Verified & Reviewed

Published on September 4, 2025 Written By Meredith Flora

Published on September 4, 2025 Written By Meredith Flora

Subscribe for More

Key Takeaways

1

The de minimis threshold value is the threshold value of goods below which no duties or taxes are charged by customs, varying significantly by country and impacting global ecommerce.

2

Ecommerce businesses benefit from de minimis values through cost savings, market expansion, and improved supply chain efficiency, while consumers enjoy lower prices and increased product variety.

3

Compliance with de minimis regulations requires businesses to stay informed about changing thresholds, ensure accurate shipment valuations, and maintain thorough documentation.

4

ShipBob offers logistics solutions that help businesses navigate de minimis challenges, optimize fulfillment processes, and ensure compliance with international shipping regulations.

The US de minimis exemption, once a powerful tool for ecommerce brands, allowed shipments under $800 to enter duty-free. But that era has ended.

As of May 2, 2025, the US has eliminated de minimis privileges for shipments from China and Hong Kong. And on August 29, 2025, the exemption disappears for all countries, marking one of the most significant shifts in US import policy in decades.

The move, part of a broader push to curb illicit trade and tighten customs compliance, means ecommerce brands can no longer bypass duties and formal entries for low-value shipments. Landed costs will rise, compliance requirements will increase, and fulfillment strategies will need a serious rethink.

In this article, we’ll explain what the de minimis threshold is, outline the key dates and policy changes, and share actionable strategies for adapting your fulfillment approach in a post-de minimis world.

What is the de minimis threshold value?

The de minimis threshold value refers to the minimum value of goods below which no duties and/or The de minimis threshold value refers to the minimum value of goods below which no duties and/or taxes are charged by customs authorities upon importation. This concept has played a crucial role in global shipping and customs, significantly impacting ecommerce businesses and consumers who purchase products internationally.

However, the landscape is changing. While the US historically allowed duty-free imports under $800, one of the world’s highest thresholds, key changes are now underway:

- May 2, 2025: De minimis exemption eliminated for shipments from China and Hong Kong

- August 29, 2025: The $800 exemption ends for all countries globally

For businesses involved in cross-border ecommerce, understanding these changes and their implications is vital for recalculating the total cost of shipping goods internationally and maintaining competitive pricing.

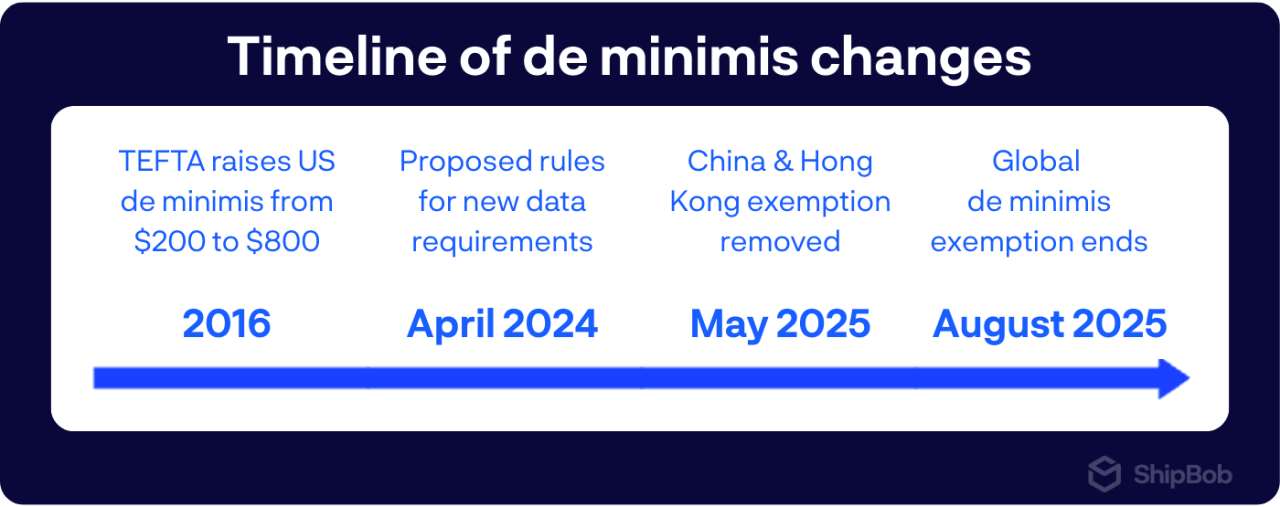

Timeline: How de minimis shipping rules are changing

The US de minimis phaseout didn’t happen overnight; it’s the result of years of policy debates, proposed rule changes, and growing scrutiny over low-value shipments.

