Key Takeaways

- Build relationship infrastructure before you need it so you earn better deals, better terms, and better people while other brands scramble.

- Run a simple cadence by tracking your top relationships in a CRM, sending quarterly updates, and using one monthly relationship day to move clear next steps forward.

- Communicate with clear emails, on-time meetings, and fast follow-through so partners, candidates, and your own team feel respected and stop guessing what is true.

- Adopt a low heart rate approach by staying calm and specific in high-stakes talks, because confidence and clarity often unlock opportunities faster than hype.

Most brands think the ceiling after $10M is ops, ads, or finance. Those matter, but they’re rarely the true limiter.

In January 2026, growth is harder to “buy” than it was a few years ago. CAC pressure is real (many brands report 25 to 40% higher acquisition costs), and loyalty has softened (one widely cited benchmark showed loyalty falling from 77% in 2022 to 69% in 2024). When paid efficiency slips, your next stage depends on trust: with customers, partners, talent, and capital.

After 400-plus founder and operator interviews across EcommerceFastlane, the pattern is consistent: the brands that break past $10M build relationship infrastructure like they build inventory planning or creative testing. They don’t “network” randomly. They run a repeatable system that turns relationships into an operating advantage.

This post lays out that system, in plain language, with a cadence you can run whether you’re at $500K a month or $2M a month.

Why DTC Brands Stall After $10M

At $10M, you’re no longer in the scrappy stage where hustle covers gaps. You have more channels, more headcount, more fixed costs, and less room for sloppy execution. Mistakes don’t just hurt, they compound.

Here’s the dead zone most teams hit on the way to $50M:

- Paid gets noisy and expensive, so “just spend more” stops working.

- Wholesale and retail interest shows up, but deals stall in the handoff.

- Agencies and vendors multiply, but accountability gets fuzzy.

- You need real leaders, but A-players can smell chaos fast.

This is the relationship part: when acquisition gets tougher and loyalty weakens, you can’t brute-force growth. You need better trust loops and better deal flow.

Relationship break points that show up right after $10M:

- The founder becomes the bottleneck for every “important” conversation.

- Vendor chaos (late invoices, unclear owners, missed handoffs) hurts terms and service.

- A weak partner pipeline means you chase whatever shows up, not what fits.

- The executive bench is thin, so you keep hiring “helpers” instead of owners.

- Inconsistent comms: people don’t know what’s true, so they assume the worst.

A quick scenario that’s painfully common: you finally get a promising retail meeting. The buyer asks for a tight follow-up: margin assumptions, promos, and a 90-day pilot plan. The brand takes 12 days to respond because nobody owns the doc, then the buyer goes cold. The brand blames the buyer. The real problem was a missing system.

The relationship debt that builds up while you are chasing ROAS

Relationship debt is the hidden interest you pay when you treat people like transactions. Every skipped update, sloppy meeting, and one-sided ask adds friction that shows up later as worse terms, slower deals, and weaker talent.

Five symptoms that relationship debt is already on your balance sheet:

- You email investors only when you need money.

- You take partner calls with no agenda, then wonder why nothing happens.

- You “have a CRM” but no notes, no next steps, and no dates.

- Vendors get paid late, then you act surprised when service drops.

- Nobody knows who the decision-maker is, so decisions drag.

The fix is simple, not easy: treat relationships like systems, not vibes.

