Key Takeaways

- Leverage your CLV to outpace competitors by identifying and retaining high-value customers while optimizing marketing spend effectively.

- Calculate your CLV using the simple formula (Average Order Value × Purchase Frequency × Customer Lifespan) to make precise, data-driven decisions.

- Enhance customer relationships with loyalty programs, thoughtful communication, and personalized offers to create lasting value for both your business and customers.

- Act quickly by using short-term CLV tools like 30- or 90-day metrics to adjust your budget and strategies without waiting years for long-term data.

Customer Lifetime Value (CLV) is one of the most underrated metrics in business.

Yet, the biggest brands—like Starbucks—know exactly how much a single customer is worth to them. A Starbucks customer, on average, has a lifetime value of $14,000. That’s huge, right?

But here’s the thing—most small and mid-sized businesses overlook CLV, and that’s a costly mistake. Why? Because knowing your CLV can help you scale your business predictably. It shows you which customers bring in the most revenue and which ones aren’t worth your time.

So today, I’ll break down CLV in the simplest way possible. No fluff. No confusing jargon. Just a straightforward formula that you can use to calculate your own CLV and use it to maximize profits.

What Is Customer Lifetime Value (CLV)?

Customer Lifetime Value (CLV) is the total revenue a business earns from a single customer throughout their relationship with the company. In other words, it tells you how much each customer is worth to your business over time.

Why does this matter? Simple—when you know your CLV, you can make smarter marketing decisions. You’ll know exactly how much you can afford to spend to acquire a customer without losing money.

The Simple Formula for CLV

Most people overcomplicate CLV by focusing on profit margins and expenses. But let’s keep it simple. Here’s the easiest way to calculate CLV:

CLV = Average Order Value (AOV) × Purchase Frequency × Customer Lifespan

Let’s break it down:

- AOV (Average Order Value): The average amount a customer spends per order.

- Purchase Frequency: How often they buy from you in a given period (e.g., per year).

- Customer Lifespan: How many years they remain a customer.

Example Calculation

Let’s say you run an e-commerce store:

- Your AOV is $100.

- Your customers buy 1.5 times per year.

- The average customer sticks with you for 10 years.

Now, multiply these numbers:

CLV = 100 × 1.5 × 10 = $1,500

Boom! That means, on average, each customer is worth $1,500 to your business.

The Challenges of Calculating CLV

Now, there are a few challenges with CLV. The biggest one? Customer lifespan is a bit abstract. If you’re a new business, you won’t know how long your customers will stick around. You’d need decades of data to get an accurate number.

That’s where short-term CLV calculations come in.

Short-Term CLV: The Game Changer for New Businesses

Instead of waiting 10 years to see your actual CLV, you can calculate shorter-term CLV. Tools like Triple Whale, Klaviyo, and Northbeam use time-based CLV calculations:

- 30-day CLV

- 60-day CLV

- 90-day CLV

For example, if your AOV is $143 and your 60-day CLV is $442, that means customers spend about $442 within the first 60 days of becoming a customer. Knowing this can help you adjust your marketing budget accordingly.

The Most Important Ratio: CAC vs. CLV

One of the most important things CLV helps with is determining Customer Acquisition Cost (CAC). CAC is how much you spend to acquire a customer through paid ads, SEO, or other channels.

Here’s the golden rule: Your CLV should always be higher than your CAC.

For example:

- If your CLV is $1,500 and your CAC is $500, you have a 3:1 CLV to CAC ratio.

- This means for every $1 spent, you make $3 back over the customer’s lifetime.

If your CAC is higher than your CLV, you’re in trouble. That means you’re spending more to acquire customers than you’re earning from them. And that’s a fast track to losing money.

CLV vs. Lifetime Gross Profit

Many people confuse CLV with profit, but here’s the truth: CLV is based on revenue, not profit.

To calculate Lifetime Gross Profit, simply subtract your Cost of Goods Sold (COGS) from CLV.

Example:

- CLV = $1,500

- COGS = $500

- Lifetime Gross Profit = $1,000

This is the number that actually tells you how much money you’re making per customer after covering your product costs.

How to Use CLV to Scale Your Business

Now that you know your CLV, here’s how you can use it to grow:

- Spend More on Acquisition: If your CLV is high, you can afford to spend more on ads and marketing to acquire new customers.

- Focus on Retention: It’s cheaper to keep an existing customer than to acquire a new one. Use email marketing, loyalty programs, and exceptional customer service to keep them coming back.

- Increase AOV & Purchase Frequency: Upsells, cross-sells, and subscription models can boost your CLV significantly.

