Key Takeaways

- Use December as your secret edge by turning BFCM shoppers into higher-margin repeat buyers while other brands slow down.

- Follow a simple December playbook that starts with your BFCM results, tightens shipping and support, and then plans January campaigns before the year ends.

- Protect your team and customers by setting clear shipping promises, helpful support scripts, and gift-friendly offers that lower stress for everyone.

- Turn shipping deadlines, gift cards, and post-holiday gift card use into fresh last-minute promos that keep sales flowing long after Cyber 5 is over.

If you run a Shopify store, you just lived through a historic weekend.

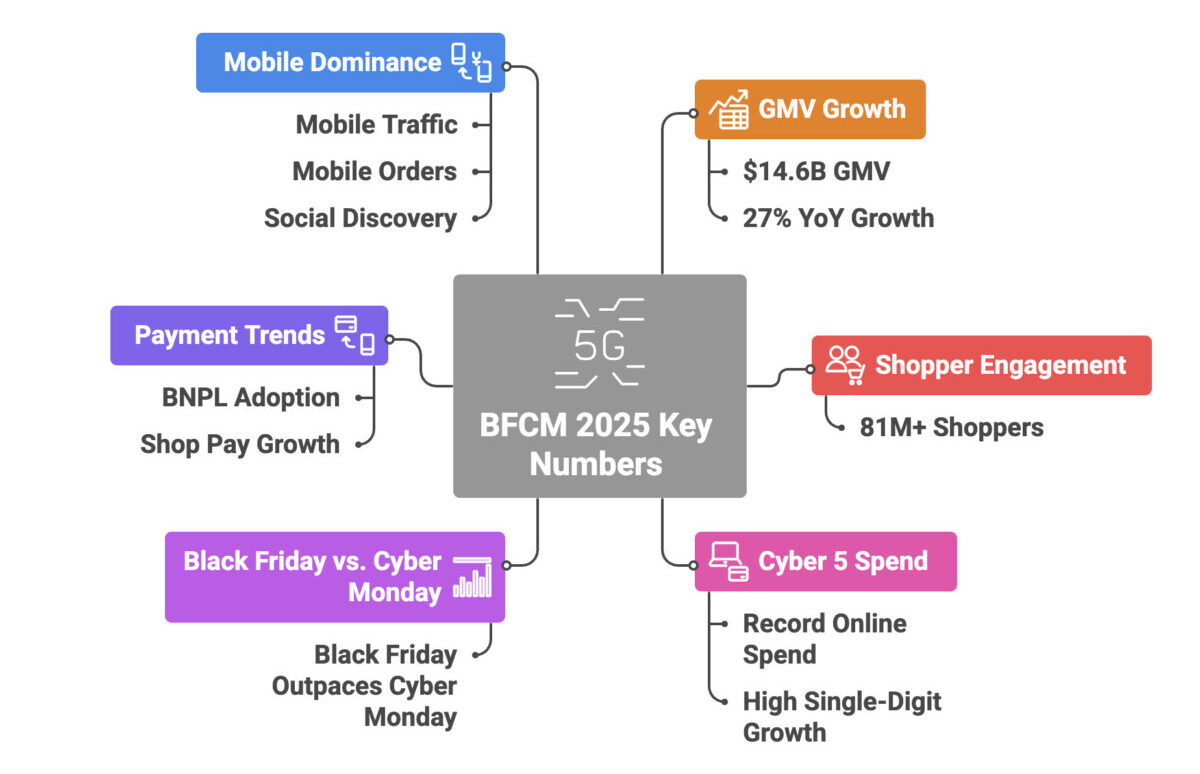

Shopify merchants drove about $14.6B in BFCM GMV with roughly 27% year‑over‑year growth and more than 81M shoppers buying direct from brands, according to Shopify’s BFCM 2025 data. The broader Cyber 5 window also hit new highs, with US ecommerce setting fresh records and Black Friday growth outpacing Cyber Monday in several reports.

