Paid Media Updates

Amazon vs. AI – Why the Perplexity Lawsuit is a Warning Shot for Agentic Commerce

By Tinuiti Innovation & Growth Team

What’s in store

- Featured story: Old Guards, New Gods – the Carve-Up of WBD

- Our Take On the News

- Helpful Links & Resources

Warner Bros. Discovery putting itself up for sale is less about one company and more about a phase change in the entire media ecosystem. A few years ago, WBD was the consolidator – the roll-up of major legacy players WarnerMedia and Discovery meant to stand against Netflix and Big Tech. Now it’s the asset on the auction block, with suitors that neatly capture the old-to-new spectrum: NBCUniversal, Skydance Paramount, and Netflix.

From broadcast plumbing to software stacks

The old TV world was built on scarcity and carriage: limited channels, bundled into cable packages, with affiliate fees and upfronts as the economic engine. Distribution was physical (via antennas or cables) and local. Measurement was panel-based. “Owning the pipe” mattered.

Streaming flipped that. The new game is global software platforms with infinite shelf space, personalized feeds, and direct relationships with hundreds of millions of users. Recommendation algorithms, identity graphs, and cloud infrastructure matter as much as writers’ rooms and soundstages.

That’s why WBD’s potential buyers care most about studios and streaming (HBO Max), not the cable networks. Studios are IP factories that can feed any platform. Streaming apps are software front ends for attention and data. Cable channels are now more like declining annuities: still cash-generative, but clearly in runoff.

The innovator’s dilemma, scripted in real time

Legacy media didn’t ignore streaming, they were simply unable to execute an extremely high-degree-of-difficulty pivot.

The linear business threw off reliable cash: affiliate fees, high-margin ad sales, and predictable audience reach. Every dollar aggressively moved into streaming risked cannibalizing that. So the big companies hedged – launching streaming products but protecting linear economics as long as possible.

Meanwhile, Netflix (and later YouTube, Amazon, etc.) had no legacy assets to protect. They could lean fully into:

- Global scale from day one

- All-in on subscriptions, then ad tiers

- Absence of any distribution conflicts

- Relentless experimentation on product and personalization

Now we’re in the predictable endgame of that dilemma: legacy players are being forced to consolidate just to reach the same scale the disruptors have already built organically. WBD as a seller just a couple of years after merging is a perfect illustration of how fast that logic culminated.

Consolidation and the rebundling of everything

Whether the buyer is NBCU, Skydance Paramount, or Netflix, the strategic throughline is the same: more scale, more library, more leverage.

- A Paramount–WBD combo would look like a classic legacy super-stack: two major studios, multiple marquee brands, and a shot at a more compelling single streaming offering (plus a giant cost-synergy hunt).

- NBCU + WBD would create another mega-portfolio that can rebundle linear, streaming, and sports rights into something closer to the old cable experience – but delivered via apps instead of set-top boxes.

- Netflix + WBD would be the purest “new world” play: a dominant global streaming OS absorbing one of Hollywood’s deepest libraries.

For consumers, this all trends toward a new version of the cable bundle – fewer, bigger platforms packaging entertainment, sports, and maybe even gaming in tiered bundles. The names change, but the logic rhymes: simplify choice, lock in households, and smooth churn.

For advertisers, consolidation means fewer, larger partners with richer data – and less negotiating power on the buy side. Big platforms will sell against cross-portfolio reach, advanced targeting, and clean-room measurement, not just individual networks or shows.

Broadcast vs streaming: different worlds for viewers and brands

In broadcast, viewers got:

- Appointment viewing and mass cultural moments

- A finite number of choices, with clear “prime time”

- Mostly one-size-fits-all ad breaks, with broad demo targeting

In streaming, viewers get:

- On-demand, algorithmically sequenced feeds

- An infinite array of choices, on-demand and spanning niches and formats

- Personally targeted advertising much more akin to modern digital platforms

For advertisers, the trade has shifted from reach first to identity and outcomes first:

- GRPs and dayparts are giving way to audience segments, modeled signals, and performance KPIs

- Instead of buying “Thursday at 9 on a top network,” brands are buying incremental reach against a precise audience, often optimized by machine learning in real time

- Measurement is migrating from mixed-model and panel-only to multi-signal, multi-touch views stitched through clean rooms and partner APIs – with privacy rules and signal loss adding complexity at every step

The WBD sale is really about who can best operate in that software-and-signals paradigm, not who owns the most cable networks.

