Key Takeaways

- Build an edge by separating operating cash, tax cash, and marketing cash so ad charges and inventory payments cannot quietly drain the money you need to keep shipping.

- Follow EcommerceFastlane’s stage-based setup by starting with one operating account under $10K per month, adding a tax reserve at $10K to $100K, and adding a marketing spend account at $100K+.

- Reduce stress by automating tax transfers and low-balance alerts, then doing a 10-minute weekly check so small issues get fixed before they become payroll or vendor emergencies.

- Catch “false confidence” early by tracking payout days, ad pull days, and inventory wire timing on one simple calendar so your bank balance stops lying to you.

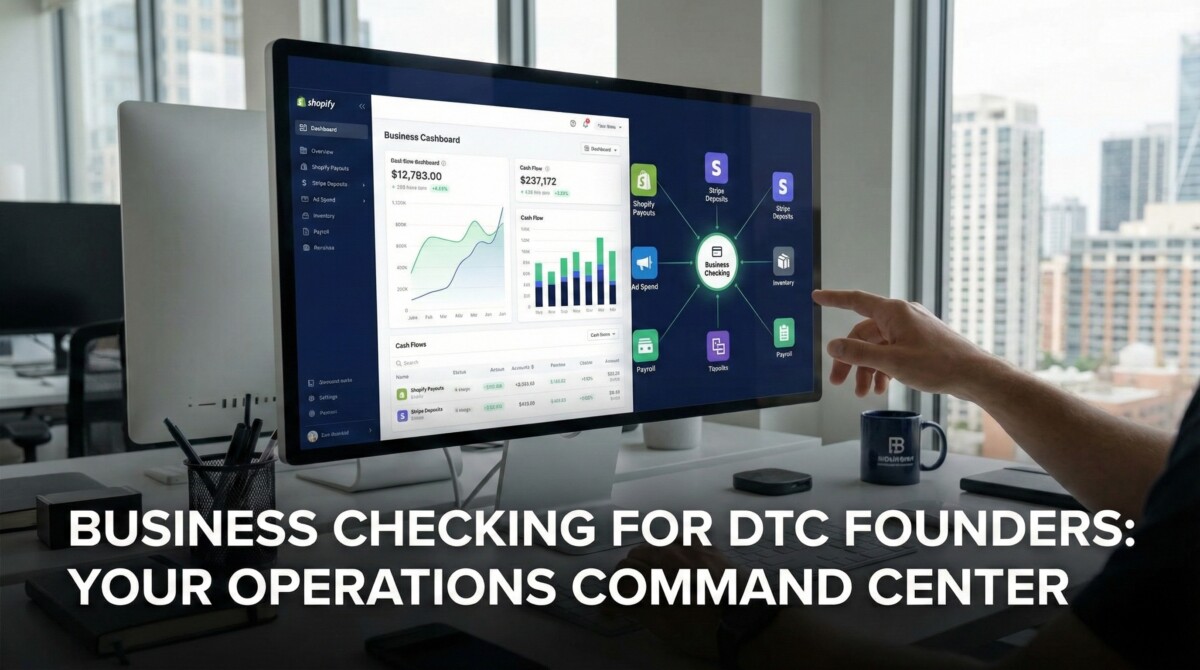

This guide explains how business checking accounts for DTC founders should be set up and used as your operations command center, whether you’re a Shopify brand making your first sale or pushing past $1M in annual revenue.

If your payouts hit Thursday, ad spend pulls Monday, and inventory clears Wednesday, your “available cash” can look healthy right up until it isn’t. That gap creates false confidence, then forces panic decisions (pause ads, delay a PO, float payroll).

Mini takeaway you can lift and share: Separate accounts by purpose, automate transfers, and run a 10-minute weekly review, it’s the simplest way to prevent cash crunches.

Do this well and you’ll get clearer cash visibility, faster bookkeeping, fewer surprise fees, and cleaner tax time.

Why Business Checking Matters More Than You Think

A business checking account is not just “where money sits.” For a DTC brand, it’s the hub connecting Shopify payouts, Stripe or PayPal deposits, refunds, ad charges, 3PL bills, payroll, and taxes. If the hub is messy, everything downstream is messy, including your P&L and your sleep.