Here is the part most operators miss: BFCM was proof of demand, not the finish line. December is where you make or miss your year.

NRF data summarized by CNBC’s holiday turnout analysis and Digital Commerce 360’s Cyber 5 highlights all point to the same thing. A huge share of holiday spend still happens after Cyber Monday, especially in December. The AI-fueled traffic spike, heavier Buy Now, Pay Later usage, and mobile-first behavior you just saw are signals for how to treat the rest of the season.

The pattern is consistent: the most profitable brands quietly turn December into their edge while everyone else catches their breath. This is your December gameplan, built to be something you can run with your team this week, not a theory deck for next quarter.

The BFCM 2025 Numbers

You’ve likely seen the headline stats, so let’s turn them into decisions.

- $14.6B GMV processed by Shopify merchants over BFCM, 27% YoY growth, per Shopify’s official recap

- 81M+ shoppers bought from Shopify brands

- Cyber 5 US online spend hit a record, with high single‑digit growth reported in sources like Digital Commerce 360

- Black Friday growth outpaced Cyber Monday in several sectors, according to StyleArcade’s 2025 Black Friday report

- BNPL and Shop Pay adoption spiked, with Shop Pay growing faster than overall Shopify GMV

- Mobile took most traffic and the clear majority of orders, with social discovery pushing a meaningful slice of that traffic

What does that actually mean for you?

- AI was in the room for almost every order. Between AI-optimized ad platforms, smart recommendations, onsite assistants, and automated flows, it is fair to assume that some kind of AI touched close to one in five orders. If you treat AI as a once‑a‑year experiment, you are already behind.

- BNPL is now a merchandising decision, not just a payment option. For carts over about $100, clear “Pay in 4” style messaging is part of the perceived price. Hide it and you suppress conversion.

- Mobile is the default store. Your real storefront is a 6‑inch screen with a thumb-scroll checkout. Every extra field or surprise in shipping terms costs you money.

- Shopify’s stability is a gift, not a given. 2025 did not bring a major Shopify outage, which is a win. Take that as permission to diversify channels and own more of your traffic, not as a reason to be platform‑dependent and passive.

BFCM proved shoppers are ready to buy from you, across channels and devices. December is where you turn that demand into margin, LTV, and repeat buyers.

From Record Sales To Remaining Demand: Why 53% Of Holiday Shopping Is Still In Play

Holiday behavior looks generous on the surface, but it is simple underneath. Most households start exploring on Black Friday, then keep spending through December as paychecks and shipping windows allow.

Depending on the report you read from NRF, Adobe, or Digital Commerce 360’s holiday coverage, roughly 30 to 50% of holiday spend still happens after Cyber Monday. Let’s split the difference and think in simple terms.

If a shopper planned to spend $800 on holiday purchases and used $350 during BFCM, that leaves $450 still waiting to be assigned. Multiply that across tens of thousands of people in your audience. That is not “cleanup.” That is the season.

Here is how that remaining budget usually shows up:

- Gifts they forgot or discovered late

- Upgrades after the main purchase (better bundle, premium version, accessories)

- Treat‑yourself spending between Christmas and New Year

- Second and third orders from people who discovered you during BFCM

Brands that treat December like “leftovers” run deep discounts, burn margin, and ignore the repeat purchase gold sitting in their own file. Brands that treat it like a fresh season build tight retention flows, sharpen their offers, and plug quiet leaks that bleed profit.

If you want to sharpen your eye for those leaks, pair this with the mindset in Invisible Profit Killers. December exposes every small weakness.

Key BFCM 2025 Trends You Must Fold Into December

You do not need a 40‑page report to adjust your December plan. You need to respond to a few sharp trends.

Here are the five that matter most and what to do about each:

- Black Friday pulled demand forward. With Black Friday growing faster than Cyber Monday in fashion and several other verticals, shoppers are moving earlier and mixing store visits with online orders.

