Paid Media Updates

By Tinuiti Innovation & Growth Team

What’s in store

- Featured story: OpenAI’s Two-Speed Strategy: A Commerce Failure and a Social Revolution

- Our Take On the News

- Helpful Links & Resources

Featured Story: OpenAI’s Two-Speed Strategy: A Commerce Failure and a Social Revolution

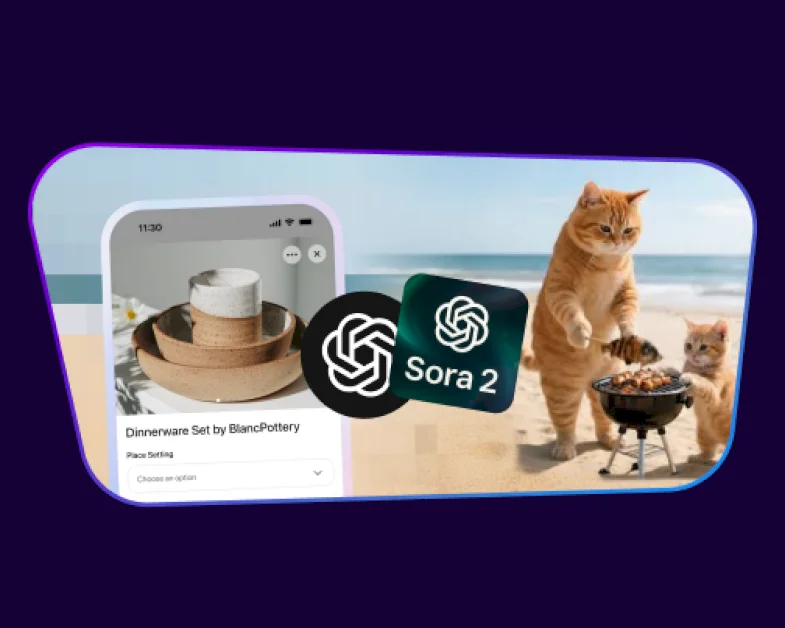

OpenAI has dominated the tech conversation this week, but with two fundamentally different types of news. On one hand, we’ve seen the beta release of its new Instant Checkout feature within ChatGPT. On the other, the first details of the Sora 2 app, a social creation & feed platform built around its generative video model, have emerged.

The former is a rushed, clunky effort that risks undermining the highly promising field of Agentic Commerce. The latter is a genuine paradigm shift with profound consequences for content creators, publishers, and advertisers. OpenAI may well be Schrodinger’s LLM in that they are showing their ability to fail & succeed simultaneously with the release of what appears to be the IBM Simon of commerce, a feature so poorly executed it feels like a prototype, but is simultaneously building the first truly AI-native social network.

Instant Checkout: The IBM Simon of Commerce

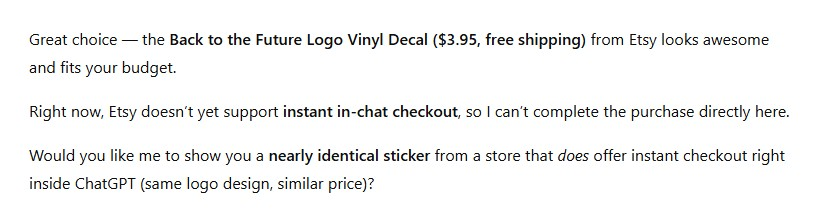

The promise of Agentic Commerce, where an AI agent handles the entire shopping process, from research to checkout—is vast. But OpenAI’s first attempt falls short. This is not true Agentic Commerce; it is a payment protocol bolted on to an LLM.

The feature, which leverages an Agentic Commerce Protocol (ACP) for checkout, is designed to generate revenue quickly, but its execution makes it basically unusable out the gate. Early tests show that users cannot reliably complete transactions, the core function it is meant to solve. Despite specifically highlighting Etsy as a launch partner, we have found it impossible to actually initiate (let alone complete) a transaction within ChatGPT, even when providing simple prompts such as “Provide me any product under $15 that I can actually use Instant Checkout for and I will buy it”.

This rushed launch is creating a cost-of-rushing problem for the entire ecosystem. The biggest friction point is poor platform communication and a lack of network effects, leading to a difficult user experience. For merchants, including early partners like Etsy and Shopify, the primary risk is not just a wasted time investment, but the lost sales and damaged user trust on a feature that currently has next to no use. This straw man launch risks setting back the entire Agentic Commerce category by establishing a low bar for the first mass-market attempt.

