Key Takeaways

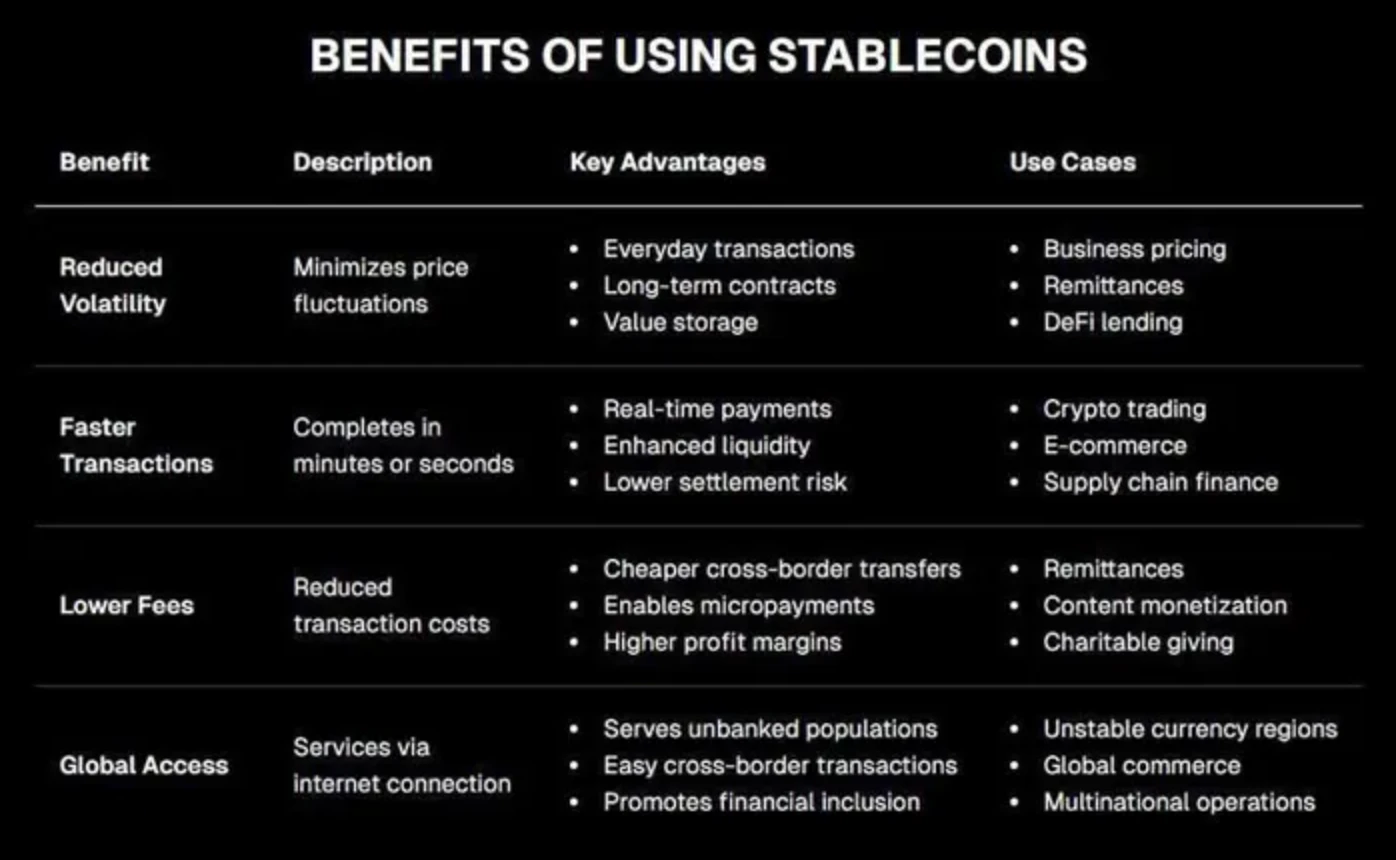

- Leverage stablecoins to cut fees and speed up cross-border payments so your money moves faster than competitors tied to banks.

- Choose fiat-backed stablecoins with clear audits, verify reserves, and use trusted wallets to reduce counterparty and freeze risks.

- Use stablecoins to protect savings in high-inflation settings and keep families funded without bank barriers or long delays.

