Retailers are increasingly focused on Black Friday and Q4 holidays, but as we see in the Insights data this week, orders are declining across the globe. Either consumers are holding back purchases in favor of Cyber Week, or consumers just have increasingly less to spend on anything other than essentials.

In August, consumer spending in the US fell by $7.2 billion, in part due to massive declines in credit card spending for six months in a row.

The US administration has shut down a second stimulus package until after the election which puts millions of consumers in danger of eviction. Earlier this year, Congress approved the $2.2 trillion CARES Act to keep the economy going.

Now Federal Reserve Chairman Jerome Powell is pleading for action from Congress, saying, “The pace of economic improvement has moderated since the outsize gains of May and June, as is evident in employment, income, and spending data. The increase in permanent job loss, as well as recent layoffs, are also notable.”

Welcome to the weekly Insights commerce roundup where we track how brands are adapting to changes in consumer shopping and spending around the world. Here are some of the top e-commerce trends we’ve spotted over the past seven days.

Despite the Move from July to October, Prime Day 2020 Forecasted to Bring in Almost $10 Billion

eMarketer has crunched the numbers and predicts that Amazon Prime Day, set for October 13th, will generate $9.91 billion in global sales (up $2.98 billion YoY), and $6.17 billion in the US (up $1.85 billion YoY). Compared to Prime Day in 2016, global sales have grown by $8.41 billion in four years.

That all hinges on how the pandemic will

However, as an August poll from Piplsay discovered, 48% of US consumers plan to spend the same as or more than Prime Day 2019, with only 31% planning to spend less.

Items that Amazon believes consumers want this Prime Day include new Alexa and Echo devices, e-learning packages, cooking, and sanitation products.

NRF Voices Hope for Holiday Retail Even as Consumers Plan to Spend Less

Chief Economist for the National Retail Federation, Jack Kleinhenz revealed in a recent press release that he’s somewhat hopeful about retail in the upcoming holidays.

“I’m cautiously optimistic about the fourth quarter in terms of the economy and consumer spending, but the outlook is clouded with uncertainty pivoting on COVID-19 infection rates… the reopening of the economy over the past several months has created momentum that should carry through the fourth quarter. The test is whether consumer spending will be sustained amid wildcard puzzle pieces, including policy surprises, the election, and a resurgent virus.”

Without extended unemployment benefits or a second round of stimulus aid, consumers may not meet the hopeful expectations for retailers. September 2020 data from Morning Consult indicates that US adults intend to spend less. Only 19% say they plan to spend over $500 this year, down 6% from 2019. The second spending tier $300-$500 is also expected to be down 2%, where the bottom tiers are increasing ($100-$300 up 4% YoY, and <$100 up 5% YoY).

In the survey, 33% said they’re actively trying to spend less this holiday season, 24% intend to budget holiday spending, 22% plan to compare prices more than in the past, and 21% say they’ll give fewer gifts to family this year.

Mark Dolliver, eMarketer principal analyst at Insider Intelligence says, “Bargain-hunting will have special urgency for low-income households, as it did during their slow recovery from the Great Recession.”

In Q3, Consumers Spent $28 Billion on Mobile Apps

With social distancing and working and schooling from home, it may not be surprising that mobile app spending shot through the roof in Q3, accelerating mobile by two to three years in one quarter. A report from App Annie shows that 33 billion apps were downloaded globally, and spending rose 20% YoY to a record $28 billion.

- Average monthly hours spent in mobile apps: just shy of 200 billion and up 25% YoY in Q3

- The top four countries in terms of hours spent on non-gaming apps:

- India: +30% YoY, around 35 billion hours

- Brazil: +30% YoY, around 15 billion hours

- United States: +15% YoY, around 12 billion hours

- Indonesia: +40% YoY, just under 10 billion hours

- Of the 33 billion downloads, Google Play was responsible for 25 billion (+10% YoY), and iOS accounted for the other 9 billion downloads (+20% YoY).

Data Insights for the Week

The Americas

Seven countries from the region are in the global top ten for pure e-commerce orders growth (five countries top the list). For retail e-commerce, the Americas have five countries in the global top ten, though most of the region is seeing declines.

Orders Increase Leaders at a Glance

Europe

Europe’s top pure-play performers trail the Americas and APAC, but overall, the region is on an upward swing in orders growth YoY. In retail e-commerce, Europe outperformed the Americas (with three countries tied for #1 in the world), a great sign as we move into Q4.

Orders Increase Leaders at a Glance

Asia Pacific

In pure e-commerce orders growth, Thailand leads the region at #4 in the world, with good growth from Japan, Australia, and the Philippines, but overall, APAC is declining. Retail e-commerce is on the rise overall, but only Australia, Japan, and New Zealand have positive orders growth YoY this week.

Orders Increase Leaders at a Glance

Top Product Trends of This Week

Key Product Trend Insights: Appliances rise to the top again, though top YOY uplift rates are under 1,000% and falling. This may be a calm before the holiday season starts.

