Measurement

You’ve spent a lot of time and money perfecting your product. You’ve gone through multiple iterations honing your services. You got everyone aligned on a brand identity that tells a compelling story. You’ve assembled all the components to build a great brand… but what does the public think?

Your brand’s sentiment—and equity—is extremely valuable. It plays a serious role in driving sustained demand for certain products, helping grow your business while reducing ad spend. CMOs know it’s important. But when it’s time to allocate the marketing budget, the exact value of brand building campaigns can be hard to pin down. And that measurable value is exactly what Finance needs to see.

That’s why marketers need to get serious about measuring brand equity. We’ll guide you through everything you need to know about brand equity, how to build it up, and how to prove its worth.

Table of Contents

What is brand equity?

Brand equity is the economic value of your brand beyond what you tangibly offer. It’s the cumulative outside perspective people have on your brand. These campaigns don’t offer the highest immediate return on ad spend, but they directly influence customer trust, loyalty, recognition, and their willingness to pay for your products and services. And as customer tastes continue to shift, your brand needs to keep up.

Every customer experience—even the ones you can’t control—contributes to your equity. Naturally, positive experiences lead to people viewing your brand favorably, improving your equity. They will have much better brand recall, and are more likely to be a repeat or long-term customer.

Negative brand equity, on the other hand, devalues your brand. Maybe a customer had a single unsatisfactory conversation with customer service, maybe you had to issue a product recall, or maybe an ad ran next to some unsavory news. It can take a long time to build up a brand’s image, and no time at all to knock it down.

Why is brand equity important?

Positive sentiments are more than just good vibes and fuzzy feelings. They influence how consumers act, which impacts revenue and market share. Customers that view your brand favorably are more likely to pay a premium for your products, less likely to be swayed by competitors, and can become evangelists for your brand.

Take, for example, a 2002 study that measured brand equity in relation to Champagne. Consumers blind-tested Champagnes and wrote down how much they would pay for each based on taste alone. Then, they were shown the bottles and asked to re-evaluate their prices. Seeing the labels consistently changes people’s responses, with fancy labels and brand recognition increasing the price participants were willing to spend. Just knowing they were sipping a “more expensive” bottle made consumers comfortable with spending more.

How can organizations build brand equity?

Building strong brand equity requires the patience to invest in something that seems nebulous and doesn’t always provide immediate gains. While exact strategies will vary from brand to brand and evolve with company goals, here is a loose framework for building strong equity:

1. Conduct research

Like any good strategy, it all starts with research. Get a deep knowledge of your brand, your consumers, and your place in the marketplace. Want to know how your customers feel? Ask them. Curious what people are saying about you? Search forums and social media, or use brand sentiment software to view that information in aggregate. You need to understand your consumers’ pain points, what they share with other consumers, and what their experience is like with your brand.

2. Find new meaning

Once you understand your current customer experience, you can craft a new narrative. This is the “why” behind your brand—why should customers care? Why would they choose you over a competitor? Understanding the deeper meaning behind what your brand represents will make it easier to create authentic, engaging experiences. It will also help you uncover new ways to solve pain points and delight your customers.

3. Evangelize your message

Now that you understand the state of your brand and the story you want to tell, it’s time to speak to your customers. Focus on the top of funnel to educate people on your brand and let your creative strategy shine. Consider using influencers and targeting audiences on the channels they use most.

You’ll also want to pay attention to the bottom of the funnel with campaigns that shape customers’ behaviors. Focus on driving conversion, promoting word-of-mouth sharing, and curating a shared meaning between your brand and your customers.

4. Audit your brand

Understand where equity is coming from by logging recent marketing efforts and how customers responded to them. This can be through surveys, interviews, and research. By knowing how your efforts are received, you can see if your customers’ perception of your brand aligns with the story you’re telling.

Once you’ve done this, the last step for building brand equity is getting stakeholders on board. That’s where measurement comes in.

How should organizations measure brand equity?

Even though brand equity directly influences revenue, it can be hard to measure and even harder to advocate for. Think of how easy it is to prove to stakeholders that a quick-turn performance campaign was successful: We saw that the clickthrough rate on our ads improved, and can put a number on how many sales it influenced.

