Verified & Reviewed

Published on September 25, 2025 Written By Meredith Flora

Published on September 25, 2025 Written By Meredith Flora

Subscribe for More

As inflation rises and tariffs increase prices, many brands are seeking ways to think more strategically about stretching their budgets. Paying duties per shipment can drain cash the moment your containers land, but there is a way to defer and consolidate payments.

The US Customs and Border Protection’s periodic monthly statements, or PMS, give you an interest‑free cushion that can stretch to the 15th working day of the following month. That float helps mid-market ecommerce brands turn inventory faster, stabilize working capital, and forecast with confidence.

Periodic monthly statements consolidate all duties, taxes, and fees into a single monthly ACH payment, eliminating the noise of daily remittances.

This article explains how the program works, how to enroll, where the savings come from, how FTZs supercharge the benefit, and how ShipBob can make the process easier for high‑volume importers.

How the Customs and Border Protection PMS program works

Periodic monthly statements are simple in concept, but there are a few moving parts you’ll want to line up before you enroll. Start with a clear definition, then confirm your systems, bank setup, and broker workflows.

What is Customs and Border Control’s periodic monthly statements?

Periodic monthly statements (PMS) is a US Customs and Border Protection (CBP) payment option that lets importers pay duties, taxes, and fees once per month instead of shipment by shipment. Brokers flag eligible entry summaries for PMS, entries accrue throughout the calendar month, and payment is due on the 15th working day of the following month via ACH.

The result is an interest‑free deferral, a single consolidated payment, and cleaner visibility for finance teams. PMS does not change how entries are filed or released, it only changes when and how the money moves.

Core components importers must know

- ACE account: PMS is managed in CBP’s Automated Commercial Environment (ACE). Your Trade Account Owner configures PMS settings and grants access to finance teams and brokers.

- ACH payment method: CBP accepts ACH Debit (CBP pulls funds on the due date) or ACH Credit (you push funds from your bank). You can choose the control level your finance team prefers.

- FTZ alignment: If you leverage Foreign‑Trade Zones (FTZ), weekly entries (Type 06) can be flagged for PMS payment. Duties are deferred while inventory sits in the zone, and then deferred again by PMS once the weekly entry is filed.

Taken together, these components create a predictable monthly cadence for customs cash outflows and help you reconcile directly against CBP records in ACE.

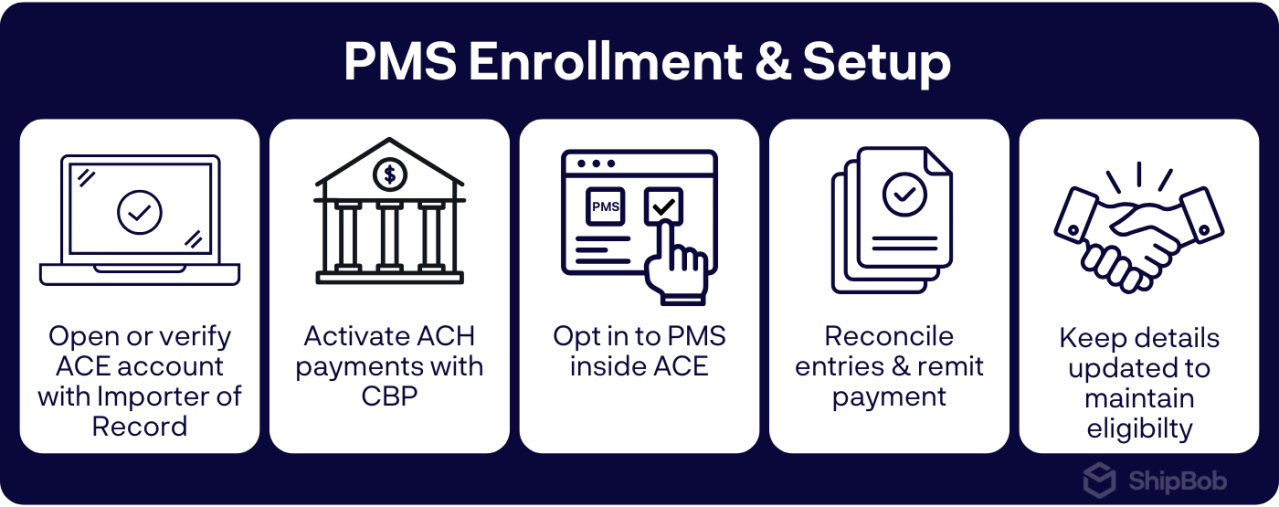

Step-by-step periodic monthly statements enrollment and setup

Getting PMS right the first time saves rework later. Treat enrollment like a mini‑project across finance, trade compliance, and your broker.