Where this is heading

Zooming out, a few things feel likely:

- We end up with a small handful of global video “operating systems” (Netflix, YouTube, Amazon, plus one or two legacy-born hybrids) and a long tail of niche and regional services.

- Traditional media companies that survive at scale will either bulk up through deals (like a WBD sale) or lean into being IP engines and production houses (like Sony), selling into whichever platforms win distribution.

- For advertisers, the center of gravity keeps shifting toward data-rich, commerce-adjacent environments – think shoppable streaming, retail media overlays, and closed-loop attribution – rather than pure awareness plays in linear.

Warner Bros. Discovery started this chapter as a would-be consolidator and is likely to exit it as raw material in someone else’s platform strategy. That’s the story in a nutshell: in the new era, content is still king, but the crown is now worn by whoever owns the software, the data, and the customer relationship. | WSJ

What We’re Tracking

The news stories we’re tracking that are likely to impact advertisers in the month ahead.

U.S. Economy & Consumers

1. US holiday shoppers are still showing up — just a bit more cautiously. Black Friday sales rose 4.1% YoY (ex-auto) according to Mastercard, with in-store up 1.7% and online up 10.4%. Consumers are clearly still willing to spend, but they’re trading down and chasing value, responding to broad (if slightly less aggressive) discounting and cheaper gift options like $10 throws and $5 toys. Teen and young adult retailers, big-box promos, and home categories (decor, tools) were notable winners.

Cyber Monday remained the digital tentpole, but with a twist. US online growth lagged Europe, as tariff worries and macro jitters weighed on Americans while EU shoppers benefited from rate cuts. Salesforce saw mid-day US sales up 2.6% vs 5.3% globally, though Adobe tracked a stronger +4.5% YoY to $9.1B by early evening. Shoppers who waited were rewarded: Cyber Monday discount depth (31%) beat Black Friday (28%), especially on big-ticket items — except gaming consoles, where tariffs kept deals scarce. | Bloomberg, Bloomberg

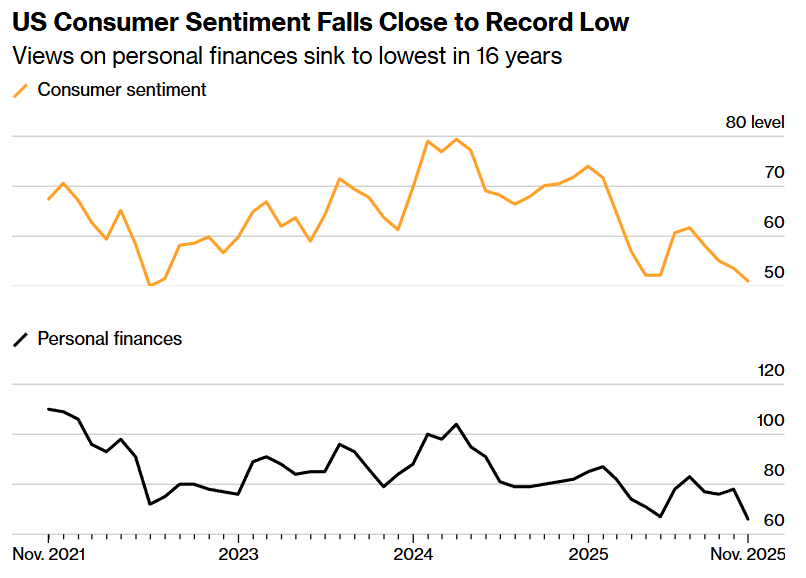

2. US consumers are heading into the holidays in a decidedly wary mood. Shutdown-delayed data show retail sales in September up just 0.2%, with tariffs cooling demand for vehicles, electronics, and apparel even as spending held up in bars, restaurants, and value channels. At the same time, consumer confidence dropped sharply in November: the Conference Board index fell to 88.7, while the University of Michigan gauge slid to one of its lowest readings on record, with views on personal finances the weakest since 2009.

