If you’re like me, you’ve probably wondered how institutional investors always seem to stay one step ahead.

Their tools, resources, and insights often feel out of reach for the everyday investor. That’s where LevelFields AI is supposed to help. In short, it’s a platform designed to level the playing field for self-directed investors.

But does it live up to its promise?

That’s the focus on my LevelFields review. Let’s get into it!

Here’s what I’ll cover:

- What is LevelFields AI? (And Why You Might Need It)

- Top Features of LevelFields AI

- How much does LevelFields cost?

- Benefits of Using LevelFields AI

- Possible Alternatives to LevelFields AI

- Who is LevelFields designed for?

- Can Beginners Use LevelFields?

- What is the Best stock picking service?

- Pros and Cons of LevelFields

LevelFields Review:

BLUF (military speak for bottom line up front):

I’ve been using LevelFields AI for many months now, and it’s a game-changer if you’re into stock trading or investing.

I’m not a financial guru by any means, but I’ve been trying to outperform the SPY index with some smarter strategies, and this tool has been a solid addition to my arsenal. Note I say addition, because it is not an all-in-one tool. I use a few others as well. I have not found one tool that does everything I want yet. If you have, please let me know!

Disclosure: I’m not getting paid to write this review, but I am writing it as a thank you to LevelFields. Let me explain.

I actually wrote a nice thank you to the LevelFields support line and a real-life, non-AI, English speaking human responded quickly with such an enthusiastic “thank you!” I wondered if anyone else had ever bothered to thank the small business owners for creating something that benefits us. I asked the support person, Avi, if they’d thought of doing any behind the scenes posts showcasing how they are building it to build a community and they said they really didn’t have enough marketing people for that. Apparently, most of them were engineers.

So I told them I loved their product and would gladly post a review in exchange for an upgrade to their premium tier. They agreed and here I am. But, I’m not doing this review for the money. I wanted to write a review of them for others anyway. But hey, why not ask for something in return right?

LevelFields AI: What is it, and how can it help you?

OK, here we go. LevelFields analyzes tons of market events—like product launches, billionaire’s trades, government actions, crypto adoption, lawsuits, and even Tesla events—and spits out alerts along with forecasts of how these events typically impact stocks. It basically looks for patterns in how events impact stock prices and tells you how to play it. It’s like having a super-smart, always-alert assistant that reads documents at the speed of light and taps you on the shoulder when it finds a little gem.

It was a little hard for me to understand what LevelFields did exactly from their website – admittedly because I’m a bit ADHD and prefer to just jump onto a platform vs read about it – so I’d like to provide some lay context for those who may have similar styles. There’s no freemium option to test drive, presumably because they don’t want to give away their analytics for free. So it did cause a bit of a knee jerk reaction and left me wondering if LevelFields was a scam (it isn’t). So here’s an analogy to help you better understand what it is they do.

The best analogy I can come up with is this:

LevelFields is like NORAD for the stock market.

NORAD is the acronym for North American Aerospace Defense Command. They are the master tracking system for all flying objects in the sky – from planes and jets to helicopters and intercontinental ballistic missiles. If it flies, NORAD tracks it, maps it, and predicts its trajectory and impact.

LevelFields is the NORAD of stock market events: they track all events, note the ones worth paying attention to, then predict their impact…on stock prices.

How Does LevelFields Work? What is LevelFields Useful For?

At its core, LevelFields AI is a research automation platform built for investors who want access to professional-grade tools without the hefty price tag of a Bloomberg terminal or the like. It uses AI and language processing to uncover actionable trading insights, exposing the same patterns institutional investors use to profit from market-altering events.

I’m no data scientist, but it seems the system was built by some because there are a ton of features on it to analyze data.

There are 3 major uses of the platform:

- Identify great stock trade ideas quickly, based on events

- Use their analytics to decide how to react to an event (buy, sell, hold) and how to set entry and exit prices

- Find underexposed companies and industries crushing it that the media only talks about way after the big move

Before I started using the platform, I manually read news from Yahoo Finance, CNBC, Bloomberg, and even Reddit forums (awful) sometimes. Problem was, by the time I found something interesting that I thought was tradeable or investable, I was already late to the party. Everyone else already read the same thing and reacted – wisely and stupidly.

