Key Takeaways

- Secure a competitive advantage by trading on platforms that use internal AI to maintain price stability and lower slippage during volatile moves.

- Follow a system-first approach by separating your personal trading strategy from the underlying liquidity mechanics that handle execution.

- Reduce your trading stress and save time by choosing markets where automated infrastructure ensures consistent order matching without relying on outside firms.

- Adopt the surprising shift toward viewing AI as a silent foundation for market health instead of just a tool for guessing price changes.

MEXQuick has said that it will add a Mexquick market making system based on AI in 2026.

This will make its internal trading system grow in a way that is built into it. The project’s goal is to make it easier to deal with liquidity and execution behavior on the platform’s derivatives markets. This will make its system work even better for business.

The platform says that the ai market making framework will be a big part of the automated market making infrastructure, but users won’t be able to see it. Its main job is to keep the markets in order by making sure that the rules are followed when it comes to price stability, liquidity behavior, and execution consistency. The company made it clear that the system isn’t supposed to tell people what to do or when to trade. This is part of a bigger trend in the industry to make infrastructure run by itself. This is especially true in derivatives markets, where the market’s integrity depends more and more on how well trades are done and how liquidity acts.

Positioning AI as Market Infrastructure, Not Trading Intelligence

MEXQuick ai market making framework is different from the AI trading tools that are common in the digital asset market because it doesn’t sell AI as a way to make trades. The platform doesn’t use AI to guess which way the market will go or to make trading plans that are better for each person. Instead, it calls its system a “automated liquidity mechanism” that is part of the trading infrastructure.

A market maker’s job is to make sure there is always enough liquidity for buying and selling so that trades can happen quickly and prices don’t change too much. Before, institutional firms or professional market makers did this job most of the time. They do their jobs for their own reasons and use their own risk models.

People and outside sources can’t choose how much liquidity to give with MEXQuick. Instead, it uses a system-level mechanism that is based on logic that has already been set up. AI doesn’t try to guess what will happen in the market. Instead, it tells liquidity what to do in different situations. The announcement for 2026 is based on this difference.

Why Market-Making Is Central to MEXQuick’s Trading Model

It focuses on AI market-making in a way that is very similar to how it trades. MEXQuick trades in short-term derivatives that are based on contracts. In other words, trades happen and are finished within certain time frames and limits. It’s very important to know how liquidity works when this happens. When trading cycles are short, thin, or not steady, liquidity can make prices go up and down, cause more slippage, and change the results of settlements.

MEXQuick says that its AI market-making system will fix these problems by making sure that there is always enough money in the market and that prices don’t change while a contract is in effect. The system is supposed to keep the market running smoothly, even when trading patterns change quickly. It shouldn’t change when things change. People who think this way believe that liquidity is not just a good thing; it’s something the market needs to stay stable.

