The clock is always ticking on returned inventory. The longer it takes to get products back to retailers, the smaller the resale window, and the bigger the hit to profit.

According to the 2024 Consumer Returns in the Retail Industry Report by the National Retail Federation (NRF) and Happy Returns, retailers estimated that 16.9% of their annual sales would be returned in 2024. That’s a projected $890 billion in returned merchandise industry-wide.

With the average cost of processing each return exceeding 21% of the order’s value, speed is critical. The faster a retailer can resell returned goods, the more revenue and margin they keep. This is why Happy Returns architected its entire reverse logistics operation for speed.

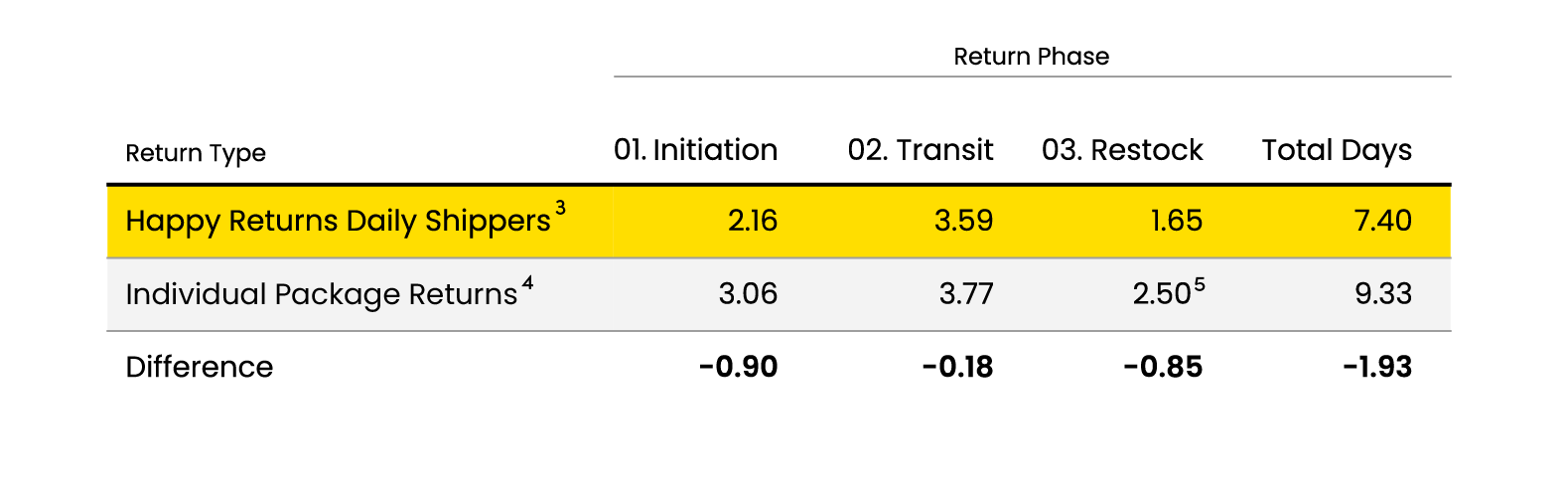

In the transit phase alone—the part of the returns journey most retailers focus on—we move returns from shopper drop-off to delivery to the merchant’s warehouse in as few as 3.59 days on average for daily shippers¹, and an average of just 6.4 days for all Happy Returns customers². That’s on par with the speed of individual package returns, but with the added advantages retailers care about most: a better customer experience, reduced fraud risk, and the efficiency of consolidated bulk shipments.

Transit, however, is only one leg of the journey. To understand true returns speed, we need to take into account the full cycle of activities during the return, measured from the moment a shopper initiates a return to the moment the item is back on the shelf ready for resale.

Happy Returns offers unique advantages when it comes to efficiency on both sides of the transit phase, as illustrated in the table below:

Source: Metrics based on large volume customer analysis of retail partners. Happy Returns internal data, 2025.

Returns reimagined: A full-lifecycle approach

A return begins with the shopper initiation phase, where convenience and instant refunds drive high opt-in rates and drop-offs one day sooner than individual package returns⁶.

The second leg of a return is the transit phase, which is the time it takes to get a return from the point of drop-off (i.e., Return Bar® location) to the retailer, which Happy Returns does in as few as 3.59 days on average⁷.

And finally, a return finishes with the restock phase, where tidy, palletized returns with a digital manifest help retailers put inventory back on shelves 34% faster than individual bags and boxes⁸.

By looking at the full returns lifecycle, we’ll show how acceleration at each stage of our returns process compounds to shorten the overall time it takes to restock items, delivering one of the fastest average restock speeds in the industry⁹.