Key milestones

- 2016 – TFTEA raises US de minimis from $200 to $800

The Trade Facilitation and Trade Enforcement Act increases the US threshold, making it one of the most generous in the world and fueling growth in small-parcel imports. - 2023–2024 – Rising political pressure

Lawmakers and trade groups call for reform, citing concerns over illicit trade, tariff circumvention, and the disproportionate share of de minimis shipments coming from China. - April 2024 – Proposed rules for new data requirements

The Biden administration introduces proposals for enhanced shipment data, tighter eligibility rules, and increased enforcement. - May 2, 2025 – China & Hong Kong exemption removed

US Customs and Border Protection (CBP) stops allowing duty-free treatment for Section 321 shipments from China and Hong Kong. - August 29, 2025 – Global de minimis exemption ends

All low-value shipments entering the U.S, regardless of origin, now require formal customs entry, duties, and taxes where applicable.

Looking ahead: The removal of de minimis marks a fundamental shift for cross-border ecommerce. Brands can no longer depend on duty-free imports to keep prices competitive and must adapt their fulfillment strategies to maintain profitability and compliance.

What de minimis values mean for ecommerce businesses

For US merchants, the phaseout of the $800 de minimis exemption is a major shift in how cross-border fulfillment costs are calculated.

Here’s what you can expect:

Higher landed costs and tariffs

With duty-free entry gone, many products will face 30% tariffs or flat fees of up to $50 per shipment, depending on product category and origin. Even small, low-value items will now add duty and tax costs to your COGS.

New compliance requirements

Every shipment, regardless of value, will need a formal customs entry, which means:

- Providing accurate HTS (Harmonized Tariff Schedule) codes

- Supplying commercial invoices and proof of value

- Ensuring all partner government agency (PGA) requirements are met

This increases both the administrative workload and the risk of fines if details are incorrect.

More complex supply chain planning

Without de minimis, fulfillment strategies that relied on frequent, small international parcels may no longer be cost-effective. Merchants will need to explore consolidation, domestic distribution, or bonded storage to maintain margins.

Higher stakes for customer pricing and conversion

If duties are passed to customers, you risk higher cart abandonment rates. Brands will need to rethink their pricing, bundling, and promotional strategies to offset these costs without losing sales.

How to navigate strategic fulfillment options post-de minimis phaseout

Losing the de minimis exemption doesn’t have to mean losing profitability. By adjusting your fulfillment approach now, you can reduce cost shocks, protect delivery speed, and stay compliant.

Domestic inventory positioning

Storing inventory inside the US eliminates the need for repeated cross-border imports, which means no duties on each individual order and fewer customs headaches.

- Benefits: Faster delivery times, smoother compliance, and margin protection.

- How ShipBob helps: With 50+ US fulfillment centers, ShipBob enables you to place products closer to your end customers, cutting both transit time and cost.

Bonded or near-shore hub utilization

Bonded warehouses and Foreign Trade Zone (FTZ) facilities, along with near-shore hubs, can defer duty payments until goods are sold domestically, or even allow for duty drawback when re-exporting.

- Benefits: Delayed cash outflow for duties, reduced risk of overpaying on unsold stock, and, in some cases, the ability to re-export without incurring US duties at all.

- How ShipBob helps: ShipBob operates Foreign Trade Zone (FTZ) warehouses, available through our De Minimis Defense Program. These locations let you stage inventory closer to your customers, reduce upfront duty costs, and keep fulfillment agile without committing to US duties until goods enter commerce.

Customs automation via ShipBob

Automating customs compliance reduces manual errors and speeds up clearance.

- Benefits: Accurate HS-code mapping, faster document prep, and less human error.

- How ShipBob helps: ShipBob’s platform can auto-generate eManifests, map HTS codes correctly, and produce required documentation in advance to avoid delays or penalties.

Landed-cost recalibration & pricing tools

Without de minimis, knowing your true landed cost is critical for your pricing strategy.

- Benefits: Prevents margin erosion, supports strategic discounting or bundling.

How ShipBob helps: ShipBob offers landed-cost estimation tools that factor in duties, tariffs, and taxes, enabling you to update product pricing or promotional offers before costs eat into profits.

De minimis in global markets

While the US is ending its $800 de minimis exemption in August 2025, most other countries still maintain their thresholds, though many are far lower and under increased review.

| Country | De minimis value for duties | De minimis value for taxes |

| United States | $800 (ended August 29, 2025) | Varies by state (ended August 29, 2025) |

| European Union | €150 | VAT applies to all goods |

| Australia | AUD 1,000 | AUD 1,000 |

| Canada | CAD 20 | CAD 20 |

| United Kingdom | £135 | VAT applies to all goods |

These examples highlight the diversity in de minimis values worldwide, with the US sunset representing the most significant shift in global trade policy in recent years.