- Explore how stablecoins bridge crypto and traditional finance, offering fast transfers, simple tracking, and growing app support.

Stablecoins have become an important part of the modern financial ecosystem.

They combine the benefits of blockchain with the relative stability of traditional currencies. However, with these opportunities come risks. Experts from Merehead, who specialize in cryptocurrency development, will discuss what needs to be considered to safely use digital alternatives to fiat currencies.

A Payment Instrument in the Digital Economy

The core value of stablecoins lies in their ability to facilitate fast and affordable global transfers without intermediaries. Unlike volatile cryptocurrencies, whose prices can fluctuate by tens of percent per day, stablecoins are pegged to real assets, most often the US dollar. This fixed-rate cryptocurrency has become a convenient means of payment for freelancers, international companies, and ordinary users who need to receive or send money abroad.

In countries with restrictions on currency transfers, stablecoins are often a viable alternative to banking systems. Transactions are processed in minutes, with significantly lower fees than traditional transfers via SWIFT or similar channels. Furthermore, users don’t need to open an account with a foreign bank.

Another advantage is transparency. Blockchain allows for the tracking of funds, and smart contracts automate most processes. In business, this reduces the risk of errors and simplifies accounting. Today, stablecoins serve as a bridge between traditional finance and the digital economy.

Stablecoins are being integrated into established payment systems, such as through bank cards or fintech apps. The market for cross-chain solutions is also developing. This simplifies the transfer of funds between different networks and reduces costs for users.

Store of value and hedge against inflation

In many countries with unstable economies, stablecoins have become a way for millions of people to secure their savings. When national currencies rapidly depreciate or access to dollars or euros is limited, users are turning to digital alternatives. Stablecoins don’t require cash and are independent of local banks, which may impose withdrawal or transfer restrictions. This allows people to feel more financially independent.

Moreover, stablecoins open access to decentralized financial services, such as lending and interest-bearing deposits. This means they offer the opportunity not only to preserve but also to grow capital. It’s important to understand that stability is ensured by linking to assets, but the guarantee isn’t always absolute. Issues with the issuer or sudden market movements can cause the exchange rate to fluctuate. Despite this, stablecoins generally remain a more reliable choice than local currencies, especially in countries with high inflation and currency controls.

Stablecoins are gaining popularity as a cash replacement for cross-border migration. Workers from countries with high inflation are transferring funds home, avoiding conversion losses and delays. The market for stablecoin wallets, accessible even without a bank account, is also booming.

Risks of centralization and dependence on the issuer

Despite the decentralized nature of blockchain, most popular stablecoins have a centralized governance structure. This means that the issuing company holds the reserves and is responsible for issuing tokens. This approach is transparent and convenient, but it also creates risks of dependency. If the issuer faces legal challenges, loss of trust, or fraud, users may lose access to their funds. The crypto market has seen cases where projects promised 100% security, only to have audits reveal shortcomings or insufficient reserves.

Another danger is the possibility of funds being frozen by the company or at the request of regulators. For users in countries with restrictions, this could lead to capital being frozen. Understanding these risks is important when choosing a specific token for storage or transactions, as not all projects are equally transparent and reliable.

Today, experts recommend diversifying funds across multiple stablecoins to reduce risks. Decentralized fractional-reserve stablecoins, where users can verify their collateral in real time, are also gaining popularity. Multi-currency projects are emerging, reducing dependence on a single asset.

Vulnerabilities of algorithmic models

In addition to stablecoins backed by reserves, there are certain algorithmic models. In these cases, the exchange rate is maintained through special mechanisms and smart contracts. Theoretically, this eliminates dependence on the issuer and makes the system fully decentralized. However, in practice, such projects often face difficulties.

The algorithm may work under normal conditions, but if demand plummets or users panic, it stops maintaining the exchange rate. The most famous example is the collapse of the TerraUSD ecosystem in 2022, when billions of dollars disappeared in just days. It was a telling example of how even a well-thought-out model can collapse under stressful scenarios.

Although developments in this area continue, and new projects provide more robust mechanisms, trust in them remains limited. Therefore, the choice between algorithmic and backup models must be made consciously, taking into account the objectives and acceptable risk level.

