Verified & Reviewed

Published on August 18, 2025 Written By Rachel Hand

Published on August 18, 2025 Written By Rachel Hand

Subscribe for More

Important Note: As of August 2025, ShipBob also offers bi-coastal FTZ warehouse access as part of its De Minimis Defense Program, in addition to a global network of fulfillment centers for international fulfillment (as an FTZ alternative for many brands).

These FTZ sites complement ShipBob’s network by enabling duty deferral – or even elimination – and other FTZ‑specific benefits for qualifying merchants without forcing them to completely overhaul their existing workflows.

With the de minimis trade exemption officially ending, many ecommerce brands are scrambling to find a way to keep high stacking tariffs and duties from eviscerating their finances.

While you can’t completely avoid these costs, there is an untapped advantage that can help you minimize their impact: foreign trade zones (FTZs).

These special warehouses exist in a customs “limbo” where you can defer, reduce, or eve eliminate duty payments on imported inventory. If FTZs are a good fit for your business, they can help you dramatically improve cash flow and profitability.

This guide explains everything about foreign trade zone warehouses, including what they are, how they benefit your brand, and how to leverage one compliantly to optimize your global commerce strategy.

What is a foreign trade zone warehouse?

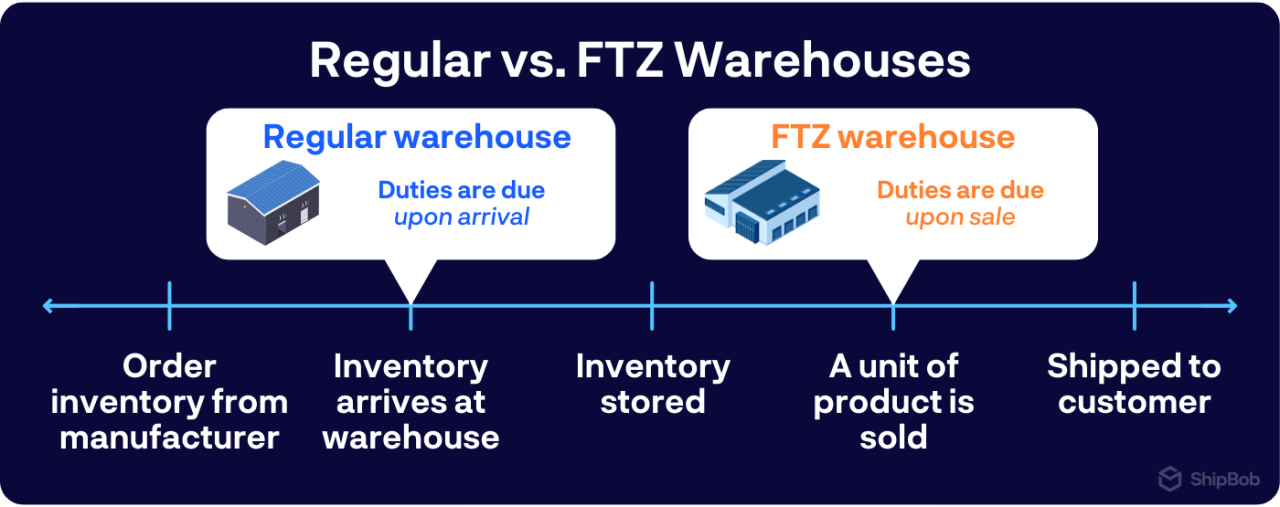

A foreign trade zone (FTZ) warehouse is a designated area within the United States that exists outside of U.S. Customs territory for duty purposes.

An FTZ warehouse lets you import and store inventory on U.S. soil – but rather than paying the applicable import duties and taxes upon entering the country, you instead pay the duties and taxes only after that inventory is sold.

Think of an FTZ as a customs “bubble” inside the U.S. — you can store, inspect, repackage, assemble, and even manufacture goods without paying immediate duties. You only pay when products are sold on the U.S. domestic market.

FTZs are typically located near major ports, airports, and industrial hubs in cities like Los Angeles, Miami, and Houston, as it minimizes the distance inventory has to travel and streamlines international fulfillment and shipping operations.