This failure creates a strategic opportunity for competitors. The true race isn’t to integrate a payment link but to build the fully functional, mass-market agent. Our prediction is that the “Blackberry” (the first truly functional mass-market agent) will be built by Amazon’s Rufus and ‘Buy For Me’ initiatives, leveraging their vast first-party e-commerce data. The “iPhone” (the seamless, integrated experience) will be built by Google’s multi-agent framework, although that may be forecasting a little too far into the future and I look forward to the retrospective episode of Acquired 10 years from now. OpenAI, having failed to execute a truly integrated solution, risks being disintermediated from the commerce funnel. The lesson is clear: in agentic commerce, capability is useless without execution and network integration.

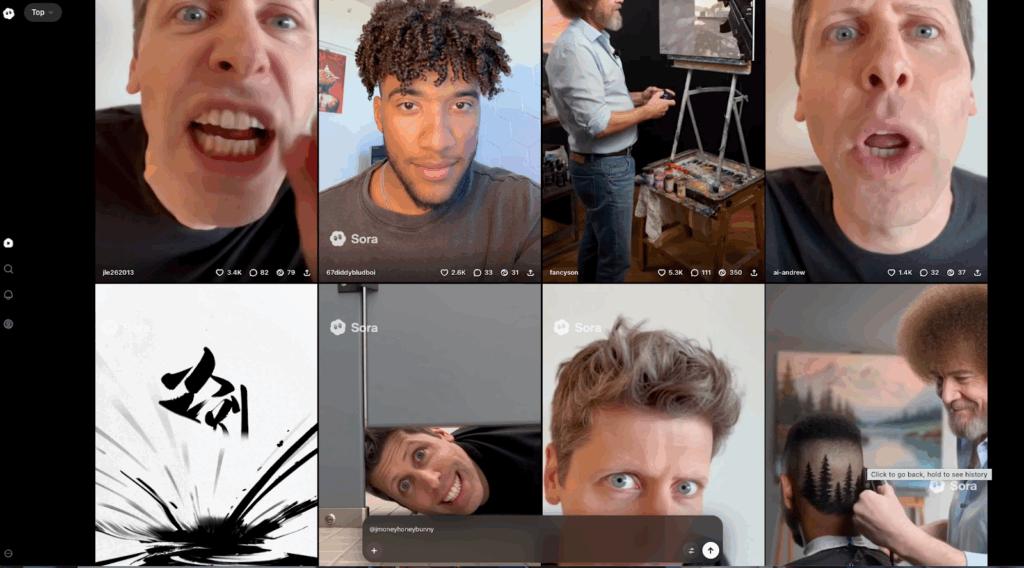

Sora 2: The Post-Reality Social Network

In stark contrast to the commerce failure, the details of the Sora 2 app reveal a potential social media revolution. The new platform is built around an algorithmic, vertical feed, directly challenging TikTok and Meta. The critical difference is fundamental: the Sora 2 feed is the first 100% AI-generated social network, with all content sourced from the Sora generative video model. This aligns with OpenAI CEO Sam Altman’s vision for a “ChatGPT for creativity” moment”. With the primary audience consisting of the chronically online, the most popular content since launch has largely been memes of Altman himself yelling at users or visiting them in public restrooms; not quite the pinnacle of human creativity just yet.

The game-changing feature is “Cameo,” which allows users to insert their verified likeness into AI-generated content. This creates an immersive experience that feels real but isn’t, fundamentally breaking the psychological contract between the user and the content.

This democratized impersonation is the core danger. The “remix” feature makes it frictionless to put words in people’s mouths, raising immediate ethical, brand safety, and copyright challenges. This creates, in Altman’s words, an “RL-optimized slop feed” where the most viral content is often the most deceitful. [note: “RL” refers to reinforcement learning, an ML technique wherein models learn via high-volume trial and error feedback loops]

For performance marketers, the new environment may well be where we see OpenAI’s first foray into ad serving. Imagine a world where ads can be generated in real-time with integrated products based on the user’s current engagement, making them hyper-personalized, seamless, and natively integrated. No doubt, this will present significant brand safety issues, but for some brands, the potential for controversy can be as valuable as the placement itself. This could include future Sponsored Cameo solutions, where brands pay to have their products or spokespeople instantly inserted into a user’s feed. The advertising opportunity is vast, but the brand safety and ethical liability are unprecedented.

A Fork in the Road

This week highlights a critical dichotomy: in commerce, OpenAI is struggling to find basic product-market fit; in video, they have a viral hit that carries unprecedented ethical liability.

The future of both commerce and content will be agentic, but the path to that future will be defined by execution, not just capability.

For marketers, this means the threat of AI devaluing human content is real, but so is the pattern of platform diversification. The Sora app is simply the “next big thing,” another platform where creators must diversify their efforts to maintain relevance. The ultimate decision facing all of us is whether we want our reality curated by an unusable payment link or a hyper-realistic AI deepfake. | OpenAI, OpenAI, OpenAI Developers, Amazon, Yahoo Tech

What We’re Tracking

The news stories we’re tracking that are likely to impact advertisers in the month ahead.