Response: Treat early December as “Act 2” of your story. Launch fresh angles, bundles, and gift guides instead of replaying the same BFCM offer. - AI influenced roughly one in five orders. Between AI‑driven media buying, recommendations, search, and chat, a large share of orders had some AI assist.

Response: At minimum, turn on AI‑assisted search or recommendation blocks and monitor what they push. If you want to go deeper, study how AI search behavior is changing in pieces like The $15 Trillion Blind Spot. - BNPL grew sharply for $100+ carts. Reports across payments providers show BNPL adoption highest in mid‑ticket baskets, not just luxury.

Response: Put your BNPL options in plain language on product pages and cart. “From $24/month with BNPL” will pull different buyers than a flat $199. - Mobile owned the funnel. StyleArcade’s Black Friday 2025 report and Shopify both highlight mobile as the primary purchase device.

Response: Audit your mobile cart and checkout today. Remove every non‑essential field and surprise, and simplify the path to Apple Pay, Shop Pay, and Google Pay. - Social content drove discovery. TikTok, Instagram Reels, and creator content sent a disproportionate amount of high‑intent traffic.

Response: For December, bias toward social content that explains, compares, and shows gifting outcomes, not just trend‑chasing hooks.

Here is the pattern I keep seeing across hundreds of brands: those who treat BFCM trends as a one‑week event flatline in December. Those who fold these signals into their offers, site experience, and retention work gain a profitable second wave.

Choose Your December Mindset: Crushed It, Met Goals, Or Missed The Mark

Your next move depends on how BFCM went. Pick your lane first, then act. Random discounting is how solid years get ruined in three weeks.

If You Crushed BFCM: Protect Margins And Turn Buyers Into Fans

If you smashed targets, you are tempted to coast, spray more discounts, or celebrate too early. I get it. That is also how you hand back your profit.

Roughly half of holiday spend is still out there and your margin is fragile. Your job now is to:

- Tighten discount depth. Keep the headline strong but pull back fringe promos that stack too aggressively or kill AOV. Free gift with purchase often beats an extra 10% off.

- Review shipping promises. Stress‑test your cutoffs and capacity. A flood of late gifts with missed delivery will hammer your support team and your reviews.

Run a simple “Love it or we fix it” style campaign to BFCM buyers inside their 30‑day window. The goal is to turn returns into:

- Size or color exchanges

- Store credit

- Small bundle upsells

Back that with post‑purchase email and SMS flows that:

- Offer help with fit or setup

- Suggest obvious add‑ons

- Invite them into your subscription, loyalty, or referral loops

This is where tools like reviews, bundles, and personalization partners pay off. You do not need a full app roundup to act, but if you want a deeper operations lens, the 4‑Week BFCM Operations Playbook pairs nicely with this mindset.

If You Hit Targets: Shift From Deal Hunters To Gift Buyers

You hit plan, but you feel like you left money on the table. That is normal. BFCM traffic is full of coupon chasers. December buyers care more about getting the right gift or solving a real problem.

Your focus now is to change the frame:

- Curate by recipient and intent. Build gift collections like “Gifts for runners,” “Under $50,” “For people who hate clutter,” or “Self‑care after a hard year.” Make the choice feel obvious.

- Rewrite product pages for gifting outcomes. Replace some feature bullets with lines that speak to the gift giver. “They will unpack this in under 2 minutes” or “No sizing guesswork.”

- Test simple bundles. Starter kits, “one and done” bundles, and themed sets reduce friction. Do not overcomplicate the options.

Use quizzes, decision trees, or short guides instead of racing back to 25% off. Help people feel confident in their choice and you win December without giving back all your margin.

If You Underperformed: Audit Calmly And Win Back Browsers

If you missed your BFCM number, December can still save your quarter, as long as you do not panic.

Run a fast, structured audit:

- Compare converters vs browsers. Look at product page and checkout behavior. Where did non‑buyers drop off that buyers did not?

- Check the basics first. Shipping costs, delivery timelines, coupon errors, and mobile load speed. Fix these before you even think about redesigns.

