Key Takeaways

- Cut costs and gain control by running manual payroll for teams under 10, turning savings and accuracy into a real competitive edge.

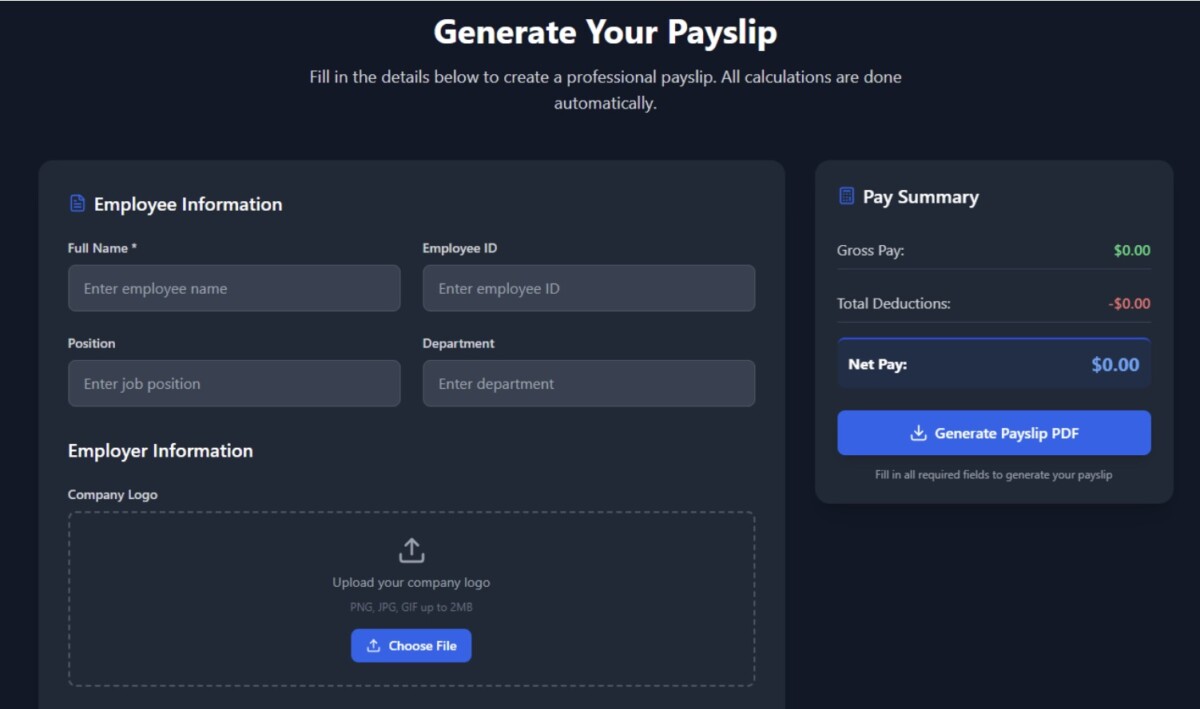

- Build a repeatable workflow by gathering employee data, calculating gross pay, applying required deductions, and issuing clear payslips every period.

- Strengthen trust with transparent payslips that help employees understand earnings, deductions, and take-home pay at a glance.

- Reclaim up to 5 hours per pay period by mastering a simple manual process, freeing time for growth and customer work.

Nineteen percent of U.K. workers face late or incorrect payments on a regular basis.

That staggering figure represents millions of employees dealing with payroll errors that damage both workplace trust and business compliance.

Most small business owners assume expensive payroll software offers the only path to accuracy. Yet companies with fewer than 10 employees can achieve the same precision through manual payroll systems. Manual payroll delivers complete control over your payment process while eliminating subscription costs that drain resources from growing businesses.

The benefits extend beyond cost savings. Payslips help employees understand their compensation structure, serving as detailed statements that document gross salary, itemize deductions, and display final take-home amounts. When employees can clearly see where their money goes, satisfaction increases and questions decrease.

Time savings matter too. Businesses with 10 employees can reclaim up to 5 hours per pay period by mastering manual payroll processes, valuable time that translates directly into business development opportunities. Those recovered hours often prove more valuable than software subscription savings.