But brand equity requires long-term effort that runs in the background of everything else your marketing team does. This means measuring direct outcomes is often muddled by congruent short-term initiatives.

Broadly speaking, you’ll want to:

- Create a solid baseline of the metrics you want to improve, like awareness, purchase intent, and consideration.

- Record your marketing spend, like channel-specific investments.

- Track your gross revenue across all channels, whether that’s your own ecommerce site, an online marketplace like Amazon, or a physical retailer like Walmart.

- Consider the context of your data. External factors like employment levels and inflation, as well as brand-specific factors like new product launches and promotions, can all influence your customers’ decisions.

You can loosely quantify your brand equity by subtracting your brand’s assets from your company’s overall value, whether that’s your current market capitalization or an independent valuation. But to get more specific data, you need a purpose-built measurement tool.

How to measure brand equity’s impact on business value

Media Mix Modeling (MMM) can quantify the direct impact of media investments on revenue. While this doesn’t traditionally account for individual media buys, it’s a great starting point for measuring your brand equity.

With a multi-layered MMM approach, you can use brand metrics as predictors of long-term revenue, as long as you control for paid media investments, seasonality, and macroeconomic factors. Then, you can isolate your brand equity spend impact, and estimate future financial gains from increased equity.

How to measure an advertisement’s impact on brand equity

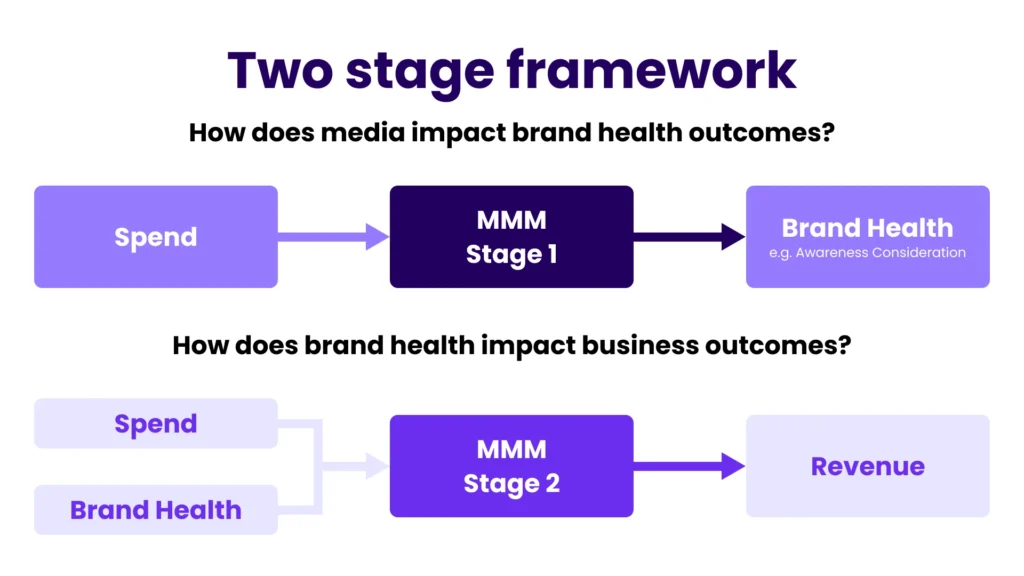

Unfortunately, a basic media mix model doesn’t show the whole picture when it comes to marketing effectiveness. That’s why our econometrics team created a two-stage MMM for brand equity, part of Bliss Point by Tinuiti. We built a casual mediation framework that isolates and measures the indirect effects of paid media on revenue—which reveals a lot more about the impact of media spend. By treating brand equity as a mediator, you’re able to see the direct revenue impact of advertising spend and the indirect impact of brand awareness, perception, and loyalty.

Our methodology is similar to our rapid Marketing Mix Modeling (rMMM) solution, except instead of directly modeling revenue, we sub in brand metrics for outcome variables. Additionally, we adjust for external factors like seasonality, ad stock transformations, and diminishing returns.

