The democratization of financial tools has transformed how we approach money management, particularly for the growing number of e-commerce entrepreneurs. Digital banking apps, instant credit approvals, and sophisticated budgeting platforms have made financial literacy more accessible than ever before. Yet with this accessibility comes responsibility, particularly when it comes to credit health, which serves as the invisible backbone of your business’s financial life and your ability to scale operations.

Understanding the Foundations of Credit Health for E-commerce

What Shapes Your Credit Score

Your credit score isn’t a mysterious calculation, it’s a reflection of five key behaviors that directly impact your e-commerce business’s funding opportunities. Payment history carries the most weight, accounting for roughly 35% of your score. Every on-time payment strengthens this foundation, while late payments create cracks that take years to repair and can limit your access to merchant cash advances, inventory financing, or business credit lines.

Credit utilization, the ratio of your balances to your limits, comprises about 30% of the equation. For e-commerce sellers, this becomes particularly important when managing seasonal inventory purchases or advertising spend. Keeping this ratio low signals responsible usage to potential business lenders and payment processors.

Why Credit Health Matters for E-commerce Success

Credit scores quietly influence far more than personal loan approvals, they directly impact your e-commerce business’s viability and growth trajectory. Payment processors like Stripe and PayPal may review credit during merchant account applications. Suppliers often check credit before extending net payment terms, which are crucial for managing cash flow between inventory purchases and sales revenue. Business credit cards and lines of credit, essential tools for managing advertising spend and seasonal inventory fluctuations, require strong personal credit scores for approval.

Poor credit choices made in your early business days can shadow your operations for years. A single default can reduce your score by 100+ points and remain visible for seven years, limiting your ability to secure inventory financing during peak seasons or scale advertising campaigns when you identify profitable opportunities. The compounding effect works both ways, early good habits create a cushion that absorbs occasional mistakes, while early missteps create a deficit that demands years of perfect behavior to overcome and may force you to rely on expensive alternative financing that erodes profit margins.

Introducing Tools That Support Credit Awareness

Credit monitoring has evolved from a luxury service to an essential component of modern e-commerce financial management. These tools track changes to your credit report in real-time, alerting you to new accounts, inquiries, or suspicious activity before damage occurs. Many banks now offer basic credit monitoring as a complimentary feature, providing monthly score updates and simplified reports.

Setting Up Beginner-Friendly Money Habits for E-commerce

Track Your Monthly Cash Flow (Personal and Business)

Financial awareness begins with knowing where your money goes, both personally and in your business. You don’t need sophisticated accounting software initially, start with your bank’s built-in spending categorization or a simple spreadsheet. The goal is visibility, not perfection. Most e-commerce beginners discover they’re bleeding cash on unnecessary subscriptions, excessive packaging costs, or advertising channels that don’t convert.

Tracking reveals patterns crucial for e-commerce success. You might notice that inventory costs spike before holidays but sales don’t justify the investment, or that certain fulfillment methods consistently erode margins. This awareness creates natural behavioral shifts without requiring strict restrictions. Apps like YNAB, Mint, QuickBooks Self-Employed, or even a basic notes app can serve this purpose effectively while keeping personal and business expenses clearly separated.

Build a Basic Budget System

The 50-30-20 framework offers an accessible starting point for personal finances: allocate 50% of income to necessities, 30% to wants, and 20% to savings and debt repayment. Customize these percentages based on your cost of living and financial goals. For your e-commerce business, consider a modified approach: 40% to cost of goods sold, 20% to advertising and customer acquisition, 20% to operations and tools, 10% to owner’s draw, and 10% to business reserves.

Automating bill payments eliminates the most common source of credit damage: forgotten due dates. Set up automatic payments for fixed expenses like rent, utilities, software subscriptions, and minimum credit card payments, both personal and business-related. This single action protects your payment history, the most influential credit score component and a critical factor when suppliers evaluate you for net payment terms.

Developing Smart Credit Management Habits for E-commerce

Maintain Low Credit Utilization

Credit bureaus prefer seeing utilization below 30%, but aiming for under 10% yields optimal results. If you have a $5,000 credit limit across personal and business cards, keeping balances below ₹1,000 signals strong financial health. For e-commerce entrepreneurs, this becomes challenging during high-spend periods like Q4 holiday preparation or major advertising campaigns.

