Who Is This For? (And More Importantly, Who Should Pass?)

You know that feeling when you find a tool that seems like it might solve a big problem for your brand, but you’re not sure if it’s the right fit? I’ve been there. Choosing a fraud prevention solution is a big decision. It impacts your bottom line, affects your approval rates, and ultimately, shapes your customer’s experience. Let’s talk about who really benefits from a solution like NoFraud and, just as important, who might be better off sticking with their current setup.

You Should Seriously Look at NoFraud if:

From what I’ve seen working with hundreds of scaling brands, NoFraud isn’t for everyone. But for certain types of Shopify businesses, it’s a strategic advantage, pure and simple.

- You are a Shopify Plus brand processing a high volume of transactions, and chargebacks are eating into your profits and causing headaches. We’re talking about more than just a stray fraudulent order; you’re seeing a consistent drain that signals a need for a dedicated solution beyond Shopify’s basic filters. This is about protecting actual revenue, not just reacting to a few bad apples.

- You are an ambitious Shopify scaler seeking to optimize order approval rates without taking on excessive risk. Generic fraud filters often lead to false positives, blocking good customers and costing you sales. You need to confidently approve more legitimate orders while keeping bad ones out.

- You lead a DTC brand focused on customer experience, and you’re frustrated by manual fraud reviews bogging down your operations team. Imagine a world where your team isn’t spending hours reviewing suspicious orders, chasing down verification, or dealing with customer service issues from blocked legitimate transactions. NoFraud brings automation and accuracy to that process.

- You currently rely solely on Shopify’s built-in fraud prevention or a general payment gateway’s tools, and you’re realizing they lack the depth and human intelligence needed to catch sophisticated fraud. As your business grows, so does the sophistication of fraudsters. You need a solution that evolves with these threats.

You Should Probably Stick with Your Current Stack if:

Being direct here: NoFraud isn’t the right fit for everyone. Sometimes, adding another tool can create more friction than it solves.

- You are an early-stage Shopify brand, perhaps doing under $50,000 in monthly revenue, and your chargeback rate is already very low (below 0.1%). At this scale, the cost and complexity of a dedicated fraud solution might outweigh the marginal benefit. Your team can likely manage the few risky orders manually.

- Your team lacks a dedicated operational owner or team member who can invest time in understanding and optimizing a new system. While NoFraud is automation-focused, any powerful tool requires an internal champion to ensure effective setup and ongoing monitoring. Without that, you won’t get the full value.

- You heavily rely on extremely niche, custom fraud rules or manual workflows that are deeply embedded in your existing, lower-volume order fulfillment process. Sometimes legacy processes, while less efficient, are too ingrained to easily replace without significant internal disruption.

- Your primary concern is transaction fee reduction, and you’re already using a payment processor with built-in, low-cost fraud protection that meets your current risk tolerance. NoFraud is about preventing financial loss from fraud and chargebacks, not necessarily reducing standard payment processing fees.

The Strategic Problem NoFraud Solves (The “Why”)

Every Shopify brand, especially those scaling quickly, grapples with fraud. It’s not just about losing a few orders. Fraud is a stealthy drain on your entire operation, eroding profitability and slowing growth. Think of it like a silent alarm constantly pulling your team away from strategic work. NoFraud steps in to tackle this head-on, allowing you to re-focus on what truly matters: serving your legitimate customers and growing your brand.

Hidden Costs of Fraud on Your P&L

You might think fraud simply means refunding a bad order, right? I’ve seen too many Shopify brands make this mistake. The reality is, the financial damage from fraud is far deeper than just the lost product. It spreads through your entire Profit & Loss (P&L) statement, quietly eating away at your margins.

Consider these less obvious, yet significant, costs:

- Chargeback Fees: Beyond the initial order value, every chargeback incurs a fee from your payment processor. These range from $15 to $50 per case, even if you win the dispute. These stack up fast, turning what seems like a small problem into a chunky expense.

- Operational Costs of Manual Review: How much time does your team spend sifting through “suspicious” orders? Hours spent on manual reviews, chasing down customer verification, or calling banks is time not spent on marketing, customer service, or other growth initiatives. This translates directly into higher labor costs and reduced efficiency. For many North American merchants, this manual review process is still the norm, slowing down operations.

