraries for SOC 2, ISO 27001, GDPR and similar frameworks were mandatory, so security and audit teams share one source of truth.

- Open ecosystems. We gave preference to products with APIs or native hooks for Jira, ServiceNow or leading GRC suites, because risk data loses value if it can’t move.

- Usability and economics. If a finance partner couldn’t pull a report unaided, or if licensing jumped 70 percent at renewal, the solution was cut.

We also reviewed pricing models and roadmap momentum; a stellar pilot means little if next year’s budget can’t keep the lights on. The nine vendors that cleared every bar appear in the pages that follow, ready for side-by-side comparison so you can match a platform to your team’s size, compliance load and risk appetite.

Quick scan: find your segment fast

Not every team needs an enterprise-grade GRC platform. Use the grid below to jump straight to the option that matches your size, pressure points and ambition.

| Platform | Segment | Ideal fit | One-line super-power |

| Vanta | Compliance-first automation | Start-ups and lean mid-market teams | Spins vendor evidence into SOC 2 and ISO dashboards in minutes |

| UpGuard | Continuous cyber ratings | Tech firms seeking outside-in visibility | Scores each supplier 0–950 and maps A–F grades for instant triage |

| SecurityScorecard | Continuous cyber ratings | Orgs wanting letter-grade simplicity | Monitors 12 million companies daily, giving you the broadest dataset on the market |

| BitSight | Continuous cyber ratings | Boards that value predictive analytics | 250–900 score correlates to breach-likelihood percentages |

| OneTrust | Enterprise GRC suite | Privacy-heavy commerce and global brands | Merges privacy, ESG and vendor risk in one pane |

| AuditBoard | Enterprise GRC suite | Public-company SOX environments | Connects vendor issues directly to enterprise risk registers |

| ProcessUnity + CyberGRX | Enterprise GRC suite | Complex supply chains that need scale | Combines deep workflow with crowdsourced assessments |

