Who Should (and Shouldn’t) Choose EcomBalance?

Here’s where honest advice meets real-world experience. At this stage, you’re not just collecting vendor pitch decks — you’re looking for the right partner that fits how your business actually runs. EcomBalance isn’t the answer for everyone, and that’s part of why they’ve built trust in the high-growth ecommerce crowd. Get this call right, and your financial clarity stress starts to melt away. Get it wrong, and you’ll just bounce to another “solution” in six months, wasting more money and even more sanity.

Ideal Fit: Who Gets the Most Value from EcomBalance

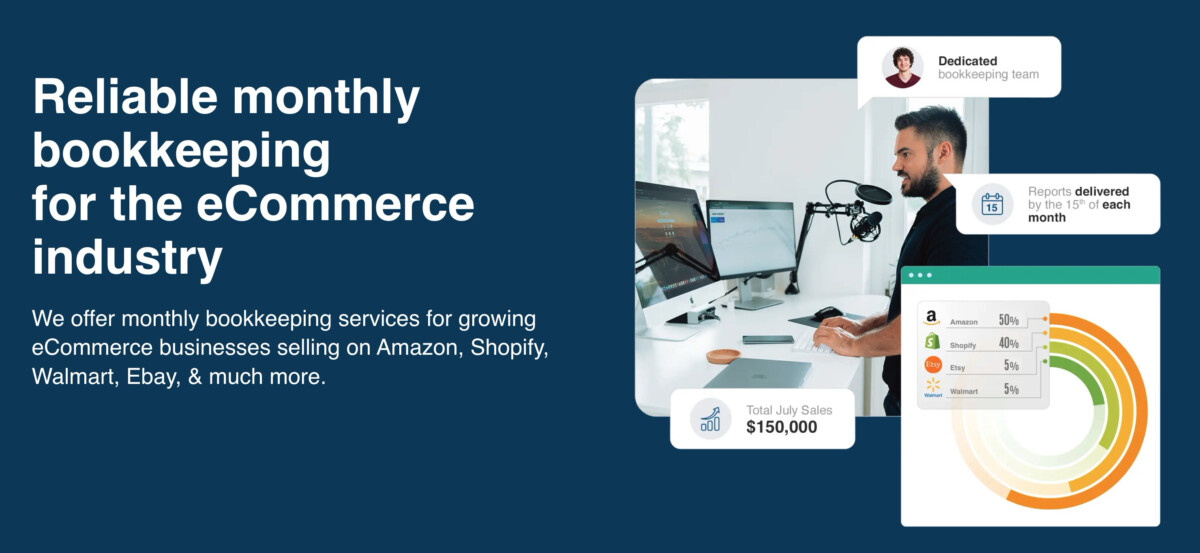

- 7- and 8-Figure Brands Selling Across Multiple Channels: If your business is active on Shopify, Amazon, Walmart, eBay, or even BigCommerce, EcomBalance makes sense. Their team knows the mechanics of reconciling sales, returns, and payouts from all over the map, month after month.

- DTC Operators Who Want Clarity and Control: Say goodbye to duct-tape reporting and “P&L mysteries.” EcomBalance delivers consistent, clear financial reports by the 15th of each month. Operators I know count on that punctual delivery for board meetings, capital raises, and spotting margin slippage early.

- Agencies or Consultants Handling Multiple Client Accounts: If you’re managing the books for several stores, EcomBalance’s cross-channel expertise and process-driven approach will save hours every month. That’s time you can reinvest into client growth, not battling spreadsheets.