- Lost Customer Lifetime Value (LTV) from False Declines: This is a big one that often gets overlooked. When a legitimate customer’s order is flagged and declined due to an overly aggressive fraud filter, they rarely come back. You’re not just losing that one sale; you’re losing their potential future purchases, their referrals, and their long-term value to your brand. Sixty-three percent of businesses actually report that fraud increases customer churn.

- Impact on Conversion Rates: Aggressive fraud prevention can introduce friction. If your system is too quick to decline, or if it requires too many verification steps, good customers might abandon their carts. Sixty-four percent of businesses acknowledge fraud negatively impacts conversion rates. Every frustrated customer who leaves your site is a lost sale that you paid to acquire.

- Higher Processing Rates & Reputational Damage: Consistently high chargeback ratios (typically above 0.9%) can flag your business as “high-risk” with payment processors. This can lead to increased processing fees, account termination, or placement in monitoring programs. This hurts your reputation with financial institutions and impacts your ability to process payments smoothly.

The true cost of fraud for US merchants is about $4.61 for every $1 of fraud. Think about that. For every dollar lost to a fraudulent order, you’re actually losing nearly five dollars across your P&L. This is why having a robust solution like NoFraud is not just a nice-to-have; it’s a strategic necessity. It’s about protecting more than just individual transactions; it’s about safeguarding your entire business.

The Strategic Advantages of NoFraud (The “How”)

Now let’s talk about how NoFraud actually changes the game for your brand. It’s not just another app that flags suspicious orders. I’ve seen firsthand how its distinct capabilities directly impact your operation, your P&L, and your ability to scale. This is about transforming fraud prevention from a reactive chore into a proactive business driver.

Capability 1: Real-time, AI-Powered Fraud Screening

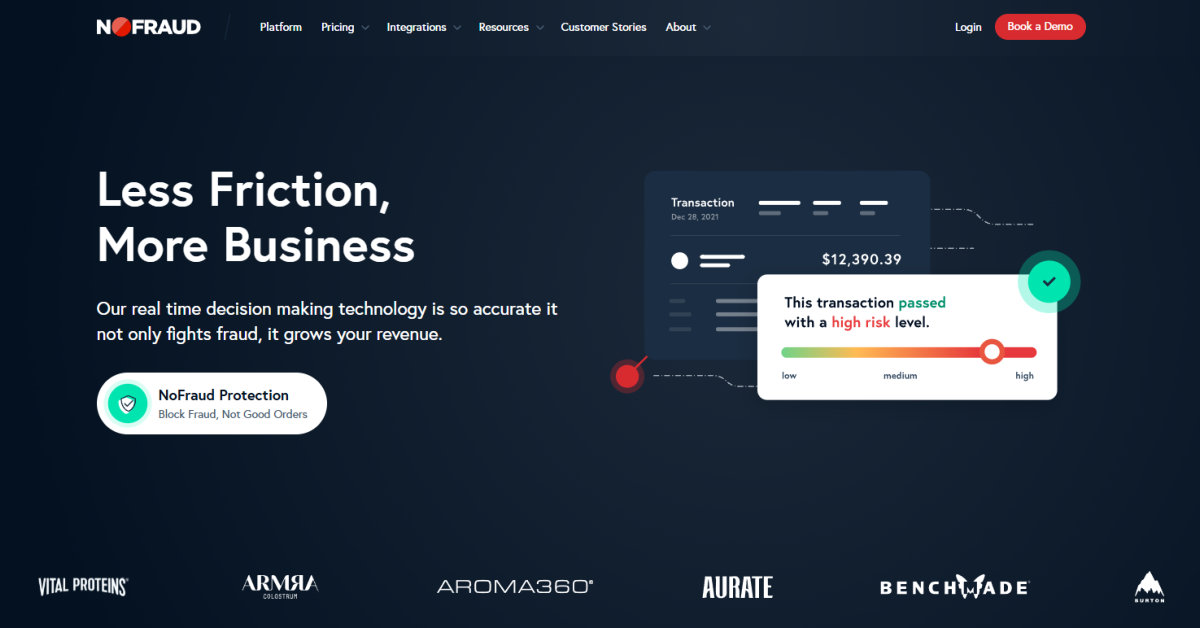

Think about the speed of modern e-commerce. Customers expect instant gratification. Any delay in order processing can lead to a canceled order or, worse, a frustrated customer who takes their business elsewhere. NoFraud steps in with an AI and machine learning system that vets transactions in real-time, instantly.