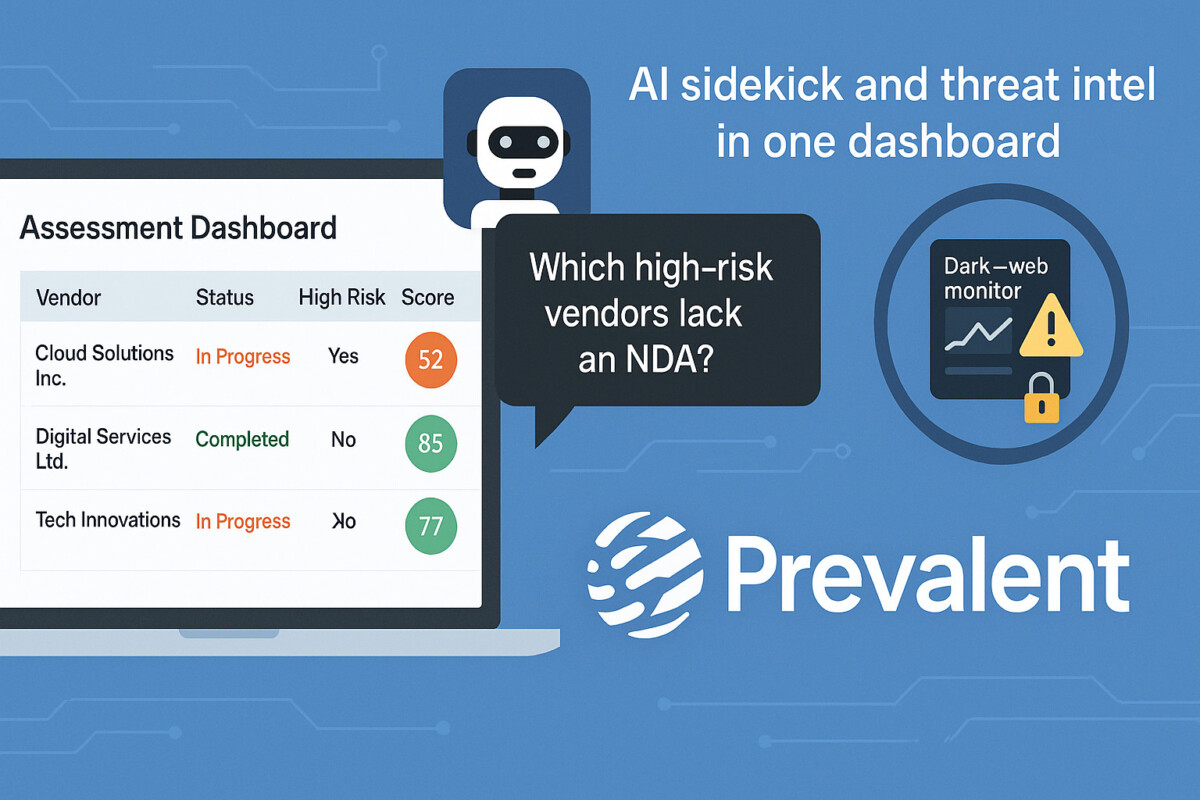

| Prevalent | AI-driven all-in-one | Lean teams seeking dark-web alerts | Alfred AI surfaces risks and suggests fixes in plain English |

| Venminder | Software + expert help | Regulated orgs short on headcount | Outsources SOC-report reviews while you keep the dashboard |

Scan the “Segment” column first. When two tools share a segment, let the “One-line super-power” decide which one solves the current challenge fastest.

Vanta – compliance-first automation

When a prospect asks for your SOC 2, Vanta lets you share a live Vendor Trust Report instead of a static PDF, turning hours of email tag into a single link.

The platform was built for compliance, so every vendor action ties back to SOC 2, ISO 27001, GDPR or Vanta’s own USDP privacy framework. Upload encryption evidence, and the related control flips green automatically.

According to Vanta, its workflows automate up to 90 percent of evidence collection and other audit chores. Its third-party risk management tools centralize vendor security reviews and can cut assessment time by as much as 50 percent by pulling real-time signals from more than 300 out-of-the-box integrations, plus a private-integration API, into each vendor profile. If an S3 bucket turns public, the dashboard flags it before an auditor or attacker can.

The UI looks more fintech than traditional GRC, which explains why more than 12,000 companies rely on Vanta for security and privacy frameworks. Teams across security, finance and leadership can pull reports without phoning an admin.

Limitations: Vanta does not scan a supplier’s external attack surface or monitor dark-web leaks. Mature programs often pair it with a ratings engine like UpGuard or SecurityScorecard for outside-in telemetry.

Choose Vanta when headcount is thin, board pressure is high and compliance deadlines loom; it turns vendor risk from a fire drill into routine maintenance.

UpGuard – live radar for your vendor perimeter

UpGuard scans every public asset a supplier controls (domains, cloud buckets, email records) and converts billions of daily data points into a numeric score (0–950) plus an A–F grade. An expired TLS certificate or open S3 bucket drops the grade in near-real time, so you know before auditors or attackers do.

Scores update continuously, and alert rules fire only when a rating slips below a threshold you set, keeping inbox noise low. Inside-out controls still matter, so UpGuard ships a questionnaire module that maps answers to ISO 27001, NIST CSF and other frameworks, giving you a single 360-degree view.

The interface looks more like a heat map than a SIEM, making “Vendor X fell from B to C overnight” obvious to non-technical stakeholders.

Watch-outs

- Highly customized questionnaires can feel rigid.

- UpGuard does not tackle deep privacy or ESG analysis; pair it with OneTrust or AuditBoard if those gaps matter.

For tech-centric teams that worry more about the next breach headline than audit paperwork, UpGuard provides an always-on early-warning system.

SecurityScorecard – letter grades executives actually read

SecurityScorecard turns every supplier into a familiar A–F report card. The platform scans a vendor’s entire internet footprint (web apps, IP ranges, email settings, patch cadence) and assigns daily grades across ten risk categories. A drop from B to C lands in your inbox with the exact issues attached, so you spend minutes, not hours, spotting what changed.

