Paid Media Updates

By Tinuiti Innovation & Growth Team

What’s in store

- Featured story: If Regulatory Pressure Lasts Four or More Quarters, Consult Your Lawyer Immediately

- Our Take On the News

- Helpful Links & Resources

Featured Story: If Regulatory Pressure Lasts Four or More Quarters, Consult Your Lawyer Immediately

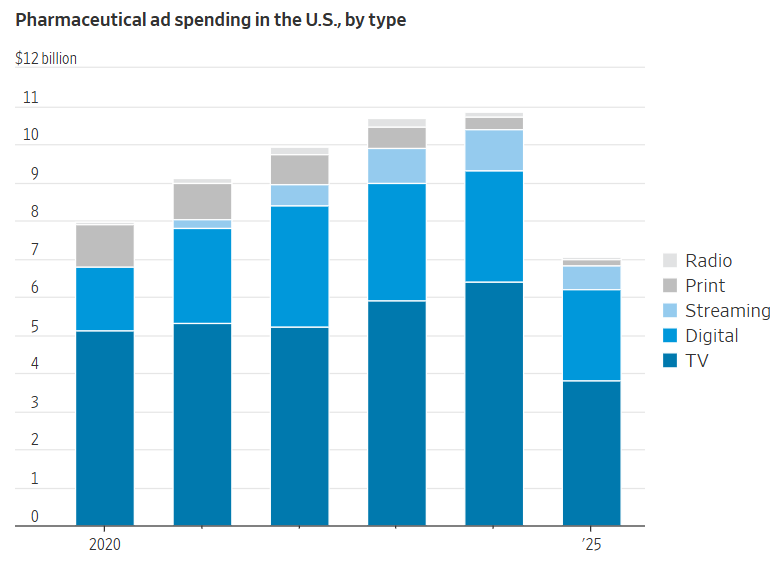

You may have heard the new Administration has taken an interest in advertising – specifically, the White House and HHS want to crack down on ‘deceptive’ pharmaceutical advertising as part of the ‘Make America Healthy Again’ policy agenda. This is a potentially major development for multiple industries: pharma accounts for 2.5% – 4% of total advertising investment in the US, and major drug companies spend 20% – 25% of their budgets on marketing and advertising. Let’s dive into what’s happening and why it matters.

Policy Developments

- In early September, the White House told HHS/FDA to tighten DTC drug ads and move to reverse the 1997 ‘adequate provision’ rule that let TV ads use abbreviated risk copy with full details elsewhere—an approach credited with fueling modern pharma TV

- Following on, the FDA launched an enforcement surge—about 100 cease-and-desist letters plus thousands of warnings—and is now scrutinizing overpromising narratives and visuals, not just skimpy side-effect lists; the scope extends beyond TV to paid social, influencer posts, and telehealth ads

- In the Senate, the Sanders–King bill would ban all DTC drug advertising across TV, radio, print, digital, and social; a separate push would end tax deductibility for DTC spend

Bottom line, the federal government has made it clear that it will exercise stricter oversight at minimum, and may take even more extreme measures.

Pharma in Ad Land

Pharmaceutical companies are a critical species in the US advertising ecosystem. Pharma companies spent ~$11B on ads domestically in 2024, with more than $6B on TV alone, making it among the largest categories in linear and streaming. (if you’ve watched 60 Minutes recently, you know that it’s basically a pharma ad with some reportage sprinkled in!)

Bottom line, cracking down on pharma advertising, or banning it altogether, would have profound effects on nearly all participants in the advertising ecosystem.

Historical Precedent

Pharma would not be the first industry to see its freedom to advertise curbed; most famously, restrictions on tobacco advertising began to be introduced in the 1970s. This began with the tobacco broadcast ban in 1971, but this was a partial curb in the sense that tobacco companies remained free to advertise elsewhere, and indeed tobacco advertising budgets shifted to channels like print media. It was only later, with comprehensive bans via litigation settlements and congressional legislation, that tobacco advertising was genuinely suppressed.

It’s very important that we keep in view the critical disanalogy between tobacco and pharma – at the risk of stating the obvious, tobacco is extremely harmful to human health, while pharmaceuticals are, on average, highly beneficial. The most rigorous research on the topic suggests that 73% of the increase in life expectancy that high-income countries experienced between 2006 and 2016 was due solely to the adoption of modern drugs. Moreover, pharmaceutical expenditure per life-year saved was $13,904 across 26 high-income countries and $35,817 in the U.S., making it one of the most cost-effective interventions we have to extend life expectancy.

The Perimeter of Protected Commercial Speech

Advertising is, of course, speech. And speech in the United States is robustly protected by the First Amendment to the Constitution. However commercial speech is treated differently under the law than core political speech. Here’s a brief primer:

- The law protects truthful, non-misleading commercial speech about lawful products, but it enjoys less protection than core political speech. Political speech generally gets strict scrutiny; commercial speech is tested under Central Hudson’s intermediate-scrutiny framework.

- The Central Hudson test first asks whether the speech is lawful and not misleading; if not, the government may legitimately ban it. If it is, a restriction is valid only if the government asserts a substantial interest, the rule directly advances that interest, and it is not more extensive than necessary.

- The government can require “purely factual, uncontroversial” disclosures reasonably related to preventing deception, so long as they’re not unduly burdensome (you can’t make the label so dense it effectively silences the ad).

