Paid Media Updates

By Tinuiti Innovation & Growth Team

Key Highlights:

Key Highlights:

- TV & Audio: Podcast continues to see rapid growth, though it is fueled by a small handful of shows.

- Paid Social: Meta continues to double down in AI advancement after another successful earnings call, X files an antitrust lawsuit against GARM and advertisers, and Snap’s subscription program continues to grow.

- Search: Google remains dominant player in Search landscape despite advancements from nascent AI-powered search competitors, including the new SearchGPT prototype and Perplexity’s new ad-supported Publisher Program

- Ad Economy: Google is a monopoly & Apple introduces ad blocking

- Consumer Economy: Cooling inflation and an anemic July jobs reports make a September rate cut seem like a lock.

TV & Audio

Harry Browne VP Innovation

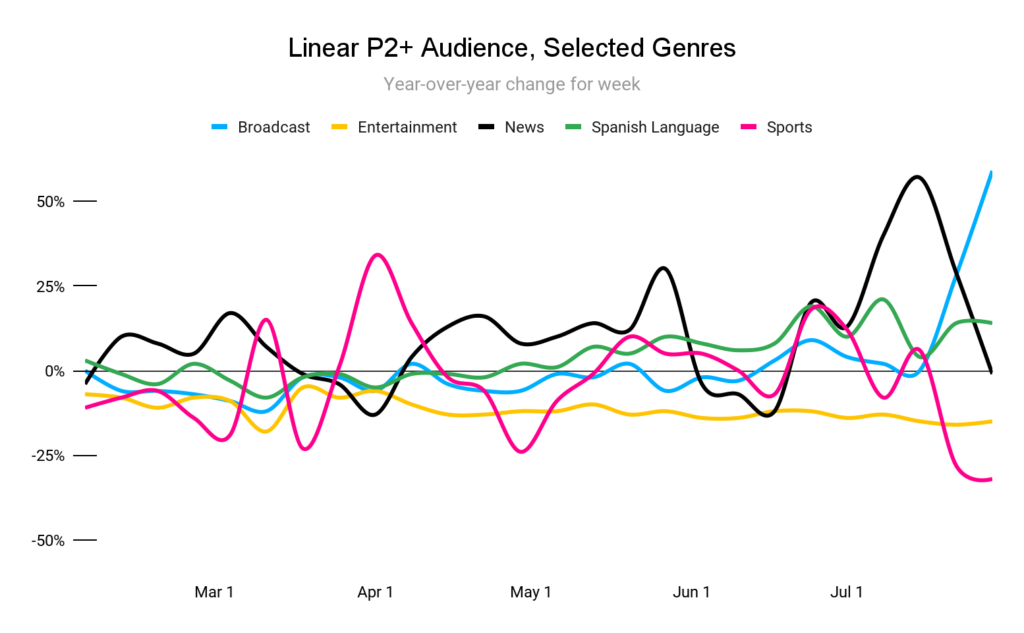

“Faster, higher, stronger” – broadcast TV has certainly leaned into the Olympic spirit, boasting record audience figures in recent weeks and pulling viewership in from other genres (especially other sports broadcasters). NBC reports average viewership of 32.6M, a 77% increase vs. the Tokyo games three years ago (with advertising revenue also coming in hot). Expect continued attention through the weekend before the closing ceremonies on Sunday, after which we can expect news viewership to bounce back strongly ahead of the Democratic National Convention, which kicks off on the 19th.