I paid for CNBC pro thinking that would help me and it was a massive waste of $399 – more than LevelFields BTW. CNBC was just a bunch of stocks being pumped by analyst upgrades. Bloomberg was good, but they advertise that their best news is only available on the $28,000 terminal. Bottom line was, I did not have a single place to go and look for stocks in play that were not crowded without either a) wading through a horrible load of opinion articles every day for hours, or b) getting the information too late.

LevelFields solves these problems for me and I really am appreciative of the 2 hours a day I’m getting back of my life now.

Can LevelFields Be Trusted?

Is LevelFields Legit?

Like any financial tool, trust in the system is critical. I’m a born skeptic so I did a bit of detective work on the people behind LevelFields to determine if I was going to get screwed over. I was looking for obvious fake websites, bogus Linkedin accounts, duplicate Chinese websites, or mentions of the founders in lawsuits. I did not find any. What I did find was the founders had incredibly impressive backgrounds that included teaching posts at Georgetown, positions at the trading desks of Deutsche Bank, and a client list that included the Office of the U.S. President and many of the largest companies in the world.

I listened to a podcast the CEO did and was really impressed with his background and how plain spoken he was about what they wanted to create and why. He and other founders have a long history of creating projects for the public good, such as a system for identifying emerging pandemics, software for identifying environmental and safety threats to U.S. military members, and projects supporting the National Institutes of Health. So it makes sense they would build LevelFields to help people out.

Looking at the LevelFields platform while reading the bios of the LevelFields founders again, I could not help but wonder why they would not just use the system for themselves. Maybe it’s the skeptic in me, or perhaps I’m more selfish than they, but I couldn’t escape this thought. Pouring over their documentation, I noticed they addressed this very question (smart) in their site FAQs with a totally reasonable answer: “We’d rather be Bloomberg than Burry.”

They are referring, of course, to Michael Bloomberg, founder and owner of the famous Bloomberg Terminal in every trading office in the world, and Michael Burry, the hedge fund manager made famous by the movie The Big Short, which glorifies Burry’s massive short on mortgage back securities during the 2008 global financial crisis. If you haven’t seen this movie, you absolutely must watch it! It’s fun, fascinating and has Margo Robbie in a bubble bath.

Their analogy made total sense. Michael Bloomberg has all the financial data in the world but he doesn’t trade stocks like a hedge fund manager. He sells software and lets others take the risks. And if he does a good job and they win, he gets more customers with no risk of a war breaking out and tanking the stock market. Bloomberg’s wealth is worth about 200X Burry’s so this seems a reasonable path to take. It passes the BS test.

Top Features of LevelFields AI

1. Event-Driven Alerts Provide Ideas for Investments

The core of LevelFields lay in its ability to identify events that are proven to impact stock prices. These could be things like stock buybacks, dividend hikes, layoffs, or activists trading. The platform analyzes these events using AI and historical data to give you alerts on what might happen next. This feature helps you focus on actionable opportunities instead of wasting time sorting through irrelevant information.

Why I like it: I don’t trust people, but I do trust data. LevelFields brings dozens of investment and trade ideas for short and long-term plays every day based on data and not some “expert opinion.” I’m so sick of these bobble heads on CNBC telling me what to buy because I have learned the hard way, the stock picks are usually duds they are trying to get rid of. LevelFields offers a fresh and rare approach of using data and AI for stock picking.

