Verified & Reviewed

Published on July 28, 2025 Written By Rachel Hand

Published on July 28, 2025 Written By Rachel Hand

Subscribe for More

The flow of inventory is the lifeblood of ecommerce businesses. You need to know which SKUs you have on hand, how to budget for and predict demand, and how much your inventory is worth.

But the value of your inventory can change over time, which makes it tricky to keep track of. This is where good inventory accounting comes in; it helps you manage changing inventory values effectively.

In this post, we’ll walk you through inventory accounting best practices for ecommerce businesses, and explore the role it plays in your ecommerce operations.

What is inventory accounting?

Inventory accounting is the process of tracking and accounting for changes in the value of inventory over time as it relates to manufacturing and costs of goods sold.

Inventory as an asset vs. an expense

Inventory is usually classified as an asset. After all, it’s something your business expects to sell, which generates revenue. So, until you sell the inventory, it falls under a current asset on the balance sheet.

Once you sell inventory, the value of that inventory becomes an expense that’s recorded as cost of goods sold (COGS) in your income statement. COGS represents the direct cost of producing or procuring the goods that you sold (which you can later use to calculate gross profit).

Example: Say your business makes candles. You make 15 candles in a single batch, and each candle costs you $10 to make. Inventory is valued at its cost, not its selling price, so you have $150 worth of inventory. But you haven’t sold them yet — so on your balance sheet, you record $150 as an asset on your balance sheet.

You end up selling all 15 candles. On your income statement, you record $150 in COGS, because that’s how much it cost to product the 15 candles you sold.

If inventory get damaged or becomes obsolete, it can be expensed immediately, without having to be sold.

Why is accounting for inventory necessary?

If you don’t have an accurate method for keeping track of the value of your inventory, you can’t properly value your assets or goods sold and budget for the raw materials you need to buy for your business. Here are some of the benefits of accounting for inventory in each accounting period.

Calculate accurate profit

The accuracy of your financial statements is directly dependent on the accuracy of your inventory accounting.

Think of it this way: If it costs you $10 to create a product and you sell it for $15, then you can record a $5 profit. But if you think you only spent $9 to manufacture the product, you will record $1 more in profit for that sale than you actually earned.

These miscalculations can add up quickly and have devastating consequences for ecommerce businesses.

Audit suppliers’ charges

Suppliers frequently overcharge, and it’s difficult to catch it if you aren’t accounting for inventory. Detailed inventory accounting will reveal discrepancies in your books and help you resolve them — and could even help you cut production costs down the line.

Budget better

Inventory is often the most valuable asset for ecommerce businesses, and is a central component of your budget. This makes inventory accounting critical to properly gauging the overall financial health of your business and can even be the catalyst to looking into inventory financing.

How inventory bookkeeping works for retail and ecommerce businesses

There are a lot of day-to-day and period-end procedures involved in maintaining accurate inventory accounting. Let’s look at some of these essential procedures that are needed for ecommerce or retail inventory bookkeeping.

Periodic vs. perpetual inventory accounting systems

Perpetual inventory accounting systems allow retail and ecommerce businesses to track orders and inventory levels in real time.

Perpetual systems:

- Use point-of-sale (POS) systems or ecommerce platforms that are integrated with inventory management systems.

- Automatically update inventory counts and data when sales clerks or warehouse personnel scan product codes into the system (so whenever an item is sold or shipped out, the inventory data gets updated to reflect this).

- Are one of the most effective ways to keep track of inventory movement based on real-time sales information.

3PLs like ShipBob offer robust inventory tracking systems that integrate with your ecommerce platform. This supports real-time inventory tracking for perpetual inventory accounting.

However, perpetual systems aren’t great at factoring in inventory theft, product damage, or missing items. This means you’ll still need to do a manual audit occasionally to ensure that your inventory data matches your actual physical inventory.

Periodic inventory accounting systems involve a physical inventory audit at the end of an accounting period.

Periodic systems:

- Are not updated in real time, but are instead calculated at the end of the period instead.

- Require businesses to perform a complete physical count of their entire inventory.

- Produce a more accurate physical inventory count

However, periodic inventory accounting process can be time-consuming, often requiring some operational downtime. This is why many ecommerce brands use a perpetual inventory system to maintain real-time inventory records and reduce the amount of work needed for inventory accounting.

