![]()

Ecommerce businesses often work in environments with different demands, distributed teams and complex financial workflows. Accountants are also facing pressure with reporting, compliance and tracking expenses. One area where automation has offered improvements is corporate travel expense tracking. By understanding new technology-driven platforms, accounting teams can reduce manual data entry and gain visibility into company spending.

The integration of automated travel expense management tools has become convenient and an essential feature for financial accuracy and efficiency.

Let’s explore in more detail how accountants can use automated travel expense tracking systems, the benefits they offer, and the challenges finance teams face when using manual systems, which can affect productivity levels.

The Challenge of Manual Expense Management in Ecommerce

Traditionally, accountants would rely on spreadsheets, email receipts and manual approvals to help manage travel expenses. Businesses often deal with:

- Supplier visits and logistics-related travel

- Multiple currencies and compliance requirements

- Complex reimbursement flows for remote working

This system is not only time-consuming but also prone to human error. Incorrect data entry, loss of receipts, and delayed reimbursements can cause significant disruptions in financial reporting.

According to a Harvard Business Review study, companies that rely on manual expense processes spend twice as long on accounts as those that use automation. This can directly impact quarterly closings and budget forecasting.

For e-commerce accounting professionals, every minute spent chasing down receipts is a minute taken away from strategic financial analysis and bookkeeping. For businesses experiencing scale increases, these challenges underscore the need for automation.

How Automation Transforms Travel Expense Tracking in Ecommerce

Many modern expense management solutions use AI, machine learning and data analytics to simplify workflows for ecommerce teams. These systems capture data and transactions directly to suppliers, attending trade shows and visiting centers.

Key improvements include:

- Instant receipt capture: This ensures no more lost receipts, from shipping hubs, warehouse audits or meetings

- Categorization: Expenses are matched to campaigns and operational projects

- Syncing: Transactions can flow directly into e-commerce accounting tools, enhancing workflows and operational support.

For e-commerce accountants, this means fewer manual touchpoints, faster reconciliation and audit trails. Automated platforms can also help reduce compliance risk and flag expenses before they reach the approval stage.

![]()

Why Ecommerce Companies Are Turning to Automated Platforms

The approach of modern expense management platforms, like that of global company Navan, to travel expense management is built around automation, transparency and usability. Instead of working across multiple platforms for approvals and bookings, finance teams can manage everything on a single platform.

What truly sets these platforms apart is the level of insight they provide into user performance. A recent collection of Navan’s Reddit Reviews shows how accountants and finance managers have helped streamline reporting, reduce errors, and improve employee satisfaction through Navan’s tool. Many reviewers note that the platform offers real-time visibility into expenses, which is essential for finance professionals to oversee travel budgets.

Benefits for Ecommerce Accounting Departments

There are many benefits involved with automated systems:

- Automated Receipts: Many apps allow travelers to take photos of their receipts, which can sync with expense reports. This helps eliminate manual uploads and reduce the risk of missing data.

- Integration: Many advanced tools also enable seamless data transfer, allowing accountants to match expenses with clients without duplicate effort.

- Compliance: There can also be a built-in environment that supports finance teams and ecommerce businesses in flagging policy violations, reducing review time, and preventing noncompliance expenses.

- Real-time reporting: Instead of waiting until the end of the month, accountants can access live dashboards that show a company’s funds, making it easier to control costs.

- Reduction in Fraud: Automation can help reduce intentional errors by enabling managers to trace every transaction and ensure complete transparency during audits.

The benefits reflect how accounting teams can gain advantages by moving towards advanced technologies to enhance workloads, improve business operations, and ensure proper tax compliance, which is essential for their business and their clients.

Internal Alignment and Broader Efficiency Gains in Ecommerce

Automation extends beyond accounting and can have a ripple effect on businesses. Travel managers can gain better visibility into booking patterns, and HR teams can benefit from reimbursements, helping to improve processes and employee experiences. For ecommerce businesses, these include:

- Travel is linked to planning or product sourcing

- HR is using automated records to speed up reimbursements

- The operations team analyzes the team data for warehouse and supplier visits.