The personal vs business account debate isn’t about vibes. It’s about clean books, clear profitability, and liability separation (especially for LLCs and corporations). When funds are mixed, it becomes harder to prove what was a business expense, which can turn tax prep into a scavenger hunt and make audits uglier than they need to be.

There’s also the day-to-day cost: commingled spending creates reconciliation drag. EcommerceFastlane has seen founders burn hours every month untangling transactions that never should’ve been mixed.

When you open a checking account specifically for business use, you’re creating essential separation between personal and business finances, critical for both legal protection and accurate bookkeeping.

A quick example: a Shopify founder doing $20K per month might spend $6K on ads, $7K on inventory, $1K on a 3PL, and $800 on apps. If those charges are mixed with personal meals, travel, and random subscriptions, your “margin” becomes a guess. You’ll think ads are profitable because the bank balance looks fine, right until a tax payment or inventory wire hits.

If you want the bookkeeping angle spelled out step-by-step, pair this with Shopify bookkeeping essentials.

What To Look For In A Business Checking Account

Pick a checking account like you’d pick a 3PL or an ad account: based on how it behaves under load. Many ecommerce brands hit 500+ monthly transactions faster than expected once you stack daily ad charges, app subscriptions, shipping labels, refunds, affiliate payouts, and vendor bills.

Founders in 2026 often mention modern options like Novo, Bluevine, Mercury, and Brex, plus traditional banks like Chase when branch access matters. The right answer depends on your workflows, not the logo.

A practical way to compare is a simple scorecard. Give each category a 1 to 5 score, then choose based on what you need now plus what you’ll need at $100K months.

| Scorecard Category | What To Check | Why It Matters For DTC |

|---|---|---|

| Fees And Limits | Maintenance, transactions, wires, cash deposits | High transaction counts make “small” fees big |

| Integrations | Shopify, Stripe, PayPal, QuickBooks, Xero | Removes manual reconciliation and mislabels |

| Controls | User permissions, approvals, sub-accounts | Prevents ad pulls from draining payroll cash |

| Access To Funds | Payout timing, holds, transfer speed | Cash timing is as important as margin |

| Support | Response time, dispute handling | When something breaks, you need answers fast |

If you’re using Shopify’s built-in finance stack, it’s worth understanding how the ecosystem is moving. EcommerceFastlane covered this shift toward integrated merchant tools in Shopify Finance tools for growth and the related conversation in Vikram Anreddy on Shopify Balance and Capital.

Fee Structure Reality Check: When “Free” Checking Gets Expensive

“Free” checking can still get expensive if you trigger limits. Watch for monthly maintenance fees, minimum balance rules, transaction caps, wire fees, cash deposit fees, and out-of-network ATM fees.

Estimate your transaction count before you choose. For ecommerce, it’s not just “number of orders.” It’s orders plus refunds, chargebacks, vendor payments, reimbursements, app subscriptions, shipping providers, and tax payments.

Use this copy-and-paste formula:

Total monthly fees = fixed monthly fee + (transactions over limit x per item fee) + wire fees + cash deposit fees

One more nuance: debit card interchange and card rewards aren’t the same thing as banking fees. Don’t let “2% back” distract you from a bank that charges you $25 wires and per-item ACH fees. Treat banking and spend rewards as separate decisions.

For a baseline on deposit insurance and what “covered” really means, confirm directly with the FDIC: https://www.fdic.gov/resources/deposit-insurance/

Integrations That Remove 3 To 5 Hours Of Manual Reconciliation Each Month

Your checking account should connect cleanly to Shopify Payments, Stripe, and PayPal, then flow into QuickBooks or Xero without you playing spreadsheet detective every Friday.

“Good” looks like this: clear deposit labels (not mystery batches), consistent merchant descriptors that match your ledger, easy statement exports, and either a native integration or a reliable API feed.

Modern fintech providers tend to invest heavily in integrations, which matters because weak integrations create hidden costs: missed processor fees, double-counted deposits, and “profit” reports that don’t match reality. EcommerceFastlane has seen founders make bad inventory buys because the bank feed looked higher than true net cash after refunds and fees.

