Originally published December 2023. Updated December 2025 with insights from BFCM 2025 and the current logistics landscape.

As we head into 2026, it’s the right moment to ask whether your 3PL is helping you grow or holding you back.

Black Friday 2025 separated the prepared from the unprepared. Brands with the right partner scaled smoothly. Others spent the weekend chasing carriers and explaining delays.

This guide distills what we saw across dozens of brands into a practical evaluation framework. It’s not about ticking boxes. It’s about avoiding bottlenecks when it matters most.

The 8 Areas That Decide 3PL Fit For Your Brand

1. Staffing and operational stability

Stable, long tenured teams protect accuracy, speed, and cost. This is why you should ask every 3PL for:

- Their last 12 months of turnover

- Their current pick and pack accuracy

- Their training program and staffing approach during peak surges

The warehouse industry turnover rate is about 49% annually, according to the U.S. Bureau of Labor Statistics. High turnover often correlates with lower accuracy. Meanwhile, top tier operations typically maintain 99%+ pick and pack accuracy, with the best achieving 99.5%+.

Stable teams handled peak season surges without major issues. High turnover operations leaked accuracy, SLA performance, and service costs.

Red flags: vague turnover data, no training docs, rotating staff across accounts.

2. Communication and responsiveness

Urgent issues do not happen on a schedule. When something breaks at 2 a.m., you need a human, not a ticket queue.

Ask for:

- A named, dedicated account manager

- Response times inside and outside business hours

- Channels supported (Slack, email, phone, WhatsApp)

- Escalation paths

- Time zone coverage

Brands with true 24/7 coverage adapted in real time during peak season.

Red flags: limited hours, slow replies during evaluation, unclear escalation.

3. Customization and specialized services

Your category dictates your handling requirements. Fragile goods, cosmetics, batteries, oversized products, and temperature sensitive items each require different workflows.

Ask for:

- Proof of experience in your category

- Photos or videos of how they handled similar brands

- Examples of custom or branded packaging

- Sustainable packaging options

See examples in Sustainable Logistics in Action: Part 2.

Red flags: “we can do anything” without proof, rigid packaging rules, limited channels.

4. Scalability and peak performance

A scalable 3PL grows with you without sacrificing accuracy, SLAs, or support.

Ask:

- How their operation performed during BFCM 2025

- What changes they made afterward

- Their ability to handle 10 to 20% month over month growth

- Whether they maintain surplus carrier or labor capacity during peak periods

- How they communicate if they approach limits

Anything promising “instant scaling” usually signals temporary labor, manual processes, or unstable systems.

Red flags: single carrier dependency, manual routing, vague peak season answers.

5. Technology and integration

Technology determines your visibility, speed to launch, and accuracy.

Look for:

- Native integrations with Shopify, WooCommerce, Amazon, TikTok Shop

- Automated order sync

- Real time tracking and exception management

- Carrier performance analytics

- Onboarding in 2 to 4 weeks

Red flags: CSV workflows, 8+ week onboarding, poor visibility after handoff.

6. Cost structure and incentive alignment

The cheapest label is almost never the lowest total cost.

Ask:

- What is included

- What is extra

- Storage fees

- Peak surcharges

- Packaging markups

- Whether they profit when products sit in storage

- How they advise brands on reducing total landed cost

See Why Most DTC Brands Fail: The Cash Flow Trap.

Red flags: opaque pricing, high storage dependence, seasonal surprises.

7. Strategic alignment and prioritization

Fit matters. If your brand is too small or too large for their core segment, your service quality will reflect that.

Ask for:

- Examples of brands your size and category

- How they helped them scale

- Customer references you can call

- Their product and operational roadmap

- Their partner ecosystem and long term strategy

Red flags: you are far outside their ICP, no customer references, no roadmap, no case studies.

8. Geographic footprint and production proximity

Where a 3PL operates relative to your production determines your lead time, cash conversion cycle, and delivery experience.