Hybrid solutions are currently being explored that combine algorithms with a fractional reserve in real assets. This helps mitigate market fluctuations and maintain exchange rates during stressful periods.

Regulation and development prospects

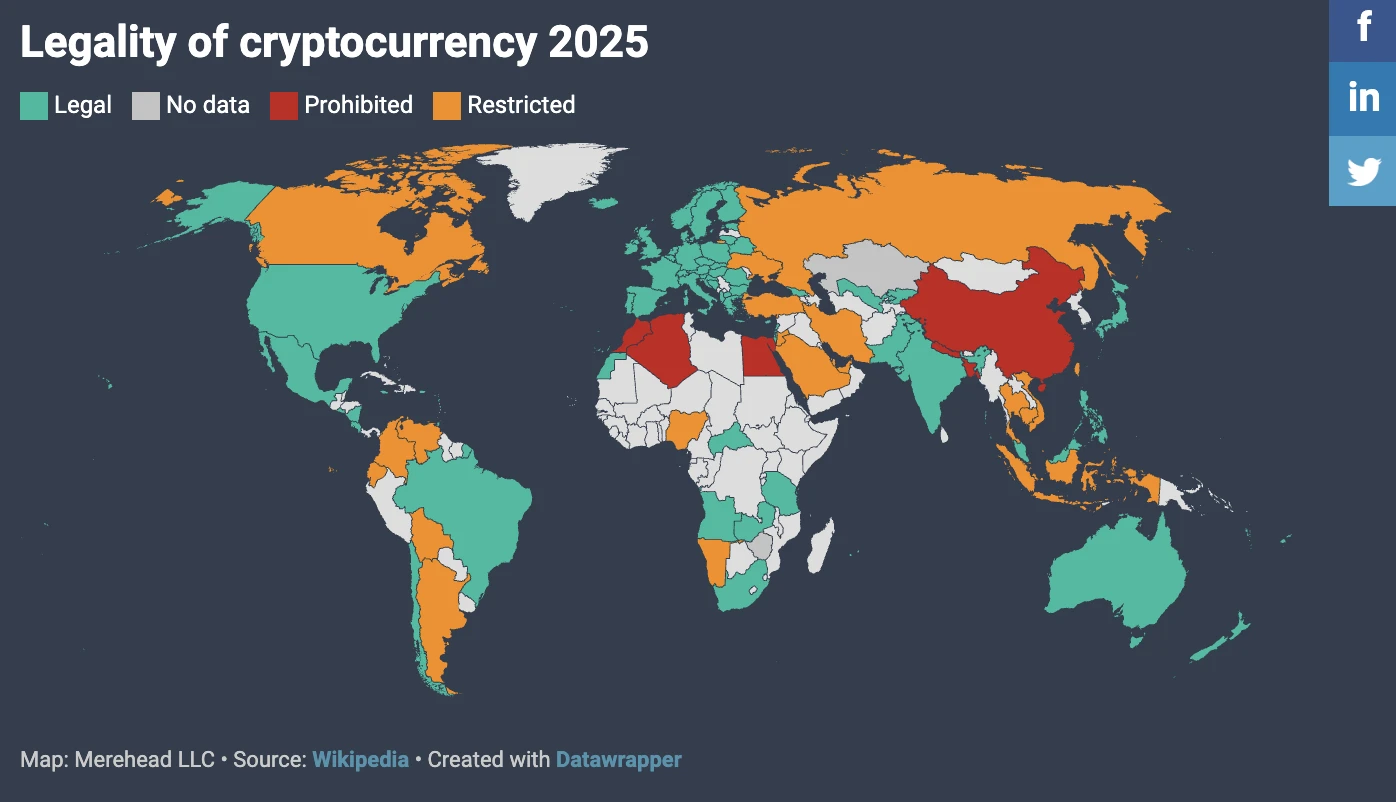

Stablecoins are increasingly attracting the attention of government agencies. On the one hand, digital analogues of fiat currencies facilitate international payments and can reduce transfer costs. On the other hand, they pose risks to financial stability, especially if issued in billions of dollars.

Therefore, governments around the world are developing regulations designed to ensure reserve transparency and user protection. In the US and EU, the following are being discussed:

- reporting standards;

- mandatory audits;

- capital requirements for issuers.