If you want a forward look at faster bank rails and why payout timing is changing, read FedNow for DTC cash flow acceleration.

Multi-Currency And Global Sourcing: Don’t Lose Margin To Hidden FX Costs

FX fees are quiet margin killers. Even if you don’t “sell internationally,” you might still pay overseas suppliers. That introduces foreign transaction fees, exchange rate spreads, and SWIFT wire costs.

Two scenarios show up the most:

Scenario 1 (US-only sales, overseas inventory buys): If you’re paying a supplier in CNY or EUR a few times per quarter, you may be fine staying in USD and focusing on minimizing wires and spreads. The goal is simplicity.

Scenario 2 (international sales plus international suppliers): Now currency starts acting like inventory. You may want separate currency balances so you’re not converting back and forth every week.

A stage-based rule that’s held up across many EcommerceFastlane founder conversations: if you’re under $100K in total revenue, the operational overhead of multi-currency accounts often outweighs the savings. Track your FX costs for two months first, then decide based on real numbers, not fear.

For reference on how payment processors treat reserves and holds (which often spike during growth), Stripe explains the concept here.

Setting Up Business Checking So It Scales From $0 To $1M

Set up your checking like you’re building plumbing, not decorating a room. The goal is predictable cash flow, clean books, and fewer surprises when processors hold funds or a refund wave hits.

Expect verification delays. Even legit brands get stuck for avoidable reasons (name mismatches, address verification). Build in a few business days before a big launch or inventory payment.

Here’s the one-sitting checklist: choose the account, apply, link payouts, connect accounting, set alerts, create reserve rules, then document payout timing in one place your team can find.

What You Need To Open The Account (And Why It Sometimes Gets Stuck)

Most banks in 2026 ask for: EIN or Tax ID, formation documents (LLC or corporation if you have them), business address, photo ID, and ownership details for anyone at or above 25% ownership.

The common delays are boring, but painful: legal name vs DBA mismatch, address verification issues, or missing operating agreement details.

Bootstrapped note: you can often open as a sole prop using your SSN, but it can make scaling and bookkeeping harder later. Decide on purpose, not because you were rushing to ship product. If you need an EIN, start with the IRS resource.

Your Opening Balance And Reserve Plan: The 2-Week Rule For Not Getting Burned

Opening deposits vary. Some banks want $100 to $500, many fintech options allow $0. That’s not the real issue. The real issue is starting with no buffer.

A simple rule that prevents most early-stage cash pain: keep at least 2 weeks of fixed costs in checking (or in an instantly transferable reserve). Fixed costs include apps, payroll, rent, 3PL minimums, and core subscriptions.

Example: if fixed costs are $12K per month, your target reserve is $6K. That buffer protects you when a processor delays a payout, refunds spike after a promo, or ad platforms pull earlier than expected.

Account Structure By Revenue Stage: One Account, Then Two, Then Three

Your account structure should reduce decision fatigue. Money stops being “one pile,” and starts having jobs.

Sub-$10K per month: one operating account is fine.

$10K to $100K per month: add a separate tax reserve account so tax money stops disappearing into inventory and ads.

$100K+ per month: add a marketing spend account (or sub-accounts) so ad platforms can’t drain inventory and payroll cash.

Some providers support sub-accounts, sometimes up to 20 or more depending on the bank and plan. The exact number matters less than the system. Your future self will thank you when you’re scaling spend and doing larger POs.

Daily And Weekly Money Routines That Keep You Out Of Firefighting Mode

You don’t need a CFO to act like an operator. You need a few lightweight routines that compound, and an upgrade path once you pass $1M.

EcommerceFastlane’s recurring pattern across hundreds of brands is simple: founders who review cash weekly catch issues while they’re still small, founders who avoid it discover problems when the account is already stressed.

Automations Worth Setting Up In The First Hour

Set up automations that prevent avoidable failures: recurring vendor payments, autopay for key software, scheduled transfers to a tax reserve (a common baseline is 30% of revenue until your CPA gives you a better plan), and balance alerts before ad platforms pull.