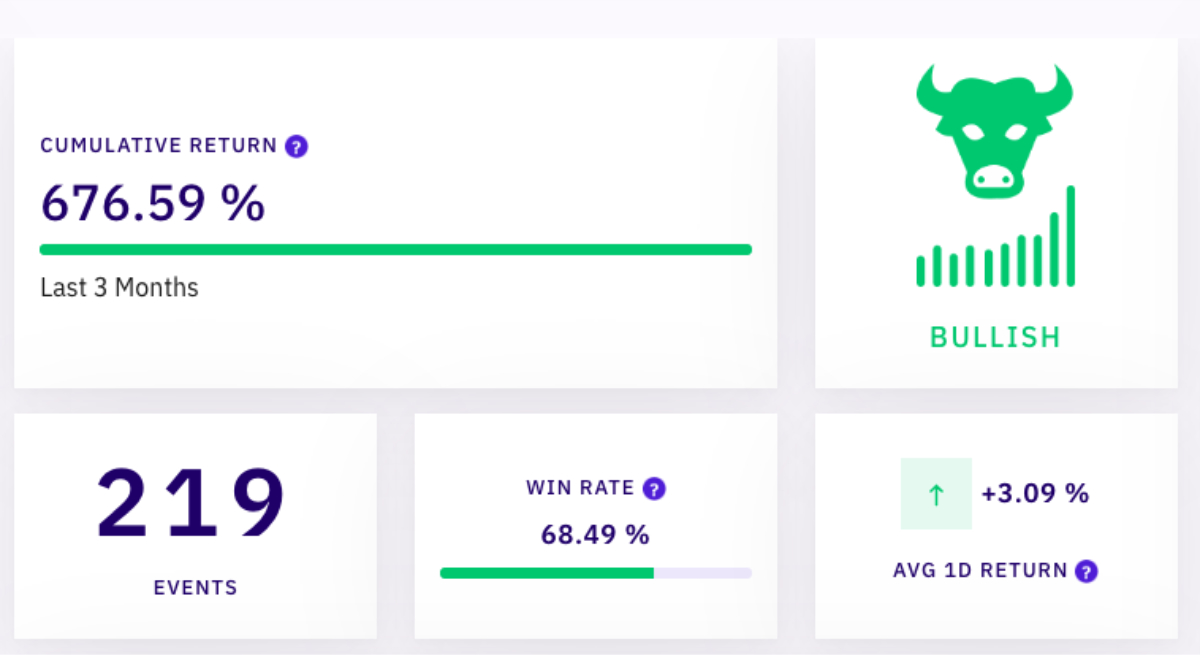

The returns are pretty incredible. There have been a number of times that I paid zero attention to their AI alerts only to look up late and see the stock up 30 or 40 percent the same day. I haven’t done a calculation but by eye-balling it, I’d say they have a consistent stream of 5-10% 1-day returns every day, a dozen 10-30% movers per week, and several 30%+ movers each month. I have witnessed some 300% 1-day movers on the platform but have not been fortunate enough to go into one yet.

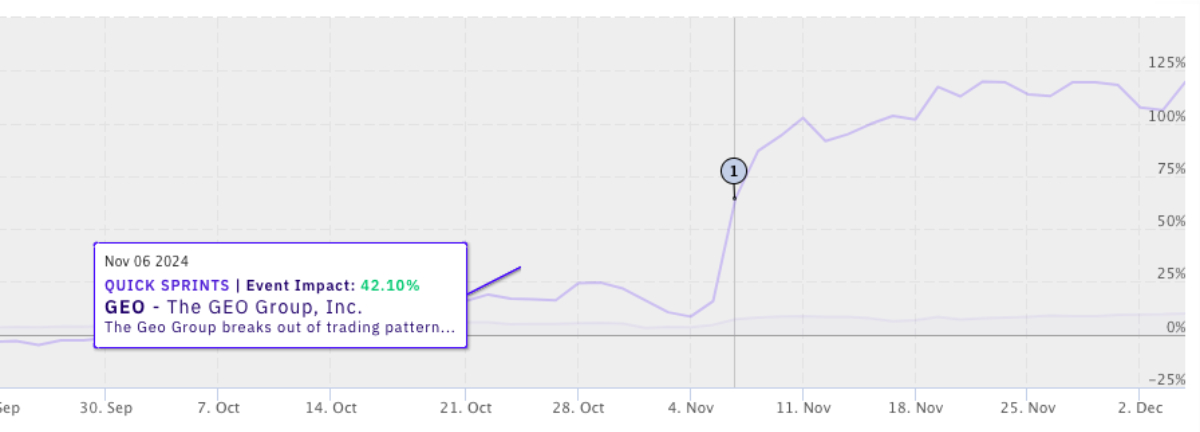

A few weeks ago, their technical indicator scenario – they have only one – got me into the GEO Group at around $20/share. In two weeks I made about 30% just on that alert alone. I’ve been really happy for most of the alerts. On occasion, some alerts come oddly late or timestamped wrong but it’s maybe 5% of them so I don’t mind.

2. Data Reports Show How to React to Events

For every type of event, LevelFields provides a digital report showing how the event affects stock. They include the win rate and the average move, as well as what one could get if each event impact was perfectly traded – staggering numbers in the thousands of percents for some event types. This would be for trading, say, 500 events a year though.