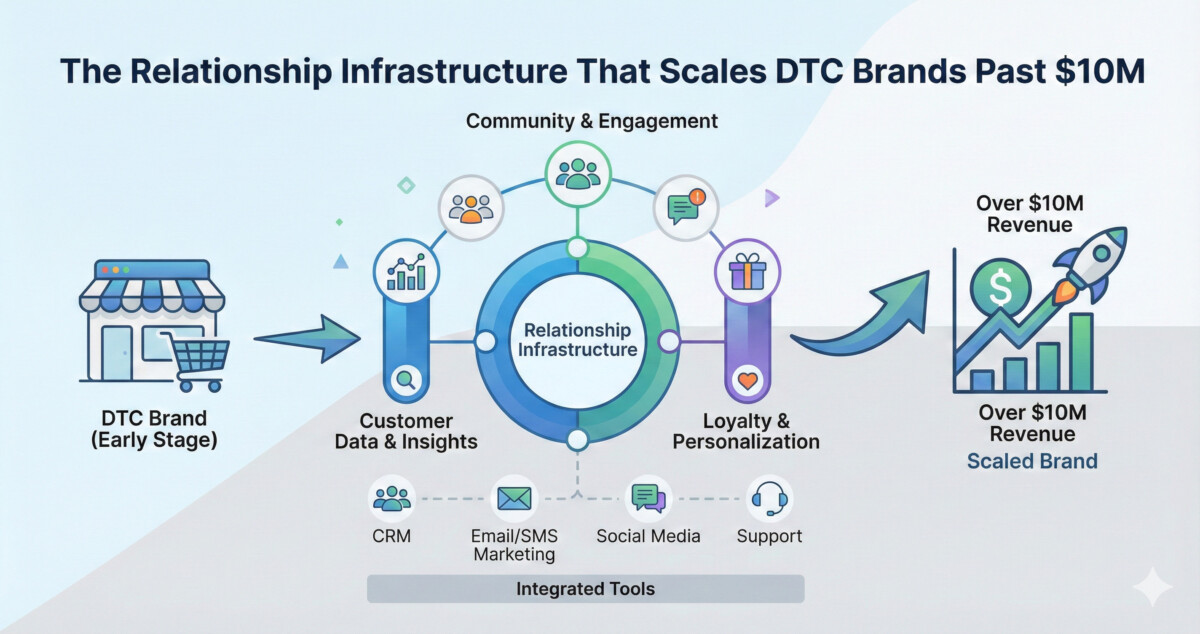

What “relationship infrastructure” means for an eight-figure DTC brand

Relationship infrastructure is a set of habits, templates, and cadences that make trust repeatable.

I like a four-pillar model:

- Customer trust loops: consistent experiences, clear promises, fast recovery when you miss.

- Investor readiness: you’re always fundable because your story and numbers are organized.

- Partner pipeline: you create deal flow with retailers, platforms, and collabs before you need them.

- Talent network: you build relationships with operators months before you open the role.

This isn’t about being fake or “always on.” It’s being consistent, prepared, and generous with value.