Use Data Analytics to Increase CLV

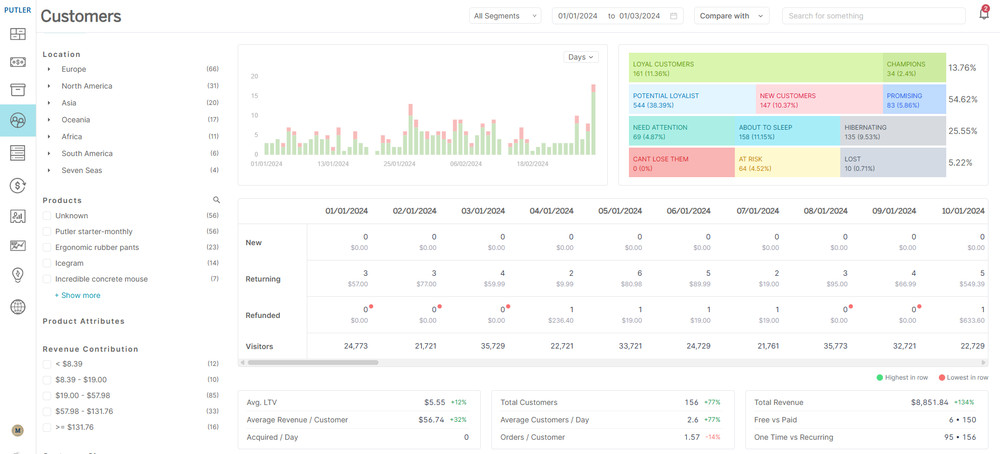

Putler is an all-in-one eCommerce analytics tool designed to help you maximize CLV. With 200+ powerful metrics, it takes the guesswork out of customer insights.

Here’s how Putler helps:

- RFM Analysis: It segments customers by purchase behavior so you can target them with personalized offers and keep them engaged.

- Frequently Bought Together: Putler identifies product pairings, helping you create bundles and upsell strategies that boost order value.

- Refund Insights: Spot trends in returns, address customer pain points, and turn potential losses into loyalty.

- Detailed Customer Profiling: Get a 360-degree view of your customers, track purchases, and personalize interactions for higher retention.

By leveraging Putler’s analytics, you can fine-tune your marketing, reduce churn, and drive more revenue per customer. Try the demo and see the power of Putler in action!

Final Thoughts

CLV is one of the most powerful metrics in your business. It helps you make smarter decisions, scale effectively, and avoid losing money on acquisition.

So, what’s your CLV? If you haven’t calculated it yet, use the simple formula today and start optimizing your business for long-term profitability.

And if you want to dive deeper into customer retention strategies, check out this comprehensive guide—it’ll show you exactly how to keep your best customers coming back for more.

Frequently Asked Questions

What is Customer Lifetime Value (CLV), and why is it important for my Shopify store?

Customer Lifetime Value (CLV) measures the total revenue a customer brings to your business over their lifetime. It’s essential for Shopify store owners because it helps prioritize high-value customers, optimize marketing budgets, and predict revenue growth. Knowing your CLV lets you make smarter decisions, like how much to spend on acquiring new customers without losing money.

How can I calculate CLV for my business?

You can calculate CLV using the formula: CLV = Average Order Value (AOV) × Purchase Frequency × Customer Lifespan. For example, if customers spend $100 per order, purchase 1.5 times annually, and stay for 10 years, your CLV is $1,500. This simple calculation provides a clear snapshot of your business’s long-term revenue potential.

What actionable insights does CLV provide for Shopify marketers?

CLV helps marketers balance spending by ensuring acquisition costs (CAC) remain lower than CLV. For example, if your CLV is three times higher than your CAC, you can scale paid ads with confidence. It also guides retention strategies like launching loyalty programs and personalized email campaigns to boost revenue from repeat customers.

What are the biggest challenges when calculating CLV, and how can I overcome them?

The main challenge is estimating customer lifespan, especially for newer Shopify stores. To overcome this, use short-term metrics like 30-day or 90-day CLV provided by tools like Klaviyo and Triple Whale. These insights help you make data-driven decisions without waiting years for long-term data.

How can CLV help me allocate my marketing budget more effectively?

By knowing your CLV, you can confidently set limits on your Customer Acquisition Cost (CAC). For instance, with a CLV of $1,500, spending $500 to acquire a customer yields a 3:1 return on investment. This ensures your marketing efforts drive profits, not losses, and enables scalable growth.

What’s the difference between CLV and Lifetime Gross Profit?

CLV calculates total revenue generated by a customer, while Lifetime Gross Profit subtracts costs (like product manufacturing or shipping). For example, if your CLV is $1,500 and your Cost of Goods Sold (COGS) is $500, your Lifetime Gross Profit is $1,000. This distinction is key for understanding your actual profitability.

How can Shopify merchants boost CLV for their online stores?

To increase CLV, focus on strategies like launching subscription models, offering upsells at checkout, and creating targeted marketing campaigns. For example, encouraging customers to bundle products or opt for recurring purchases can increase both their purchase frequency and average order value.

What role does CLV play in customer retention strategies?

CLV highlights the importance of retaining high-value customers, as it’s cheaper to retain them than acquire new ones. Retention tactics like loyalty programs, personalized customer service, and email campaigns can extend customer lifespan while strengthening relationships. These efforts turn one-time buyers into long-term supporters.

How can tools like Klaviyo and Triple Whale help with CLV?

Tools like Klaviyo and Triple Whale offer time-based CLV analysis, such as 30-, 60-, or 90-day metrics, to help Shopify businesses adjust marketing strategies quickly. These tools identify which channels bring in high-value customers and reveal opportunities for immediate budget optimizations. They also make short-term CLV accessible, even for small businesses.

What is the ideal CLV to CAC ratio for profitable growth?

A good CLV to CAC ratio is at least 3:1, meaning you earn $3 for every $1 spent on acquiring customers. For example, if your CLV is $1,800 and your CAC is $600, that’s a healthy 3:1 ratio. This ensures your Shopify business remains profitable and helps maintain a scalable growth trajectory.