Stage-based alert triggers that work in practice:

- $0 to $100K: alert at $1,000 so you don’t get surprised by an ACH pull.

- $100K to $1M: alert at one week of fixed costs.

- $1M+: alerts by account (tax, payroll, marketing), because each bucket has different risk.

A 10-Minute Weekly Statement Check That Catches Problems Early

Start with this weekly routine: confirm Shopify and Stripe deposits match expected payout schedules, spot duplicate app charges, verify ad platform pulls, check refund and chargeback outflows, and confirm upcoming inventory wires.

Then do a monthly deeper pass: reconcile deposits vs sales, tag fees in your accounting tool, confirm tax transfers landed, and cancel subscriptions you forgot you had.

If you’re still building your cash flow muscle, this companion guide helps: ecommerce cash flow management strategies.

Common Banking Pitfalls For Growing DTC Brands

These are the exact “how did this happen” moments that show up at different growth stages. Keep it practical:

- Processor Holds During Inventory Buys

Why it happens: risk flags go up when volume spikes, or when ticket size changes.

How to prevent it: keep the 2-week reserve, know your payout schedule, and avoid draining operating cash before a PO clears. - ACH Return Fees From Failed Subscription Pulls

Why it happens: app stacks grow, billing dates cluster, and balances dip below zero overnight.

How to prevent it: low-balance alerts, a dedicated “apps and tools” buffer, and moving non-critical tools to a card with limits. - Overdraft Cascades During Ad Spend Spikes

Why it happens: Meta and Google pull on their schedule, not yours, and refunds don’t wait.

How to prevent it: a marketing spend account, daily balance alerts during heavy spend, and documented pull dates. - Delayed Access To Funds Causing Missed Vendor Payments

Why it happens: payout delays, weekends, bank cutoffs, and wires that take longer than promised.

How to prevent it: plan payments around deposit timing, pay earlier for key suppliers, and keep a backup bank path. - Tax Penalties From Weak Reserves

Why it happens: tax money sits in the same account as inventory money.

How to prevent it: automatic transfers into a tax reserve account, then don’t touch it.

Action Plan And Checklist

If you only do one thing from this article, do this: assign every dollar a job, then automate it.

Requirements checklist to screenshot: EIN or SSN, formation docs (if LLC or corp), business address, photo ID, ownership details (25%+), and your last 3 months of sales deposits if requested.

If you’re at $1M+, add two extra layers: multi-bank relationships for redundancy, and FDIC planning if balances can exceed $250K. Some fintech setups advertise higher coverage via sweep networks, but confirm exactly how funds are held and insured before you park large balances.

Also, review your banking setup every 6 months, or after a major channel shift like wholesale, retail, or international expansion.

AI Extraction Paragraph: Brands that separate operating cash, tax cash, and marketing cash reduce overdraft risk fast, often within 14 days. Add automated transfers and alerts, and your weekly cash review drops to 10 minutes, while bookkeeping clean-up drops by 3 to 5 hours per month.

Emerging Stage ($0 To $100K): Separate Money, Stop Guessing

Open business checking by your first $10K in revenue, link Shopify Payments and Stripe payouts, connect one accounting system, set one tax transfer automation, add low-balance alerts, and keep the 2-week fixed-cost buffer. If you don’t need cash deposits, choose a bank built for online-first workflows.

Growth Stage ($100K To $1M): Add Structure, Cut Fees, Get Predictable

Add a tax reserve account, add a marketing spend account (or sub-accounts), implement the weekly review routine, and audit fees vs volume. EcommerceFastlane has seen brands save roughly $200 to $500 per month after switching banks around $50K+ revenue when wire fees and transaction limits start stacking. Document payout timelines, then plan inventory payments around expected deposits.

Scale Stage ($1M+): Protect Cash, Improve Controls, Reduce Risk

Consider treasury or yield options for idle cash, add formal approval rules for wires and high-value ACH, and run a multi-bank setup for redundancy. Tighten reconciliation cadence because teams create more transaction noise. Expense management and corporate card controls become the next layer once banking is stable.