Apart from the sunset of de minimis in the US, here are a few global trends to watch:

- Lower thresholds, more scrutiny: The EU has proposed removing duty exemptions for low-value parcels due to concerns about non-compliant products and unfair competition, while the UK is reassessing its thresholds.

- Reforms underway: Countries like Canada, the UK, and several EU member states have introduced or are considering tighter reporting requirements for low-value shipments.

Compliance complexity: Merchants selling globally must stay on top of varying thresholds and exemptions. What’s duty-free in one market may trigger duties in another.

Enjoy cost-efficient fulfillment with ShipBob’s De Minimis Defense Program

No matter how US or global import rules change, ShipBob helps brands stay agile, compliant, and competitive. With the De Minimis Defence Program, you can pivot quickly to post–de minimis realities without disrupting your customer experience.

Rapid landed-cost modeling & forecasting

ShipBob can provide landed cost estimates within 24 hours, giving you an up-to-date picture of duties, tariffs, and taxes for any product and destination. This allows you to:

- Model “what-if” duty scenarios ahead of policy changes.

- Adjust pricing, promotions, and bundling to protect margins.

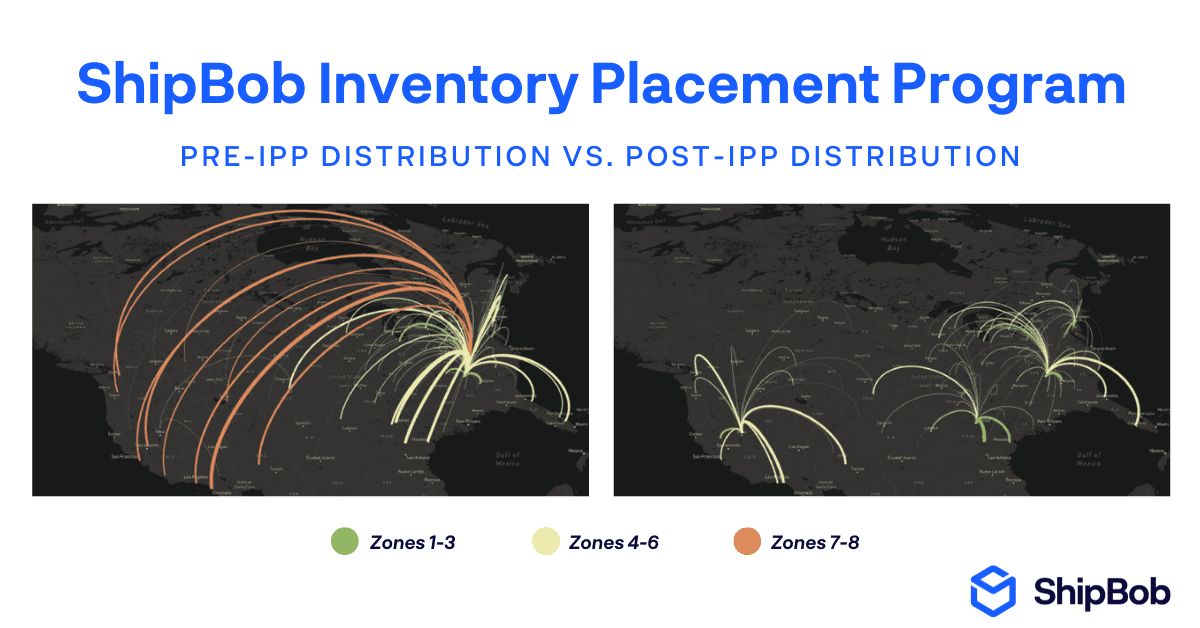

Inventory Placement Program for smart distribution

Our Inventory Placement Program (IPP) automatically determines the most strategic ShipBob fulfillment centers for your products based on order data and demand trends. By splitting inventory across US, Canada, and other key markets, you can:

- Shorten delivery times.

- Reduce duties on cross-border shipments.

- Keep inventory closer to customers to avoid unnecessary imports.

Compliance & documentation automation

When every shipment now requires a formal customs entry, speed and accuracy in paperwork can make or break your delivery timelines. Manual processes not only slow things down but also increase the risk of costly errors or compliance issues.

ShipBob’s platform streamlines the customs process by:

- Automating HTS code classification.

- Generating complete and accurate customs paperwork.

- Ensuring declarations meet the latest import regulations.

This helps you reduce manual effort, lower the risk of errors, and keep your goods moving smoothly through customs, even in a post-de minimis environment.

Get started with ShipBob

Interested in leveraging ShipBob as your fulfillment provider? Connect with our team to get a customized quote.

De minimis value entry FAQs

Here are answers to the most frequently asked questions about de minimus value entry.

How has the US de minimis threshold changed for imports from China/Hong Kong starting May 2, 2025?