- Identify friction spikes. Confusing bundles, unclear returns, or weak social proof will stand out in session replays and chat logs.

Then run two or three focused plays:

- Dynamic retargeting ads and email that highlight “You almost grabbed this” products

- Honest messaging tied to shipping cutoffs and last‑minute gifting

- Simple offers like free shipping over a threshold or a small bonus gift, not 40% off site‑wide

Treat your BFCM data as a goldmine, not a verdict. If your numbers or attribution feel fuzzy, the perspective in Your Data Is Lying To You will help you see where the blind spots sit.

Your December Operations Gameplan: Shipping, Support, And Easy Wins

December success is much more about operations than it is about creativity. You can align your team in 24 to 48 hours around three pillars: shipping, low‑friction products, and customer service.

Have one short standup or war‑room session per pillar. Assign an owner and a deadline. The brands that separate from the pack around 7 figures are rarely the ones with the flashiest ads; they are the ones whose systems hold under pressure.

Turn Shipping Deadlines Into A Conversion Tool, Not A Scare Tactic

Shipping deadlines already create urgency. You do not need fear‑based copy. You need clarity.

Do this now:

- Publish clear “order by” dates on your homepage, key collections, product pages, cart, and checkout. Example: “Order by December 18 for delivery by December 24 with standard shipping.”

- Segment by region or carrier if you can. Even a simple “East vs West” cutoff helps shoppers trust you.

- Test free or discounted expedited shipping for high‑AOV or repeat buyers instead of another percentage discount. “Free 2‑day shipping over $200” protects margin and makes your premium buyers feel seen.

Back this with strong post‑purchase communication. Proactive shipping updates and honest expectations reduce support tickets and keep reviews high. Operators who treat shipping as a core CX lever almost always see higher repeat rates in Q1.

Make Gift Cards And Easy Gifts Your Safety Net

Gift cards and simple, universal products are your December safety net. They catch all the “I do not know their size” and “I waited too long” buyers.

Position them as thoughtful, not lazy:

- “Let them choose their perfect fit”

- “For the friend who is picky in the best way”

Place gift card calls‑to‑action:

- Near size‑ or fit‑sensitive products

- In abandoned cart flows where size confusion is the likely blocker

- In last‑minute campaigns after your shipping cutoffs pass

The cash flow benefit is real. You recognize the revenue now and handle most of the redemptions when your warehouse and support teams are calmer in January.

Use Customer Service To Seed Q1 Retention And Upsells

Support volume always spikes in December and January. You can treat that as a cost center or as the front line of LTV.

Give your CX team:

- Clear scripts that turn “This did not fit” into size exchanges or store credit, not straight refunds

- Authority to offer small bonuses or bundles when someone has a rough first experience

- Tags for first‑time buyers, gifts, and high‑AOV orders so marketing can follow up later

Then, in January, have marketing build sequences for each of those tags. A first‑time buyer with a smooth exchange is far more likely to become a high‑value subscriber than a first‑time buyer you quietly refunded and forgot.

We have seen this play out again and again in conversations with CX leaders on the Ecommerce Fastlane podcast. Brands that win here often see double‑digit lifts in repeat purchase rate with no extra ad spend.

Set Up Your Post-Holiday Plays: January, AI, And 2026 Experiments

December is not the closing chapter. It is the bridge into January and your 2026 roadmap.

Plan January Campaigns While BFCM Data Is Still Fresh

January is not only for clearance. It is prime time for:

- New Year, better‑you bundles

- Education content that helps customers get more from what they bought

- Loyalty, referral, and review pushes

Before your team checks out for the holidays, block time to:

- Segment BFCM buyers into at least three groups: discount‑driven one‑timers, high‑AOV gift buyers, and subscribers or repeat purchasers.

- Map one follow‑up sequence for each group that focuses on value and outcomes, not more discount codes.

- Lock in subject lines and landing pages while insight is still fresh and your analytics are top of mind.