Under the hood, the story is bifurcated. Higher-income households, buoyed by asset markets, are still spending, but lower earners are clearly under strain, trading down and flocking to off-price and discount retailers. Labor market signals are flashing yellow — layoffs are rising, jobless claims are at a four-year high, and fewer people see jobs as ‘plentiful.’ Add in sticky inflation and fading income expectations, and you get a holiday shopper who’s still buying, but more cautious and promotion-driven. | WSJ, Bloomberg, Bloomberg

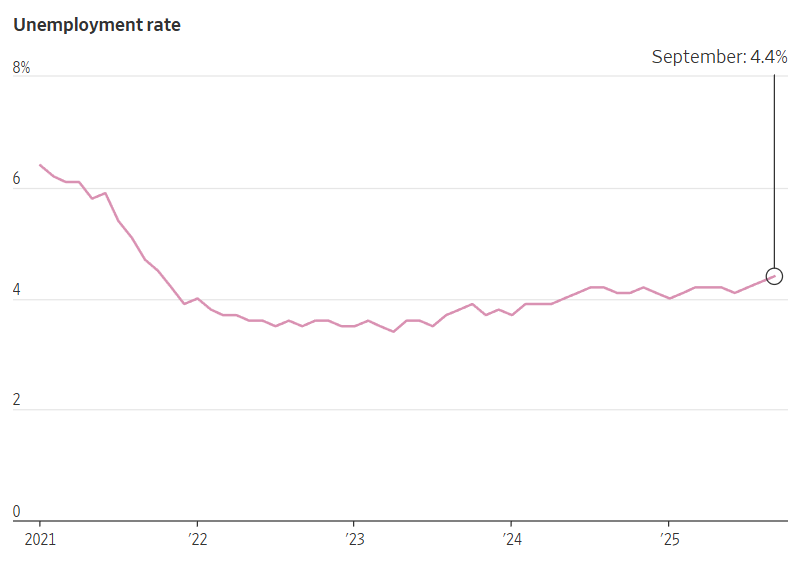

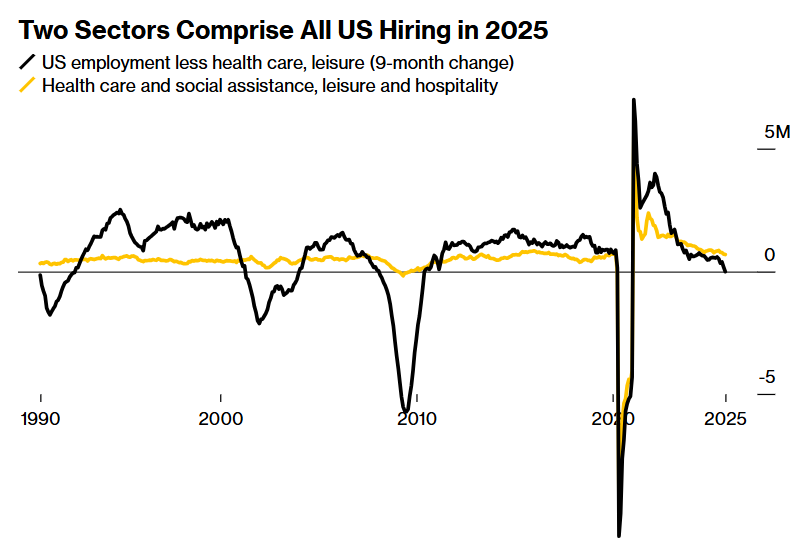

3. The US labor market is cooling, but not collapsing. Shutdown-delayed data show September payrolls up 119,000, more than double forecasts, but the jobless rate ticked up to 4.4%, a four-year high as nearly half-a-million people re-entered the labor force.