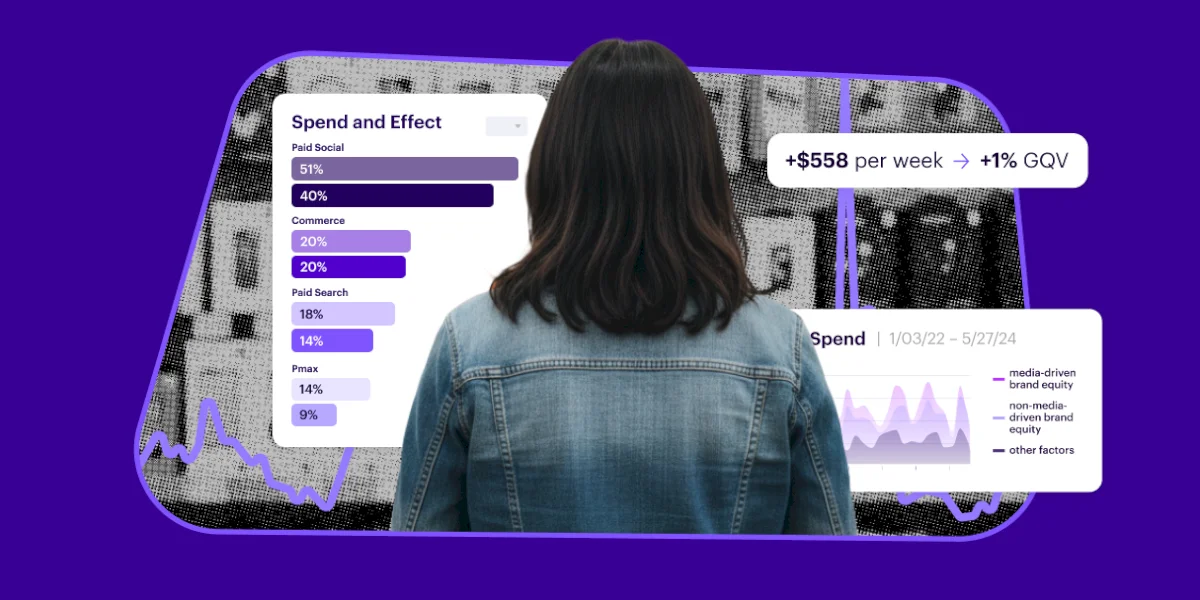

This style of measurement brings clarity to brand equity. We can uncover how each channel—and your portfolio overall—contributes to brand outcomes, such as what percentage of aided awareness lift came from display campaigns versus social media campaigns. With these insights, we’re able to give you “next best dollar” direction, showing you where to invest next to maximize your brand building—and your budget.

What are the challenges of measuring brand equity?

There are several challenges when quantifying brand equity: operationalizing brand equity, lagged and saturation effects, and confounding factors.

1. Operationalizing Brand Equity

Brand equity is a latent construct consisting of subjective perceptions, emotions, and associations. This is compounded by the lack of standard measurement methods and differing stakeholder priorities. Data used to measure brand equity often comes from multiple sources, like customer surveys, sales data, social media sentiment, and market research, which don’t always align or provide consistent insights. Inconsistency between periodic survey data and isolated platform-specific metrics makes establishing reliable, unified measures of brand equity a lot trickier.

Solution: Brands need access to readily available, high-fidelity measures of brand equity. Survey firms like YouGov, which conduct daily surveys of thousands of individuals across core brand equity themes, offer a continuous and reliable measure of brand perception and consumer sentiment. When survey-based measurement is not available, proxies for brand equity, such as brand term query volume from search engines, can provide alternative real-time insights into consumer interest and high-intent awareness. By incorporating these consistent and high-fidelity data sources, brands can effectively capture and quantify the impact of brand equity on business outcomes.

2. Delayed and Diminishing Response

Brand equity metrics like awareness and consideration evolve gradually, making their relationship with media spend more difficult to detect than direct-response metrics. This problem with delayed response is especially apparent for linear TV advertising and brand campaigns. Because these campaigns aren’t designed to elicit an immediate response, traditional attribution methods can’t quite capture their true impact.