01 RETURN INITIATION

Convenient, fast, and preferred by shoppers

About the Return Bar® experience

We operate the largest network of box-free return drop-off locations in the United States. With more than 8,000 locations nationwide, customers drop off their returns box-free and label-free — no printing, no packaging, and no waiting, with refunds and exchanges initiated at the time returns are dropped off.

This approach is extremely popular: 86% of shoppers choose our hassle-free Return Bar® service when given the option and award our service with a 93 lifetime Net Promoter Score¹⁰.

How does it work?

The shopper begins their return online in the retailer’s return portal (often linked in their order confirmation email or on the retailer’s website). They select the items they want to return and the reason for the return, choose “Drop off at a Return Bar® location” as their return method, and instantly receive a QR code—no need to print a label or find packaging. With their unboxed items and QR code in hand, the shopper brings in their items to a Return Bar® location, where they are scanned to verify that the items being returned are the items that were purchased. Once the return is accepted, most refunds are initiated instantly.

How do we measure it?

The return clock starts when the shopper initiates their return online. We measure both the number of days on average that it takes for a shopper to drop-off their returns at a Return Bar® location and the number of days it takes a shopper to bring their return in for a traditional carrier return.

Happy Returns requires less work from the shopper—no printing labels, packaging, and mailing—and because we offer instant refunds once returned items are verified at drop-off, customers complete the initiation phase one day faster than a typical individual package return.¹¹

02 TRANSIT

Smart consolidation and routing

About the transit phase

After items are dropped off at a Return Bar® location, they’re consolidated along with returns from other Happy Returns merchants. Full boxes are shipped—often on the same day—to one of our regional Return Hubs, where they are sorted and palletized by retailer, ready for outbound bulk shipment.

We measure the transit phase in three parts: inbound transit, hub sorting, and outbound transit. Together, these steps track returns from the moment they leave a Return Bar® location to the moment they arrive back at the retailer. For retailers who qualify for daily shipping, this entire phase averages just 3.59 days¹². For all customers including non-daily shippers, the average is still a fast 6.40 days¹³.

What we mean by daily shipping

Daily shipping is an option for high-volume retailers whose returns fill outbound shipments every day. For these qualified retailers, we ship all returns from our hubs to their warehouses daily, rather than waiting to build larger, less frequent shipments. This constant flow accelerates the entire reverse logistics process, getting goods back faster for restocking.

A: Inbound transit: Speed at the hourly level

What do we mean by inbound transit?

The movement of consolidated returns from our Return Bar® locations to one of our three hubs located in California, Mississippi, and Pennsylvania.

How does it work?

The Return Bar® not only solves for customer satisfaction but also allows us to aggregate returned packages and route them intelligently from the very beginning.

Individual returns are bagged and labeled for tracking and then combined with other returns from other retail brands into a single Happy Returns box. This way, the shipping box is quickly filled with returns and hits the road to our hubs efficiently without waiting.

Another unique advantage is our integration within the UPS ecosystem, giving us priority access to the nation’s largest package delivery company. This access includes same-day pickups, end-to-end visibility, and the use of bypass lanes to ensure returns arrive at our hubs by 6 a.m., which is early enough to complete processing before outbound trucks depart¹⁴.

How do we measure it?

We track the time it takes for each shipment to travel from a Return Bar® location to one of our regional hubs. Thanks to the high volume of retailers and shoppers in our network—and the speed of our UPS-operated transportation—shipments reach our hubs in an average of 1.24 days¹⁵ for daily shippers.

B: Hub sorting: Efficiency powered by robotics

What do we mean by hub sorting?

When returns arrive at our hubs, they’re in consolidated return boxes—each box contains items from many different retailers. Before we can send anything back, we need to separate and then organize these items by retailer.

How does it work?

Our team opens each box and places each return bag onto state-of-the-art Geek+ S20C sortation robots. These robots transport each item to its designated shipping gaylord for that specific retailer. Once enough items for a retailer have been collected, the gaylords are palletized for outbound shipping. Automation speeds up the work, reduces errors, and improves safety for our warehouse teams.

How do we measure it?

We measure hub sorting as the time from each return bag’s arrival scan to the time stamp at tender, when the freight carrier departs our facility. We complete sorting of all inbound returns on the same day they arrive on 98% of days¹⁶.

C: Outbound transit: Predictive, AI-powered logistics

What do we mean by outbound transit?

We use our knowledge of what is flowing through our network as well as historic volume trends to predictively set up shipments from our hubs to retailer warehouses.

How does it work?

Our hubs reduce pickup delays with system-triggered auto-bookings once volume thresholds are met. This process eliminates manual scheduling errors and balances shipment speed with cost per shipment.

This predictive approach increases speed and accuracy with earlier trailer access, better carrier timing and route planning, and smoother daily warehouse operations.