Recording inventory purchases

Another important step in inventory bookkeeping is recording your inventory purchases. You need to accurately account for any new inventory procured and update your stock levels and inventory ledger accordingly.

- Scan each inbound inventory item during the warehouse receiving process. This help you maintain accurate data on your stock count, as it automatically updates your inventory in your inventory management software system (IMS).

- Record the transaction in your inventory ledger to properly account for inventory costs. Make sure to include details about the purchased inventory, such as the date, quantity, supplier, and cost. Don’t forget to account for shipping, duties, and other acquisition costs on top of the inventory price.

These purchases will reflect in your books as purchased inventory that’s added to your beginning inventory for the period.

If you return any goods to suppliers, make sure to properly record this as well. This may occur when you bought excess goods or if the supplier made a mistake and sent more products than you actually need.

Handling deposits and prepayments

Sometimes, businesses put down a deposit for inventory they want to buy in the future. This can cause complexities and timing issues, especially when payments span multiple accounting periods. For example, you may pay a deposit during the first quarter and only receive the inventory in the second quarter because of production delays or raw material shortages.

Deposits should be recorded as prepayments or advances in your inventory records. You’ll need to enter the prepayment as a separate transaction in your journal entries. It will initially appear as a current asset on the balance sheet because it’s an expense not yet incurred. Once the expense is incurred, the prepayment will be deducted from the prepaid expense account.

Accounting for inventory adjustments

Despite your best efforts, you’ll probably hit some snags eventually, such as theft, loss, damage, and obsoletion. You’ll need to account for these events in your records, too.

This could involve an:

- Inventory reconciliation: A process where you perform periodic cycle counts to compare your physical inventory against your data to see if they match (and fix it if they do not).

- Inventory write-down: Write-downs are necessary when your inventory partially loses value but is still sellable. It’s a crucial step in accounting as it helps to reduce tax liability in case of damaged or excess inventory.

- Inventory write-off: Write-offs involve completely removing inventory from accounting records when it loses all of its value, such as in the case of theft, damage, or expiration.

Tracking multi-stage inventory (for manufacturers and hybrid brands)

If you create or produce your own inventory, you’ll also need to account for inventory across all its stages and forms. This includes:

- Raw materials inventory: This means tracking and valuing the materials used in production. It will include the costs of acquiring, storing, and using the materials. During the initial raw materials purchase, the raw materials inventory account is debited while the Accounts Payable account is credited. When the materials are used in production, they’ll then be transferred from the raw materials inventory account to the…

- Work-in-progress inventory: This consists of partially finished materials within the manufacturing process. Accounting for this type of inventory involves tracking the costs associated with partially finished goods, such as raw materials, direct labor, and manufacturing overhead (rent, utilities, and equipment depreciation). Once production is finished, the goods become…

- Finished goods inventory: This consists of ready-to-sell goods and are reported as current assets in the balance sheet. Accounting for this inventory involves calculating the cost of goods manufactured and the cost of goods sold.

IFRS vs. GAAP: Key differences in inventory accounting

When accounting for inventory, ecommerce businesses have two accounting standards to choose from:

- IFRS (International Financial Reporting Standards), which is a globally accepted set of principles used across different countries.

- GAAP (Generally Accepted Accounting Principles), which is the standard used in the United States.

There are several key differences between these two options. Here’s a breakdown of some of the biggest differences between IFRS and GAAP to help you decide what works for your business:

| IFRS | GAAP | |

| Scope | Used internationally | Specific to the United States |

| Focus | More principles-based | More rule-based with specific instructions on how to account for specific transactions |

| Inventory Valuation Methods | Allows FIFO and weighted average only | Allows FIFO, LIFO, and weighted average |

| Disclosures | Requires fewer disclosures | Requires more disclosures |

| Revenue Recognition | Recognizes revenue when value is delivered | Has specific rules for revenue recognition |

| Cash Flow Statement | Interest and dividends to be listed under operating or financing section | Interest paid and received + received dividends listed under operating section, dividends paid listed under the financing section |

| Asset Revaluation | More flexible; allows revaluation of most assets, such as property, inventories, intangible assets, etc. | Only allows revaluation of marketable securities at fair market value |

| Inventory Write-Down Reversals | Allows reversal of earlier write-downs in case inventory value increases later on | Doesn’t allow reversal of earlier write-downs |

How to account for inventory: top 4 methods

The most accurate way to calculate inventory value is to count each unit you have on hand and then add up the inventory costs of each product. Of course, this can be highly impractical, if not impossible for many ecommerce businesses and retailers.