The company reports that it continuously rates more than 12 million companies worldwide. Odds are your new marketing plugin is already in the database, shaving weeks off due-diligence cycles.

Collaboration comes built in. Vendors can view their own scorecard for free, accept remediation tasks and watch the grade climb in real time, avoiding PDF ping-pong.

The tool also maps fourth-party relationships, exposing hidden dependencies that could threaten uptime.

Watch-outs

- Outside-in grades do not reveal internal policy gaps, so pair the platform with a questionnaire engine for full coverage.

- Ratings refresh daily, but changes that occur within a few hours may appear later.

If you want an executive-friendly gauge that converts cyber risk into a single letter, and you need that gauge to cover your supply chain out of the box, SecurityScorecard is tough to beat.

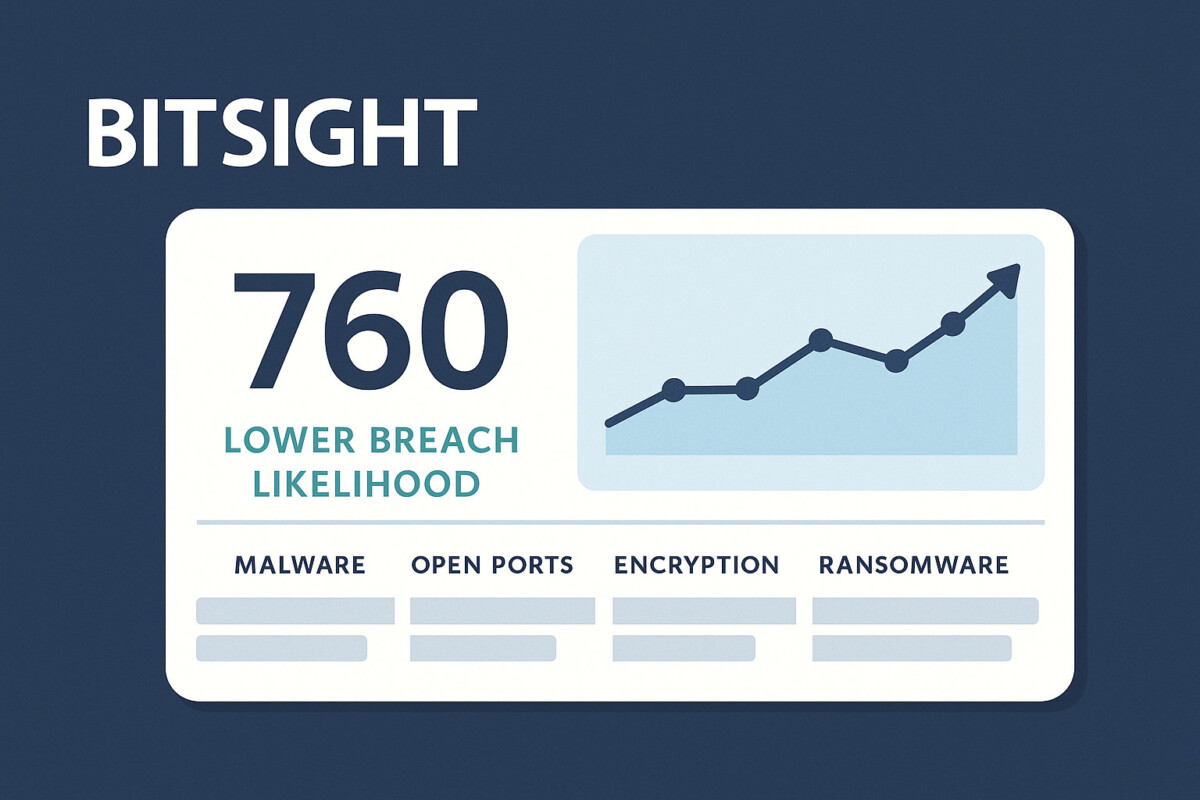

BitSight – credit-score depth for cyber risk

BitSight translates security posture into a familiar 250–900 score, where higher numbers signal lower breach likelihood. Think of 760 as “prime” and 500 as “riskier.” The rating draws on years of internet-wide telemetry and now supports more than 2,300 enterprise customers worldwide.