1. Open or verify your ACE account

Confirm you have an active ACE Secure Data Portal account with the correct importer of record (IOR) tied to your Tax ID or CBP-assigned number. Add the right users, and grant your broker the access they need to flag PMS‑eligible entries.

2. Activate ACH for duty payments

Enroll for ACH Debit or ACH Credit with CBP so payments can move electronically on statement day. Plan ahead for the approval lead time, align with your bank on any filters/thresholds, and store your payer details in a secure internal SOP.

3. Opt in to periodic monthly statements inside ACE

Within ACE, enable PMS and select the statement type (importer statement you pay, or broker statement your broker pays). Confirm your chosen statement processing date aligns with your accounting close and cash forecasting calendar.

4. Reconcile entries and remit payment

Use ACE pre‑statement reports to compare entries against broker data and internal POs. Resolve discrepancies quickly, then remit one ACH payment on the due date and archive confirmations for audit and month‑end tie‑outs.

5. Keep your eligibility intact

Pay on time, keep ACH details current, and update powers of attorney when changing brokers. Establish a cadence to review ACE permissions, statement settings, and bank controls at least quarterly.

Periodic monthly statements benefits: Cash-flow and operational gains

PMS benefits grow with volume and import frequency, but even modest shippers see cleaner processes and better planning.

Deferred duty payments = interest-free capital

By consolidating and deferring payments to the 15th working day of the following month, PMS creates short‑term, interest‑free working capital. Brands reallocate that float to inventory buys, paid media, or seasonal ramp, improving sell‑through before cash leaves the account.

One statement, fewer headaches

A single monthly ACH payment replaces a thicket of daily remittances. Finance teams get:

- A reconciled ledger from ACE that matches CBP’s view

- Fewer bank transactions and less manual chasing

- A predictable calendar anchor for customs cash flow

The administrative ease often rivals the cash benefit, especially for teams managing multiple brokers or entry types.

Is PMS worth it for every importer?

PMS shines for brands with steady import cadence, multi‑SKU catalogs, and year‑round demand. Very low‑volume or highly seasonal shippers may see less impact. If your broker frequently advances duties and invoices you later, PMS can also reduce pass‑through fees and payment fragmentation.

How to maximize savings by pairing PMS with Foreign-Trade Zones

When PMS is paired with Foreign-Trade Zone (FTZ) warehouses, deferral stacks on deferral without sacrificing speed to customer.

How FTZ weekly entries stack with monthly payment dates

In an FTZ, you defer duty until inventory leaves the zone and enters US commerce. With weekly entry filing, you consolidate withdrawals into one entry per week. Then, by flagging that weekly entry for PMS, you defer payment again to the monthly PMS due date. The combined effect pushes cash outflows as far right as legally possible while keeping fulfillment timelines intact.

Challenge: Managing dual programs across thousands of SKUs

Running both FTZ weekly entries and PMS requires tight coordination across compliance, finance, and your broker. ShipBob supports this complexity by offering FTZ warehousing options within our De Minimis Defense offering, so brands can stage inventory domestically, defer duties appropriately, and still meet omnichannel service levels from the same network.

Common pitfalls and how to stay compliant

Here are a few proactive habits that help brands avoid late payments, reconciliation gaps, and audit friction to ensure PMS eligibility.

Avoiding missed payment deadlines

Use ACE’s preliminary monthly statement to validate totals, then set layered reminders for the due date. Treasury should pre‑stage funds in the correct account a day early, especially for ACH Credit users.

Reconciling broker-filed entries

Ask brokers to flag PMS‑eligible entries at filing and to send weekly entry data extracts. Run a weekly three‑way check between ACE, broker summaries, and your purchase orders to catch mismatches before statement day.

Keeping paperwork audit-ready

Centralize digital entry packets (commercial invoice, packing list, bill of lading, 7501) with ACE pre‑ and final statements in a single repository. ShipBob’s dashboard provides real‑time order, inventory, and cost visibility that complements your customs records, making audits and month‑end reviews faster.

How ShipBob streamlines periodic monthly statements for high-volume brands

PMS is a CBP program, but the right fulfillment partner can make it easier to capture the benefits and keep your working capital plan on track. Here’s how ShipBob can support brands utilizing PMS.

Fast-track onboarding and integration

ShipBob can move as quickly as you need to go live, align inbound flows, and place inventory where it should be for cost‑efficient deliveries. For brands impacted by the recent duty changes, our De Minimis Defense Program offering includes expedited onboarding support and incentives that reduce transition friction.

Cash-flow forecasting inside the ShipBob dashboard

Finance leaders get a single source of truth for inventory, fulfillment, and shipping costs across ShipBob’s network. That clarity helps you model landed cost impacts, plan ACH funding for periodic monthly statements, and decide when to pull inventory from FTZ storage into commerce.

Embedded customs expertise through partnerships with tax consultants and customs brokers

ShipBob is not a licensed customs broker. We partner with licensed brokerage providers through our referral network and collaborate closely with your chosen broker to keep entries statement‑ready. That way, your PMS setup, FTZ weekly entries, and fulfillment workflows stay in sync while ShipBob focuses on warehousing and distribution. We also work closely with tax consultants to ensure that merchants remain informed and compliant.

At ShipBob’s 2025 Fulfilled event, Elliott Davis shared how brands can navigate tariff changes and how they work together with ShipBob so brands can streamline their operations.

Turn customs duties into a competitive advantage

Periodic monthly statements free working capital, simplify administration, and deliver a cleaner audit trail, especially when paired with FTZ weekly entries. When your inventory is staged in the right locations and your cost data is visible in real time, duties become a lever you can plan and optimize around. To see how PMS and FTZ storage can fit into your US distribution and ShipBob’s network, request a custom quote and we’ll map the best path forward.

FAQs about CBP’s periodic monthly statements (PMS)

Below are answers to more queries and questions we regularly read from ecommerce merchants about CBP PMS.

What is the minimum duty amount to justify enrolling in CBP PMS?

There’s no hard threshold. If you import regularly, use multiple brokers, or want a predictable once‑a‑month payment, PMS is usually worthwhile. The more entries you make in a calendar month, the greater the administrative and cash‑flow benefit.

How long does PMS enrollment usually take?

Enrollment in PMS depends on completing ACH setup and ACE configuration. Build in time for ACH approval with CBP and internal bank coordination, then enable PMS in ACE and validate with a small cycle before your first live statement.

Can my customs broker manage periodic monthly statements on my behalf?

Yes. You can use an importer statement (you pay CBP directly) or have your broker place entries on a broker statement (the broker pays CBP, then invoices you). Many mid‑market brands prefer importer statements for control and cleaner audit trails.

How does ShipBob’s De Minimis Defense Program connect to PMS?

ShipBob helps brands pivot their US fulfillment and storage strategy quickly, including access to FTZ warehousing options, advanced analytics, automated smart inventory placement through our Inventory Placement Program, and more. While ShipBob doesn’t run your PMS, our network and visibility help align duty timing, FTZ withdrawals, and monthly cash planning.

Do I need an FTZ to benefit from PMS?

No. PMS stands on its own and delivers cash‑flow and process benefits. FTZs add another layer of deferral and can be valuable for high‑duty items, frequent imports, or complex omnichannel operations.

What happens if I miss the monthly payment deadline?

CBP expects payment by the due date. Late payments can jeopardize eligibility and lead to penalties. Use ACE pre‑statement reports, layered reminders, and a clear handoff between treasury and your broker to stay current.

Are periodic monthly statements available outside the United States?

PMS is a US CBP program. Other jurisdictions may offer different consolidated payment options, but rules, timing, and eligibility vary by country.

How does the ShipBob dashboard help forecast duty payments?

ShipBob’s analytics provide real‑time inventory and cost data that complement your ACE reports. Brands merge ShipBob data with broker and ACE statements to forecast duty outflows, model landed costs, and plan ACH funding for PMS.

Does PMS change how I file entry summaries?

No. Your broker still files entry summaries and releases cargo the same way. PMS only changes the timing and method of payment, consolidating amounts into a monthly ACH debit or credit.

Can small ecommerce brands use PMS, or is it only for high-volume shippers?

Smaller brands can use PMS and often appreciate the simpler reconciliation and predictable due date. The impact tends to scale with volume, but the operational simplicity helps teams of any size.