Solution: To adapt a marketing mix model for brand measurement, account for immediate and carryover effects and track the gradual influence of media on slow-moving brand metrics. For Bliss Point by Tinuiti, we use adstock transformations to account for the lag between improved brand equity and eventual revenue response, giving us a realistic model of consumer memory and delayed purchase decisions. We also layer in hill functions, which enforces diminishing returns to paid media and reflect the various degrees of channel saturation.

By incorporating adstock and saturation adjusted variables into MMM, businesses can better predict the long-term impact of current media spend and build budgets that balance short-term sales with sustained brand investment. This is critical to a true performance marketing strategy.

3. Casual Confounding

Even with robust, longitudinal measures of brand equity, failing to adjust for appropriate marketing and external factors can lead to significant bias when estimating the impact of brand equity on revenue. Many factors that influence both brand metrics and revenue are correlated with media investment. For example, product launches, brand refreshes, adverse PR events, and economic conditions can alter both how consumers relate to brands and revenue generation.

Solution: Brands need to unify online and offline data across all marketing channels to get a complete picture of their media portfolio. Take stock of all your marketing activities, including promotions and pricing. Then, layer in externalities that might be out of your control—like economic indicators or social disruptions.

Once your brand measurement platform has all the control data it needs, you can start determining the overall marketing impact of previous brand lift experiments. This helps us interpret paid media’s effect on revenue as mediated by brand equity in a causal manner and grounds the analysis in experimental knowledge. Taken together, these provide a transparent framework for estimating brand equity’s causal impact on business outcomes.

Example: How brand equity impacts the marketing funnel

Tinuiti has helped brands of all sizes and industries measurably improve their brand equity. One example is how we helped illy grow their market share and revenue through increased awareness. Our research suggested higher-cost, slower converting formats would have a bigger long-term impact, so we moved their focus to streaming ads that targeted new-to-brand (NTB) audiences.

The strategy worked: illy experienced a 21% increase in consideration. We also helped them optimize their search to maximize page traffic and captured non-converting leads with Amazon Standard Identification Number (ASIN) Retargeting campaigns. These changes increased click-through-rate by 54% and conversion rate increased by 14% YoY.

But how did this work impact illy’s overall brand equity? Bliss Point measurement revealed that this work increased organic sales by 59%, a true testament to how spreading awareness to new-to-brand customers can have a big impact on revenue, even if the campaign’s impact isn’t clear at first.

Conclusion

Being able to prove brand equity’s impact on revenue opens the doors for marketers. Bliss Point by Tinuiti gives marketers holistic measurement and data-driven insights, making it easier to advocate for budgets and drive growth at every stage of the funnel. It answers questions like, “Which channels drive the greatest lift in awareness, buzz, or consideration?” and “How much revenue growth can be attributed to a 1-point lift in brand awareness?”

With these brand equity estimates in hand, marketers can better understand the total impact of their media dollars, and finally fill in the missing piece of their brand.

Want to learn more?

We recently released our first Brand Equity whitepaper, designed to be a comprehensive guide to quantifying the value of brand campaigns. Let’s keep those budgets healthy in 2026.

Frequently Asked Questions

Is brand equity the same as brand health?

As marketers, there is a hidden set of variables we all struggle to measure, understand, and leverage to our benefit as they relate to the slowly-won equity of a brand, with the terms “brand equity” and “brand health” often being used interchangeably. However, we think of brand equity as a broader umbrella term that represents the intangible value of a brand, while brand health is more closely associated with the immediate perception of a brand at a particular point in time.

How does MMM measure brand equity?

While randomized control trials are the gold standard for causal inference, brand-building is a slow process, and running these experiments can be both time-consuming and expensive. Media Mix Modeling (MMM) provides a neat alternative to this problem by leveraging observational data in a two-stage framework.

On the first iteration, brands can just run their brand marketing spend through a media mix model to understand how each dollar impacts brand health metrics, like awareness and consideration. From there, you can reiterate using the spend metrics and your new brand health outputs. Together, this will provide insight into how spending on brand health translates into revenue. This is the basis of our MMM model within Bliss Point by Tinuiti.