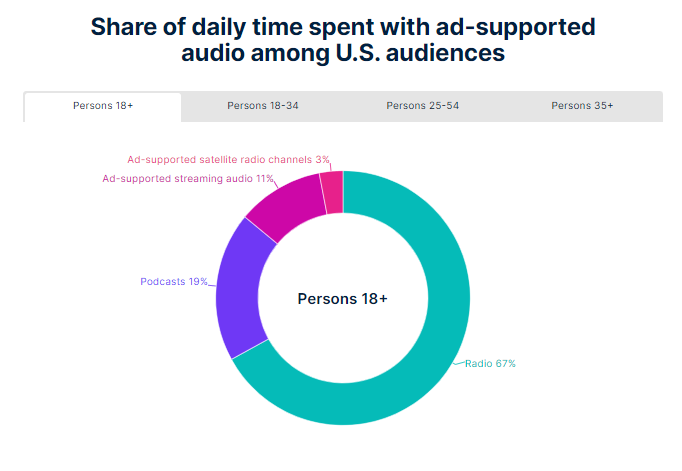

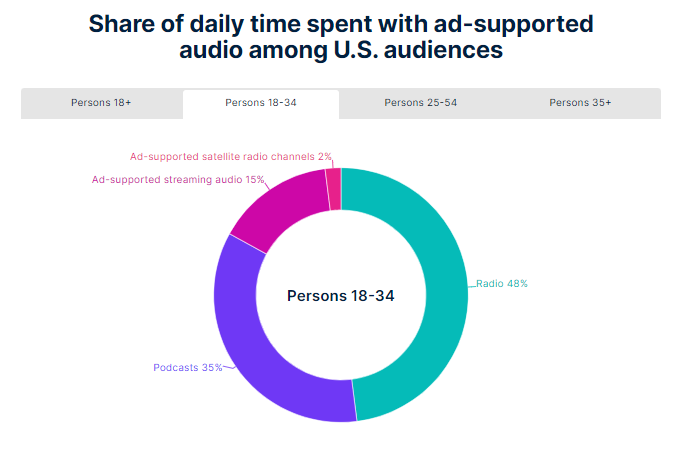

We often focus on TV in this space – the decline of linear, the fragmentation of streaming – given its premium position on the biggest screen in the house. However, as our advertiser partners know well, we should be careful not to ignore the power of audio. The latest figures from Nielsen show that the average American spends over 4 hours per day with audio, split between radio, podcasts, streaming music, and satellite.

For the majority of Americans, this time is heavily allocated towards radio, but among younger audiences, a full 50% of time is split between podcasts and ad-supported streaming audio.