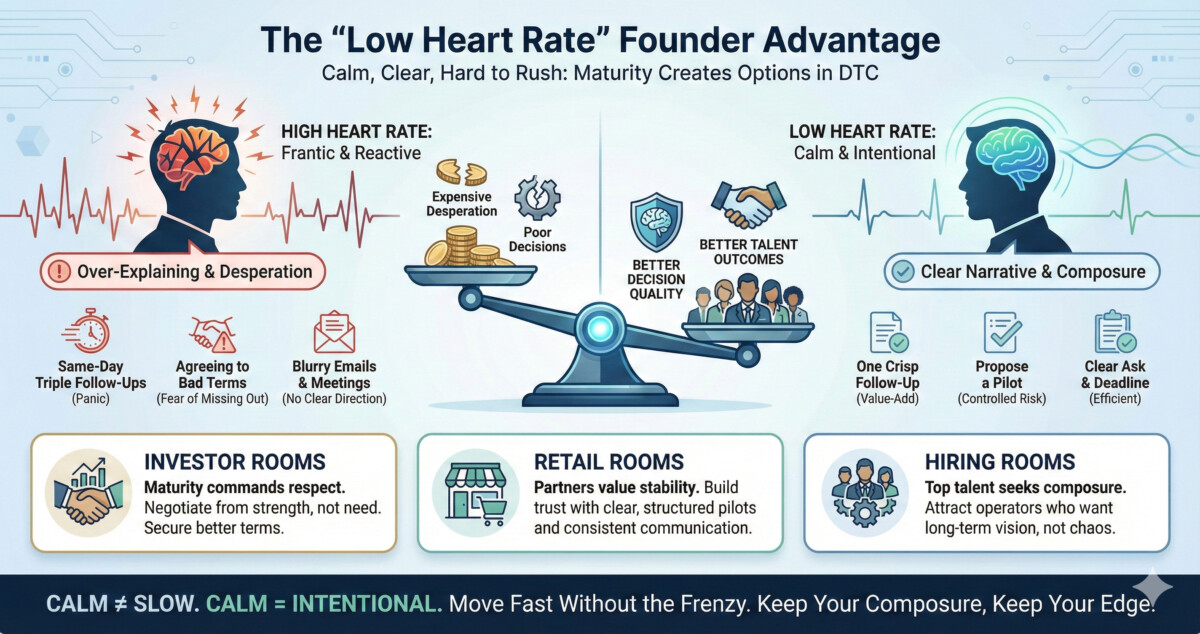

The “Low Heart Rate” Founder Advantage in Investor, Retail, and Hiring Rooms

Low heart rate means you show up calm, clear, and hard to rush. In DTC, that calm reads as maturity, and maturity creates options.

When CAC is up and growth is slower, the founder who can keep composure gets better outcomes:

- Better decision quality under pressure.

- Better terms, because desperation is expensive.

- Better talent outcomes, because top operators want stability.

What calm looks like in practice:

- Emails that get to the point, with a clear ask and a clear deadline.

- Meetings that start with context, end with owners, dates, and next steps.

- Negotiations where you can say “no” without posturing.

High heart rate tells vs. low heart rate replacements:

- “Just checking in??” → “If this isn’t a priority now, totally fine. Want to revisit in 60 days?”

- Over-explaining your brand story → One crisp narrative, then questions.

- Same-day triple follow-ups → One follow-up, then add value, then wait.

- Agreeing to bad terms to “get the deal” → Propose a pilot with clear gates.

Trade-off to be honest about: calm doesn’t mean slow. It means intentional. You can move fast without sounding frantic.

The scarcity trap that kills deal flow (and how to replace it with calm momentum)

If you treat every conversation like your one shot, you start negotiating against yourself. You talk too much, discount too early, and accept vague next steps.

Replace scarcity with a pipeline:

- Keep 20 to 40 active relationships warm across capital, partnerships, and talent.

- Always set a next step before the call ends.

- Protect optionality, even if you love the opportunity.

A follow-up rule that works:

- Same day: thank you plus recap of next steps.

- 3 business days: quick check-in if you’re waiting on their input.

- Next ping: bring value first (a metric update, a relevant intro, a small insight).

That cadence keeps momentum without noise.

A Simple Relationship Operating System: Capital, Partnerships, and Executive Talent

Here’s the “answer first” version that you can copy into your operator doc:

Run relationships on a calendar. Send quarterly updates to investors and key partners, do monthly touchpoints with your top 20 relationship accounts, and block one 2-hour relationship day each month to move pipelines forward. This works at $500K/month and at $2M/month because it’s about cadence, not charisma.

Keep the stack lightweight:

- A CRM (Airtable, Notion, HubSpot, or a spreadsheet).

- Three recurring calendar blocks (weekly review, monthly relationship day, quarterly cleanup).

- One update template for investors and partners.

- One meeting notes template (attendees, goal, key points, decision, next step, due date).

If you want the bigger operating backdrop, pair this with a planning rhythm like Sales & Operations Planning for DTC so relationship work matches your forecast and inventory reality.

Investor Relations Infrastructure

Investor relations is not “fundraising.” It’s staying investable.

Start with a clean target list:

- Thesis fit: do they invest in your category and model?

- Stage fit: are they writing checks at your current size?

- Behavior fit: do founders describe them as helpful or heavy?

Warm intro approach that keeps dignity: use a double opt-in. “If you think it’s a fit, I’d love an intro. If not, no worries.” Make it easy to say no.

What “keep warm” means: short updates on a schedule, even when you’re not raising. This is how you earn speed later.

A simple quarterly investor update outline (five bullets):

- Top-line: revenue, gross margin, contribution margin (pick what you can stand behind)

- Retention: repeat rate, subscription churn, LTV trend

- Wins: one to three tangible wins

- Misses: what didn’t work, and what you changed

- Ask: intros, hiring, retail doors, media, capital timing

Common mistakes to avoid:

- Mass emails with no segmentation.

- Vague metrics like “strong growth” with no numbers.

- Only reaching out when you need money.

If you want to tighten your measurement story so updates feel credible, read Turn Attribution Data into Action. Investors trust founders who can explain what’s working and what’s unclear.