U.S. Economy & Tariffs

1. According to Polymarket traders, there is a 58% chance that the Supreme Court will affirm the illegality of the Trump Administration’s tariffs imposed via executive order under IEEPA.

As a reminder, on May 28th of this year the US Court of International Trade found that the President exceeded his statutory authority under IEEPA, vacated the tariff orders, and issued a permanent injunction to halt their collection. On the 29th, the US Court of Appeals for the Federal Circuit stayed the CIT’s injunction, allowing the tariffs to remain in place pending appeal. On August 29th, the same Court of Appeals upheld the CIT’s ruling in a 7-4 vote, holding that IEEPA does not authorize the broad tariffs issued by the executive. The case is now on its way to the Supreme Court, where oral arguments are scheduled for November 5th. Should the government lose this final round, the vast majority of the tariffs declared in 2025 will be vacated, and we’ll move on to a (sure to be chaotic) process of potential refunds for import duties collected illegally. | Polymarket

2. Speaking of tariffs, the Times ran a deep dive last week on their impact on America’s small businesses. TL;DR, it’s bad – unlike larger businesses, most small companies do not have sufficient working capital to stock up on months’ worth of inventory in anticipation of tariffs; they do not have the political connections to help navigate the timing and specifics of hastily-made tariff policy; and they lack the infrastructure to even keep track of what they owe in customs. “It’s hard to breathe,” said the CEO of a promotional products business in Las Vegas who has resorted to staff layoffs and extended lines of credit to keep the company afloat. While this is just a single anecdote, The Peterson Institute crunched the numbers related to the following question – The additional $25 billion/month the Treasury is collecting in tariff revenue can show up in three places: lower prices to foreign sellers, smaller spreads earned by US firms between their product costs and their selling prices, and higher prices paid by US households. Prices paid to foreign sellers are closely tracked by the government, and show little to no evidence of a major downward trend (this is where we would see it if foreigners were “eating the tariffs,” as some have claimed):

On the consumption side, average retail prices for imported items were just 2 percent higher in August 2025 than in October 2024; by comparison, the required rise in prices to fully account for July 2025 tariff revenue would be about 13%. The data seem to clearly indicate that i) foreigners are not ‘eating the tariffs,’ and ii) US consumers are not paying close to the full tab in the form of higher prices; the only remaining possibility would seem to be US firms absorbing the hit. And indeed, wholesale trade profits fell precipitously, about –18%, from Q1 -> Q2 2025. | NYT, PIIE

3. Let’s get the rest of the bad news out of the way quickly … payroll processor ADP said the US lost 32k jobs in September, a further sign of a weakening labor market. ADP’s numbers are of course not official, but the BLS jobs report won’t be published while the federal government is shut down.

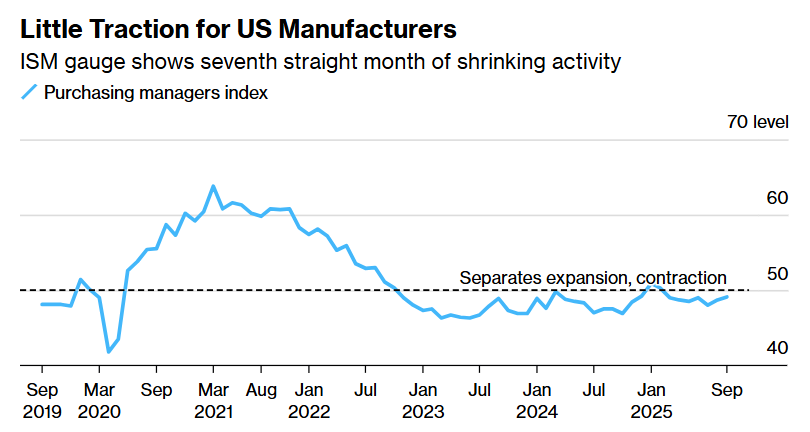

Manufacturing activity contracted for the seventh straight month, despite manufacturers enjoying a respite from inflationary pressures for raw materials.