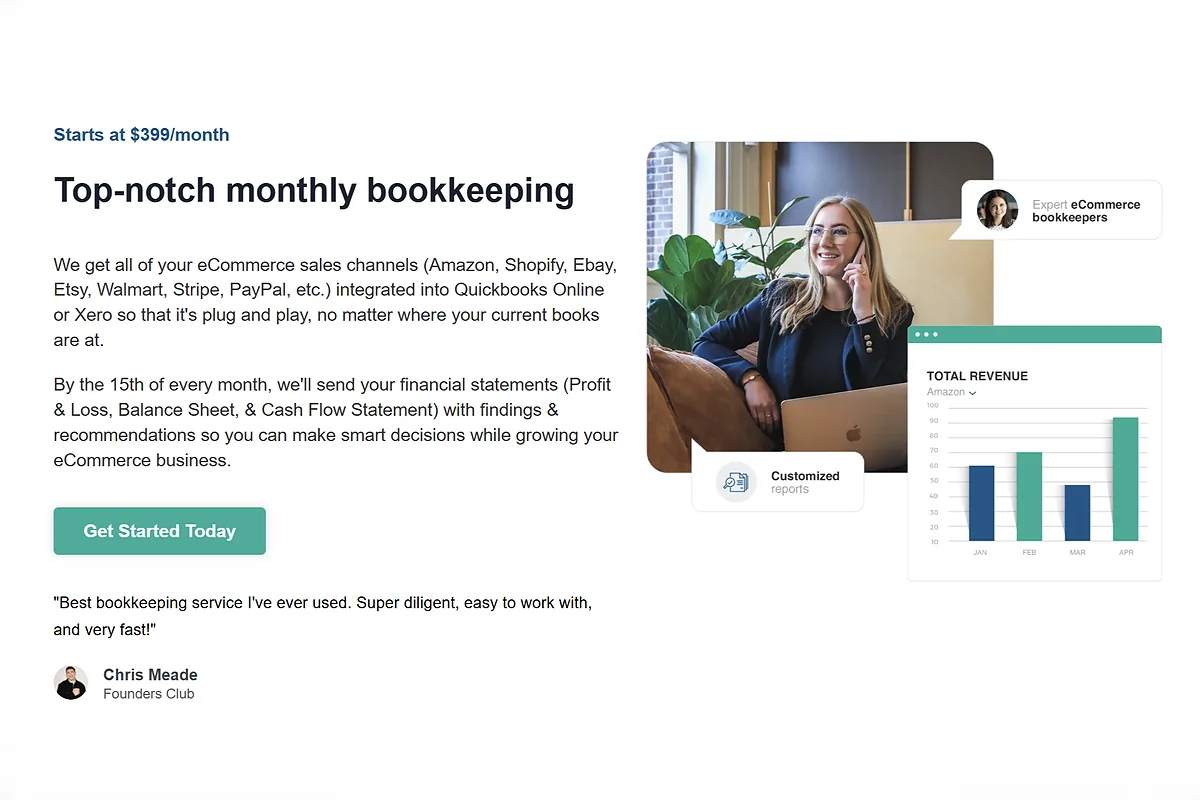

- Brands Ready to Delegate: Typical clients are founders or CFOs who know their time is better spent on strategy, not firefighting receipts and categorizing Amazon fees. With a “plug and play” workflow into QuickBooks Online or Xero, you avoid manual imports entirely.

- Operators Who Value Dedicated Support: EcomBalance is known for direct, reliable support. Ask a question, get a real answer — quickly. This becomes a lifesaver, especially during tax prep or periods of rapid growth.

Quick Signs You’re a Strong Candidate:

- You’re running a growing ecommerce business with tangled, multi-channel sales data.

- You want to shift from monthly chaos to monthly clarity.

- You need clean, gap-free books as a non-negotiable for scale, acquisition, or funding.

- Your team is ready to separate business and personal expenses — no more mixing.

- You want a team that answers the phone and speaks “operator,” not just “accountant.”

Who Shouldn’t Choose EcomBalance

- Early-Stage Stores Without Consistent Revenue: If you’re not yet consistently above the six-figure run rate, their detailed monthly service may be more than you need. Yours is likely a case for a streamlined bookkeeping solution or a DIY approach.

- Non-Ecommerce Businesses or Service-Only Brands: EcomBalance is exclusively focused on ecommerce sellers. If you’re a service agency, law firm, or offline business, the systems and expertise just won’t match up; you might prefer something like AccountsBalance, which handles non-ecom bookkeeping.

- Brands Not Ready to Stop Mixing Personal and Business Expenses: This is a strict line — EcomBalance won’t take on clients who intermingle personal and business finances. If your books are a mess for this reason, pause and clean up before reaching out.

- Companies with Ultra-Niche, Advanced Accounting Requirements: If you need exotic custom accounting integrations, accrual strategies for every tiny category, or have demands that dwarf most ecommerce use cases, prepare for a bespoke (and likely pricier) solution.