Partnership Development Playbook

Partnerships should not be random inbound. Run them like a pipeline.

A four-step partner flow:

- Identify: list 50 targets across retailers, platforms, creators, and tech partners.

- Qualify: stage, audience match, economics, and execution effort.

- First call: align on value and constraints.

- Pilot then expand: small test with clear success metrics, then scale.

Use industry events as accelerators. NRF is a proven hub for retail and tech relationships (see the official event site at https://nrfbigshow.nrf.com/). Shoptalk (https://shoptalk.com/) and SubSummit (https://subsummit.com/) are also common places where DTC operators do real deals, but the win comes from follow-up, not badge scans.

A simple discovery call agenda (keep it tight):

- Goal: what would success look like in 90 days?

- Constraints: inventory, margin, exclusivity, creative, ops capacity

- Mutual value: what each side brings, and what each side needs

- Next step: who owns what, by when

Warm intro best practices:

- Double opt-in, always.

- Write the intro email for the connector.

- Close the loop with a thank you and a result.

For brands exploring curated collaborations without taking inventory risk, Scale Multiple Brands with Shopify Collective is worth reviewing, because partner ops breaks when inventory and fulfillment aren’t clear.

Executive Talent Relationships

Top operators join clarity. They avoid confusion. Relationship infrastructure shows up in hiring more than founders expect.

Signals that tell A-players you’re a real company:

- A clear scorecard and outcomes for the first 90 days.

- A tight interview loop with fast feedback.

- A crisp written role with decision rights.

- Reference checks both ways, including what the candidate needs from you.

- Clean internal alignment, so offers don’t get messy.

A practical 5-point interview checklist for founders and execs:

- “What does success in 90 days look like, in numbers?”

- “What decisions can you make without me?”

- “What do you need from the team weekly?”

- “What breaks at $20M if we don’t fix it now?”

- “What are you walking away from to join us?”

Responsiveness is part of this. If it takes you 9 days to send feedback, great candidates assume the company runs that way too.

For a broader view of building systems that hold up under pressure, Building a Resilient DTC Operations System pairs well with the people side, because great execs want operational ground truth.

Communication and Follow Up That Builds Trust (Without Being Annoying)

Trust is built in small moments: clear emails, on-time meetings, and follow-through that doesn’t waste anyone’s time.

“Good enough” standards for a busy DTC team:

- Emails: one screen long, one clear ask, one clear deadline.

- Scheduling: always include timezone, always propose two times.

- Meetings: send an agenda 24 hours before if it matters.

- Notes: recap decisions and owners within 6 business hours.

Copy this cadence:

- Weekly team relationship review (15 minutes): who needs a reply, who needs value, who is stuck.

- Monthly relationship day (2 hours): send updates, book calls, move deals.

- Quarterly relationship cleanup (1 hour): prune dead leads, update titles, refresh targets.

If you’re building on Shopify and your tech stack is part of the trust story, Shopify Platform for High-Growth DTC is a strong reference point for how systems and customer experience connect.

The follow up framework: stay top of mind for months, not minutes

Helpful follow-up respects attention. Pushy follow-up asks for attention.

Use six touch types, rotated over time:

- Thank you note

- Metric update (“here’s what changed since we last spoke”)

- Useful intro

- Relevant article or data point

- Congrats note on a launch or promotion

- Quick check-in with a clear yes/no question

Walking away gracefully keeps doors open. Scripts you can steal:

- Declining a deal: “I don’t think we can execute this well right now. If we revisit in Q3, I’d be open to re-scoping a smaller pilot.”

- Passing on a partnership: “The audience fit is strong, but the economics don’t work for us today. If your model changes, let’s reconnect.”

- Closing a hiring loop: “You’re clearly talented. This role needs a different shape right now. If we open a role closer to your strengths, can I reach back out?”

That tone protects your reputation, and reputation is a growth asset.