The reports update daily, automatically, and they allow you to backtest strategy ideas. For example, I really like trading energy stocks. So I filter for small cap energy stocks with a p/e under 10. I set it up to alert me when a company with these attributes increases its dividend. Once set up, it just sends an alert so I never have to check and the alert is continuous, meaning it stays active alerting me again and again to new opportunities. I’ve made a lot of money with this strategy.

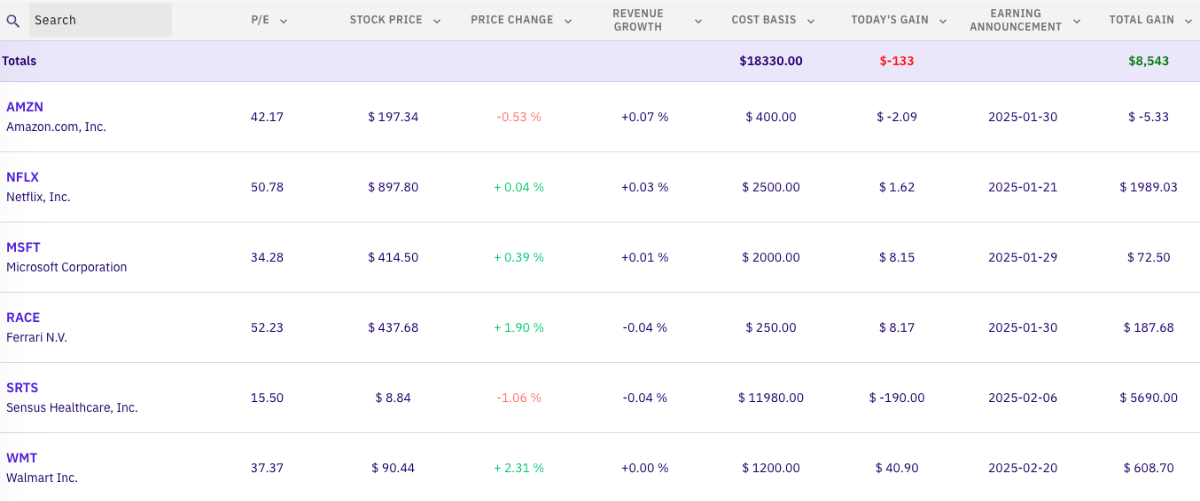

3. Watchlists, Paper Trading, and Alerts on Specific Stocks

Like many brokerage systems, you can set up watchlists for stock you want to buy or own. What’s different is you can also set up metrics to track alongside your watchlist, enabling you to keep an eye on valuations, revenue growth, and upcoming earnings events from one view. You can also paper trade and track wins/losses.

The standout feature for me though, is being able to set alerts of specific event types for just those stocks I’m tracking. I have bearish events set for all my stocks with just one click, as you can set the alert for the entire list of companies in the watchlist. This helps me bail on positions if something major happens, like a company reducing staff.