This means a fraudulent order is caught before it ships. Imagine avoiding the headache of recalling a package or dealing with the financial hit of a lost product. NoFraud’s intelligence also keeps false positives to a minimum. You approve more legitimate orders without the risk. From a strategic viewpoint, this translates directly into:

- Faster Order Fulfillment: You can ship orders within minutes, not hours or days.

- Reduced Manual Review: Your team isn’t bogged down sifting through endless “suspicious” flags. They can focus on growth initiatives instead.

- Improved Conversion Rates: Legitimate customers experience a smooth checkout, leading to more completed sales.

This capability alone is a significant win for any growing Shopify brand.

Capability 2: Chargeback Elimination and Guarantee

Here’s where NoFraud truly transforms your risk profile: its chargeback guarantee. This isn’t just a promise; it’s a financial shield. If NoFraud approves an order that later results in a fraud-related chargeback, they cover it completely.

For any brand grappling with the true cost of fraud, this is huge. It impacts your Profit & Loss statement directly by converting an unpredictable financial drain into a predictable operating expense. What does this mean for your business?

- No more unexpected hits from fraudulent chargebacks.

- You free up capital that would otherwise be tied up disputing claims.

- Your finance team can forecast expenses with far greater accuracy.

This effectively turns fraud prevention from a cost center into a strategic investment, freeing you to reinvest those savings into growth initiatives like marketing or product development. It’s a fundamental shift in how you manage risk.

Capability 3: Approving More Legitimate Orders

Most traditional fraud filters are too aggressive. They cast a wide net, catching fraudsters but also declining a significant number of good customers. Think of it as a bouncer at a club who turns away half the paying guests because a few might cause trouble. This leads to false declines, a silent killer of revenue and customer loyalty.

NoFraud uses advanced analytics, combined with human review when necessary, to distinguish genuine from risky orders. Their system identifies subtle patterns that basic filters miss, allowing more legitimate transactions to go through. I’ve seen brands boost their approval rates by significant percentages after implementing NoFraud.

What’s the strategic impact?

- Increased Revenue: Every legitimate order that was once declined is now a sale.

- Improved Customer Experience: Your loyal customers don’t face the frustration of having their purchase blocked. This builds trust and encourages repeat business.

- Enhanced Customer Lifetime Value (LTV): By approving more legitimate customers, you’re not just getting a single sale; you’re building relationships that contribute to your long-term success.

This capability ensures you’re not leaving money on the table. You’re maximizing every marketing dollar spent to acquire customers by ensuring their valid purchases are approved.

The Operational Assessment (The “Brass Tacks”)

Alright, let’s talk about the nitty-gritty, the details that matter when you’re thinking about adding a new tool to your tech stack. We’re past the “why” and “how” now. This is about what it’s like to actually use NoFraud day-to-day, how it fits into your existing setup, and what the real financial picture looks like. As founders, we know a great idea only matters if it can be implemented and deliver tangible value without creating new headaches.

The Shopify & Shopify Plus Integration

This is where rubber meets the road for Shopify brands. You need a tool that speaks Shopify’s language, not just one that tolerates it. I’ve seen firsthand the headaches caused by integrations that are clunky or require constant workarounds. NoFraud gets this right. Their integration with both Shopify and Shopify Plus is deep and smooth, minimizing friction.

Here’s what caught my attention:

- Real-time Decisioning: NoFraud processes orders in real-time, often within seconds of a customer hitting “purchase.” This means you get a fraud decision, a clear pass or fail, right in your Shopify admin. No more waiting, no more manual pauses for review. This lifts your speed-to-fulfillment significantly.

- Data Synchronization: It pulls essential data directly from Shopify (customer details, shipping address, order history) to inform its risk assessment. This rich data context helps NoFraud make smarter decisions.

- Fulfillment Workflows: The integration allows for automated fulfillment workflows. An order approved by NoFraud can immediately pass to your fulfillment team, ready for pick and pack. If it’s flagged, it can automatically enter a manual review queue within Shopify or be canceled. This saves countless hours for your operations team.