Strategies include requesting credit limit increases (without increasing spending), using multiple business credit cards to distribute charges, or making mid-cycle payments to keep reported balances low. Understanding utilization helps you make strategic decisions about when to scale advertising or purchase bulk inventory. If a large inventory purchase is necessary, consider the timing, making it right after your statement closes minimizes its impact on your reported utilization since most issuers report balances on the statement date.

Consider separating personal and business credit strategically. A business credit card exclusively for advertising spend and inventory purchases protects your personal utilization ratio, though note that many business cards still report to personal credit bureaus during the application and approval process.

Consistently Review Credit Reports

Errors appear more frequently than most people realize. Accounts you’ve closed might show as open, payments marked late despite being timely, or accounts belonging to others with similar names appearing on your file. These inaccuracies can suppress your score by dozens of points, potentially costing you business loan approval or forcing you into suboptimal supplier payment terms.

Credit monitoring services simplify this process by flagging discrepancies automatically. Set quarterly reminders to review full reports from all three bureaus. Disputing errors is straightforward, documentation of the mistake typically resolves issues within 30-45 days. Regular reviews also help you track your progress, transforming credit management from an abstract concept into measurable improvement that directly correlates with better financing options for your e-commerce business.

Protecting Your Credit: The Role of Freezes, Alerts & Digital Safety for E-commerce

Understanding Credit Freezes and Their Benefits

A credit freeze locks your credit file, preventing lenders from accessing it without your explicit permission. This stops identity thieves from opening accounts in your name, even if they’ve obtained your personal information, a particular risk for e-commerce entrepreneurs whose data appears across multiple platforms, payment processors, and supplier databases. Freezing is free, doesn’t affect your credit score, and provides ironclad protection against new account fraud.

For e-commerce entrepreneurs managing businesses while juggling personal finances, understanding how to properly freeze and unfreeze your credit becomes essential. The process has become significantly more streamlined in recent years, with major credit bureaus like TransUnion offering online portals where you can manage your freeze status in minutes.

When and How to Responsibly Manage Credit Freezes

Certain business events require credit file access: applying for new business credit cards, commercial leases, inventory financing, or merchant cash advances. When these situations arise, you’ll need to unfreeze credit temporarily for these situations, then refreeze immediately after. Most bureaus allow you to specify unfreeze duration, select the minimum necessary period.

The process is straightforward: log into your account with each credit bureau, select the temporary or permanent lift option, and specify which creditor needs access if you want to limit exposure. For e-commerce entrepreneurs who may need to apply for multiple financing options during growth phases, you can unfreeze for just a few days or weeks, then automatically refreeze without any additional action required.

This freeze-unfreeze routine might seem cumbersome initially, but it becomes second nature quickly. The security benefit far outweighs the minor inconvenience, particularly given the rising sophistication of identity theft targeting e-commerce entrepreneurs whose business information proliferates across platforms. Maintaining frozen credit as your default state represents one of the most effective preventive measures against identity-related credit damage that could jeopardize your business financing options.

Building a Long-Term Credit Resilience Plan for E-commerce Growth

Automating Good Behaviors

Automation removes willpower from the equation. Beyond auto-paying bills, automate savings transfers on payday and retirement contributions. Set up automated rules that move percentages of each deposit into designated savings goals, both personal emergency funds and business reserves for inventory and operating expenses. Quarterly subscription audits identify forgotten charges draining your accounts. Most e-commerce entrepreneurs discover they’re paying for software tools, analytics platforms, or marketing services they no longer use.

This infrastructure creates a financial system that works correctly by default. You actively decide to deviate from good behaviors rather than actively remembering to practice them, a subtle shift that dramatically improves consistency. For e-commerce businesses where cash flow fluctuates with sales cycles and seasonal patterns, automation ensures bills get paid on time even during slow periods when you’re focused on marketing and operations rather than financial administration.

Periodic Credit File Maintenance

Establish a quarterly credit review ritual. Beyond checking for errors, analyze changes in your credit profile. Have your scores improved? Has your oldest account aged, strengthening your history? Are utilization ratios trending in the right direction despite increased business spending? This regular assessment provides motivation and helps you catch problems early, before they affect that crucial business loan application or supplier credit negotiation.