The Foreign-Trade Zones Board authorizes these zones, while U.S. Customs and Border Protection (CBP) supervises daily operations. For ecommerce brands importing from overseas suppliers, FTZs serve as strategic tools for managing import costs and improving cash flow.

How foreign trade zone warehouses work

When goods enter an FTZ, they exist in a “duty suspension” state where they are physically in the U.S. but legally outside customs territory. Your shipments arrive under CBP supervision, but do not trigger duty payments immediately.

Inside the FTZ, you maintain control over your inventory with one key advantage: no duties are paid until the products enter U.S. commerce.

This flexibility creates significant value. For instance:

- You do not owe a huge amount of money to CBP up front, which helps you free up your cash flow.

- You can perform light manufacturing at an FTZ, combine test products, customize packaging, and even destroy defective items – all without customs complications or duty payments.

- If you sell to customers based outside the U.S., you do not have to pay U.S. customs fees on those goods. Since an FTZ is not legally U.S. soil, any goods stored in and shipped from there never legally entered the US.

What’s changed in 2025?

An Executive Order ends the duty‑free de minimis exception for goods imported into the U.S. from all countries, effective on August 29, 2025.

To help merchants minimize the impact on ecommerce merchants, ShipBob has introduced our De Minimis Defense Program. This program bundles FTZ access with accelerated onboarding, discounts, and expert support to help cushion the costs cost, optimize cash‑flow, and maintain compliance ahead of peak.

The legal framework of FTZs

FTZs operate under the Foreign-Trade Zones Act of 1934, which promotes U.S. foreign commerce while ensuring trade compliance.

Key Stakeholders:

- The Foreign-Trade Zones Board (led by the Secretary of Commerce with the Secretary of Treasury) approves zone status based on public benefit and alignment with U.S. trade policy.

- CBP handles daily supervision, monitoring activities and conducting regular audits to ensure compliance.

- FTZ operators must maintain detailed records and submit regular reports on all zone activities.

Compliance:

- Real-time inventory systems must track every item entering, stored in, or leaving the zone.

- FTZs must also comply with broader regulations including WTO rules, bilateral trade agreements, and product-specific requirements (like FDA or USDA regulations).

5 core benefits of an FTZ warehouse

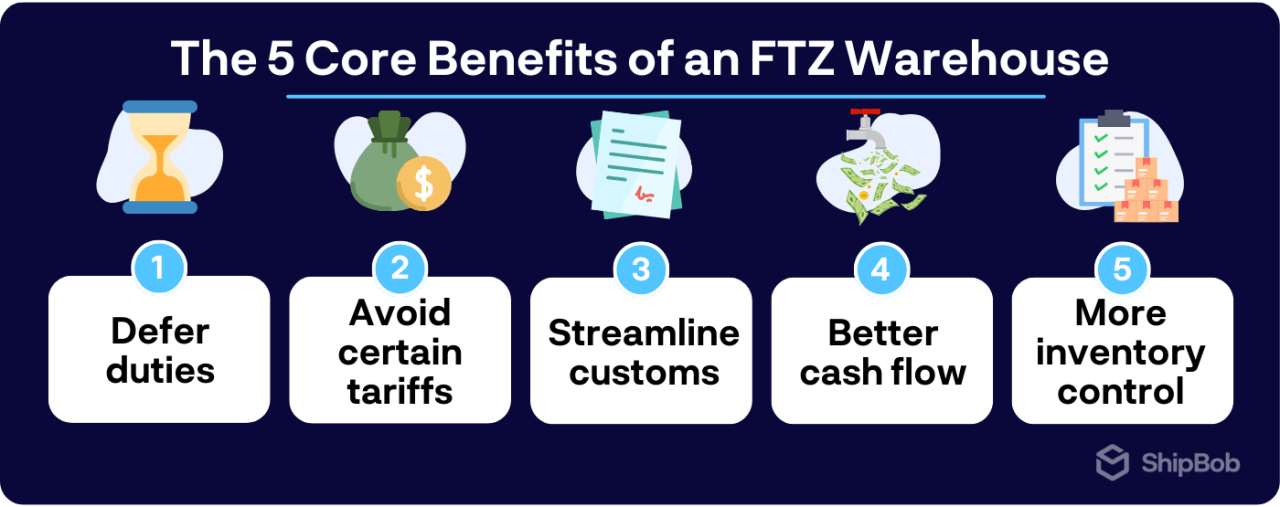

Foreign trade zone warehouses offer significant advantages for import-heavy ecommerce brands – especially those that will be hit hard by the end of the de minimis exemption. Here’s how these benefits could align with your growth strategy:

1. Deferring or eliminating duties

With an FTZ warehouse, you only pay duties when products are sold in U.S. commerce, instead of when they arrive in the country. This isn’t just a timing shift; it’s a cash flow transformation.

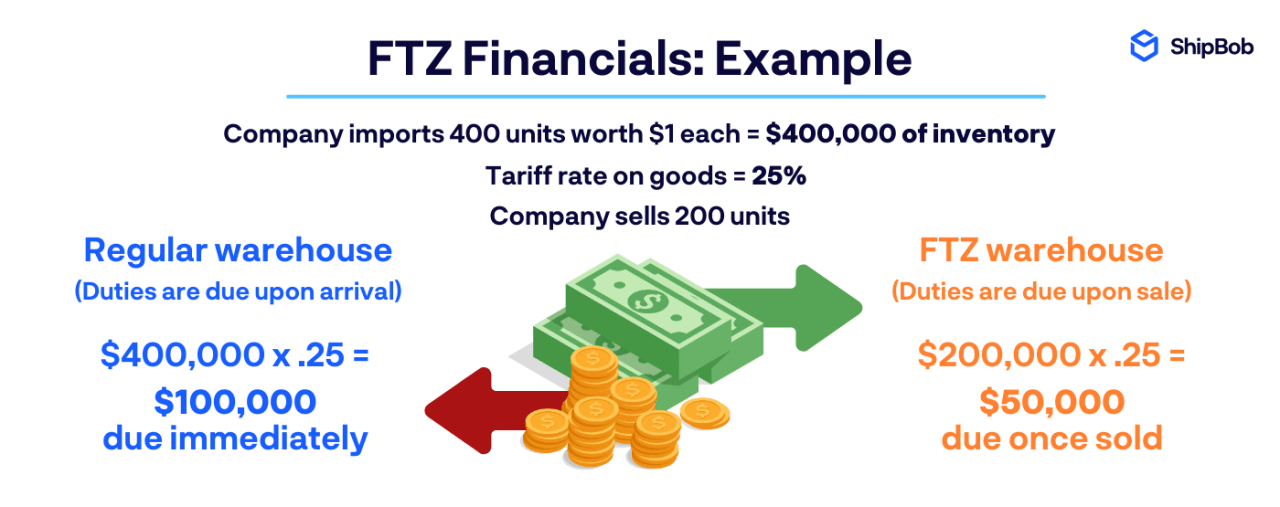

For example, say an apparel brand imports 400 units of inventory, collectively worth $400,000, into the U.S. from China, and must pay a 25% tariff on those goods. Ordinarily, the 25% tariff payment would be due as soon as the goods enter the U.S., and the brand would owe $100,000 upfront without having sold a single unit.

But if the brand leverages an FTZ warehouse, they would not pay any duties or taxes right away. That $100,000 stays in their account, and they would to pay the 25% tariff only after the inventory is sold.

Moreover, they would only pay if the inventory sold. Say the brand ended up selling half of the units due to a product defect. Under normal circumstances, the brand would have already paid $100,000 in duties; but using an FTZ warehouse, the brand only pays a 25% tariff on the 200 units sold. Therefore, they only owe $50,000.

For businesses importing millions annually, these savings compound significantly. With FTZ warehouses, multi-channel sellers can route inventory strategically based on destination, paying duties only when necessary and optimizing cash position throughout the year.

2. Avoiding certain tariffs and taxes

FTZs provide unique opportunities to reduce – or even fully sidestep – specific costs that cut into your margins, such as:

- U.S. tariffs for internationally-bound orders: If you want to store inventory in the U.S., but ship to customers in other countries, an FTX warehouse is an excellent option. You can keep goods geographically within the U.S., but not legally – meaning that you do not owe any U.S. duties or tariffs on those goods at any point.