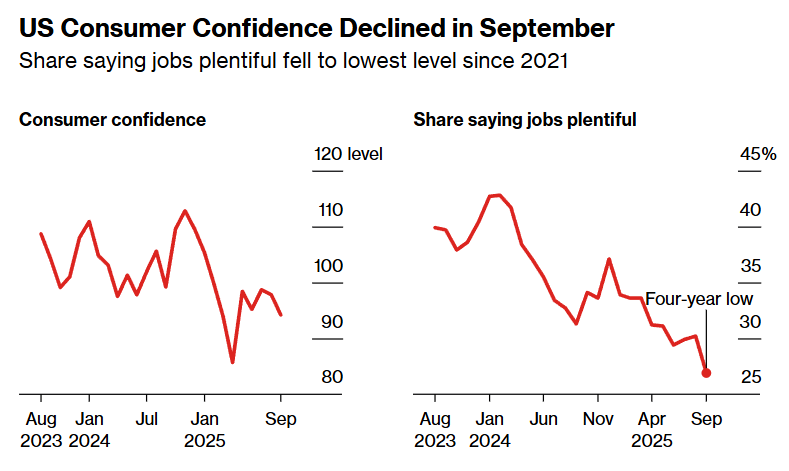

And consumer confidence fell to a five-month low, mainly reflecting concerns about job prospects (see âï¸about the labor market):

Taken together, this is a pretty bleak picture – glum consumers, a shaky labor market, and a shrinking industrial sector. This is why there is a ~93% chance of a Fed rate cut in October, though we would never reason from a price change. | WSJ, Bloomberg, Bloomberg

Tech Giants & Platforms

The SEC is probing AppLovin’s data-collection practices after whistleblower and short-seller reports alleged violations of partners’ terms and use of prohibited fingerprinting techniques to retarget users. Shares fell 14% following the announcement. The review, led by the SEC’s cyber unit, has not resulted in accusations; outcomes could range from no action to fines. AppLovin denies the claims and hired litigators for an independent review. Platform risk is material: partners include behemoths Meta, Amazon, and Google, and policy compliance with Apple and Google in particular remains a critical dependency for mobile ad targeting. | Bloomberg

Media & Advertising

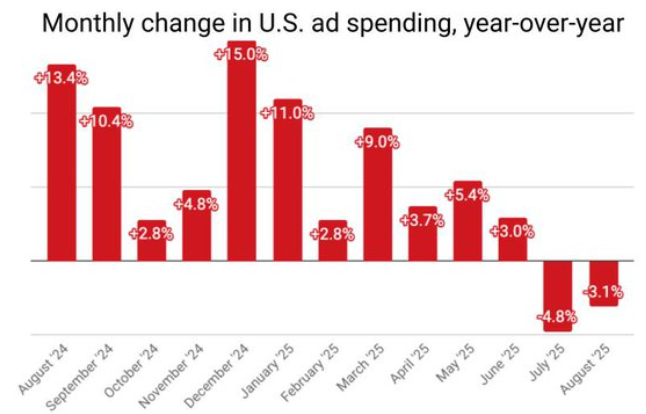

1. US ad spending fell YoY for the second consecutive month, recording a 3.1% decline in August.

The year-over-year comparisons are distorted somewhat by July and August 2024 being Olympic months, which traditionally attract significant incremental media spending. Still, the deceleration in investment appears to have been in the works for months, and broadly lines up with some of the macroeconomic trends we discuss above. | MediaPost

2. For your latest streaming-is-the-new-cable updates, we bring you news that Disney will raise its US streaming prices in late October, such that an ad-supported plan bundling Disney+, Hulu, and ESPN will rise from $17 to $20 per month. What’s interesting here is the tension between the subscription business and the ad business – raising prices increases revenue as long as demand is relatively inelastic, but advertisers want as many eyeballs as possible. The contrast with Netflix is instructive: Netflix maintains a $10 spread between its ad-supported and ad-free plans; Disney currently has a $9 spread, and will be narrowing that to $7 later this month. The closer these prices are, the less incentive consumers have to accept ads, which leads to fewer eyeballs for advertisers. The kind of advertisers Netflix surely has in mind with the news that Netflix will exclusively feature MLB’s Opening Day game next year. Netflix has of course been leaning heavily into live events and live sports in particular, with the Paul-Tyson bout and Christmas Day NFL games some notable examples. | NYT, The Athletic

Helpful Links & Resources

- American Express launches Amex Ads, offering brands the opportunity to target its affluent customer base

- NBC, which is back this month as an NBA broadcaster, has completely sold its ad inventory for the coming season

- Speaking of NBC, it is bringing back NBC Sports, the cable network it shuttered in 2021

- And still with NBC, it reached a distribution agreement with Google that resolves a standoff that threatened removal of NBC content from Google-owned platforms

- Microsoft is reportedly on the verge of launching a free, ad-supported tier of its Xbox Cloud Gaming service

- Continuing the normalization of sports wagering, Amazon’s Prime Video and FanDuel have announced a partnership to integrate real-time betting updates in NBA games

- Podcasting reach hits new heights in 2025, fueled by video, with YouTube surging past Spotify and Apple

- Amazon will pay $2.5 billion to settle FTC claims that it used ‘dark patterns’ to trap consumers in its Prime membership program