Fortunately, there are a number of much more efficient methods of calculating inventory value. There are four widely accepted inventory accounting methods that can accurately track changes in inventory value while letting you avoid having to hit the shelves and count items one-by-one. Here’s how they work.

1. FIFO (first in, first out)

FIFO, the most commonly used inventory accounting method, assumes that the first products you received from your manufacturer will be the first ones sold and shipped out to customers. This allows you to calculate the value of inventory on hand despite changes in supplier pricing.

For example, let’s say you bought 5 of one SKU at $10 each and then another 5 of the same SKU at $15 each a few months later. If these 10 same products are in your available inventory and you sell 5 of them, using FIFO you would sell the first ones you bought at $10 each and record $50 as the cost of goods sold.

FIFO calculation example

Susan, who runs a pet supply store, starts the accounting period with 80 boxes of dog treats, which she had acquired for $3 each. Later, she buys 150 more boxes at a cost of $4 each, since her supplier’s price went up.

Susan now has 230 boxes of dog treats in stock. At the end of her accounting period, she determines that of these 230 boxes, 100 boxes of dog treats have been sold.

Using the FIFO method, Susan assumes that she sold all 80 of the original boxes before dipping into the newer stock. Thus, in her balance sheet, the total cost of goods she sold above (100 boxes) would be:

COGS = Starting Inventory + Purchases − Ending Inventory

COGS = (80 units x $3) + (150 units x $4) − (130 units x $4)

Notice that Susan lists the 130 units remaining in her inventory as costing $4 apiece. This is because she presumes that she sold the 80 units that she bought for $3 apiece first. There are no units of the first, cheaper batch of inventory left.

She finishes her calculation like so:

COGS = $240 + $600 − $520

COGS = $320

FIFO is especially beneficial for ecommerce brands selling perishable products, as it matches physical flow in most warehouses. It also helps to prevent obsolete inventory costs as your oldest inventory gets sold first.

However, there can be some discrepancies in case of a spike in COGS. It typically results in higher reported profits during inflation. As such, it can also lead to higher tax liabilities.

You can use 3PL warehouse management systems to effectively manage a FIFO method through physical stock rotations.

“From a FIFO perspective, we always want to make sure that the right products are going out to customers. We recently went through a packaging transition, so we needed to ensure that the right packaging was getting to the right facilities as we made those changes. When we were placing our B2B orders during this time, it was important that items had the right lot code, consistent packaging, and were compliant with retailer requirements.

With ShipBob, we were able to make sure no product got left behind and that all of our products were going out within the right timeframe. Using the ShipBob dashboard, we can track which lot codes are going out to which customers. It’s really important we have the transparency of lot tracking so we have the assurance that our customers are getting the right product.”

Jessica Stoller, Director of Supply Chain and Operations at Arrae

2. LIFO (last in, first out)

In the LIFO method, the most recently purchased inventory items are the ones that are sold and shipped out first.

Let’s use the same example above of purchasing 5 units of a SKU at $10 each and then another 5 of the same SKU at $15 each. If you sell 5 units using the LIFO technique, you would sell the 5 items you purchased most recently at $15 each and record $75 as the cost of goods sold.

LIFO calculation example

Let’s imagine a stationery business, who purchases 3 batches of 100 units each. The cost of the first batch was $1 each unit. Due to inflation, the next two batches cost $2 each and $3 each unit, respectively.

| Batch | Unit count | Cost per unit | Total cost |

| Batch 1 | 100 | $1 | $100 |

| Batch 2 | 100 | $2 | $200 |

| Batch 3 | 100 | $3 | $300 |

Then, this merchant sells 200 pens. With LIFO, the merchant assumes that they first sell all the inventory purchased in Batch 3, and then all the inventory from Batch 2. All of Batch 1 still remains on hand.

To calculate COGS, the merchant would therefore use the newest purchase prices.