- Inverted tariff relief: When finished products have lower duty rates than components, assembling items in the FTZ means paying only the lower finished-good rate. For instance, if components face 5% duties but the assembled product faces 2%, you capture 3% savings across your production volume.

- Processing fees: FTZ warehouses let you file weekly entries to CBP, instead of paying fees on every shipment. Many FTZs also offer property tax exemptions or reductions on stored inventory, creating additional savings beyond federal benefits.

- Protection from tariff rate increases: When you admit products in under privileged foreign status, you lock in the tariff rate that you’ll pay when you bring the goods into the zone – not when you withdraw them. So, if tariff rates increase in the meantime, you don’t have to worry about paying more in taxes.

3. Streamlined customs processes

FTZs eliminate friction in international supply chains through simplified customs procedures:

- Weekly entry filing reduces paperwork and broker fees (e.g., a business receiving daily shipments might cut customs entries from 250+ annually to just 52).

- Direct delivery allows shipments to move from port to FTZ without border inspections, saving days in your supply chain.

- Returns and rejected merchandise can re-enter the FTZ without formal customs procedures, simplifying inspection and redistribution.

- Clear protocols between FTZs and Customs create predictable operations without unexpected delays that cause supply chain issues.

4. Cash flow advantages

By changing when cash leaves your business, FTZs fuel growth and improve financial flexibility beyond simple duty deferral.

Seasonal businesses see dramatic benefits. For example, a holiday decor company importing inventory in July would traditionally pay duties months before their November-December selling season. With an FTZ, duties align with actual revenue generation, making cash flow easier to handle.

Capital preserved through duty deferral can fund marketing campaigns, product development, or inventory expansion. A brand deferring $100,000 quarterly could reinvest that money to create value exceeding the original savings.

5. Enhanced inventory control and quality management

While financial benefits drive FTZ adoption, the operational improvements can be equally valuable.

FTZ regulations require precise tracking of every item, forcing you to adopt robust inventory systems with real-time visibility. Many brands find these compliance requirements finally deliver the inventory accuracy they’ve struggled to achieve.

Additionally, quality control improves significantly when items are inspected, tested, and sorted before paying duties. In an FTZ warehouse, you can identify defective items without complex drawback claims, and perform value-added services like labeling or assembly without triggering duties on components.

These operational benefits often outlast the financial advantages. Strong inventory and quality processes established for FTZ compliance typically spread across entire operations, driving long-term efficiency improvements.

Where ShipBob fits:

For brands that need FTZ workflows, ShipBob now provides access to FTZ warehouses on both coasts (CA + PA). For brands that don’t, ShipBob’s globally-distributed fulfillment network still captures many of the same outcomes (lower landed cost, faster delivery, improved cash flow) with less regulatory overhead.