- Shopify Flow Compatibility: For Shopify Plus users, NoFraud plays well with Shopify Flow. You can build advanced automations based on NoFraud’s risk scores or statuses, triggering specific actions like adding customer tags for high-risk profiles or sending internal notifications.

What about gaps? Most scaling brands won’t find significant gaps for core fraud prevention. While some hyper-specific, multi-platform scenarios might always require a custom API integration or a Zapier bridge, for the vast majority of Shopify needs, NoFraud covers the critical ground. It’s built for Shopify first.

Pricing vs. ROI: The P&L Conversation

Let’s cut to the chase: what does NoFraud cost, and more importantly, what’s the return on that investment? Most brands overlook the true cost of fraud. It’s not just the lost order, but the chargeback fees, the operational costs of manual review, and the crucial lost customer lifetime value from false declines.

Here’s a look at how NoFraud typically structures its pricing and who each tier serves best:

The Tech Stack Consolidation Math

Here’s where the P&L conversation gets really interesting. Many brands cobble together a “fraud prevention” stack that’s actually costing them more than they realize.

Let’s compare:

Typical “Siloed” Fraud Stack (Monthly Costs):

- Basic Shopify Fraud Filters: Included (but limited)

- Manual Review Labor: $500 – $2,000 (depending on volume and team hourly rate)

- Chargeback Losses (uncovered by guarantee): $200 – $1,500+ (highly variable)

- False Declines (lost sales): Potentially thousands of dollars in lost revenue

- Payment Processor Chargeback Fees: $15 – $50 per dispute

Consolidated Stack with NoFraud (Monthly Costs):

- NoFraud Monthly Fee: Based on transaction volume (e.g., $0.10/transaction)

- Chargeback Losses: $0 (covered by NoFraud’s guarantee for approved orders)

- Manual Review Labor: Significantly reduced, often near $0

The ROI isn’t just the direct cost savings on chargebacks. It’s the hours saved by your team no longer sifting through suspicious orders. It’s the conversion lift from approving more legitimate customers. I’ve seen brands boost their approval rates by 5-15%, which, for a $1M brand, could mean an extra $50,000 to $150,000 in revenue annually. Plus, no more surprise chargeback hits to your P&L. That predictability alone is huge for financial planning.

User Experience & Team Adoption

When you bring in a new tool, it needs to be intuitive, especially for busy operations teams. No one has time for a steep learning curve. NoFraud’s user experience for a power-user is generally strong, particularly in its core functionality.

- Where it Shines: The dashboard is clean and offers quick insights into your approval rates, fraud velocity, and the status of individual orders. The ability to quickly search for orders, drill down into NoFraud‘s risk factors, and understand why an order was passed or failed is excellent. If a manual review is needed, the interface makes it easy to gather more information or contact the customer for verification. I’ve found that teams can get comfortable with the basics, like reviewing flagged orders and understanding decisions, within a few hours.

- Potential Friction: While the core functionality is solid, like any powerful tool, diving deep into custom rules or advanced settings might require a bit more time for your team. This isn’t a negative, just a reality: sophisticated controls imply a need for a sophisticated understanding.

- Time-to-Value: For a skilled team, especially one familiar with Shopify’s admin, the “time-to-value” with NoFraud is surprisingly fast. Setting up the integration takes minutes. You can realistically see high-impact results, like a noticeable drop in chargebacks and a rise in approval rates, within the first few days or a week of implementation. NoFraud offers solid onboarding resources and documentation to help your team get up to speed quickly. It’s not a tool you spend weeks configuring before seeing results.

Pros & Cons (Through the EcommerceFastlane Lens)

Here is what I have seen and heard from scaling brands using NoFraud:

Pros:

- Strategic Advantage 1: Chargeback Elimination. This is the big one. If NoFraud approves an order, they back it fully. This turns an unpredictable fraud loss into a predictable operating expense, giving your finance team real clarity. It’s about protecting your P&L, not just a single order.

- Strategic Advantage 2: Higher Approval Rates & Increased Revenue. Most fraud tools are too blunt, missing good customers. NoFraud uses smart AI and human review to distinguish real buyers from fraudsters. I’ve seen brands boost legitimate order approvals by 5-15%, which means more money in the bank from customers you’ve already paid to acquire.