Credit monitoring serves as your between-review early warning system, alerting you to changes as they happen rather than discovering issues months later during your quarterly check. This layered approach, automated monitoring plus periodic deep reviews, creates comprehensive oversight that protects both your personal creditworthiness and your business’s access to growth capital.

Recognizing Risky Credit Products and Financial Caveats for E-commerce

Understanding Property-Based Lending: The Caveat Loan Trap

When e-commerce businesses face cash flow challenges or need rapid capital injection for inventory opportunities, some entrepreneurs turn to alternative financing secured against personal property. This is where understanding the true nature of these products becomes critical for protecting both your credit health and your assets.

Caveat loans represent a particularly risky borrowing category that preys on individuals with limited credit options, including struggling e-commerce entrepreneurs desperate for inventory capital. These loans use property as collateral but operate outside traditional mortgage structures, often carrying interest rates exceeding 15-20% annually. The term “caveat” refers to the legal notice placed on your property title, giving the lender rights to your asset if you default.

The Reality of Short-Term Caveat Loans

E-commerce beginners find short term caveat loans attractive because approval doesn’t depend heavily on credit scores, and the capital can quickly fund inventory purchases or advertising campaigns. The promise of fast approval, sometimes within 24-48 hours, appeals to entrepreneurs facing time-sensitive opportunities like securing limited inventory or capitalizing on seasonal demand.

However, the risks are substantial and often underestimated. Short repayment periods, typically ranging from 3-12 months, create intense payment pressure incompatible with e-commerce cash flow cycles where revenue arrives weeks or months after inventory purchases and advertising spend. Unlike traditional mortgages spread over decades, these compressed timelines demand large monthly payments that can devastate cash flow.

The property risk means that defaulting could result in the forced sale of your home or land. For e-commerce entrepreneurs who’ve built equity in property, losing this asset due to a business setback compounds the financial damage. The high interest rates, often 15-25% annually, combined with origination fees of 2-5% mean you’re paying significantly more than conventional financing options, directly reducing business profitability.

When Caveat Loans Might Be Considered (and Better Alternatives)

These loans should be absolute last resorts, considered only after exhausting all conventional options and with full understanding of the consequences. If you’re considering this path, ask yourself: Have you approached traditional banks? Have you explored SBA loans or community development financial institutions? Have you considered taking on a business partner or seeking angel investment instead?

Better alternatives exist for most e-commerce capital needs. Business lines of credit, though requiring better credit, offer flexibility without risking your home. Invoice factoring converts pending sales into immediate cash. Inventory financing uses the purchased inventory itself as collateral rather than your property. Even business credit cards, while carrying high interest rates, don’t place liens on personal assets and offer more manageable repayment structures.

Smart Borrowing Strategies for E-commerce Future Growth

Choosing Safe Loan Options for Business Growth

For e-commerce businesses, several legitimate financing options exist that don’t jeopardize personal assets or credit health. Business lines of credit provide flexible access to capital for inventory purchases and advertising, with interest charged only on amounts used. Term loans offer lump-sum capital for major investments like automation software or warehouse equipment. Equipment financing specifically covers technology purchases, using the equipment itself as collateral.

Secured loans, backed by collateral like inventory or equipment, offer lower rates and easier approval for credit builders. Unsecured loans rely solely on creditworthiness, carrying higher rates but not risking specific assets. Understanding this distinction helps you select appropriate products based on your credit profile and business needs.

APR reveals total borrowing costs, including fees, while simple interest rates exclude these charges. Always compare APRs when evaluating offers. A loan with a 10% interest rate but 5% origination fee costs significantly more than a 12% APR loan with no fees, a crucial consideration when margins in e-commerce can be thin.

When Borrowing Makes Sense vs. When It Doesn’t for E-commerce

Strategic debt for e-commerce finances assets or activities that generate returns exceeding their cost. Borrowing to purchase proven inventory that sells reliably with healthy margins makes sense; the revenue generated covers the financing cost. Scaling profitable advertising campaigns with borrowed capital works when customer lifetime value significantly exceeds acquisition cost plus interest.

Avoid borrowing for experimental products, unproven marketing channels, or consumption disguised as business expenses. The discipline of growing organically within cash flow constraints builds sustainable businesses and prevents the interest burden that enriches lenders at your expense. Many successful e-commerce businesses grow initially by reinvesting profits rather than pursuing aggressive external financing; slower growth beats over-leveraged failure.