The catch: job growth is increasingly narrow. Healthcare, education, and leisure & hospitality are doing most of the hiring, while sectors like transportation, warehousing, and temp work are shedding jobs.

Under the surface, stress is building. Continuing jobless claims hit their highest level since 2021, WARN layoff notices surged to near-record territory, and private data show companies cutting thousands of roles per week. Job security worries are spreading, with more than half of workers concerned about losing their job.

For the Fed, it’s a Rorschach test: hawks see resilient job gains; doves see rising unemployment and weakening breadth—all based on stale data heading into the December meeting. Prediction markets expect a quarter-point rate cut at the next Fed meeting. | WSJ, NYT, Bloomberg, Bloomberg, Bloomberg

Tech Giants & Platforms

1. Google is rolling Nano Banana Pro, its upgraded image-generation model, directly into Google Ads, including Performance Max and the broader display network. The big unlock for marketers: far better text fidelity in images—so copy on posters, product labels, and UI mockups no longer melts into AI gibberish after a few prompt tweaks.

The model also supports higher-resolution output (2K and 4K), making it more viable for premium digital placements and even some print use cases. Creatives can expect cleaner visuals and easier prompting, reducing the number of iterations needed to get client-ready assets.

Nano Banana has already built a reputation in the creator community for slick, on-brand imagery, competing with tools like Midjourney, DALL·E, Stable Diffusion, and Firefly. Now, tied into Google’s Gemini 3 ecosystem and native to its ads stack, it’s positioned to speed up asset production while raising the floor on AI creative quality—funny name, serious upgrade. | AdAge

2. Walmart is quietly testing ads inside its AI shopping agent, Sparky, signaling how agentic commerce and chat UX could become ad-supported surfaces. The new unit, ‘Sponsored Prompt,’ appears on Walmart.com; when a user clicks (e.g., “What energy drink has the most caffeine?”), Sparky answers and a click-to-buy product ad renders directly beneath.

While engagement volumes in the test have been low, advertiser interest is high as brands race to understand what ad experiences will look like in conversational environments. As my Tinuiti colleague Simon Poulton notes, marketers are eager to see how agentic shopping will influence purchase behavior and performance.

Strategically, this fits Walmart’s broader AI and retail media push, including Sparky in the app, internal agents for associates/suppliers, and a new OpenAI tie-in that will let ChatGPT users buy Walmart products. With Amazon’s Rufus already live with sponsored prompts, AI assistants are fast becoming the next battleground for retail media dollars. | WSJ

3. Reddit posted a breakout Q3, with revenue up 68% YoY to $585M and ad revenue up 74%, driven by both 19% DAU growth and ARPU up 41% globally / 54% in the US. The company beat on both top and bottom line and guided Q4 revenue to $655–$665M, signaling confidence in continued momentum.

On product, Reddit is leaning hard into search and AI: over 75M people search Reddit weekly, Reddit Answers is now integrated into core search (including non-English), and growth priorities center on app users, personalization, and international expansion.

For advertisers, the story is performance and automation. Reddit is scaling DPA, app-install optimization, CAPI adoption (3x YoY), auto-bidding and auto-targeting, with an end-to-end automation suite and SAN-style measurement on the roadmap. The platform is still mostly managed-service, but improving automation and shopping tools point toward more scalable lower-funnel performance — without simply cranking ad load. | Mobile Dev Memo

4. Meta just got a major legal win at the exact moment its core product is driving marketers up the wall. A federal court rejected the FTC’s antitrust case, ruling that Meta is not a social networking monopolist given “fierce competition” from TikTok and YouTube, especially in short-form video.

Yet on the ground, media buyers are living through another ‘Glitchmas’ on Meta’s ad platform. Marketers report budget mispacing, erratic targeting, and glitchy AI creative, including warped visuals and auto-enabled promo features. For many, there’s no reliable path to human support, even for large-spend accounts, as automation and chatbots have replaced most reps.