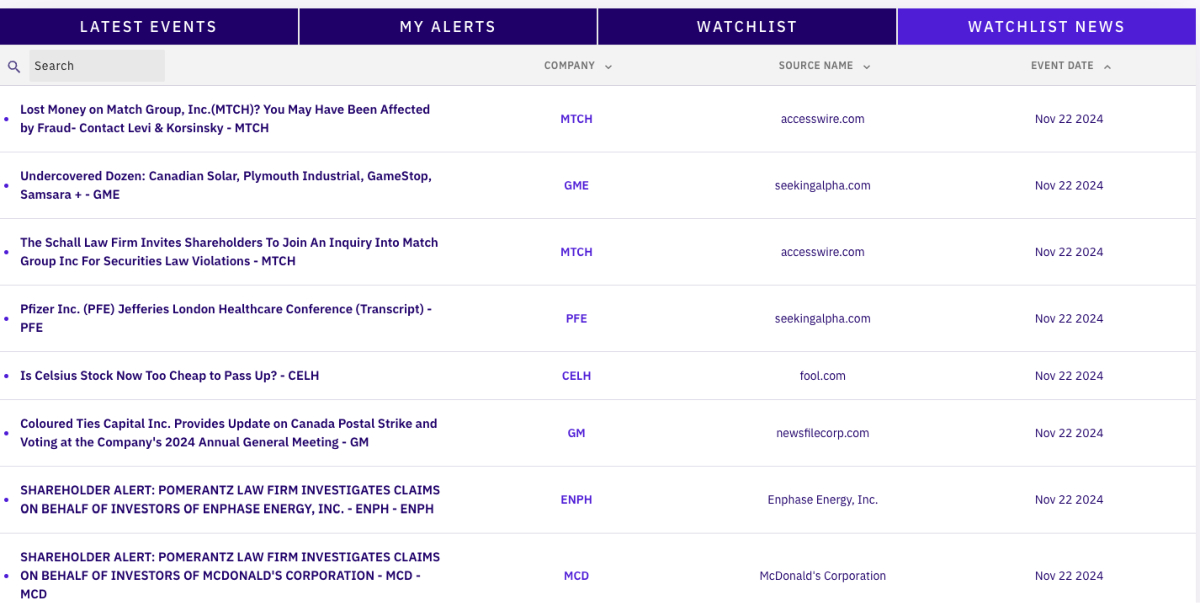

4. Comprehensive News from Many Publications

LevelFields aggregates news from 3rd party sources and companies, providing really nice feeds of news streaming into the platform that is also searchable and sortable. While not all the news is high quality, much of it is from the top financial news provider. I set it up so I can get news feeds for my watchlists in one stream.

Do note that subscriptions are required to read full news articles for some publications.

5. Thoughtful Help Center

If you’re new to trading or just need guidance, the Help Center is packed with tutorials and explanations. It covers how to use the platform, interpret scenarios, and trade specific events. This resource saves you time compared to searching for the same information online. I’ve found it to be a treasure chest of high quality educational information. They have some videos, but most of the information is in easily-digested bullets and screenshots.

6. Live One-on-One Training Session

Premium (Level 2) users get access to a detailed onboarding session that walks you through the platform and its features. It’s designed as a bespoke walkthrough of the platform that answers most of your most pressing questions right off the bat, making it easier to get started. Live sessions are available for those that subscribe to their annual Level 2 plan, otherwise the session is pre-recorded. This is a huge differentiator and I’m looking forward to getting my own onboarding session to find out the best trade setups.

7. Great Weekly Newsletter with Macroeconomic Analysis

One of the perks of LevelFields is that they send a great weekly newsletter that summarizes the week in one email. I rarely have time to read the news daily, so I appreciate the detailed summaries and analyses they provide about what’s happening in the world. More importantly, they are a non-biased source of information as they relate the global events to how that will impact stocks and markets. This can sometimes come off as dispassionate – especially when they are discussing how to profit from wars happening around the world – but I believe they are just being mission focused and connecting the dots for people like me that can’t do it themselves.

For example, they related U.S. support for Israel and Boeing’s ongoing issues building planes that don’t crash or break up in the air as a reason to buy into Raytheon stock.

Pricing: How Much Does LevelFields AI Cost?

LevelFields offers two pricing tiers, with significant savings for annual billing:

Basic Access (Level 1)

- Cost: $299/year (a 75% discount from the month to month option, which is $99/mo).

- Features:

- AI analytics and event-driven strategies

- 17 trading strategies

- Weekly insights

- Access to 6,300 company profiles

- 10 custom event alerts

- 1 year of data

Premium Access (Level 2)

- Cost: $1,599/year ($167/month for the month to month option).

LevelFields Premium Access (Level 2) is one of those tools that makes you go, “Hmm, do I actually need this?” So, I tried to break it down in the simplest way possible.

Here’s the deal: LevelFields is for people who trade stocks or options and want an edge without drowning in endless research. If you’re the kind of person who likes clear instructions and doesn’t have time (or patience) to sift through market data, this might be worth a look.

What’s Special About Level 2?

With Level 2, you’re getting two main things: alerts and human insights. Think of it as a combo of AI doing the heavy lifting and human analysts adding the cherry on top. You get trade ideas straight to your inbox, and they’re not random—they’re based on stuff proven to move stock prices.

For example:

- A company announces a big stock buyback. That usually pushes the price up.

- An activist investor buys a chunk of shares. That can mean big changes (and price jumps).

- These things together paired with a good earnings report and positive macroeconomic conditions, and we got a winner.

The system catches these events fast, and the analysts put the full picture together for you, explaining the rationales in each trade. I have only seen one example of these, and it was compelling, with clear entry and exit points, but I have not upgraded to Level 2 yet.