- Under current law, the government may ban false or misleading ads; regulate promotions for unlawful uses; require narrow, factual risk disclosures; and impose tailored time/place/manner rules that genuinely advance health or safety. Total or content-based bans on truthful ads face steep odds under Central Hudson—and steeper still if they look like speaker- or topic-based discrimination.

The Regulators’ Theory of Mind

It is worth asking, If the coercive power of the state is to be brought to bear on pharmaceutical brands’ discretion in advertising, what is the implied hypothesis about the current state of the world? And how will restrictions improve on that state?

Significantly restricting, or outright banning, pharmaceutical advertising is most consistent with a model of market failure where pharma marketers win by non-informational persuasion and consumers are highly malleable and easily manipulated. In such a world, consumers are genuinely harmed – in their wallets, and potentially their health – by ads that cause them to consume the wrong medications in larger quantities than would be optimal.

The world we actually live in does not look much like this. Advertising generally operates via the channels of raising awareness, overt persuasion, making promises, and honest signaling; all of which are fully compatible with broadly rational consumers. In this version of the world, restrictions or bans on pharma ads would risk removing useful signals and raising search costs: fewer reminders that a therapy exists, less credible reassurance that a company will stand behind it, etc.

Looking Ahead

It seems likely that policy will be updated in one of two ways. The ‘light’ possibility is that additional informational requirements are imposed for pharma ads on TV and maybe a small number of other channels, but there is no outright ban and many channels remain unaffected; the ‘heavy’ possibility is that onerous restrictions are imposed across all advertising channels, with outrights bans being a ‘nuclear option.’ Anything falling in the ‘heavy’ category is sure to be litigated extensively; the ‘light’ category may amount to more work for advertisers, agencies, and S&P departments, but otherwise minimal effects at the industry level.

What We’re Tracking

The news stories we’re tracking that are likely to impact advertisers in the month ahead.

U.S. Economy & Tariffs

- Warnings Signs in the Housing Market? Google search volume for “help with mortgage” just hit a level it last reached in February 2009. Gulp. | Google Trends

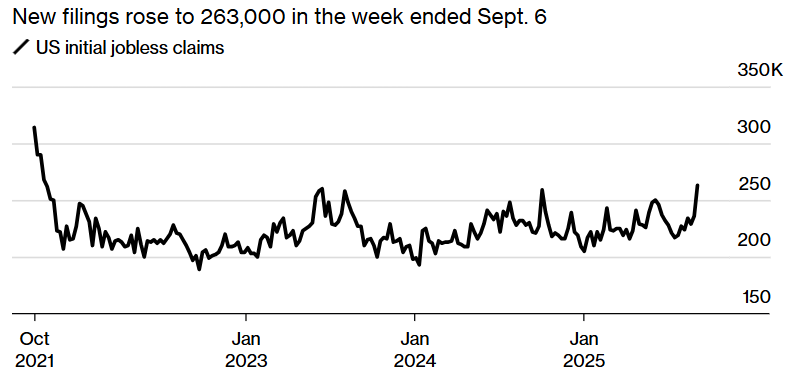

- More Labor Market Weakness: Initial jobless claims jumped to their highest level in almost four years. | Bloomberg

Tech Giants & Platforms

- TikTok for America: As you’re undoubtedly aware, the Administration announced that it has reached the ‘outline’ of a deal to create an American-owned subsidiary of the wildly popular platform, complying with the law passed last year requiring either American ownership or an outright ban. | WSJ

- Amazon DSP Extends Its Reach: Amazon and SiriusXM announced a deal that makes SXM inventory available to media buyers through Amazon’s DSP, further signaling Amazon’s ambitions to be the central hub for ad planning and execution both on its platform and off. | Adweek

- Google Remedies: Google is back in federal court (we’ll let you know if they’re ever not in court) for the remedies phase of its ad tech trial. The DOJ is urging structural divestitures—chiefly AdX and potentially DFP/Google Ad Manager—while Google pushes for behavioral fixes. | Ari Paparo

Media & Advertising

- The NFL Boosts Broadcast: Broadcast TV saw its first viewership gains since April with the return of the NFL, while Netflix owns the top four streaming titles with 22 billion combined minutes. | Nielsen Gauge

- And YouTube as Well: YouTube’s NFL Brazil broadcast was a big success, setting new livestream records with over 17 million average-minute-audience viewers. The game now holds the record for the most concurrent livestream viewers ever on YouTube. | eMarketer

- Unbundling to Rebundle: After WarnerBros Discovery announced plans to undo the merger that brought Warner Media and Discovery together in 2021, Paramount Skydance is preparing a bid to combine them all. | WSJ

Helpful Links & Resources

- WPP published its look ahead to advertising in 2023

- Digiday summarizes the current state of streaming subscriptions

- Eric Seufert opines on the ‘immense’ opportunity in front of Netflix

- Holiday sales forecasts are all over the place, reflecting heightened uncertainty over the macroeconomy and consumers’ willingness to spend

- Amazon released an AI agent to produce ads for its own platform

- Google, in collaboration with numerous fintech platforms, released Agent Payments Protocol (AP2), an open protocol to securely initiate and transact agent-led payments across platforms

- Sticking with Google, it announced a raft of new AI features in Chrome