- Those Looking for the Absolute Cheapest Option: EcomBalance isn’t trying to be the “$99 a year” bookkeeping solution. Their service starts at $399/month, reflecting the expertise and hands-on process that seven- and eight-figure brands require. If you’re just seeking the lowest possible price, look at lightweight solutions compared in their guide on choosing an ecommerce accounting partner at EcomBalance’s Ultimate Guide.

Bottom line: The right time to upgrade is when the chaos starts costing you more than the fee, and when your next stage of growth depends on consistently accurate numbers. Brands who wait too long typically wind up paying much more in “catch-up” and clean-up fees than if they’d moved earlier.

Pricing, Tiers, and ROI: The P&L Conversation

If you’re running a growing DTC brand, you know every new sales channel or tool adds layers of complexity—and cost. Suddenly, your “stack” includes three different bookkeepers, a finance contractor, and yet another SaaS tool for cobbling together reports. That’s not just money out the door—it’s mental overhead and real operational drag. Let’s unpack how EcomBalance approaches pricing, how their tiers map to ROI, and why a unified platform keeps both your P&L and your team’s productivity out of the weeds.

Tech Stack Consolidation: Savings & Efficiency

Fragmented finance ops aren’t just annoying; they’re expensive and risky. Most brands start with a piecemeal approach: a freelance bookkeeper for day-to-day entries, a tax CPA for year-end questions, plus separate reporting tools for Shopify and Amazon. Now compare that to EcomBalance’s all-in-one pricing.

Let’s break down what that typical “siloed” finance stack looks like each month:

That’s not hypothetical. When you consolidate, you not only reduce your direct costs—you also reclaim team time (and sanity) thanks to a single system with processes that “just work.”

Final Verdict: Strategic Pros, Cons, and Alternatives

This is the section where we bring everything together. After months of test-driving EcomBalance with brands in the $1M to $50M range, and cross-referencing feedback from other operators and consultants, I want to hand you the hard-won clarity that saves countless hours of research. Here’s where we get strategic—highlighting not only what works, but what to watch out for and where else to look if you find yourself on the fence.

Alternative Solutions: Who Else Should You Consider?

Choosing smart is about fit, not just features. If you see EcomBalance as a great “but not perfect” match, here’s where you might want to look for alternatives:

- Bench: Well-reviewed for DTC and Shopify stores in earlier stages, Bench offers a clean monthly service that’s more affordable but less specialized for complex, multichannel operators. They sync with ecommerce platforms but don’t match the depth offered by operator-run services. Compare with what real brands say on Bench’s best ecommerce accounting software roundup.

- Bookkeep: If automation is more important than hands-on human expertise, Bookkeep can centralize channel data directly into accounting software. The trade-off is less high-touch guidance. There’s a useful breakdown of competitors in Webgility’s Bookkeep alternatives guide.

- Traditional CPAs or Local Firms: Legacy CPAs occasionally “get” ecommerce, but most struggle with the pace and complexity of multi-channel DTC brands. If you’re evaluating this route, demand to see proof of recent experience with brands like yours. For a full landscape of traditional and modern solutions, check out this solid overview of top ecommerce accounting services.

Snapshot Comparison

Bottom line: You want your financial reporting to move as fast and as confidently as you do. Most growth-stage Shopify and DTC brands outgrow beginner bookkeeping long before they expect—and the cost of delay is much higher than the cost of expertise.

Conclusion

EcomBalance has proven itself as the bookkeeping partner that operators actually keep—not just trial, but stick with—because the team delivers real, usable clarity where it counts. You get detailed, on-time financials, integration with every sales channel that matters, and the kind of fast, actionable support you wish you’d had years ago. This isn’t just “outsourced books”—it’s financial control, mental bandwidth, and the operational rhythm that enables brands to grow without getting blindsided by their own numbers.

Don’t wait until another month of chaos or missed numbers. Claim your free EcomBalance trial and let your P&L finally work for you, not against you. Share your biggest finance headaches in the comments so we can tackle them together, and subscribe to FastlaneInsider for more real-world brand optimization playbooks you won’t find anywhere else.