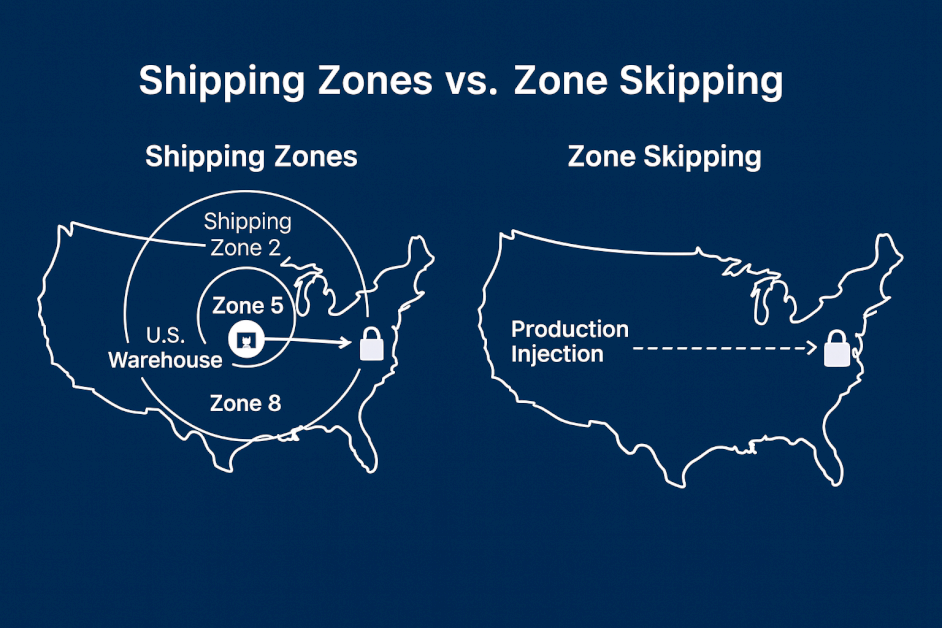

Traditional 3PLs rely on fixed U.S. warehouses. This means:

- Customers far from that warehouse fall into higher shipping zones

- Higher zones mean slower delivery and higher cost

- Peak surges hit harder because inventory must already be stored domestically

Zone skipping solves this, but only if your 3PL has the right model.

Portless injects packages directly into the nearest zone to the customer, reducing time in transit compared to U.S.-only 3PLs with fixed warehouse footprints.

If your production is in Asia and your first touchpoint is a U.S. warehouse 30 days away, capital stays locked.

Direct from production compresses 60+ days of lead time into about 5 days, with customer delivery averaging 7.5 days.

Learn how this works in practice in Direct Fulfillment 101.

Red flags: destination only operations, no teams near production, long pre availability transit.

What success looks like from a 3PL partner

- Capital efficiency: faster turns, less cash trapped in warehouses

- Operational resilience: redundancy and flexibility when things break

- Strategic optionality: scale up or down without drama

- Peace of mind: fewer fires, more focus on growth

- Real partnership: proactive comms and problem solving

Making the right decision on a 3PL partner

Score each provider on the eight areas above and sort into:

Must-haves: proven peak performance, multi-carrier capacity, transparent pricing, responsive communication, tight integrations, 99%+ accuracy.

Nice-to-haves: 24/7 coverage, analytics dashboards, eco-friendly packaging, teams near production, proactive comms, automation and AI.

Deal-breakers: hidden fees, poor communication, cannot scale, misaligned incentives, no presence near production when you manufacture overseas.

If you’re still deciding whether to stick with a 3PL, bring it in-house, or switch to direct fulfillment, read Which Fulfillment Model Maximizes Your Profit Margins.

Next steps in your search

- Shortlist 3–5 partners and run structured interviews using this guide

- Speak to references at your scale

- Pilot with a subset of SKUs before full migration

- Document answers, red flags, and outcomes in a scorecard

- Choose on strategic fit, not sticker price

Want the printable scorecard? Export this checklist and question set as a PDF for vendor calls.

Ready to evaluate your options with Portless?

Book a call with us, and we’ll walk you through factory-adjacent fulfillment, global team coverage, multi-carrier routing, and a 30-minute Shopify integration.