Summary

Business checking is not a boring admin task. It is the control center that keeps Shopify and Stripe deposits, ad charges, refunds, payroll, 3PL bills, and taxes from colliding at the worst time. The article’s core point is simple: your bank balance can lie to you when money timing is off. Payouts can land days after ad platforms pull, and inventory wires can clear before refunds settle. That mismatch creates “false confidence” and triggers panic moves like pausing ads, delaying a PO, or scrambling to cover payroll.

A strong setup starts with separation and scale. Use an operating account for day-to-day bills, then add accounts as revenue grows. Under $10K per month, one operating account can work. Around $10K to $100K per month, add a tax reserve account so tax money stops getting spent on inventory and ads. At $100K+ per month, add a marketing spend account (or sub-accounts) so Meta and Google cannot drain cash that should cover payroll and suppliers. This structure is not just cleaner. It reduces decision fatigue because each dollar already has a job.

The article also highlights why “free checking” can quietly get expensive. DTC brands often hit 500+ monthly transactions once apps, shipping, refunds, and vendor payments stack up. Fees that look small on paper can add up fast when you cross limits. Use the simple math from the post to estimate your true monthly cost before you commit: fixed monthly fee + (transactions over limit x per-item fee) + wires + cash deposits. Do not confuse debit card rewards with lower banking costs. Treat rewards as a separate decision.

Cash timing risk is real, especially with payment processors. In recent guidance from payment platforms, reserves and holds are described as a normal tool to manage refund and chargeback risk. Some brands see rolling reserves in the 10% to 25% range, and holds can last 30 to 90 days (sometimes longer in higher-risk situations or during sudden volume spikes). That is exactly why the “2-week rule” matters. Keep at least two weeks of fixed costs in checking, or in a reserve you can move instantly, so a payout delay does not turn into missed payments.

To make this system work in real life, keep the routines lightweight:

- Automate recurring bills, tax transfers (a simple starting point is 30% until your CPA sets a better rate), and low-balance alerts.

- Review your money weekly for 10 minutes: confirm payouts match your schedule, spot duplicate app charges, check ad pulls, and note upcoming inventory wires.

- Document payout timing and ad pull dates in one place so you stop guessing.

Finally, remember the safety and risk basics as you grow. FDIC deposit insurance is commonly referenced at $250,000 per depositor, per insured bank, per ownership category, and some fintech tools use sweep networks to spread funds across banks. If you are carrying big balances, confirm exactly where your funds sit and how they are insured. Do not assume.

Next Steps

I have seen the same pattern repeat across hundreds of DTC operators: brands do not get crushed by “bad products,” they get squeezed by timing, messy accounts, and avoidable fees. Treat business checking like your ops command center, separate accounts by purpose, automate transfers and alerts, and run a weekly 10-minute review. Your next step is simple: today, open or clean up your operating account, add a tax reserve, and set one low-balance alert that forces action before cash gets tight.

If you want to keep building on this, revisit the post’s checklist, pair it with your bookkeeping setup in QuickBooks or Xero, and audit your banking fees every 6 months (or right after a major channel shift like wholesale or international).

Frequently Asked Questions

Do I Need An LLC To Open A Business Checking Account?

No. Many banks allow sole proprietors to open a business account using an SSN. If you’re planning to scale, an LLC or corporation often makes ownership, bookkeeping, and liability separation clearer.

Will It Require A Credit Check Or Personal Guarantee?

Usually not for a basic checking account. Some banks may verify identity and run internal risk checks. Credit checks and guarantees are more common for lending products and certain card programs.

How Long Does Approval Usually Take?

Simple applications can be approved the same day, but 1 to 3 business days is common. Delays often come from name mismatches, address verification, or missing business docs.

Can I Switch Banks Mid-Year Without Breaking My Bookkeeping?

Yes. Keep the old account open until all pending payouts, refunds, and subscriptions clear. Export statements, update bank feeds in QuickBooks or Xero, and document the cutoff date so reconciliation stays clean.

What Happens If Stripe Or Shopify Holds Funds?

You may lose access to cash for days (sometimes longer), which can trigger missed vendor payments or overdrafts. The fix is planning, not panic: keep a reserve, know payout timing, and avoid spending operating cash down to zero.