Boards value the trend lines. A single upward or downward stroke shows whether a supplier is improving or slipping. Click any score to drill into malware events, open ports, encryption strength and ransomware susceptibility, turning vague requests into precise tasks.

In 2025 BitSight completed its Dynamic Remediation rollout; rescans now update ratings within a day, and often within minutes. Partnerships with Dun & Bradstreet and Moody’s add financial health and cyber-insurance analytics, converting “high cyber risk” into numbers executives can grasp.

Watch-outs

- Depth adds complexity, and most teams route BitSight data into GRC tools like ProcessUnity for workflow.

- Outside-in scores do not reveal internal policy gaps, so keep questionnaires in play.

If you manage a large vendor portfolio and need numbers that hold up in risk-committee meetings, BitSight delivers credit-score clarity for your supply chain.

OneTrust – the privacy powerhouse that handles vendors, too

When your storefront stores large volumes of customer data, privacy and third-party risk converge. OneTrust unifies both.

- Regulation coverage at onboarding. As soon as you add a supplier, OneTrust screens them against GDPR, CCPA and dozens of emerging laws, then logs the results in a shared portal.

- Questionnaire Response Automation. Vendors can reuse past answers, cutting assessment cycles from weeks to days.

- Vendorpedia exchange. Users can tap more than 6,000 pre-vetted vendor profiles, complete with SIG questionnaires and certifications, and subscribe to alerts when anything changes.

- Proven scale. The platform now supports about 14,000 customers, including 75 percent of the Fortune 100.

Drag-and-drop workflows route high-risk findings to legal, low-risk items to procurement and roll everything into a single privacy-plus-security score your DPO can present to the board.

Trade-offs: OneTrust’s breadth can overwhelm smaller teams, and advanced reporting still requires manual effort. For brands juggling fast-moving privacy laws and sprawling vendor lists, consolidating risk in OneTrust beats managing three separate tools.

AuditBoard – connecting vendor risk to your enterprise story

Most TPRM tools sit in a silo. AuditBoard plugs vendor findings directly into the same platform your SOX, IT risk and ESG teams already use, so the board sees a single risk picture instead of a patchwork.

- One dashboard, many lenses. A supplier flagged as high inherent risk flows into the control-testing, incident and ERM views your executives review each quarter.

- Templates that move. Pre-built SIG, CAIQ and custom questionnaires route through automated approvals, and reminders lift completion rates without extra emails.

- Visual evidence. Heat maps highlight vendors that threaten revenue, while trend lines show whether residual risk is dropping or stalling—an advantage during tight audit-committee agendas.

AuditBoard surpassed $300 million in ARR and serves over 50% of the Fortune 500, earning G2 “Leader” status in Third-Party Risk Management for six consecutive reports.

Trade-offs: Advanced analytics require configuration time, and pricing sits at the higher end. For mid-to-large enterprises already running AuditBoard modules, adding TPRM extends a familiar platform rather than introducing a new tool.

ProcessUnity + CyberGRX – heavy-duty workflow meets crowdsourced insight

ProcessUnity is the factory floor of vendor risk: intake, tiering and remediation move along rails you configure. The 2023 merger with CyberGRX added a data warehouse containing 17,000 validated assessments covering 350,000 third parties, so most answers fill in before you even click “Send questionnaire.”

- Self-service onboarding. Vendors enter a portal, run through inherent-risk logic you set and the automated vendor-onboarding workflows auto-populate most fields, trimming weeks of email tag.

- Unified Kanban view. Security, procurement and legal share the same cards, so bottlenecks surface and vanish quickly.

- Extreme flexibility. Mirror any approval chain, weight risk factors or spin parallel tracks for privacy or business continuity. The depth adds a learning curve, but strong documentation and partners shorten the ramp.

- AI on the way. Early adopters report assessment cycle times dropping up to 50 percent after new auto-remediation and anomaly-detection features rolled out.