COGS = (The Number of Newest Units x Their Value) + (Remaining Units From the Second Purchase x Their Value)

COGS = (100 x $3) + (100 x $2) = $500

Meanwhile, items of Batch 1 are considered unsold.

The ending inventory value reported would be:

Ending Inventory Value = Remaining Units x Their Value

Ending Inventory Value = 100 x $1 = $100

LIFO can have potential tax advantages during inflation as it leads to lower reported profits. However, this method is prohibited under IFRS while U.S. GAAP allows it. It’s also not recommended for perishable items or time-sensitive products.’

3. Specific identification method

Specific identification requires tracking each individual item in inventory from purchase to sale. When an item is sold using specific identification, the cost is matched to the initial buying price. This is the most accurate method, but also requires extremely detailed accounting.

4. Weighted average

The weighted average method averages out the cost of purchased goods in your available inventory. To calculate inventory value with the weighted average cost method, you just divide the total amount you spent on all the inventory you have on hand by the total number of items on hand.

Weighted average cost calculation example

The following formula is used to calculate weighted average cost:

WAC = Cost of goods available for sale / Total number of units in inventory

| Purchases for June | Quantity | Cost per unit | Total cost |

| Beginning inventory (June 1) | 100 | $2.50 | $250 |

| June 6 | 300 | $2.75 | $825 |

| June 15 | 200 | $3.00 | $600 |

| June 20 | 500 | $2.50 | $1,250 |

| Ending inventory (June 30) | 1,100 units | $2.65 (average weighted cost) | $2,925 |

The total cost of the inventory purchased is $2,925. The total number of units in inventory is 1,100. To calculate the WAC, follow the formula as follows:

WAC = $2,925 / 1,100 units

WAC = $2.65 per unit

This is a highly preferred method due to its simplicity, especially as it reduces the need for record-keeping. You can easily use ecommerce inventory systems to automatically recalculate averages with each purchase. It’s typically recommended for homogenous products (i.e., products that are all the same) and businesses with frequent inventory turnovers.