Finance teams can reconcile travel costs against project budgets in real time, helping to improve planning and collaborations. This approach helps businesses become more data-driven by reducing financial silos and improving operational support.

Emerging Technologies Driving Expense Automation

The future of automated expense management and ecommerce businesses lies within the new advanced technologies that are evolving into the accounting workflows:

- Artificial Intelligence and Analytics: AI can now predict categories, identity anomalies, and automate approval routing based on historical behavior.

- Optical Character Recognition (OCR): OCR extracts data from digital receipts or invoices with accuracy, helping to reduce any manual verification.

- Mobile-first Platforms: Employees can submit expenses from anywhere, while accounts can approve them remotely, supporting global remote workforces.

- APIs: Expense management tools can now connect to other systems, such as payroll, ERP, and CRM systems, to access financial data.

These innovations empower accountants and firms to ensure they focus less on paperwork and more on decision-making for business operations.

Implementing Automation: Best Practices for Ecommerce Accounting Teams

Transitioning from manual to automated systems can sometimes be challenging without a structured approach. Here are some best practices for successful implementation:

- Evaluate Workflows: Identify where bottlenecks and redundancies occur in reporting.

- Scalable Platform: Select an effective solution that integrates easily with current software and can grow with your business.

- Training: Ensure both finance staff and employees understand how to use systems effectively.

- Clear Policies: Automated systems work best when working with consistent expense policies.

- Monitoring: Regularly review reports and user feedback on processes and ROI.

By following these steps, accounting teams and other industries can ensure a smooth transition to automation and realise its benefits.

Data Security and Compliance Considerations

Ecommerce businesses often handle large amounts of sensitive data and ensure that they have secure processes in place. Reputable expense management tools. Expense management tools can help organisations comply with global compliance frameworks such as GDPR, SOC 2, and ISO 27001 to ensure sensitive information is protected.

Automated systems can help ensure compliance with tax regulations by storing digital copies of receipts, enabling data traceability, and supporting audits. For many businesses, this ensures there is consistency across many jurisdictions with tax codes.

Maintaining strict security and compliance standards, accountants can rely on automation without worrying about data integrity.

Authoritative Industry Trends

A Deloitte report found that over 60% of CFOs now place great importance on automation in expense management as part of their digital transformation strategies. These leaders understand the ability to capture and analyze financial data in real time, which is essential for uncertain markets.

This issue is evident in businesses with large travel programs, where minor inaccuracies in reporting can lead to financial discrepancies. Many advanced tools can empower contacts with transparency, accuracy, and automation.

The Evolving Role of Ecommerce Accountants

As automation scales to handle a larger workload, the accountant’s role shifts from data entry to strategic analysis. Accountants are increasingly acting as data interpreters, using automation tools to identify trends, reduce any risks and provide insights that guide businesses towards better data-driven decision-making.

Rather than worrying about automation, accountants can now embrace it as an enabler, allowing them to focus on high-value tasks such as business planning, financial modelling and forecasting.

Empowering Employee Engagement and Adoption

While automation promises speed and accuracy, its success depends on how well employees can engage with new systems. One common obstacle in digital transformation projects is resistance to change. When employees are accustomed to manual processes, they may fear new technology, which can complicate existing systems.

To overcome this, businesses should focus on employee training, onboarding and engagement from the start. This not only communicates the technological value but also allows employees to feel comfortable using new technologies with the support of training. For example, employees can benefit from faster reimbursements, admin tasks completed faster, and greater visibility; all of which are enabled when they trust new systems.

Many advanced technologies offer user-friendly experiences, making it easy to upload receipts, track systems and comply with current tax policies. This ensures that the benefits of automation support accounting teams.

In addition, businesses can use gamified compliance programs, such as recognizing teams that submit expenses on time and stay within business budgets. Turning compliance into a collaborative effort can ensure businesses can boost participation and refine accountability and transparency.