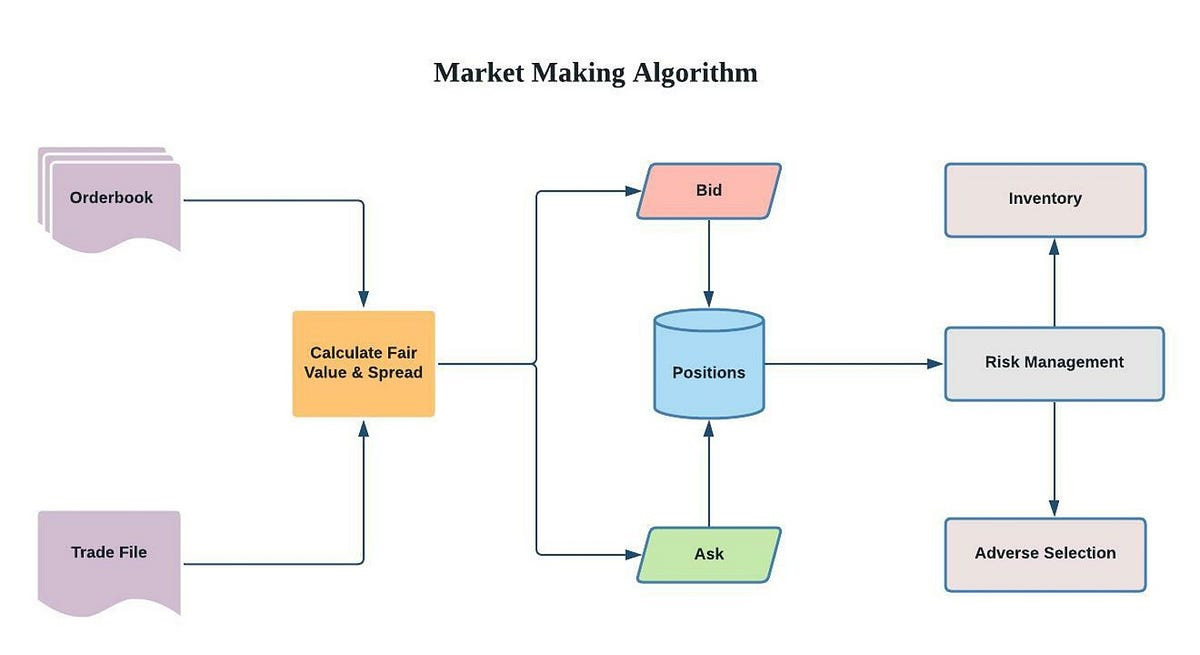

High-Level Operation of the AI Market-Making System

The company hasn’t said much about the technical side of things yet, but it has given a general idea of how the AI market-making infrastructure will work. The system will always be checking real-time market data, such as how many orders are coming in, how much trading is going on, and how much cash is needed. It will move bids and asks around within certain limits based on these inputs to make sure that the conditions for execution stay the same.

The AI system is different from manual or static market-making models because it can change quickly while still following the rules for execution. This balance lets the system change with the market without letting people pick. MEXQuick has made it clear that the system doesn’t care what traders want or where the market is going. Its only job is to make sure that all contracts can always be carried out and that they have enough liquidity.

Separation Between Traders and Market Mechanics

One of the main ideas behind MEXQuick’s AI market-making framework is that traders shouldn’t be able to change how the market works. People who trade on the platform can still pick their own contracts, set their own risk levels, and decide when to trade. The AI system works on its own, so prices and liquidity don’t change no matter what traders do.

The point of this separation is to make it easier to deal with emotional or reactive liquidity patterns. Models that use both manual and automated market-making see these patterns happen a lot. MEXQuick wants to make trading more predictable by making the way liquidity works at the system level more stable. The business calls this “system-first” instead of “participant-driven.”

Implications for Execution Quality

Traders should see the most immediate effects of AI market-making in how well they stick to their plans, not in how they come up with them. MEXQuick says that the system is meant to make execution easier by keeping prices more stable and close together when the market is normal. This means that liquidity won’t drop as much all of a sudden, and it will be easier to match orders when things change.

Short-cycle traders, who make decisions based on when trades happen and how prices stay the same, will probably be the most affected by these changes. In these kinds of situations, even small changes in how much liquidity there is can have a big effect on the results. The platform says that AI market-making is meant to help with these execution needs without changing how traders use contracts.

Internal Liquidity Management and Reduced External Dependence

The AI market-making framework also wants to help the company rely less on liquidity providers that aren’t part of the company. Third-party market makers often make it easier to trade. Depending on the market, the incentives, or how much risk they are willing to take, they might act differently. Change can be hard, especially when things are very unstable.

MEXQuick wants to have more control over how markets work by adding AI liquidity infrastructure crypto’s logic directly to its infrastructure. The AI system will only do what the platform tells it to do, not what other people want it to do. This helps you figure out what it will do next. This change is part of the company’s plan to make trading conditions the same in all of its markets.

Retail Traders and Access to Institutional-Grade Liquidity Systems

Institutions have usually made markets, but MEXQuick’s ai-driven market structure framework is meant to let regular people use professional-grade derivatives trading liquidity systems without having to make markets themselves.

Retail users don’t make the system more liquid. They trade on markets that always have an automated layer of liquidity running in the background.

This model tries to make the conditions for execution more fair by getting rid of differences that can happen when institutional participation is the main thing that affects how liquidity behaves. MEXQuick says that adding liquidity management to the platform itself makes it easier for regular traders to trade in a market that is less volatile.

Risk Controls and Rule-Based Market Behavior

Managing risk is a key part of the AI market-making system. The system will only work if the risks stay within a certain range. These limits determine how money is added and removed.

The AI system doesn’t use volume-based or aggressive spread compression methods. Instead, it works to keep the market running smoothly and without problems. Prices shouldn’t change too quickly, and people shouldn’t be able to get their money out too quickly.

MEXQuick has made it clear that following the rules and being honest are still important. Everyone can easily see how trades are made and settled because there are clear rules about how execution logic and liquidity work.