- Strategic Advantage 3: Automated Operational Efficiency. Your team spends less time sifting through suspicious orders. NoFraud makes decisions in real-time, sending clean orders straight to fulfillment. This frees up countless hours for your team to focus on growth initiatives, not manual review.

Cons:

- Potential Hurdle 1: Cost for Very Early Stage Brands. If your chargeback rate is already low and you are under $50,000 in monthly revenue, the per-transaction cost of NoFraud might feel significant. At that scale, manual review might still be manageable.

- Potential Hurdle 2: Requires an “Owner” on Your Team. While highly automated, getting the most out of NoFraud means having someone on your team who understands how to interpret the data, adjust settings, and optimize for your specific business. It’s powerful, but it needs an engaged user.

- Potential Hurdle 3: Not a Silver Bullet for All Abuse Types. While excellent for fraud and chargebacks, sophisticated abuse like promo code misuse or reseller abuse from legitimate customers might need additional bespoke solutions or careful operational processes. However, NoFraud continues to expand its coverage to these areas.

Key Alternatives & The Deciding Factor

Conclusion

For Shopify brands looking to grow, dealing with fraud is a major challenge. It’s not just about losing a few sales; fraud quietly drains your profits and slows down your business. Manual review processes cost your team valuable time, pulling them away from focusing on strategic growth. This is where a solution like NoFraud becomes essential.

NoFraud acts as a strong defense against these hidden costs. It uses smart AI to check orders instantly, catching fraud before products ship. This means fewer chargebacks and more successful orders from real customers. By guaranteeing approved sales against fraud-related chargebacks, NoFraud turns an unpredictable cost into something you can plan for.

The real benefit goes beyond just stopping fraud. NoFraud helps your team work more efficiently by cutting down on manual reviews. This frees them to focus on marketing, customer service, and other important tasks that grow your brand. Many brands have seen their legitimate order approval rates go up by 5-15%, leading to more revenue. This shows that preventing fraud isn’t just a cost; it’s an investment that pays off by boosting sales and improving customer trust.

For ecommerce founders and marketers, the message is clear: do not let fraud silently hurt your business. Consider trying NoFraud to see its direct impact on your profits and team’s efficiency. It’s about protecting your business and ensuring lasting success.

Frequently Asked Questions

What is NoFraud, and how does it help Shopify stores?

NoFraud is a tool that stops online fraud for Shopify businesses. It checks orders quickly to make sure they are real. This helps stores avoid losing money from fake purchases and chargebacks.

How does NoFraud prevent chargebacks?

NoFraud uses smart AI to check transactions in real-time. If NoFraud approves an order and it later becomes a fraud-related chargeback, they pay for it. This protects your store from financial loss.

Will NoFraud increase my order approval rates?

Yes, NoFraud helps approve more good orders. Many fraud tools are too strict and block real customers. NoFraud’s system is smarter, letting more honest buyers complete their purchases.

How quickly does NoFraud make fraud decisions?

NoFraud checks orders very fast, usually in a few seconds. This means your team can ship genuine orders right away. It saves time by reducing the need for manual checks.

Is NoFraud suitable for small Shopify businesses?

NoFraud is best for Shopify brands doing more than $50,000 in monthly sales. If your sales are lower and you have very few chargebacks, manual checks might still work for you.

Can NoFraud help my team save time on fraud reviews?

Absolutely. NoFraud automates most fraud checks. This frees up your team from reviewing suspicious orders. They can then focus on growing your business instead.

What is the true cost of fraud beyond lost products?

Fraud costs more than just a refunded item. It includes chargeback fees from your payment processor, time spent on manual reviews, and lost sales from legitimate customers who get declined. The hidden costs add up quickly.

How does NoFraud fit with my existing Shopify setup?

NoFraud connects smoothly with Shopify and Shopify Plus. It processes orders and shares data in real-time with your Shopify admin. This allows for automated shipping workflows.

Is NoFraud a solution for all types of customer abuse?

NoFraud is excellent for preventing fraud and chargebacks. However, some other types of abuse, like misusing promo codes, might need different solutions. NoFraud is always improving its coverage.

What is a “false decline,” and why is it important to avoid?

A false decline happens when your fraud system blocks a good customer’s order. This costs you a sale and can make the customer upset. They might not come back, which means losing their future business too.