Choose ProcessUnity + CyberGRX when your vendor list runs into the thousands and audit evidence piles up by the terabyte; you will outgrow spreadsheets, not this platform.

Prevalent – AI sidekick and threat intel in one dashboard

Prevalent combines an assessment engine, dark-web monitor and AI analyst in a single dashboard.

- Exchange first, emails later. Enter a vendor’s email domain and the platform checks its Vendor Threat Network, featuring more than 2,700 current risk profiles in healthcare alone. You see breach history and leaked-credential data before sending a questionnaire.

- Alfred, your virtual analyst. Launched in late 2023, Alfred is a chat-style assistant trained on billions of risk events across two decades of Prevalent data. Ask “Which high-risk vendors lack an NDA?” and receive an actionable list.

- 360-degree monitoring. Beyond CVEs, the platform flags geopolitical unrest, credit-rating drops and social-media sentiment, giving you a broad business-resilience view.

- Fast time to value. Custom questionnaires, scoring weights and escalations are flexible, and G2 reviewers note that first assessments ship in under two weeks.

Scores use a straightforward 0–100 scale. While less granular than some rivals, pairing the number with Alfred’s narrative insight makes the findings immediately actionable.

Prevalent fits lean teams that want complete TPRM coverage with AI explanations while keeping internal headcount small.

Venminder – when you need a vendor-risk team in your back pocket

Software handles the workflow; Venminder supplies the humans.

- Now part of Ncontracts, the combined platform supports over 5,000 financial & regulated institutions.

- Expert document reviews on tap. Upload a 150-page SOC 1, and Venminder’s in-house auditors dissect it, flag gaps and summarize residual risk while your team stays focused on core work.

- Beyond cyber. Venmonitor tracks litigation filings, credit ratings, sanctions lists and ESG controversies; a class action against your payment processor triggers same-day alerts.

- Guided launch. Every account receives a named success manager plus mentoring sessions, a feature that drives Venminder’s top-rated customer-support scores on G2.

Pricing scales with service depth: keep costs low by using just the platform, or add deep-dive assessments when regulators require professional judgment. If headcount is thin but accountability high, Venminder gives you seasoned vendor-risk expertise within a tool that keeps everyone on the same page.

Conclusion

Vendor risk pressures will only intensify as regulations expand and digital supply chains grow more complex. As you plan for 2026, whether your ecommerce business needs fast compliance automation, continuous outside in cyber ratings, or a full scale GRC backbone, the nine platforms above give you a proven starting point.

Start by choosing the segment that matches your reality today: compliance first automation, continuous ratings, enterprise GRC, or software plus services. Then map each tool’s strengths to your company size, industry, and regulatory exposure. If you make that choice deliberately, third party risk turns from a last minute scramble into a strategic advantage for your store.

Frequently Asked Questions

What is third-party risk management (TPRM) software?

TPRM software centralizes how you assess, monitor, and remediate risk from vendors, suppliers, and partners. It replaces ad hoc spreadsheets with workflows for onboarding, questionnaires, continuous monitoring, and reporting so you can prove diligence to auditors and regulators.

Do I need a full TPRM platform or are security ratings enough?

Security ratings tools give powerful outside-in visibility but only show part of the picture. Most teams pair ratings with a TPRM platform that handles questionnaires, contracts, privacy checks, and remediation so you see both technical and business risk.

How should a small startup choose between these tools?

If you are under 100 people and racing toward SOC 2 or ISO 27001, start with a compliance-first platform like Vanta that automates evidence collection and basic vendor reviews. You can add a ratings engine later when your vendor list and regulatory pressure grow.

How long does TPRM software take to implement?

Lightweight, compliance-focused tools often go live in a few weeks once you connect core systems and load a vendor list. Enterprise GRC platforms usually need several months for workflow design, integrations, and training, especially in regulated industries.

What KPIs show that TPRM software is working?

Track time to complete vendor assessments, percentage of vendors with current reviews, number of high-risk vendors without mitigation plans, and the rate of overdue tasks. Over time you should see faster onboarding, fewer unmanaged high-risk vendors, and cleaner audit findings.