This method works well with the growing need for transparency in digital asset markets, especially when it comes to trading derivatives.

Part of the 2026 Platform Roadmap

The AI market-making system is a cornerstone of MEXQuick’s 2026 development roadmap. Rather than expanding its product lineup, the platform has focused on strengthening foundational systems such as execution logic, liquidity mechanisms, and contract design.

The emphasis is on durability over novelty.

By treating liquidity management as core infrastructure instead of a service layer, MEXQuick signals a long-term commitment to execution quality and system resilience.

Automation as a Structural Necessity

Across financial markets, automation has steadily replaced manual processes—especially in liquidity provision and order matching. High-frequency and derivatives markets now demand levels of consistency that discretionary models struggle to maintain.

AI-driven infrastructure offers a middle ground: strict rule enforcement combined with the flexibility to adapt to changing conditions.

MEXQuick’s announcement reflects this broader shift. Rather than promoting speculative automation, it emphasizes controlled execution and structural integrity.

Timeline and Next Steps

The platform has stated that the AI market-making system has been going since 2025, following internal testing and phased deployment. No specific launch date was announced, its readiness and stability cited as the primary criteria. In 2026, the focus shifts toward decentralization.

As development progresses, additional technical disclosures are expected.

A Structural Evolution, Not a Feature Launch

Ultimately, MEXQuick’s AI market-making initiative represents a change in how its markets function rather than an expansion of what users can trade.

By embedding automated liquidity management directly into its core architecture, the platform is prioritizing execution quality over surface-level innovation.

As digital asset markets continue to mature, this infrastructure-first philosophy may play an increasingly important role in defining sustainable, resilient trading environments.

Frequently Asked Questions

What is the MEXQuick AI market making system?

This system is a new part of the platform’s internal infrastructure designed to manage liquidity automatically. Unlike trading bots that guess price moves, this AI works behind the scenes to make sure there are always enough buyers and sellers. It acts as a digital foundation to keep the derivatives market running smoothly for all users.

Is this AI system meant to help me pick better trades?

No, the MEXQuick AI framework is not a trading signal tool or an investment advisor. Its only job is to maintain price stability and ensure trades happen at the expected price without big delays. You still make all your own choices about which contracts to buy and how much risk to take.

How does “automated liquidity” benefit a regular trader?

Automated liquidity helps reduce “slippage,” which is when the price changes between the time you click buy and when the trade finishes. By keeping the market steady, the AI ensures you get a fair price even when things are moving fast. This creates a more predictable environment for people who trade short-term contracts.

Why is MEXQuick building this directly into their platform instead of using outside firms?

By building their own system, MEXQuick reduces its dependence on external companies that might leave the market during stressful times. An internal AI follows the platform’s specific rules 24 hours a day, providing more consistent support than human-led firms. This move gives the platform more control over the quality of every trade made on the site.

Will I be able to see the AI working while I trade?

The AI market making framework is designed to be invisible to the user. You will see the results through stable prices and fast order matching, but there is no specific dashboard or “AI mode” to toggle. It is part of the core engine that powers the exchange, much like an engine in a car that runs without the driver needing to touch it.

Does the AI favor certain traders over others?

One of the main goals of this system is to create a fair market for everyone by removing human bias. The AI follows set logic and does not care about your account size or trading style. It treats every contract the same way to ensure the market remains honest and follows its own rules.

Can the AI handle sudden changes in the market without crashing?

The system is built to monitor real-time data like order volume and cash needs to adjust instantly. Because it is powered by AI, it can react to thousands of data points much faster than a manual system could. This helps prevent “liquidity gaps” where the market stops moving during busy times.

What is a common misconception about AI in crypto trading?

Many people think all AI in crypto is designed to “beat the market” or predict the future. The MEXQuick system proves this is a myth, as its goal is structural integrity rather than social guessing. It focuses on the mechanics of the market rather than trying to win a game against its users.

How can I prepare my trading strategy for these 2026 changes?

Since the system makes execution more stable, you can focus more on your own strategy and less on worrying about price gaps. Traders should look at the platform’s documentation on contract limits to understand the boundaries within which the AI operates. This allows you to plan your risk levels with more confidence that your orders will fill correctly.

What happens next on the MEXQuick roadmap after the AI system is live?

After the AI system is fully stable in 2026, the company plans to focus heavily on decentralization. This means they want to take these automated tools and give more control back to the network of users. This step-by-step approach ensures the market is strong and stable before they make bigger changes to how the platform is led.