In Asia, some countries have already begun licensing companies issuing stablecoins. At the same time, central banks are developing their own digital currencies (CBDCs) that could compete with private tokens.

Prospects depend on the balance between innovation and oversight. Too much regulation could slow the industry’s development, but a lack of regulations increases the likelihood of crises. In practice, the future of stablecoins will likely combine government oversight with the preservation of some decentralized solutions.

Recently, there has been increasing discussion of the idea of global regulatory standards that would be applied uniformly to issuers across countries. Such unification could facilitate the cross-border use of stablecoins and reduce legal uncertainty.

There’s also a trend toward integration with the banking sector. Some major banks are beginning to test their own stablecoin products for corporate payments.

Stablecoins: What Matters Now for Operators

Stablecoins give you the speed and predictability that legacy rails struggle to match. They move funds across borders in minutes, run 24/7, and aim to hold a steady 1:1 value with a reference asset like the US dollar. That mix makes them useful for payouts, refunds, creator earnings, and holding working capital in volatile markets. For teams sending money to contractors or affiliates in multiple countries, stablecoins can cut fees and remove weekend delays that slow cash flow.

But tools are only as strong as their design and governance. Fiat‑backed coins depend on reserve quality and transparency. Look for monthly attestations from reputable auditors, clear disclosures on cash and T‑bill holdings, and proven freeze/unfreeze policies. Algorithmic models can fail during stress; most operators should avoid them. Centralized issuers can also freeze assets to meet legal requests, so choose tokens and platforms that publish controls and incident reports. As regulation expands, expect stricter KYC/AML checks and clearer standards for reserve backing, which is good for risk management but adds compliance steps.

For founders and marketers, the practical value shows up in three places:

- Faster settlements and lower fees for cross‑border payouts, letting you pay partners on time and reclaim hours lost to banking delays.

- Predictable pricing compared to volatile crypto, which keeps your accounting clean and reduces FX surprises on tight margins.

- Broader access for buyers and sellers where banks are limited or expensive, opening new markets without heavy fintech buildout.

Actionable Steps You Can Use This Week

- Pick your rails: Default to fiat‑backed stablecoins with frequent reserve attestations; avoid algorithmic models for operating cash.

- Standardize custody: Use a compliant, well‑rated custodian or exchange with strong security, role‑based access, address allowlists, and withdrawal locks.

- Control risk per wallet: Separate hot wallets for operations from cold storage for treasury; cap hot wallet balances to 1–2 weeks of payouts.

- Write the playbook: Document a stablecoin SOP covering token selection, whitelisted addresses, signer roles, payout windows, reconciliation steps, and incident response.

- Reconcile daily: Log tx IDs, amounts, and counterparties; match on-chain activity to invoices and your accounting system.

- Plan compliance early: Collect required KYC from payees, keep audit trails, and align with tax treatment in each market; review issuer and platform policies quarterly.

- Pilot with a narrow scope: Start with one region or one partner group, measure fee savings and settlement speed, then expand to affiliates, refunds, or marketplace sellers.

Real-World Uses to Start Now

- Global creator payouts: Pay weekly in stablecoins with a clear cutoff time; publish a simple help doc so creators know how to receive and convert.

- Supplier deposits: Hedge time-to-delivery risk by holding short-term operating cash in a top fiat‑backed stablecoin to avoid FX swings before settlement.

- Fast refunds: For high‑ticket digital goods, issue opt‑in stablecoin refunds to cut chargeback risk and reduce time-to-resolution.

Next Steps

Stablecoins bridge the gap between crypto speed and fiat stability. Used well, they improve cash flow, sharpen your unit economics on global payouts, and expand your reach where banks fall short. The edge comes from disciplined choices: stick to fiat‑backed coins with strong attestations, keep custody tight, separate operating and treasury wallets, and reconcile like clockwork. Treat this as core financial infrastructure, not a marketing experiment, and you’ll gain speed without taking on hidden risk. If you’re ready to go deeper, draft your SOP, run a two‑week pilot with a single partner segment, and review results with your finance lead before scaling to the rest of your operation.

Curated and synthesized by Steve Hutt | Updated September 2025

📋 Found these stats useful? Share this article or cite these stats in your work – we’d really appreciate it!