This guide walks through creating professional, compliant payslips manually. The process requires attention to detail but delivers straightforward results that keep both employees and regulators satisfied.

Understand What a Payslip Is and Why It Matters

A payslip breaks down an employee’s earnings and deductions for a specific pay period, allowing them to verify their income and understand where their money goes. The document serves as both a financial record and a communication tool, bridging the gap between employer calculations and employee understanding.

What a payslip includes

Manual payslip creation demands precision across multiple components. Each element serves a specific purpose in creating comprehensive payment documentation.

Essential payslip components include:

- Employee information: Name, employee ID, department, and designation

- Pay period details: Specific dates covered and payment date

- Earnings breakdown: Gross pay, basic salary, overtime, bonuses, and allowances

- Deductions: Tax withholdings, retirement contributions, insurance premiums, and other authorized deductions

- Net pay: The final amount the employee receives after all deductions

- Year-to-date totals: Accumulated figures for earnings and deductions for the current financial year

Additional elements like leave balances can enhance the payslip value, showing vacation days or sick time available to employees. These extras often prevent HR inquiries and improve employee self-service capabilities.

Why are payslips important for employees and employers

The stakes around payslip clarity run higher than most employers realize. Over 26% of employees struggle to understand their payslips, which can lead to poor financial management and reduced financial resilience. This confusion creates problems that extend far beyond payday.

For employees, clear payslips enable:

- Verification of pay calculation accuracy

- Proof of income for loan applications and visa processing

- Tax contribution tracking for accurate filing

- Effective personal financial planning

Employer benefits center on compliance and operational efficiency. While federal law doesn’t require employers to provide pay stubs, most states mandate regular pay statements. Smart business owners recognize additional advantages:

- Labor regulation compliance regarding minimum wages and benefits

- Payroll expense tracking for budgeting and financial planning

- Audit documentation and financial transparency

- Trust building through clear compensation communication

Manual payslip creation requires greater attention to detail than automated systems. Yet understanding these components and their significance helps ensure you produce accurate, compliant documentation that serves both business operations and employee needs effectively.

Prepare Before You Start: Key Information to Gather

Accurate payslip creation starts with comprehensive information gathering. Poor preparation leads to calculation errors that create compliance headaches and employee disputes.

Employee personal and tax details

Start with basic employee information: full name, employee number, and complete address. Tax details prove equally critical to collect tax codes, filing status, and any specific identification numbers required by your jurisdiction. Banking information like sort codes and account numbers ensures smooth payment processing.

Security matters here. Keep this sensitive data accessible for payroll processing but protected from unauthorized access. Many small businesses store this information in locked filing cabinets or password-protected spreadsheets.

Work hours and salary structure

Hourly employees require meticulous time tracking. Document total hours worked each pay period, separating regular time from overtime. Salaried employees need their annual rate documented as it appears on the final day of each pay period.

Understanding your salary structure prevents calculation errors. Most companies structure compensation around these components:

- Basic salary (typically 40-45% of total compensation)

- Allowances covering housing, medical, and transportation

- Performance bonuses and incentive payments

- Additional benefits or special allowances

Each component may face different tax treatment, making accurate categorization essential for proper deductions.

Understanding legal deductions

Deductions are split into two categories: mandatory and voluntary. Mandatory deductions include:

- Federal income tax (ranges from 10-37% based on income)

- Social Security at 6.2% up to annual limits

- Medicare at 1.45% with surcharges for high earners

- State and local taxes where applicable

- Court-ordered garnishments

Voluntary deductions encompass retirement contributions, health insurance premiums, and other employee-selected withholdings. Track these categories separately to maintain compliance with tax authorities.

Systematic information gathering creates the foundation for error-free manual payroll. The extra time spent on preparation saves hours during actual payslip creation.

Step-by-Step: How to Make a Payslip Without Software

Manual payslip creation follows a systematic process that builds accuracy through careful attention to detail. With your employee information gathered, the actual calculation work begins.