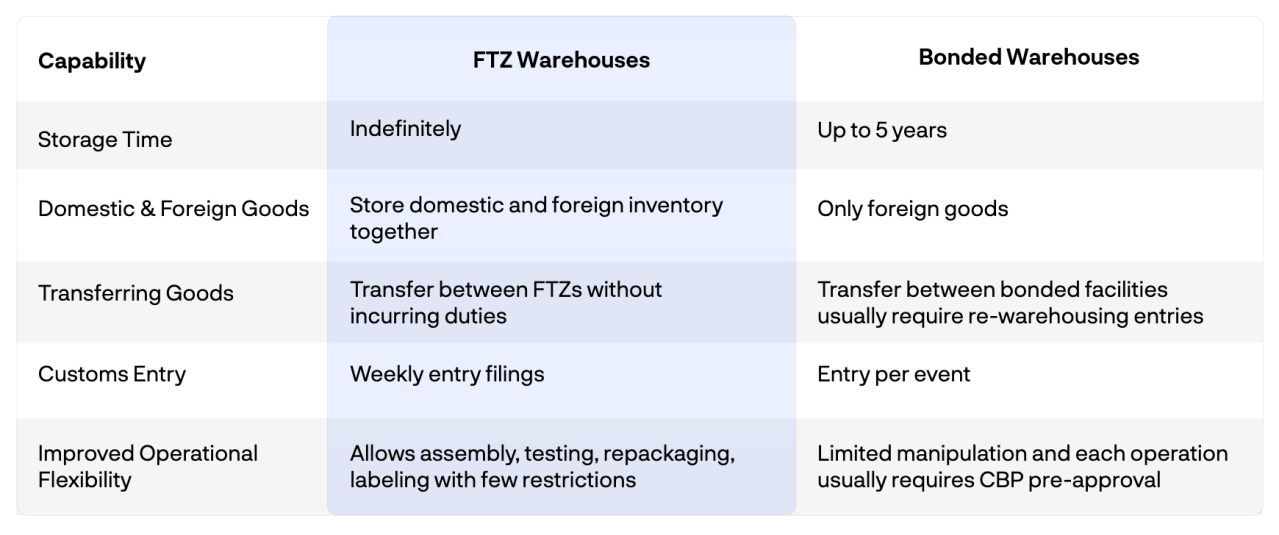

FTZ vs. bonded warehouses: Key differences

Here’s a quick comparison of the key differences:

When to choose an FTZ over a bonded warehouse

You should choose an FTZ warehouse when you:

- Need more than just storage: FTZs are better suited for businesses assembling components, manufacturing products, or customizing items with significant repackaging for the U.S. market than bonded warehouses are.

- Optimize cash flow: FTZs deliver the best ROI for high-volume importers paying six figures annually in duties. By deferring these payments, you free up substantial cash for growth initiatives (which is particularly valuable if you import goods with high tariff rates or those hit by Section 301 tariffs on Chinese products).

- Regularly ship internationally: FTZs eliminate U.S. duties on re-exported merchandise, boosting your global profit margins. Many brands use FTZs as distribution hubs, paying duties only on products sold domestically.

- Need long-term storage: Businesses wanting a long-term storage facility for safety stock, seasonal items, or strategic reserves benefit from an FTZ’s unlimited storage timeframe.

When a bonded warehouse makes more sense

Bonded warehouses work better for businesses with:

- Straightforward storage and distribution for finished goods that require minimal handling: Simpler compliance requirements and lower operational costs make them practical for basic needs.

- Smaller import volumes: When monthly duty savings don’t exceed FTZ compliance costs, bonded warehouses deliver sufficient benefits without the administrative burden.

- Short-term storage: If your inventory turns over within months, the five-year storage limit won’t affect you. Many businesses use bonded warehouses effectively for seasonal imports or supply chain buffers.

- Interest in testing new markets or products: Bonded warehouses’ lower entry barrier lets you experiment with importing strategies before committing to more complex FTZ operations. You can always upgrade as volumes grow.

Your decision should align with your business model, import patterns, and growth trajectory. Many successful importers start with bonded warehouses and graduate to FTZs as operations expand and manufacturing or long-term storage needs increase.

FTZ warehouse compliance and regulations explained

Operating an FTZ means navigating strict federal regulations monitored by two key agencies: the Foreign-Trade Zones Board (handles zone designation) and U.S. Customs and Border Protection (CBP) (oversees daily operations).

Before pursuing an FTZ, read through these key aspects of compliance to get an idea of what’s required.

Activation process and requirements

Setting up an FTZ happens in two stages: establishment (getting legal approval) and activation (beginning operations).

The legal application to set up an FTZ requires a detailed proposal showing public benefit, operational plans, and local support letters. Expect a 10-12 month review with environmental assessments and public hearings.

You’ll need extensive documentation including site plans, security details, and proof of financial capability. All personnel need background checks, and facilities must have secure perimeters, proper lighting, and alarm systems.

After initial approval, CBP activation follows with operations manuals and security assessments, typically taking another 3-6 months.

Permitted activities within an FTZ

FTZs allow for more than just storage. You can manufacture, assemble, and package goods, all while deferring duty payment.

Ecommerce brands commonly use FTZs for kitting, importing components from various countries, assembling finished products, and shipping to customers. You only pay duties on items entering U.S. commerce, with exports remaining duty-free.

Manufacturing activities require specific approval through production notifications detailing your materials and processes. Certain activities are restricted: retail stores aren’t allowed in FTZs, and products like firearms and tobacco need special permits.