Additionally, speed in reverse logistics is only possible with smart geography. Our hubs are strategically located to optimize ground coverage. Each location—Valencia, CA (West), Southaven, MS (Central), and Shoemakersville, PA (East)—is purposefully located to balance scale, proximity to freight infrastructure, and our ability to grow with merchant demand.

How do we measure it?

We track how quickly shipments leave our hubs and arrive back at retailer warehouses. For retailers who qualify for daily shipments, all returns are processed and shipped out the same day they arrive. Once outbound, 85% of all returns reach retailers within one to three days¹⁷.

03 INVENTORY RESTOCK

Faster warehouse intake, faster resale

About the inventory restock phase

The faster retailers can get their items back into sellable inventory, the less the inventory holding cost.

Once returns reach the retailer, the final step—restocking returned inventory—has historically been slow and disorganized. But not with Happy Returns.

How does it work?

Happy Returns’ ships bulk returns in bagged, labeled, and palletized shipments with a digital manifest. Warehouses know exactly what is coming and when each shipment will arrive, allowing them to organize receipt and processing to minimize returned inventory restocking time.

How do we measure it?

Inventory restock is the amount of time from when the returns arrive at the retailer’s dock doors to when they’re able to be resold. A comprehensive study completed in partnership with the UPS Customer Solutions team in 2025 concluded that Happy Returns consolidated returns allow retailers to restock inventory 34% faster than individual return packages¹⁸.

Conclusion

By accelerating the full returns lifecycle—from initiation to transit to restock—we’ve redefined how the industry views consolidated returns. Merchants no longer have to trade speed for a better shopper experience—they can have both.

Every hour, every day gained in the returns cycle means more inventory back on shelves, more customer satisfaction, and more margin protected.

Citations

1 Data based on Happy Returns daily shipper customers. Daily shipping with Happy Returns is an engagement option for high-volume retailers whose returns fill outbound shipments every day.

2 Source: Metrics based on large volume analysis of all Happy Returns retail partners. Happy Returns internal data, Q2 2025.

3 Daily shipping with Happy Returns is an engagement option for high-volume retailers whose returns fill outbound shipments every day.

4 Analysis completed by comparing 2025 internal Happy Returns data and other carriers, including Bleckmann, Canada Post EastPost, DHL, DHL eCommerce EasyPost, FedEx, FedEx EasyPost, Purolator, UPS, UPS EasyPost, UPS Mail Innovations EasyPost, and USPS. Data collected via the Happy Returns return portal utilized by Happy Returns customers.

5 Reported data, as written in SLA contracts, from Happy Returns retail partners to customer success teams. Common reported time frame is 2-3 days from return package arrival at retailer warehouse to inventory restocking. Happy Returns internal data, 2025.

6 Source: Metrics based on large volume analysis of all Happy Returns retail partners. Happy Returns internal data, Q2 2025.

7 Source: Metrics based on large volume analysis of all Happy Returns retail partners. Happy Returns internal data, Q2 2025.

8 A comprehensive study completed in partnership with the UPS Customer Solutions team in 2025 concluded that Happy Returns consolidated returns allow retailers to restock inventory 34% faster than individual return packages.

9 Analysis completed by comparing 2025 internal Happy Returns data and other carriers, including Bleckmann, Canada Post EastPost, DHL, DHL eCommerce EasyPost, FedEx, FedEx EasyPost, Purolator, UPS, UPS EasyPost, UPS Mail Innovations EasyPost, and USPS. Data collected via the Happy Returns return portal utilized by Happy Returns customers.

10 Net Promoter Score is a customer loyalty metric that measures how likely customers are to recommend a company, product, or service to others.

11 Source: Metrics based on large volume analysis of all Happy Returns retail partners. Happy Returns internal data, Q2 2025.

12 Source: Metrics based on large volume analysis of all Happy Returns retail partners. Happy Returns internal data, Q2 2025.

13 Source: Metrics based on large volume analysis of all Happy Returns retail partners. Happy Returns internal data, Q2 2025.

14 Source: Metrics based on large volume analysis of all Happy Returns retail partners. Happy Returns internal data, Q2 2025.

15 Source: Metrics based on large volume analysis of all Happy Returns retail partners. Happy Returns internal data, Q2 2025.

16 Source: Metrics based on large volume analysis of all Happy Returns retail partners. Happy Returns internal data, Q2 2025.

17 Source: Metrics based on large volume analysis of all Happy Returns retail partners. Happy Returns internal data, Q2 2025.

18 A comprehensive study completed in partnership with the UPS Customer Solutions team in 2025 concluded that Happy Returns consolidated returns allow retailers to restock inventory 34% faster than individual return packages.