The result of this connects technology to being an effective asset for employees and the finance industry, offering efficiency, trust, and engagement to help businesses grow.

Looking Ahead: The Future of Automated Accounting

As artificial intelligence advances, the next generation of expense management tools is helping reduce friction between employees and finance teams. Accountants can enhance features such as categorization, tax compliance and integrations with other planning systems.

Many advanced tools can support companies by not only simplifying their travel expense management but also defining the role of accounting departments as a strategic driver in business.

By adopting automated travel expense management systems, accountants today are not only improving efficiency but also laying the foundation for a more transparent, data-driven future in the finance industry.

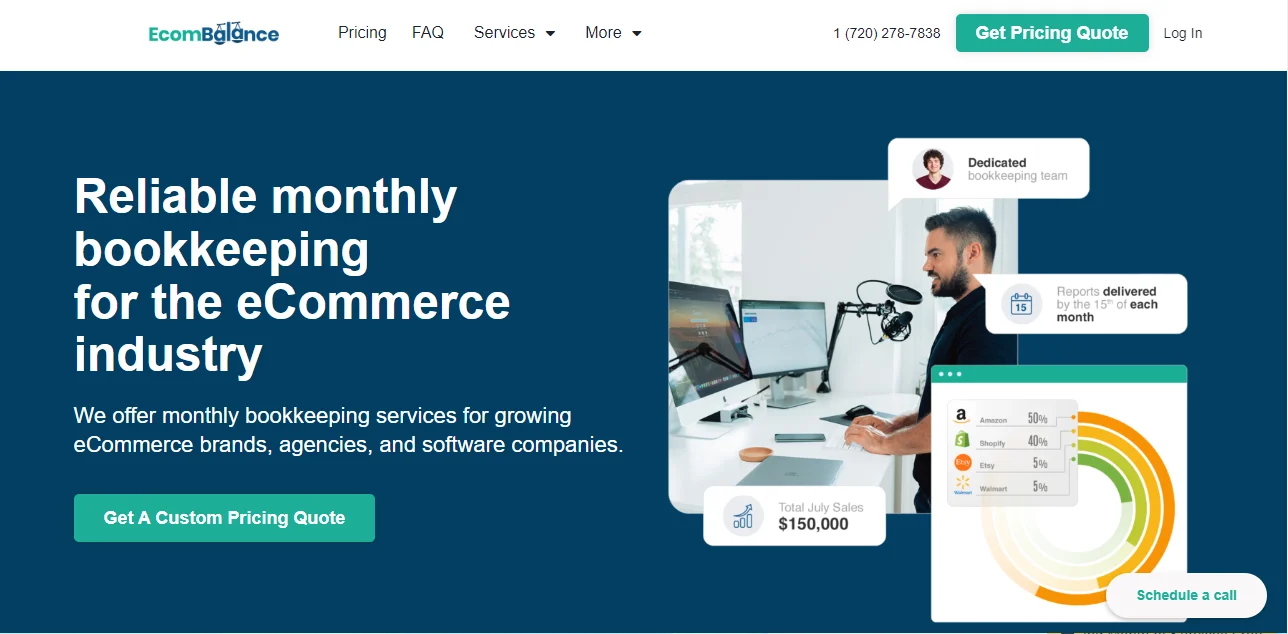

What Is EcomBalance?

EcomBalance is a monthly bookkeeping service specialized for eCommerce companies selling on Amazon, Shopify, eBay, Etsy, WooCommerce, & other eCommerce channels.

We take monthly bookkeeping off your plate and deliver you your financial statements by the 15th or 20th of each month.

You’ll have your Profit and Loss Statement, Balance Sheet, and Cash Flow Statement ready for analysis each month so you and your business partners can make better business decisions.

Interested in learning more? Schedule a call with our CEO, Nathan Hirsch.

And here’s some free resources: