Key Takeaways

- Treat inventory forecasting as answering three core questions—future demand by SKU, time to stockout, and what to reorder now—so buying decisions stop being guesswork and start being intentional.

- Move beyond spreadsheets once you have real velocity by factoring in lead times, safety stock, seasonality, promotions, and stockouts, instead of just looking at “inventory on hand.”

- Turn forecasts into action with clear reorder points, early stockout alerts, and PO workflows that match your constraints like MOQs, cash limits, and multi-location realities.

- Roll out predictive inventory in stages, starting with top sellers and variant-level forecasting, then expanding to suppliers, warehouses, and finance so you protect both availability and cash.

If inventory feels like a guessing game, it’s because most brands still run it that way. One person updates a sheet, another person changes a PO, a third person launches a promo, and the “truth” about stock lives somewhere between Slack and yesterday’s numbers.

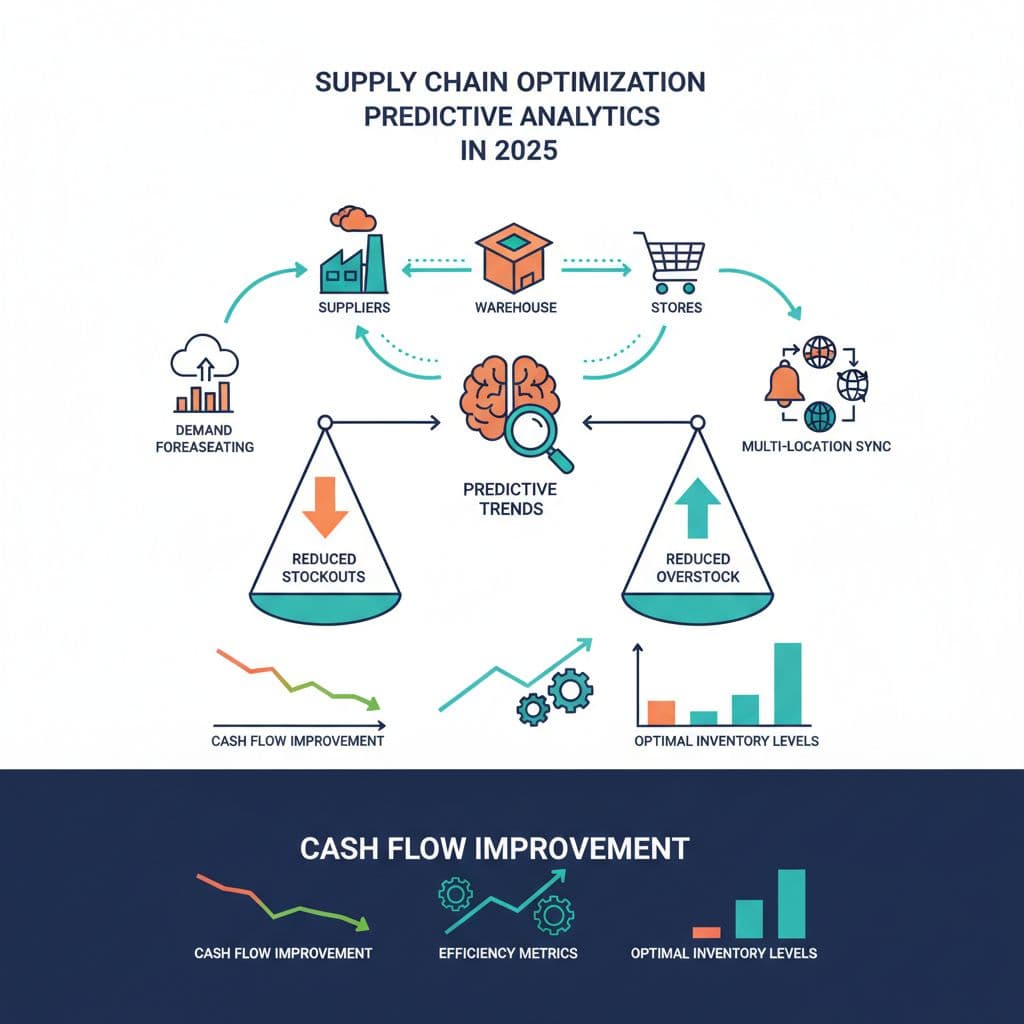

That’s where predictive analytics inventory earns its keep. It turns your sales history, lead times, and seasonality into a forward-looking plan, so you buy what you’ll sell, when you’ll sell it, without parking cash in slow movers.

Think of it like a weather forecast for your supply chain. It’s not perfect, but it’s way better than sticking your head out the window and hoping.

What predictive analytics inventory actually does (and what it doesn’t)

At a practical level, predictive analytics inventory answers three questions your business asks every week:

- How many units will we sell by SKU (and variant) over the next X days?

- When will we run out if we do nothing?

- What should we reorder now, based on supplier lead times and a safety buffer?

This isn’t a crystal ball. If you change price, run a new ad angle, land in retail, or get hit with a competitor copycat, the forecast has to adapt. The win is that you’re no longer reacting after the stockout. You’re seeing risk early and acting with intent.

For a solid overview of how predictive analytics ties to retail inventory optimization, Vusion’s explainer is a good companion read: predictive analytics for retail inventory optimization.

Why spreadsheets fail once you hit real velocity

Sheets are fine when you sell 12 SKUs and reorder twice a month. They fall apart when:

- You carry deep variant trees (size, color, bundles)

- You run promos that spike demand (BFCM, January resets, Mother’s Day)

- You have suppliers with uneven lead times

- You’re multi-location (3PL plus in-house, or multiple warehouses)

The hidden problem is timing. A spreadsheet can show you “inventory on hand,” but it rarely models inventory on hand minus demand during lead time, which is the whole game.

A clean way to say it is this:

Reorder point = expected demand during lead time + safety stock.

If your process doesn’t bake that into day-to-day buying decisions, you’re not planning, you’re reacting.

The inputs that make forecasts useful (not just “interesting”)

Predictive analytics only works if you feed it signals that match how customers buy and how suppliers behave. In ecommerce, these are the inputs I care about first:

Sales velocity by SKU and variant

Not just revenue. Units matter. Variant-level forecasting is where most brands get burned.

Seasonality and calendar effects

Weekly patterns (weekends vs weekdays), monthly cycles, and the obvious peaks like Q4.

Stockouts and lost-sales periods

If your best seller was out of stock for 12 days, your history lies. A decent system corrects for that.

Lead times and lead time variability

A supplier that “takes 21 days” but sometimes takes 35 days should change your buffer.

Marketing and merchandising events

Email drops, paid spend ramps, influencer launches, price changes, bundling, and site placement.

If you want a quick gut check: if your forecast tool doesn’t let you account for promotions or stockouts, it’s going to make confident-looking mistakes.

Turning predictions into purchase orders (the part that saves your sanity)

Forecasts are only valuable if they drive action. The best workflows feel boring in the best way, because the questions get answered before the panic hits.

Here’s what “actionable” predictive analytics inventory looks like inside an operator’s week:

Stockout risk alerts that are early enough to matter

Not “you’re out.” More like “you’ll be out in 18 days, and your supplier needs 28.”

Suggested reorder quantities tied to a target coverage window

Example: “Buy enough to cover 45 days of demand,” adjusted for supplier cadence.

Safety stock that matches your business model

If you’re a premium brand with long lead times and high gross margin, you can afford a bigger buffer than a low-margin commodity seller.

PO creation and tracking that closes the loop

If your team builds POs in one place, approves them in another, and tracks inbound in a third, errors multiply. A forecasting system should connect planning to execution.

The most common mistakes I see (and how to avoid them)

Most inventory pain isn’t caused by “bad forecasting.” It’s caused by good forecasting applied to messy ops. Watch for these patterns:

Treating all SKUs the same

Fast movers and slow movers need different rules. Even basic ABC classification helps you focus where errors cost the most.

Ignoring constraints like MOQs and cash

A forecast that recommends 312 units is cute until your MOQ is 1,000 and your cash is tight. Your system must model constraints, or your team will ignore it.

Planning from revenue, not units

Revenue forecasts don’t ship boxes. Unit forecasts do.

Letting one big month poison the data

A viral spike can distort reorder logic for weeks. You need manual overrides or promo tagging.

Failing to measure forecast accuracy

You don’t need perfection, but you do need a scorecard. Track something simple like forecast error by SKU family, then improve the areas that actually move the P&L.

Shopify tools worth evaluating for inventory forecasting

If you want predictive analytics inventory inside Shopify, start by reviewing a few dedicated forecasting apps and compare how they handle lead times, variants, and PO workflows.

A few options to put on your shortlist:

- Prediko Inventory Management (pricing details here: Prediko pricing & plans)

- Monocle AI inventory forecasts (pricing breakdown: Monocle pricing)

- Rewize | AI-Powered Inventory Management & Forecasting (real merchant feedback: Rewize reviews)

Don’t pick based on the prettiest dashboard. Pick based on whether it matches your operating reality: multi-warehouse, long lead times, bundles, and how your team actually creates and approves POs.

A simple rollout plan (by business stage)

You don’t need a six-month project. You need a tight loop that gets you from “forecast” to “better buys.”

If you’re early-stage (under 50 SKUs):

Connect Shopify data, clean up SKU naming, and forecast your top 20 sellers. Build reorder points with lead time and a small safety stock. Run it for 30 days before expanding.

If you’re scaling (new products every month, promos, real spend):

Tag promos, track stockouts, and start forecasting at the variant level. Add supplier lead time variability, then use the tool to drive weekly PO meetings with one owner.

If you’re established (multiple locations, wholesale, retail, or global supply):

Push for one planning source of truth and align it with finance. Cash planning and inventory planning should talk daily, not quarterly.

Summary

Inventory only feels chaotic when decisions rely on scattered spreadsheets, ad-hoc POs, and partial views of what is actually happening across your catalog. Predictive analytics inventory gives Shopify brands a way to replace that chaos with a forward-looking plan, using past sales, seasonality, and supplier lead times to estimate what you will sell, when you will run out, and what you should reorder today. Instead of reacting to stockouts after they hurt revenue or overordering slow movers that trap cash, you get a “weather forecast” for your supply chain and can make calmer, more confident calls.

The practical shift is simple: stop thinking in terms of “inventory on hand” and start thinking in terms of demand during lead time plus safety stock. When you model unit sales by SKU and variant, layer in promo effects and stockout gaps, and account for suppliers that sometimes take longer than their “standard” lead time, your reorder points become far more reliable. From there, predictive tools can surface early stockout risk (“you’ll run out in 18 days; lead time is 28”), suggest quantities that hit your target coverage window, and generate POs that match real-world constraints like MOQs and limited cash. Even basic segmentation—treating fast movers differently from long-tail SKUs and measuring forecast error by product family—helps you focus effort where mistakes cost the most.

To make this work in the real world, you do not need a huge project; you need a tight loop. Early-stage brands can connect their store data, clean up SKUs, and forecast their top 20 products with lead-time-aware reorder points for a 30-day trial. Scaling brands can start tagging promotions, tracking stockouts, and forecasting at variant level, then run weekly PO reviews driven by the forecast instead of gut feel. More established operations can push toward a single planning source of truth shared with finance so inventory and cash planning stay in sync. The real win isn’t a perfect model; it is fewer emergency shipments, fewer “we should have reordered” meetings, and more cash staying in the business as you grow.

Frequently Asked Questions

What is predictive analytics inventory for Shopify brands, in simple terms?

Predictive analytics inventory uses your past sales, seasonality, and supplier behavior to estimate future demand and guide when and how much stock to reorder. Instead of guessing, you use data to see likely stockout risks in advance and plan purchases so you have enough product without tying up too much cash.

How is predictive inventory better than using spreadsheets?

Spreadsheets can show current stock, but they rarely account for demand during supplier lead times, variant-level differences, promotions, and late deliveries. Predictive inventory tools bake those factors into the forecast and update them automatically, which is hard to maintain reliably in manual sheets once you have many SKUs and regular promotions.

What core questions should predictive inventory answer for my business?

A useful system should answer three weekly questions: how many units you are likely to sell by SKU or variant in the next period, when you will run out if nothing changes, and what to reorder now based on lead times and safety stock. If your current process cannot answer those clearly, you are still managing inventory reactively.

Why do spreadsheets start to fail as my store scales?

As you add SKUs, variants, promotions, and locations, spreadsheets struggle to keep up with all the timing and complexity. They do not easily model stockouts, variable lead times, and overlapping POs, so numbers get out of sync, and teams end up making decisions based on outdated or partial data.

What inputs are most important for accurate inventory forecasts?

The most important inputs are unit sales by SKU and variant, seasonality patterns, known promotions, periods when you were out of stock, supplier lead times and their variability, and any big merchandising or pricing changes. When those signals are captured and understood, the forecast reflects how your business actually behaves, not just a flat average.

How do I turn forecasts into concrete purchase orders?

You translate forecasts into reorder points by combining expected demand during lead time with a safety stock buffer. When stock drops toward that threshold, the system suggests PO quantities that cover a target number of days or weeks of demand, adjusted for supplier constraints, and those suggestions become the basis for your PO approvals.

How should I handle different SKUs, like fast movers versus slow movers?

Fast-moving SKUs deserve more attention, tighter monitoring, and possibly higher safety stock because stockouts are costly. Slow movers can use looser rules and longer review cycles, and in some cases the forecast can help you reduce future buys or phase out products that consistently tie up capital without selling.

What are common mistakes brands make when using predictive inventory?

Common mistakes include treating all products the same, ignoring MOQs and cash limits, forecasting from revenue instead of units, letting a one-off viral spike distort future orders, and failing to track forecast accuracy. These issues either cause the team to ignore the system or create misleading recommendations that hurt trust.

How can a smaller Shopify brand start with predictive inventory without a big project?

Start by plugging your store data into a simple forecasting tool, cleaning up product identifiers, and focusing on the top 20–50 SKUs that drive most of your sales. Build lead-time-aware reorder points for those items, test the recommendations for a month, and refine from there before rolling the process out to the full catalog.

How does predictive inventory help my cash flow and stress levels?

Better forecasts reduce both stockouts and overstock, which means fewer rush shipments, fewer lost sales, and less money locked in slow-moving items. Over time, this leads to more predictable purchasing, fewer emergencies, and a clearer picture of when cash will be tied up in inventory versus available for marketing, hiring, and growth.