The result is a sharp contrast: in court, Meta is framed as a disciplined competitor in a dynamic market; in Ads Manager, it can feel like an uncontested dependency with limited accountability. And despite the frustration, most advertisers still have little choice but to lean heavily on Meta in Q4. | CNBC, AdExchanger

Media & Advertising

1. TV viewing numbers for October are out, and they underscore the power of the NFL in deciding the fates of media properties across platforms. Beginning at the high level, streaming took ~46% of October viewing while broadcast and cable TV each took 22% – 23%:

While overall TV usage increased by 1.3% from September, streaming outpaced at +2.4%. As we’ve detailed at length, streaming platforms no longer suffer reduced share when major sports are in season: most of the major streaming platforms are now home to those sports, and thus benefit from the trends that have traditionally boosted TV viewing. The streaming share picture remains quite stable, with Youtube at ~13% and Netflix at ~8% of the streaming market. | Nielsen Gauge

2. We told you back in October that, beginning with the 2026 season, Formula One will have a new US home on Apple TV. The technology giant paid a premium for the broadcast rights, with plans to “amplify the sport across Apple News, Apple Maps, Apple Music, Apple Sports, and Apple Fitness+.” We expressed some caution when the deal was announced, reflecting on the arc of Major League Soccer:

… look no further than Major League Soccer for a cautionary tale. In 2022, its last year on ESPN, MLS averaged 343k viewers per game; two-and-a-half years into its exclusive ten-year deal with Apple TV, the MLS Season Pass service is averaging 120k viewers per game, a two-thirds decline in 30 months. Back in 2022, MLS was a burgeoning league, with a small but growing fanbase, trying to crack the extremely crowded American sports market; putting it behind Apple’s paywall seems to have killed that momentum.

There are two pieces of good news – first, Apple has learned its lesson and will not repeat its paywall mistake with F1: access to all live F1 content will be included with a standard Apple TV subscription, and select races and practices will be available for free within the Apple TV app. In even better news for F1 fanatics, the much-loved F1 TV app will be included with an Apple TV subscription. The second bit of good news is that Apple is eliminating MLS Season Pass next year, meaning MLS will no longer be behind a (secondary) paywall and will be available in full to all Apple TV subscribers.

When you decide to pay a lot for broadcast rights, it is unhelpful to limit the audience for the product. This is why there are so few cases of major sports existing on ad-free platforms. Now that Apple has taken this lesson, it just needs to introduce an ad-supported tier … | @JoePompliano, @MLSMoves

3. Speaking of Formula One, its media momentum in the US continues – the Las Vegas Grand Prix averaged ~1.5m viewers, a 70% increase from 2024. This year’s viewing was undoubtedly aided by a more viewer-friendly start time: the race began at 8pm Pacific, whereas the past two years saw the Vegas GP start at 10pm in order to make it more watchable for European audiences. (your humble correspondent was in attendance this year and in 2023, and can confirm 8pm is far better!)

Fourteen of 22 races this season have set a new viewership high, and the season average of 1.3 million is on pace to surpass the record of 1.2 million set in 2022. | SMW

4. Continuing with the theme of people-enjoy-watching-sports, NBA viewership for the new season is up 30% over last year, reaching its largest opening-month audiences since 2017. The NBA is of course on more platforms this year with the beginning of a new broadcast rights cycle, meaning games are now spread across ESPN, NBCUniversal, and Amazon Prime. While distribution fracturing is a genuine annoyance to fans, and can have the effect of depressing viewership, that doesn’t appear to be happening in the NBA’s case. Expect other leagues to take notice when their broadcast rights come up for renewal. | SMW

Helpful Links & Resources

- Paramount has secured the broadcast rights to the UEFA Champions League, the world’s premier soccer competition, from 2027 – 2031

- Major League Baseball has signed a new broadcast rights deal spanning ESPN, NBCUniversal, and Netflix

- The US ad market expanded by 5.5% YoY in October

- Adobe has acquired Semrush for $2B in a play for the GEO (generative engine optimization) market

- The European Union is seriously considering reform of GDPR, a data protection law that has contributed to Europe being a laggard in internet services and, now, in artificial intelligence