You can see their entire trade history and an example of what they provide here. Their returns are incredible – 40X in two years – so it’s pretty tempting to upgrade.

You get one or two premium alerts a week, and they come with actual reasoning. It’s not just, “Buy this stock and trust us.” They explain what’s happening, why it matters, and give you price targets. Some examples they shared include:

- Toast (TOST): Alert sent at $20, with a target of $23. It hit the target in two weeks—nice little 15% gain.

- European Defense Stock: Alerted at $120, and it shot up to $181 in less than a month.

The alerts also give options for people who trade differently. For example, if you’re into options trading, they’ll suggest things like strike prices. If you’re a stock trader, they’ll tell you buy-and-sell ranges. It’s all there.

What Stands Out About LevelFields

- It saves time. If you’re busy or don’t enjoy researching, this does a lot of the work for you.

- It’s a confidence booser. LevelFields doesn’t just throw buy or sell signals at you—they show you what worked before, so you feel more confident.

- Customizable. You can set up alerts to focus on the kinds of trades you like using tons of filters for company attributes and event types.

- Clarity. The alerts and scenarios are simple to understand. No jargon overload.

- Opinionless: I love that they aren’t claiming to know what the next Nvidia or Amazon is like all the other stock peddlers. The data shows what’s what and they make no claims – just shows the facts.

- Simple Interface: I love the interface. It’s clean and easy to browse new ideas. It’s truly amazing how many stocks come through I’ve never even heard of that are crushing it.

- Gotta love the mission: LevelFields is trying to bring pro tools to the little guys to compete better against the big guys who are trying to screw the little guys. I love supporting mission-driven small businesses.

What I Don’t Like

- Patience is required. Not every alert is a quick win. Some take weeks or even months to play out. It depends on the event type. For longer term investors and swing traders, this is a good thing. For day traders, this may be annoying but there are plenty of opportunities.

- The premium version is pricey for casual traders. At $167/mo, it’s not cheap. If you only trade a few times a year, it might feel like overkill. So it requires a commitment to trade monthly and a pot of money to have 10-20 active positions.

- Not spoon-fed. The platform gives you great info, but you still need to decide when to buy and sell using the data analytics. It’s not a set-it-and-forget-it tool.

- No automated trading: I wish they had this, but I can see why it’s a liability.

- No integration with brokerage account: A one-click buy/sell button would be great to have. I also had to enter all the stocks I own manually one at a time into their watchlists, so that was annoyingly slow

- No mobile app: Their application is accessible from a mobile device but some pages are hard to read. I wish they had a mobile app.

Is LevelFields AI Worth It?

If you’re trading actively and want to get smarter about it, LevelFields is an amazing tool. For $299 a year I personally think it’s underpriced given what they provide and how often I make $300 off the stocks that they flag.

Level 2 is a solid offering with unlimited data and alerts. The premium alerts from the samples I’ve seen are well-researched, and the returns they put up are insanely good – 40X in 2 years.

That said, it’s not for everyone. If you’re more of a buy-and-hold, long-term investor, or if you trade super casually, the $167/mo price tag might feel steep. In that case, the cheaper Level 1 plan might be a better fit. On the other hand, the training on the platform and expert event analysis is probably worth a half year of the Level 2 subscription alone. I have not received it yet, but I can tell from their help center they know WTF they are doing.

Benefits of Using LevelFields AI

If you’re into trading or just trying to get better at investing, LevelFields AI is one of those tools that can make things easier to handle. I’ve been using it for a bit, and It’s not perfect, but it does a good job of simplifying trading and giving you solid insights when you don’t want to spend hours researching.

Here’s why I think it’s useful:

1. LevelFields Helps You Make Smarter Trades

Markets can feel overwhelming, especially with all the news, charts, and advice out there. What LevelFields does well is finding patterns and events that actually matter. It filters out the noise and shows you insights that you can act on, like how similar events affected stocks in the past. It doesn’t tell you exactly what to do, but it gives you enough context to make better decisions.

2. LevelFields Makes the Market Easier to Understand

When I started using LevelFields, I was still a beginner at trading. The stock market felt overwhelming, with so much news and data coming from all directions. I didn’t really know what to focus on or how to connect the dots.