Inventory control and recordkeeping systems

Precise inventory tracking is non-negotiable for FTZ compliance. CBP requires real-time visibility into every item’s origin, status, and transformations.

Modern FTZs use warehouse management systems with built-in inventory management capabilities to track all inventory movements and create complete audit trails.

Your system must distinguish between different merchandise statuses and document all transfers with specific forms. Best practices include daily reconciliations, regular cycle counts, and barcode systems to minimize errors.

Security and supervision requirements

FTZ security maintains the integrity of the customs territory distinction. Facilities need fencing, controlled access, surveillance systems, and comprehensive alarms.

CBP conducts both scheduled and surprise inspections. Building a collaborative relationship with local CBP officials makes these interactions smoother.

All personnel need background checks, with many facilities adding drug testing and security training. Any security breaches must be reported immediately with detailed documentation of both the incident and your corrective actions.

How to set up or partner with an FTZ warehouse

Leveraging an FTZ requires significant planning, investment, and regulatory knowledge. Before diving in, evaluate whether your business can handle the complex compliance demands and operational changes involved using these steps.

1. Evaluate your import volume and duty exposure

Start by analyzing your recent import data (12-24 months), focusing on duty rates, countries of origin, and total landed costs. Calculate your annual duty payments across all products (including additional tariffs like Section 301 duties on Chinese goods), plus processing and maintenance fees.

Factor in your growth projections and potential product expansions. If you’re currently paying $500,000 annually in duties but expect to double imports soon, include this in your analysis.

In addition, consider how U.S. tariffs will impact your particular products. Products with high duty rates typically justify FTZ usage, whereas products with lower duties may not necessarily need an FTZ warehouse.

2. Choose between operating your own FTZ or using a service provider

If you opt to use an FTZ warehouse, it’s time to consider your options: operating your own FTZ warehouse, or partnering with a provider or 3PL that offers them.

Operating your own FTZ gives you complete control but requires substantial investment, regulatory expertise, and compliance management. You’ll need dedicated staff, CBP relationships, and specialized systems.

Partnering with an existing FTZ operator offers faster implementation with lower upfront costs. These providers bring established relationships, compliance systems, and operational expertise. However, you may experience higher transaction fees, have less control, and be more limited in the activities you can perform in the warehouse.

Many businesses use hybrid approaches, starting with a service provider to test benefits before transitioning to self-operation, or maintaining their own FTZ for core operations while using providers for overflow.

3. Complete application and activation processes

The FTZ application process is extensive, with documentation often running hundreds of pages. Consider hiring FTZ consultants and legal counsel to improve approval odds and timelines.

After approval, the CBP activation phase requires detailed operations manuals, inventory systems, and security measures. Site inspections often identify needed improvements in physical infrastructure.

Common pitfalls include underestimating infrastructure requirements, inadequate inventory systems, and insufficient staff training. Prepare thoroughly for public hearings where competitors might raise objections.

4. Implement compliant inventory and security systems

Your warehouse management system (WMS) must handle FTZ-specific requirements like status designations, transformations, and reporting. This system should integrate with your ERP, customs broker software, and CBP’s ACE portal.

Physical security needs include access control systems, segregated storage areas, and possibly environmental controls. Every employee working with FTZ merchandise must understand compliance implications through regular training and clear procedures.

5. Establish ongoing customs procedures and reporting

After activation, you’ll need efficient procedures for the many customs transactions generated daily. Regular reporting includes weekly entry summaries, monthly reconciliations, and annual FTZ Board reports.

Conduct regular self-audits rather than waiting for CBP inspections. Keep organized documentation and stay current with regulatory changes through industry associations and customs attorneys. This proactive approach prevents compliance issues and keeps operations running smoothly.

Alternatives to FTZs: Achieve similar benefits with less complexity

Foreign trade zones offer great benefits for certain businesses, but you can optimize international trade costs in other ways, too. Many ecommerce brands achieve similar advantages through simpler strategies with less regulatory complexity.

Focus on which FTZ benefits matter most to your business (whether improving cash flow, reducing duties, or streamlining customs) and find easier ways to capture that value using these approaches.