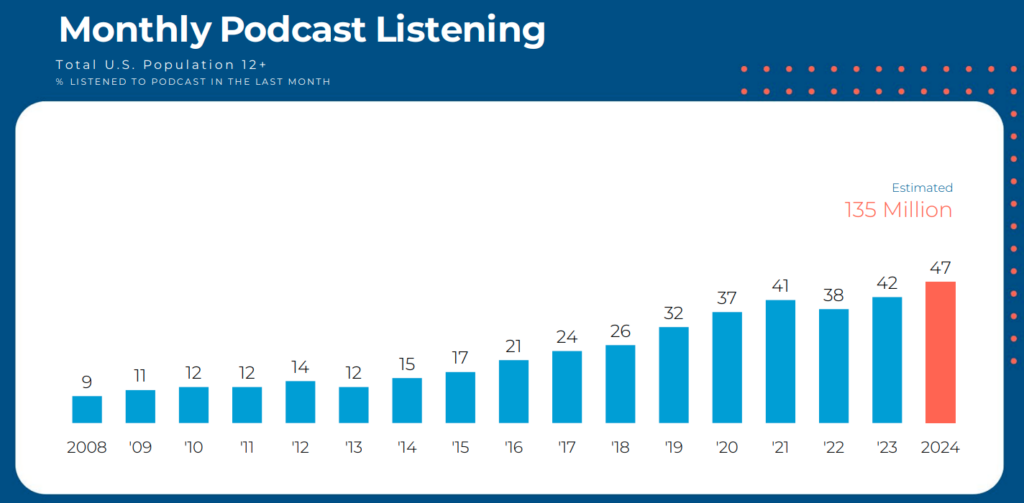

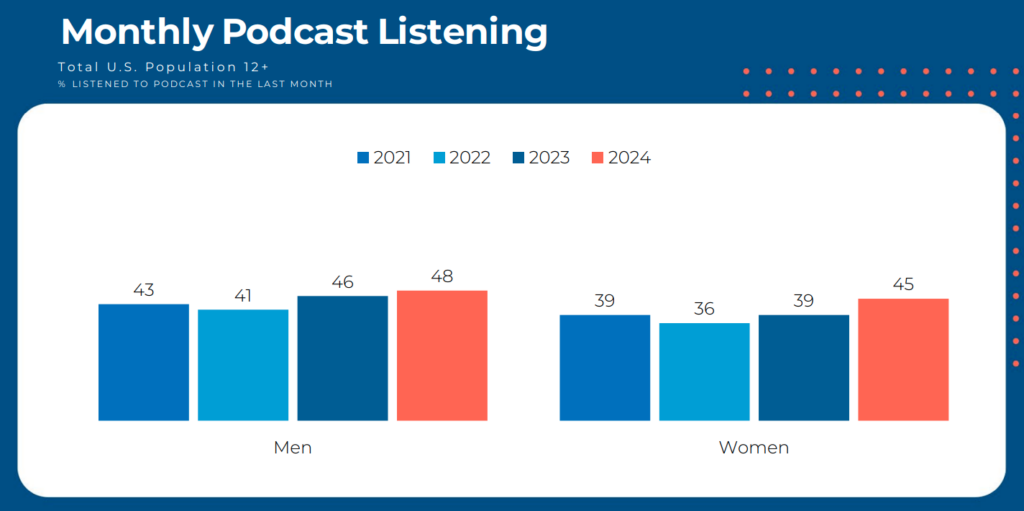

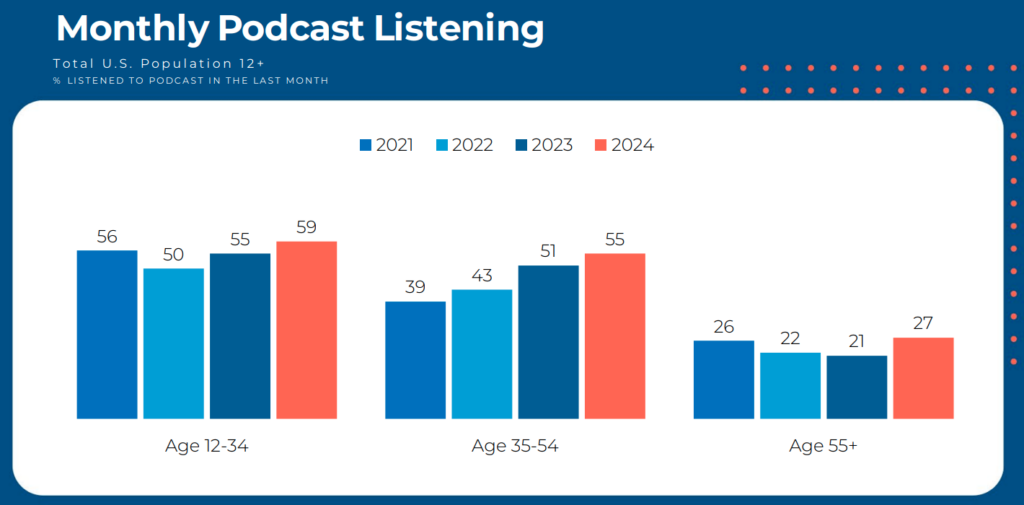

The growth of podcasts in particular is truly impressive, as it has occurred across genders and ages, with all groups reaching record highs in 2024, even accounting for COVID-era tailwinds.

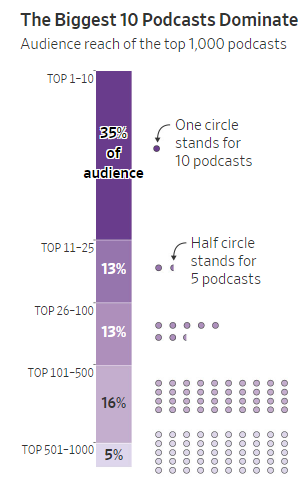

However, the growth of the medium overall masks an undercurrent of consolidation. Audiences are skewed heavily towards a small handful of podcasts, helping to drive some of the megadeals that have been recently reported, such as a $100M deal for Call Her Daddy host Alex Cooper and a similarly sized opportunity for the Kelce brothers. The stereotype that anyone with a microphone can start a podcast may persist (with over 400K podcasts currently active), but not everyone can get big enough to quit their day job, as just 25 podcasts reach 48% of the US audiences.

For brands, this leaves a complicated landscape to navigate, as costs to advertise in the largest podcasts can be heavy and attract some of the biggest spenders, including auto manufacturers and leading names in CPG. The good news is that the landscape leaves ample opportunity for strategic investment. The long tail of smaller podcasts opens the door for targeted advertising, as brands can piggyback on a host’s credibility and self-selected audience to reach engaged listeners who may already be primed to convert (and with dynamic ad insertion technology, advertisers can directly measure the

Two weeks ago, we noted that WarnerBros Discovery could pursue legal action against the NBA for rejecting its offer to match Amazon’s media rights bid. Soon after, WBD did just that, filing suit for breach of contract in the New York State Supreme Court. The league responded that because Amazon’s offer is to stream games, it is not obligated to accept WBD’s match. Further developments will now play out in courtrooms and legal offices, though WBD faces an uphill battle. Regardless, it may be a battle WBD needs to fight, as the increasingly competitive streaming landscape pressures David Zaslav’s organization. On the heels of its ~$10B quarterly loss, recent reporting suggests that WBD may be considering a breakup or beginning to offload smaller pieces of the conglomerate’s puzzle. As we’ve often said, streaming’s consolidation era is upon us and is picking up pace. | WSJ, Yahoo, ESPN

Jack Johnston Senior Director Innovation