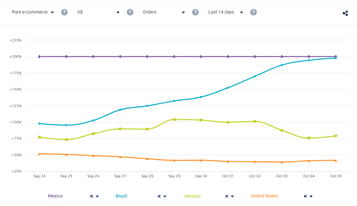

Growth Rate of Online Transactions

Looking at orders growth this week, pure e-commerce in the Americas has remained on top for the last month, but in retail online orders, Europe and APAC are seeing the most growth. This may change dramatically in the next few weeks as the first holiday sales kick off in the US and around the world.

Following are the growth trends we see this week, but you can explore Regional and Countries trends in more depth.

Trends by Region

Pure e-commerce: The Americas have the top pure-play orders growth this week with seven countries in the global top ten, though Europe is only 10% behind the Americas and making steady gains. APAC, overall, is hovering around -10% YoY.

Retail online: Europe’s retail e-commerce has outperformed the other two regions for most of the last two weeks, but in the past few days, APAC has overtaken Europe and continues to rise, though only Australia made it into the global top ten. Despite great growth for Ecuador, Chile, Peru, Mexico, and Colombia, the Americas overall are tanking at the end of this period. We’ll see what Amazon Prime Day and Target Deal Days do for retail orders growth.

Trends by Country

Pure E-Commerce

The top three countries in the Americas (all tied for #1 in the world) are seeing over 200% orders growth YoY. Argentina and Puerto Rico have led pure players in the region for the last three months, but over the last four weeks, Mexico rose +63% to join them.

In the same time, the rest of the region has performed well with six countries over 100% orders growth YoY: the Dominican Republic only fell 0.95% to end at +199% YoY and #2 in the world, Brazil rose a strong 52% (+191% YoY, #3 global), Chile fell sharply, down 95% (+105% YoY, #5 global), and Jamaica rose 15% (+82% YoY, #7 global). The US fell 8% in the last four weeks to end at +41% YoY, and Peru came back 13% to end at 14% YoY.

Orders growth in pure e-commerce in Europe is modest this week, with ten countries under 0% YoY, although the majority of the region is seeing small yet positive growth rates. As the only country in the global top ten (coming in at #9), Sweden leads the region with +19% growth in the last four weeks ending at +67% YoY.

In the same time, Bulgaria had the second biggest increase of +34% (+51% YoY), Germany rose 21% (+50% YoY), Italy rose the most, up 35% (+45% YoY), Belarus fell 42% (+44% YoY), Poland rose 11% (+42% YoY), the Czech Republic gained 21% (+24% YoY), Denmark rose 19% (+21% YoY), Slovakia had the third biggest rise, up 29% (+15% YoY), and the United Kingdom climbed 4% to end at +13% YoY.

Despite the top five countries in APAC being the only ones with over 0% YoY in pure e-commerce orders growth, four APAC countries are in the world top ten, and most of the region has made gains over the last month.

Way ahead of everyone else, Thailand rose 44% to end at +183% YoY and #4 in the world. Nearly 100% lower than Thailand is Japan, up 74%, the second biggest gain in APAC in the last four weeks (+85% YoY, #6 global), followed by Australia up 7% (+78%, #8 global), the Philippines with the biggest gain, up 76% (+66%, #10 global), and South Korea up 41% (+17% YoY).

Further down, China made a small 4% gain to finish at -76% YoY, and India held on to -99% YoY with only a -0.5% fluctuation in the last four weeks.

Retail Online

The top five countries in retail e-commerce orders growth in the Americas all made the global top ten as well, with Ecuador continuing its three-month reign at over 200% YoY growth and tied for #1 in the world.

Close behind and over 100% YoY orders growth are Chile up a monumental 167% in the last month (+199% YoY, #2 global), Peru up 13% (+191% YoY, #4 global), and Mexico down 53% (+147% YoY, #6 global).

Rounding out the region, Colombia slipped 3% (+76% YoY, #9 global), Canada plummeted 56% (+58% YoY), the United States dropped 36% (+35% YoY), and Brazil fell 16% to end the week at -66% YoY.

Retail e-commerce in Europe has seen good orders growth over the last four weeks, outperforming pure e-commerce, with the top six countries over 100% YoY growth and only four countries under 0% YoY. The top three countries (Belgium, Poland, and the United Kingdom) are all over 200% YoY growth, have all been on top for the last month, and are also all tied for #1 in the world.

In the last four weeks, Finland gained 96% (+199% YoY, #3 global), Spain rose 37% (+163% YoY, #5 global), and Austria rose 29% to finish at +101% YoY and #7 in the world.

Forty percent lower than Austria is the Netherlands, down 3% (+61% YoY, #10 global), and further down in the last month are Germany (up 5% for +15% YoY) and France (up 2% for +12% YoY).

Year-over-year orders growth in APAC retail e-commerce is overall lower than the other regions. Only the top three countries have positive annual growth and only one, Australia (down 1% in the last month for +83% YoY), made it into the global top ten at #8.

Over 50% below Australia, Japan gained the most (+21%) in the last month to finish at +26% orders growth YoY, followed by New Zealand falling 43% (+20% YoY), Thailand rising 12% (-3% YoY), Taiwan falling 13% (-18% YoY), and China dropping 11% to end at -29% YoY.

This article originally appeared by our friends at Emarsys.