Effective May 2, 2025, the US removed the $800 de minimis exemption for goods shipped from China and Hong Kong, meaning:

- All low-value shipments from these countries now require formal or informal customs entry, regardless of value.

Postal items face 120% ad valorem duties or flat fees (e.g., $100 per item), depending on the shipment method.

What global changes to the $800 de minimis exemption will take effect August 29, 2025?

Starting August 29, 2025, the US will eliminate the de minimis exemption for all countries.

All commercial imports, especially those via private carriers like FedEx, UPS, and DHL, will be subject to duties and customs procedures.

No shipment under $800 will remain duty-free.

How can ShipBob help brands automate duty calculations and customs compliance under new de minimis developments?

ShipBob simplifies international shipping by:

- Generating commercial invoices. We automatically create and print these mandatory documents for parcel orders, which customs officials use to calculate duties and taxes.

- Streamlining B2B shipments. For manual B2B orders, merchants can easily attach invoices in our dashboard.

- Offering a DDP solution. Our delivered duty paid (DDP) solution helps prevent unexpected fees for your customers, making cross-border shipping smoother.

Additionally, our De Minimis Defense Program helps brands kickstart their order fulfillment with ShipBob in the wake of the global change updates.

Important Note: Merchants are responsible for providing accurate customs information (tariff codes, product value, descriptions) to avoid delays or additional fees. For inventory shipped to ShipBob fulfillment centers, always use a DDP service and designate yourself as the Importer of Record. ShipBob cannot act as the Importer of Record and may charge administrative fees if incorrectly designated.

How can brands minimize surprise duties by leveraging US-based fulfillment and bonded warehouses?

Brands can protect margins and avoid unexpected tariffs by:

- Warehousing inventory in the US, so shipments originate domestically and avoid new de minimis rules.

- Using bonded facilities to defer duties until import is finalized or goods are moved.

- Consolidating imports into fewer formal entries, reducing reporting complexity and duty exposure.

These strategies help brands retain pricing control and preserve supply chain predictability.

What impact will the phase‑out of de minimis exemptions have on small shipments and pricing strategies?

The end of the de minimis exemption flips the economics for low-value international shipping:

- Tariffs of 10-50% (or higher) will now apply, often rendering formerly cheap parcels unprofitable.

- Small shipments may no longer justify cross-border pricing, pushing brands to absorb costs or transition to US-based fulfillment.

- Pricing strategies may need revising, especially for fast-fashion, low-margin products

In short: The change makes cost transparency and fulfillment strategy more critical than ever.

How does ShipBob help brands impacted by the elimination of de minimis?

As countries reduce or eliminate de minimis thresholds, ShipBob helps brands stay compliant, improve operations, and deliver a seamless international experience.

Brands can leverage the following capabilities through our De Minimis Defense Program:

- Foreign-Trade Zone warehouses – Store inventory in ShipBob’s two US FTZ facilities to defer or reduce duties and optimize cross-border fulfillment.

- Global network of 60+ fulfillment centers – Distribute inventory across ShipBob’s warehouses in the US, EU, UK, Canada, and Australia to ship locally.

- Duty & tax management – ShipBob integrates with landed cost tools to help calculate duties and taxes upfront, reducing cart abandonment and compliance risk.

By combining FTZ solutions, localized fulfillment, and tax management, ShipBob helps brands maintain margins and scale globally despite changing de minimis rules.

Is the de minimis threshold still active in the US?

The de minimis threshold is being phased out in the US. As of May 2, 2025, shipments from China and Hong Kong no longer qualify for the $800 exemption. On August 29, 2025, the de minimis threshold will be completely eliminated for all countries, meaning all imports will be subject to applicable duties and taxes regardless of value.

Are any goods exempt from the de minimis sunset?

When the de minimis exemption ends, every commercial import will require a formal customs entry and will be charged duties, taxes, and fees based on its HTS classification. Some products may still qualify for reduced or zero duties under programs like the Generalized System of Preferences (GSP) or certain free trade agreements.

How can I tell if my shipment splitting approach is compliant?

Multiple shipments to the same customer are generally fine if each is a genuine, separate order with its own transaction and invoice, not parts of one order split up just to lower the declared value. If there’s no clear commercial reason for the separation, customs may apply extra duties or penalties, so keep records and check with a broker or fulfillment partner like ShipBob if you’re unsure.

What happens if my shipment is incorrectly valued at customs?

Incorrect valuation can result in significant penalties, including fines up to the domestic value of the merchandise, seizure of goods, and loss of import privileges. With increased scrutiny following de minimis elimination, accurate valuation is critical. Always declare the true transaction value, including shipping costs where required. If customs disputes your valuation, you’ll need to provide supporting documentation such as invoices, payment records, and comparable sales data.