Step 1: Calculate gross pay

Hourly employees require straightforward multiplication: hours worked times hourly rate. When overtime enters the equation, multiply overtime hours by 1.5 times the regular rate and add the result to regular pay. The math looks like this:

- Regular pay: 40 hours × $20 = $800

- Overtime: 10 hours × $30 = $300

- Total gross pay: $800 + $300 = $1,100

Salaried employees need a different approach. Divide the annual salary by the pay periods per year. A $37,440 annual salary paid weekly breaks down to $37,440 ÷ 52 = $720 gross pay per period.

Step 2: Apply mandatory deductions

Start with pre-tax deductions like health insurance or retirement contributions. Then calculate and subtract:

- Federal income tax (based on W-4 form)

- Social Security (6.2% of wages up to the annual limit)

- Medicare (1.45% of all wages)

- State and local taxes where applicable

Each deduction requires separate calculation and careful record-keeping to maintain compliance with tax authorities.

Step 3: Determine net pay

The formula remains simple: Net Pay = Gross Pay – Deductions. After subtracting all mandatory and voluntary deductions from gross pay, you arrive at the employee’s actual take-home amount. This figure represents what employees see in their bank accounts.

Step 4: Format the payslip manually

Professional payslips require specific information elements:

- Employee’s full name and ID

- Pay period dates and payment date

- Itemized breakdown of gross pay components

- Detailed list of all deductions

- Net pay amount clearly displayed

Spreadsheet programs or word processors can create consistent templates for future use. The key is maintaining a professional appearance while ensuring all required information appears clearly.

Step 5: Deliver the payslip to the employee

Secure delivery protects sensitive financial information. Options include printed copies in sealed envelopes or secure electronic delivery. Many jurisdictions permit electronic payslips, which often prove more efficient for record-keeping purposes. Confidentiality remains critical since payslips contain personal and financial details that require protection.

Stay Compliant and Organized with Manual Payroll

Manual payroll compliance comes down to three core elements: accurate calculations, timely reporting, and meticulous documentation. Understanding these requirements protects your business from costly penalties while maintaining regulatory standing.

Manual Payroll Reporting Essentials

Accurate wage calculations form the foundation of compliant payroll reporting. Calculate wages precisely, withhold correct tax amounts, and file returns with appropriate agencies. Documentation supports every calculation you make.

Quarterly and annual tax reports carry strict deadlines. Missing these deadlines triggers penalties that often exceed the cost of professional payroll services.

Record-Keeping That Protects Your Business

The Fair Labor Standards Act demands three years of payroll record retention. These records must capture employee details, including names, Social Security numbers, and addresses, plus work information covering hours, rates, and earnings, alongside payment specifics like deductions and payment dates.

The IRS takes a harder stance. Employment tax records should stay accessible for four years after filing your 4th quarter returns. No specific format requirements exist, but accuracy and accessibility during audits remain non-negotiable.

Avoiding Costly Manual Payroll Mistakes

Small businesses pay billions in payroll tax penalties each year. The most expensive errors stem from worker misclassification, inaccurate records, missed tax deadlines, unreported taxable compensation, and botched garnishments.

Protection requires systematic approaches. Clear procedures, regular internal audits, and comprehensive payroll handbooks significantly reduce compliance risks. These safeguards often prove more valuable than the time invested in creating them.

Conclusion

Manual payslip creation demands precision, but the rewards extend far beyond cost savings. Small business owners who master this process discover they’ve gained something more valuable than software subscriptions: complete operational control.

The benefits compound over time. Employees appreciate transparent documentation that clearly explains their compensation. Employers maintain regulatory compliance while building detailed financial records that support business growth. This dual advantage creates a foundation for stronger workplace relationships.

The systematic approach outlined here, gathering comprehensive information, calculating gross pay accurately, applying correct deductions, and determining net pay forms the backbone of effective payroll management. Each step builds upon the previous one, creating a reliable process that becomes more efficient with practice.

Record retention remains non-negotiable. The FLSA requires three years of payroll documentation, while the IRS recommends four years after filing fourth-quarter returns. These records protect your business during audits and provide employees with historical compensation data when needed.

Small teams often find manual payroll less time-consuming than anticipated once the process becomes routine. The transparency and control gained through this approach frequently outweigh the initial learning curve.

Manual payslips serve businesses seeking straightforward, cost-effective payroll solutions. For companies with small teams, this method delivers professional results without the complexity or expense of specialized software.