One paragraph you can hand straight to your team:

After reviewing our BFCM 2025 data, here is the pattern. Shoppers who bought bundles and used BNPL had 20 to 30% higher AOV and engaged more with post‑purchase content. Our January goal is to turn that behavior into a habit. We will run education‑first campaigns for those buyers in the first three weeks of January and measure repeat purchase rate by cohort.

What To Test In 2026: AI Commerce, BNPL, Mobile UX, And Social Shopping

Use this BFCM as your lab for 2026.

From Shopify’s data, NRF’s recap, and Cyber 5 reporting, four themes are not going away: AI‑assisted shopping, BNPL comfort, mobile‑first journeys, and social discovery.

Plan at least one simple test in each area:

- AI and search. Improve onsite search, FAQs, and content for natural language questions that AI tools and shoppers actually use.

- BNPL clarity. Call out BNPL availability and cost breakdowns on product pages and in cart for carts above a set threshold.

- Mobile UX. Run a focused mobile checkout audit for speed, autofill, payment options, and thumb comfort. Fix what slows people down.

- Social shopping. Shift part of your content plan toward short videos that explain products, compare use cases, and show real outcomes.

Brands that treat 2025 data as a testing ground for 2026 decisions will outrun those who reset every year. If you want to expand your view of where AI in commerce is headed, The Future Of Ecommerce In A World Of AI is worth your next reading block.

December Is Where The Year Is Won

December is not the time to clean up after BFCM; it is the month that decides your profit, your repeat buyers, and how strong you enter 2026. Shopify merchants just processed about $14.6B in BFCM GMV with 27% year-over-year growth and more than 81M shoppers, and US Cyber 5 spend hit record levels. Yet a large share of holiday spend still happens after Cyber Monday, which means the real game is what you do with that demand in December.

The most important shift is mindset. Look at your BFCM results and choose your lane:

- If you crushed it, your job is to protect margin and turn first-time buyers into fans with smart post-purchase flows, gentle “love it or we fix it” promises, and exchange-focused policies.

- If you hit targets, focus on moving from deal hunters to gift buyers with clear gift guides, simple bundles, and product pages that speak to gifting outcomes, not just discounts.

- If you underperformed, run a calm audit of converters vs browsers, fix obvious friction (shipping costs, page speed, unclear returns), then use retargeting and honest shipping cutoffs to win back shoppers without blanket 40% off sales.

Operational discipline is what separates brands that coast from those that compound. Turn shipping deadlines into a conversion tool by clearly showing “order by” dates on key pages, and use free or discounted expedited shipping for high-AOV segments rather than higher percentage discounts. Make gift cards and easy, universal products your safety net for late or unsure buyers, and treat customer service as your Q1 launchpad by turning returns into exchanges and tagging high-value tickets for tailored follow-up.

You also need to look past December. Plan your January campaigns now, while BFCM data is fresh. Segment buyers into at least three cohorts (discount-driven, high-AOV gift buyers, and subscribers or repeat purchasers) and map one follow-up sequence for each that focuses on education, habits, and bundles, not just more coupons. Then choose one simple test for each key 2025 trend that will matter in 2026: AI-assisted search and recommendations, clear BNPL messaging on higher-ticket carts, faster and cleaner mobile checkout, and social content that explains and compares, not just entertains.

If you are earlier in your journey, pick one move from this game plan and execute it this week, such as fixing mobile checkout or publishing clear shipping cutoffs. If you are running a 7- or 8-figure brand, use this as a one-hour war-room agenda: align on your December mindset, lock in shipping and support plays, and schedule your January segmentation and campaigns before the team checks out. For deeper tactics, dive into the Ecommerce Fastlane podcast and related guides on AI, invisible profit killers, and full-funnel strategy, and turn this BFCM surge into long-term, compounding growth.

Curated and synthesized by Steve Hutt | Updated December 2025

📋 Found these stats useful? Share this article or cite these stats in your work – we’d really appreciate it!