Let ShipBob take care of inventory tracking and management

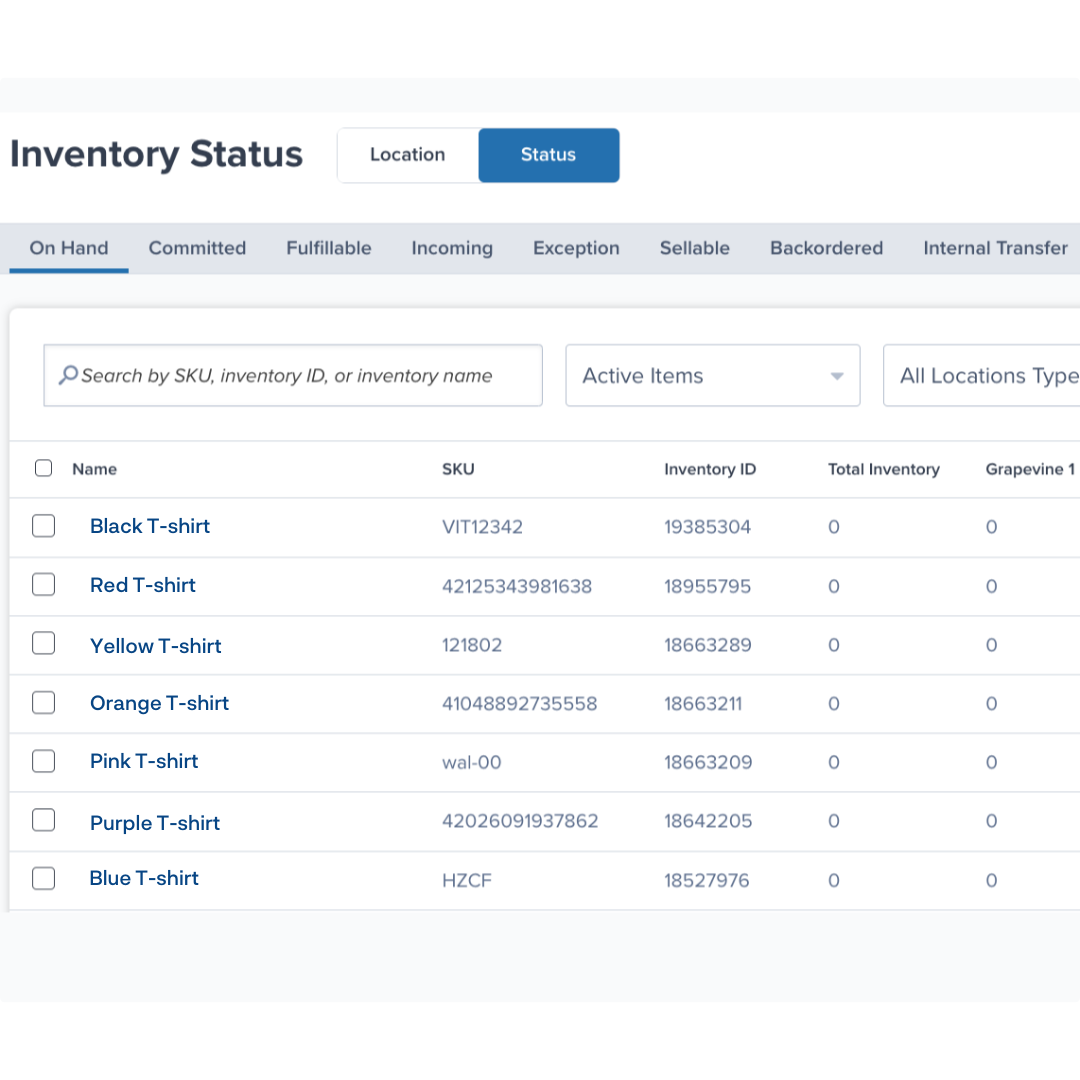

Inventory accounting is just one part of inventory management. ShipBob offers a complete ecommerce fulfillment solution with built-in inventory tracking and management software that gives end-to-end oversight and control of inventory. ShipBob helps ecommerce businesses with high inventory turnover scale and get orders shipped out quickly.

Real-time tracking

Most ecommerce businesses aren’t equipped to track their inventory in great detail. With ShipBob, you can view and track your inventory levels at each fulfillment center in real-time right from the dashboard.