Global fulfillment networks as an FTZ alternative

If you don’t want to deal with U.S. customs and duties, consider bypassing the U.S. altogether. Instead of storing inventory and shipping orders from a U.S.-based FTZ, store your products in fulfillment centers located within the country or countries you’re shipping to. This approach places inventory closer to customers and reduces duties while improving delivery times.

For example, a brand shipping to customers in a European country can use ShipBob’s fulfillment centers across Europe to store their inventory and ship orders. That way, instead of paying hefty U.S. customs fees on top of pricy international shipping costs, the brand only pays taxes for the destination country and keeps costs and lead times down with a local delivery.

ShipBob’s global network spans North America, the UK, Europe, Australia, and Canada, and lets you distribute inventory strategically without losing operational consistency or visibility. Our platform gives you a unified view across all locations to easily balance inventory and route orders efficiently.

Duty optimization strategies without an FTZ

There are a couple tactics that can reduce your duty costs without FTZ complexity. These include:

- DDP shipping: Delivered Duty Paid (DDP) shipping gives you the option to absorb duty costs for the customer and calculate duty cross-border duties upfront to maintain transparency (and preserve customer satisfaction).

- Tariff engineering: Legally structure imports to minimize the duty rate you pay by changing product configurations, separating components with different duty rates, or timing imports strategically. ShipBob supports these strategies with flexible receiving and intelligent routing.

Hybrid approaches: combining FTZs with global fulfillment

Some businesses benefit the most from a combined approach: using FTZs for bulk storage and duty deferral, then leveraging distributed fulfillment for fast and cost-effective last-mile delivery.

Here’s how it works:

- A merchant imports large inventory quantities into an FTZ to defer duties.

- As orders come in, the merchant withdraws inventory for domestic sales (paying duties only on those items) and moves it to regional fulfillment centers.

- Those regional fulfillment centers pick, pack, and ship the order to the end customer for a cheaper, faster delivery.

- Internationally-bound orders ship directly from the FTZ, so that they don’t incur U.S. duties.

This hybrid strategy maximizes both duty deferral benefits and delivery speed. The FTZ handles customs management while the fulfillment network ensures fast customer delivery; you maintain flexibility to route inventory based on demand and cost optimization.

ShipBob takes the hybrid approach one step further to unify it. We offer brands one dashboard for inventory visibility, allocation, and order routing across FTZ and non‑FTZ warehouses, with your licensed broker handling entries and compliance.

How ShipBob supports cross-border commerce beyond FTZ

Whether you need the full FTZ toolkit or just want to cut costs and speed up delivery, ShipBob can help. Qualified brands can leverage our bi‑coastal FTZ warehouses as part of our De Minimis Defense Program, or distribute inventory across our global fulfillment network to reach customers faster with lower total landed cost. With expert guidance every step of the way, we’ll help you choose the shortest path to seamless cross-border ecommerce.

Global fulfillment network advantages

ShipBob’s international network spans the US, Canada, Europe, UK, and Australia, letting you position inventory strategically near your customers. This approach naturally minimizes duty exposure by placing products directly in their destination markets while unlocking 1-2 day delivery in major metropolitan areas.

ShipBob makes expanding to new markets refreshingly simple: just route inventory to an the international ShipBob facility you need. No lengthy applications, complex compliance systems, or regulatory relationships are required, so you can test new territories with minimal commitment and scale based on actual demand.

“Right now we’re currently leveraging three of ShipBob’s fulfillment centers, including two in different regions of the US from our warehouse and one in the UK. Shipping to UK customers from a facility within the UK saves us $6 per shipment on average, which is huge! England is a big market for us, so those per-order cost-savings really add up, and our international customers are getting a much faster and less expensive delivery thanks to ShipBob’s global presence.

Distributing inventory across the world with ShipBob also drastically cut our transit times. When we were only shipping from our Miami, FL warehouse, it would take us 25 days to deliver an order to a customer in the EU, while using ShipBob’s UK fulfillment center, it takes only 3 days. That’s an 88% reduction in shipping time for those international customers!”

Rachel Tannenholz, President of Aroma360

DDP designed to delight customers

ShipBob’s DDP solution enables brands to calculate duties and taxes for every international order at checkout, so customers can see exactly how much an order costs up front. This helps your brand minimize surprises, preserve transparency and customer trust, and even convert more global shoppers.