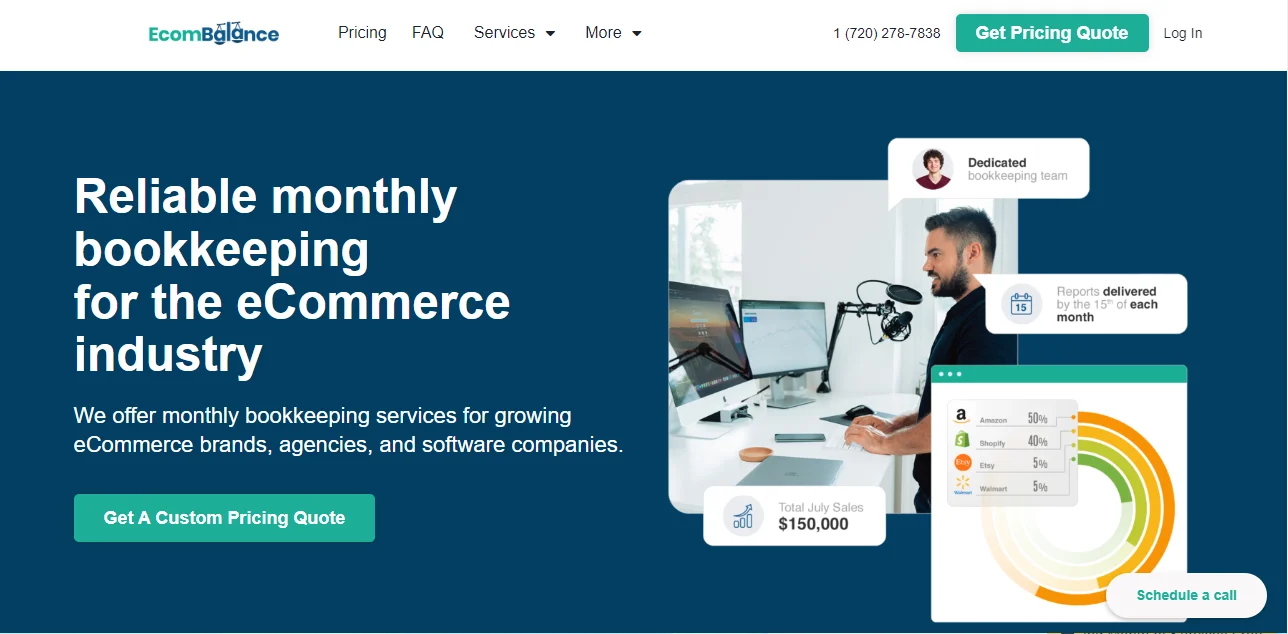

What Is EcomBalance?

EcomBalance is a monthly bookkeeping service specialized for eCommerce companies selling on Amazon, Shopify, eBay, Etsy, WooCommerce, & other eCommerce channels.

We take monthly bookkeeping off your plate and deliver you your financial statements by the 15th or 20th of each month.

You’ll have your Profit and Loss Statement, Balance Sheet, and Cash Flow Statement ready for analysis each month so you and your business partners can make better business decisions.

Interested in learning more? Schedule a call with our CEO, Nathan Hirsch.

And here’s some free resources:

- Monthly Finance Meeting Agenda

- 9 Steps to Master Your Ecommerce Bookkeeping Checklist

- The Ultimate Guide on Finding an Ecommerce Virtual Bookkeeping Service

- What Is a Profit and Loss Statement?

- How to Read & Interpret a Cash Flow Statement

- How to Read a Balance Sheet & Truly Understand It

Conclusion

Financial confidence for e-commerce entrepreneurs emerges from the compound effect of simple habits practiced consistently. Tracking your spending, both personal and business, creates awareness of where cash actually flows versus where you believe it goes. Budgeting transforms awareness into intention, helping you allocate resources toward growth activities rather than letting money drift into low-value expenses. Emergency funds provide security that prevents desperate financing decisions during inevitable rough patches.

Responsible credit use builds the history necessary for accessing business financing while maintaining low utilization protects your score, particularly important when managing the cyclical cash flow challenges inherent in e-commerce. Regular credit report reviews catch errors before they calcify into lasting damage that limits business financing options or forces you into expensive alternative funding sources.