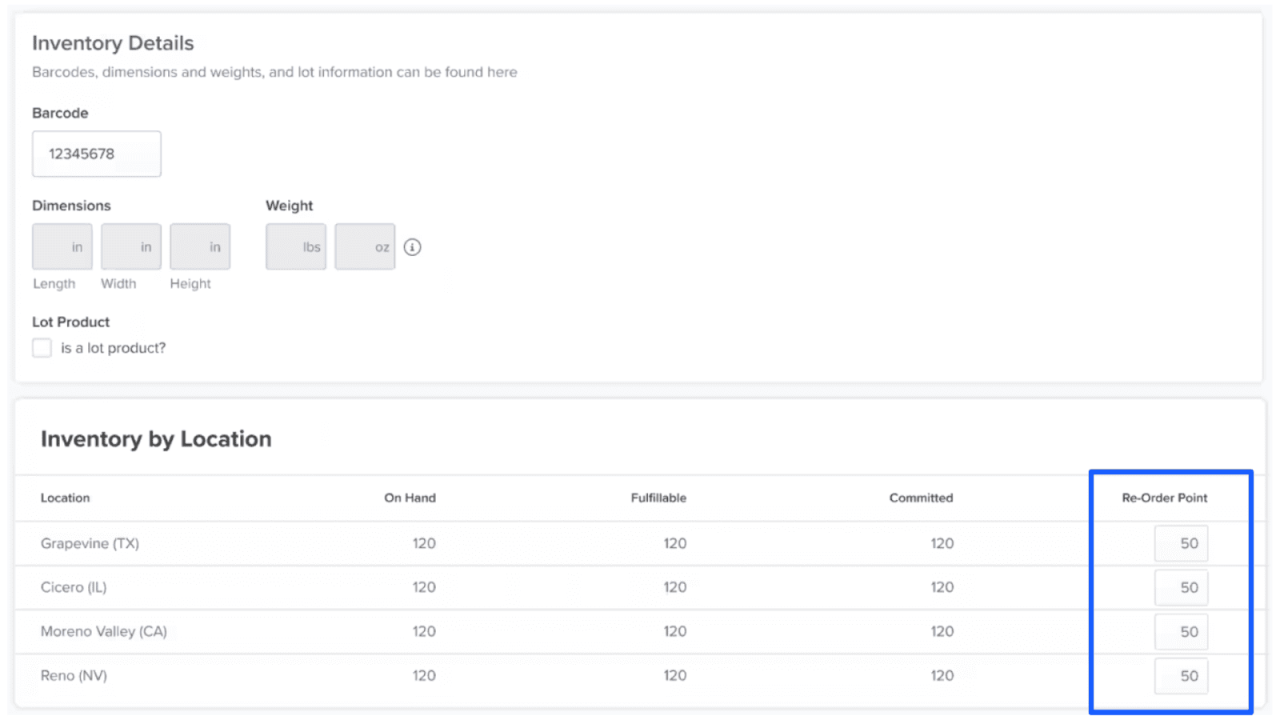

Automatic notifications when it’s time to reorder

Through ShipBob’s dashboard, you can set up reorder thresholds for every SKU. Once your inventory levels for that SKU deplete to that level, you’ll automatically get notified that it’s time to replenish. This helps you stay on top of demand, and avoid costly stockouts and backorders that complicate inventory accounting.

Manage inventory through a single dashboard

ShipBob’s network of global fulfillment centers lets you distribute inventory strategically to minimize shipping costs and times. This helps you save money while delighting customers — a win-win.

Not only that, ShipBob’s unified dashboard lets you monitor and manage a single pool of inventory across locations with ease, delivering up-to-the-minute insights and simplifying your day-to-day operations.

“The beautiful thing about it is everything was connected. I could log on to our ShipBob account and see everything in one place, no matter if I’m looking at our facility in Kankakee, IL, or the ShipBob fulfillment centers in Canada or Europe. It was all the same system. I didn’t have to learn various different platforms or deal with support representatives at different companies.

Plus, if we experience any issues with syncing orders between systems, there’s one place we go to reconcile it. ShipBob is connected to our ERP, NetSuite, which is our single source of truth. Now we only have one place to troubleshoot and resolve potential issues across all logistics.”

Adam LaGesse, Global Warehousing Director at Spikeball

Conclusion

Inventory management is related to every part of your business, and inventory accounting is critical to keeping up with your financial wellbeing.

If you’re looking for a third-party logistics (3PL) provider that helps with inventory solutions, warehousing, and ecommerce fulfillment, download our e-guide, “How to Choose a 3PL for Your E-Commerce Business,” and learn important tips and considerations.

To find out how ShipBob can help you optimize your inventory management and fulfillment, click the button below to get in touch.

Inventory Accounting FAQs

Below are answers to the most common questions about inventory accounting.

Which inventory accounting method is best for ecommerce?

There’s no single best inventory accounting method for ecommerce businesses. The ideal method for your business depends on various factors, such as the type of product, price volatility, and tax situation.

How does inventory accounting affect taxes?

Different accounting methods can increase or decrease your tax liability. For instance, FIFO may record higher profits during inflation, leading to higher taxes. Meanwhile, LIFO could reduce tax liabilities during inflation. Businesses can also enjoy tax benefits under the Internal Revenue Code Section 179, which allows you to deduct the full purchase price of qualifying equipment and/or software on your tax return.

What’s the difference between IFRS and GAAP for inventory accounting?

IFRS offers more flexibility as it’s more principles based, while GAAP is more rule-based.

IFRS also prohibits accounting methods like LIFO. Although GAAP permits this method, it’s not suitable for businesses operating internationally.

Additionally, IFRS requires fewer disclosures than GAAP. However, it’s crucial to understand the disclosure requirements under each framework.

How do I handle deposits for inventory not yet received?

Deposits for inventory not yet received will be treated as advanced payments in your journal entries. It will be debited from your prepaid asset account once the inventory is received.

How can I reduce manual errors in inventory accounting?

Using inventory systems that seamlessly integrate with your ecommerce platform and POS systems is crucial to reduce manual inventory accounting errors. You’ll also want to track inventory movement in real-time through your 3PL partners. Make sure you use a consistent process for documenting and tracking inventory and perform regular reconciliation and audits to ensure accuracy.