Summary

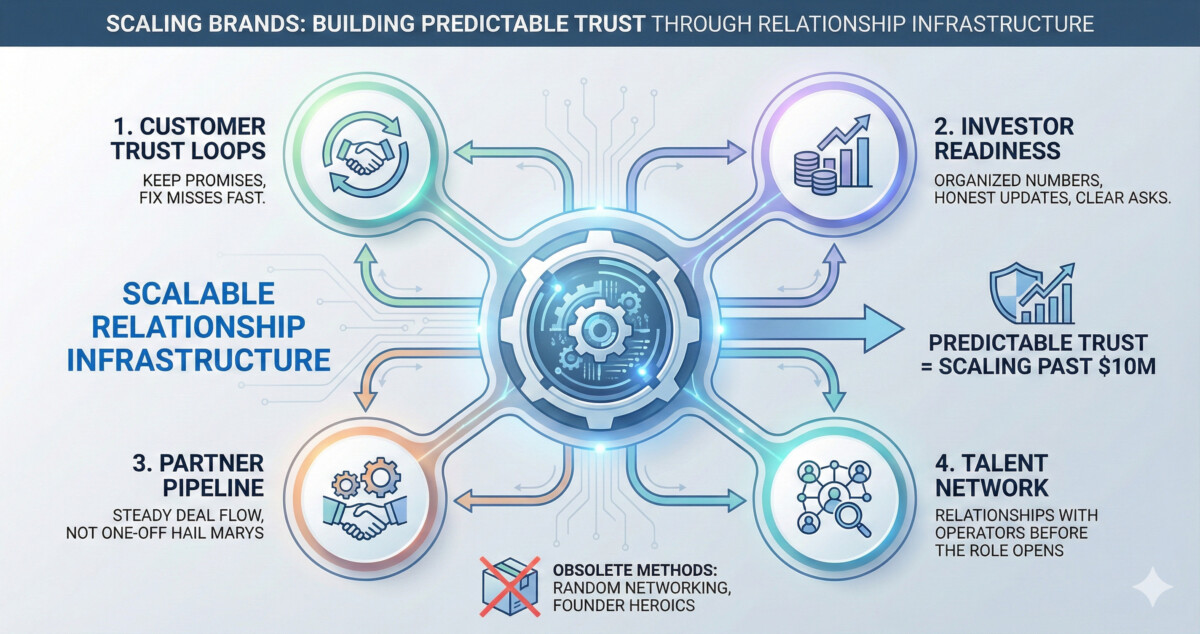

Scaling past $10M is not just an ops problem. It is a trust problem.

In 2026, growth is harder to “buy.” Many DTC teams report 25% to 40% higher CAC, and loyalty has softened (a widely cited benchmark dropped from 77% in 2022 to 69% in 2024). At the same time, mid-market growth has been stuck around 3%, and many brands fight for 7% to 8% EBITDA. That means small mistakes cost more, and recovery takes longer. When your margins are tight, you cannot afford slow follow-up, messy handoffs, or “we’ll get back to them” decisions.

That’s the core idea of this post: brands that scale past $10M build relationship infrastructure the same way they build inventory planning or creative testing. They stop relying on random networking and founder heroics. They run a repeatable system that makes trust predictable across four pillars:

- Customer trust loops (keep promises, fix misses fast)

- Investor readiness (organized numbers, honest updates, clear asks)

- Partner pipeline (steady deal flow, not one-off hail marys)

- Talent network (relationships with operators before the role opens)

What to do next (practical and immediate)

If you want this to pay off in the real world, treat relationships like a monthly operating rhythm:

- Start a simple CRM this week (a spreadsheet is fine) and list your top 20 people across capital, partnerships, and talent. Add: last touch, next step, due date, and “value I can give.”

- Send quarterly updates to investors, advisors, and key partners even when you are not asking for money. Keep it tight: top metrics, wins, misses, and one clear ask.

- Run partner calls with an agenda and end every call with owners and dates. If there is no next step, it is not a real deal yet.

- Tighten your hiring loop with a written scorecard, fast feedback, and clear decision rights. Great candidates read your process as a signal of how your company actually runs.

- Adopt a low heart rate style in email and meetings: clear subject lines, one ask, one deadline, and calm follow-up that adds value instead of pressure.

If you want a simple rule to remember: retention is often far cheaper than acquisition, and trust is what drives retention, referrals, better terms, and faster yeses. When relationships are run as a system, you stop paying “relationship debt” interest.