LevelFields helped me by breaking things down and showing me the events that actually impact stock prices—like stock buybacks. It took the guesswork out of figuring out what mattered. Instead of wasting time trying to piece things together, I could focus on the insights LevelFields highlighted, and that made trading feel way less intimidating.

3. LevelFields Offers Advanced Tools Without Being Complicated

I like that the tools on LevelFields feel professional but aren’t intimidating. It looks at things like buybacks, dividends, and even government surprises, and gives you clear insights. You don’t need to be a market expert to get value from it, which is nice for someone like me who’s still learning.

What LevelFields Is Not

Just to be clear, it’s not some magical tool that guarantees success. Nor is it an ATM. You’ll still need to understand your goals and have a bit of patience since not every trade will hit immediately. It’s a helpful tool, not a replacement for good judgment.

Possible Alternatives to LevelFields AI

While LevelFields is packed with features, other tools may suit your needs better depending on your trading style. Some notable alternatives include:

- Finviz: This is a nice old school stock screener with basic technical indicators but lacks AI-driven insights. It’s best known for its S&P 500 visuals.

- TrendSpider: Offers advanced charting and automated technical analysis, though it’s more focused on advanced day traders.

- Seeking Alpha Premium: Provides editorial content and analyst opinions but doesn’t include event-based AI alerts.

Who Is LevelFields Designed for?

LevelFields AI is designed for self-directed investors seeking to enhance their trading strategies through data-driven insights. The platform caters to various types of investors, including:

- Options Traders: LevelFields provides analytics to help determine entry and exit points, win rates, and target returns, offering a steady stream of AI-generated options investment ideas.

- Swing Traders: The platform offers tools to identify event-driven opportunities, enabling traders to capitalize on short- to medium-term market movements.

- Long-Term Investors: By monitoring news, significant events, and growth metrics, LevelFields assists long-term investors in finding optimal entry points for sustained gains.

- Day Traders – day traders can easily use LevelFields to find stocks in play that day. They can play the first move, buy the dip post-selloff, or play the inverse the following day. LevelFields’ analytics shows how the stocks typically move by day following an event, making it easier to judge the right time frame, entry/exit points, and stock price direction and magnitude.

- Technical Analysis Traders – those using technical analysis and LevelFields together will have a unique advantage of knowing why a stock is moving and how far it will move, thanks to LevelFields. The technical signal can be used to further validate the expected moves provided by LevelFields.

Can Beginners Use LevelFields?

Yes, LevelFields is good for beginners but let me share my personal experience so you get a realistic picture. When I first started using LevelFields, I was juggling two jobs as a graphic designer, so I didn’t have much time or mental energy to spare. I was hesitant at first because trading platforms can feel overwhelming, and I wasn’t sure if this one would be any different.

When I started exploring LevelFields, I noticed they really tried to make the interface user-friendly. That said, with all the data displayed, it can still feel a bit much at first—kind of like using stock screeners like Yahoo Finance or TradingView. The difference is that LevelFields has a cleaner, more modern design and focuses entirely on events that are proven to move stock prices. That part really caught my interest.

Once I understood that the platform revolves around these key events and uses AI to analyze patterns we might miss, it started to click. I decided to simplify things by focusing on just one or two trading styles. I made a watchlist, customized my alerts, and started experimenting.

Honestly, there were some losses at the beginning. But as I got the hang of relying on these events, it became easier to make decisions. I found myself asking, “Should I make this trade? Does this event align with what I’ve learned?” It helped me develop a more structured approach to trading over time.

The Help Center was a big help. It’s like having a mini guidebook on trading, packed with information you’d normally have to spend hours searching for online. And the onboarding session—about 30 to 40 minutes long—was a great start. It answered most of my questions and made me feel more confident about using the platform.

So yes, beginners can definitely use LevelFields. It takes a little time to adjust and learn the ropes, but the resources they provide, along with the AI-driven insights, make it manageable even if you’re just starting out.

LevelFields Promo Code

If we’ve read through my manifesto, congratulations and thank you. I wrote way more than I had planned but was trying to answer the questions I had in my head leading up to subscribing.

For those seeking a discount, I snagged a promo code they had put out by email newsletter a while ago for you: “big5” is supposed to get 5% off all plans.

Relevant Links:

- Website: Http://www.levelfields.ai

- Youtube Channel: https://www.youtube.com/@levelfieldsai

- Twitter Handle: https://twitter.com/levelfieldsai