“We also leverage ShipBob Delivered Duties Paid (DDP) shipping to reach our customers outside of the US. Using ShipBob DDP allows us to ship worldwide and we’re lucky that ShipBob has a solution like that because we’ve used it since we onboarded.”

Kayleigh Christina, Co-Founder and CMO of CLEARSTEM

Unified inventory management across locations and channels

ShipBob’s platform provides real-time visibility across all international locations, enabling intelligent order routing that optimizes for both speed and cost.

Our analytics help identify regional sales patterns, optimal inventory levels, and replenishment timing, so you’re never out of the loop when it comes to your stock. This distributed approach also improves cash flow by allowing smaller, more frequent inventory purchases while positioning products closer to customers for faster turnover.

The inventory management capabilities built into ShipBob’s technology let you experience FTZ-like benefits (improved cash flow, reduced duty exposure, and operational flexibility) while actually enhancing your ability to deliver orders quickly. It’s a solution built for modern ecommerce, and deisgned to help your brand succeed.

“We’re constantly looking at expanding into different markets, so working with a global fulfillment partner was a factor in our decision. While we’re currently only fulfilling orders from the UK, we know that with ShipBob as our partner, we could seamlessly place inventory in new countries and keep everything within the ShipBob platform. If we wanted to start storing products in the US or mainland Europe, we would have a direct connection there because of ShipBob, while allowing us to keep everything within one ecosystem. This is really important as we scale our operations and supply chain.”

Connor Stewart, Head of Operations + Impact at ARTAH

For more information about how ShipBob can help your brand leverage an FTZ warehouse or optimize your international logistics, click the button below to get in touch.

FAQs about foreign trade zone warehouses

Here are answers to some of the most common questions about FTZ warehouses.

When are duties paid on goods stored in an FTZ?

When you use an FTX warehouse to store goods, you pay duties when goods leave the FTZ and enter U.S. commerce (rather than when they arrive at the warehouse). This happens when you ship to customers, transfer inventory to domestic warehouses, or move to retail locations.

How long can products remain in an FTZ warehouse?

FTZ warehouses have no time limits on storage. Unlike bonded warehouses that enforce a 5-year limit, your products can stay indefinitely in an FTZ warehouse.

Practical costs still apply, so as long as you store inventory in an FTZ warehouse, you will have to pay warehouse fees and inventory carrying costs. Most businesses use FTZs for strategic inventory positioning rather than long-term storage, balancing duty savings against storage expenses.

What types of products cannot be stored in an FTZ?

Most consumer goods can be stored in FTZs, but there are some exceptions. Prohibited items include counterfeit goods, products violating U.S. laws, and items under trade sanctions. Products like tobacco and alcohol require special permits and additional oversight.

If you’re unsure about your products, check the FTZ Board guidelines or consult with a customs broker before committing.

Is an FTZ warehouse or bonded warehouse right for my ecommerce business?

FTZs make sense if you:

- Import significant dutiable goods annually

- Need to perform value-added activities like kitting

- Want unlimited storage timeframes

- Import from high-tariff countries

- Manage seasonal inventory

Consider bonded warehouses if you need simple temporary storage without manipulation, prefer less complex compliance, or lack the volume to justify FTZ setup costs.

How are shipments transferred from an FTZ to carriers?

For domestic shipments: File a customs entry (typically weekly), pay applicable duties, and receive release authorization before goods can leave. The FTZ operator handles most paperwork, but you’ll need systems in place to track withdrawn inventory and ensure proper duty payments.

For international shipments: Export directly without formal customs entry or duty payment. You’ll still need export documentation, but avoiding duties streamlines the process, making FTZs an attractive option for businesses serving both domestic and international markets.

Does ShipBob operate as an FTZ or provide a similar solution?

Yes, ShipBob now offers access to Foreign Trade Zone warehouses on both coasts for brands using ShipBob Plus, in partnership with licensed FTZ operators.

These sites offer duty deferral and sometimes elimination, inverted tariff relief, and simplified compliance, while still integrating with ShipBob’s global fulfillment network.