Key Takeaways

- Boost conversions by using Whop’s smart routing to rescue failed payments and capture up to 11% more sales.

- Set up fast by completing KYC, embedding checkout, and choosing payouts like ACH, local banks, or Bitcoin with clear fees and timelines.

- Support your team and customers with instant, global payouts and fewer failed checkouts that build trust and reduce stress.

- Explore a single platform that runs checkout, payouts, subscriptions, and affiliates so you can launch faster and cash out anywhere.

Picture this: you’ve done all the work to bring shoppers to your site, but your payment processor falters and a chunk of checkouts fail right at the finish line.

For DTC brands and creators striving for global reach, this isn’t just frustrating—it directly impacts lifetime value (LTV). The market demands a payment experience that matches your flexibility and persistence.

That’s why Whop is gaining so much traction. Rather than another patchwork of apps, they’ve built a social commerce platform designed with scalability in mind—an all-in-one hub built to grow with your brand. Their latest innovation addresses the “why did my customer get declined again” issue by streamlining payment processing worldwide. The outcome: near-instant global payouts across 241+ territories, support for every meaningful payout method (ACH, crypto, local rails), and smart routing that can boost revenue by up to 11%—all while reducing engineering complexity.

If you’re serious about minimizing checkout friction and delivering a flexible payment experience that meets shoppers where they prefer to pay, Whop’s approach deserves attention. It sits at the unique intersection of efficiency, reliability, and rapid cash flow—a winning combination in today’s evolving ecommerce landscape. As you plan your next stage of direct-to-consumer growth, it’s time to elevate your expectations for what a modern payment stack can truly deliver.

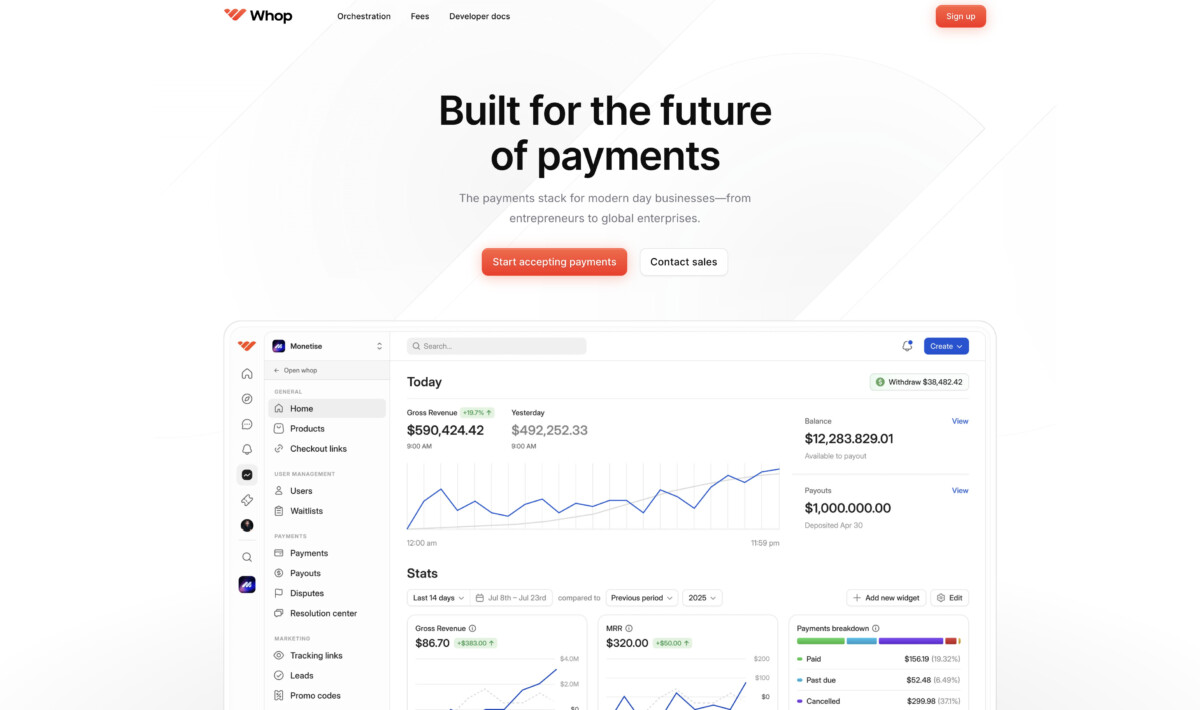

Meet Whop Payments: Powering the Next Generation of Social Commerce

Whop Payments isn’t just another payment gateway; it’s the ultimate solution for creators and ambitious founders looking to sell, get paid, and scale their side hustle—without the friction and limits of outdated platforms.

Built for an era defined by global, instant, and community-driven commerce, Whop delivers the technical backbone that allows you to reach anyone, anywhere, and access reliable payouts on your terms. Frustrated with clunky platforms, slow growth, and rigid payout systems? Whop’s unified system removes these barriers, tailored to the needs of modern sellers.

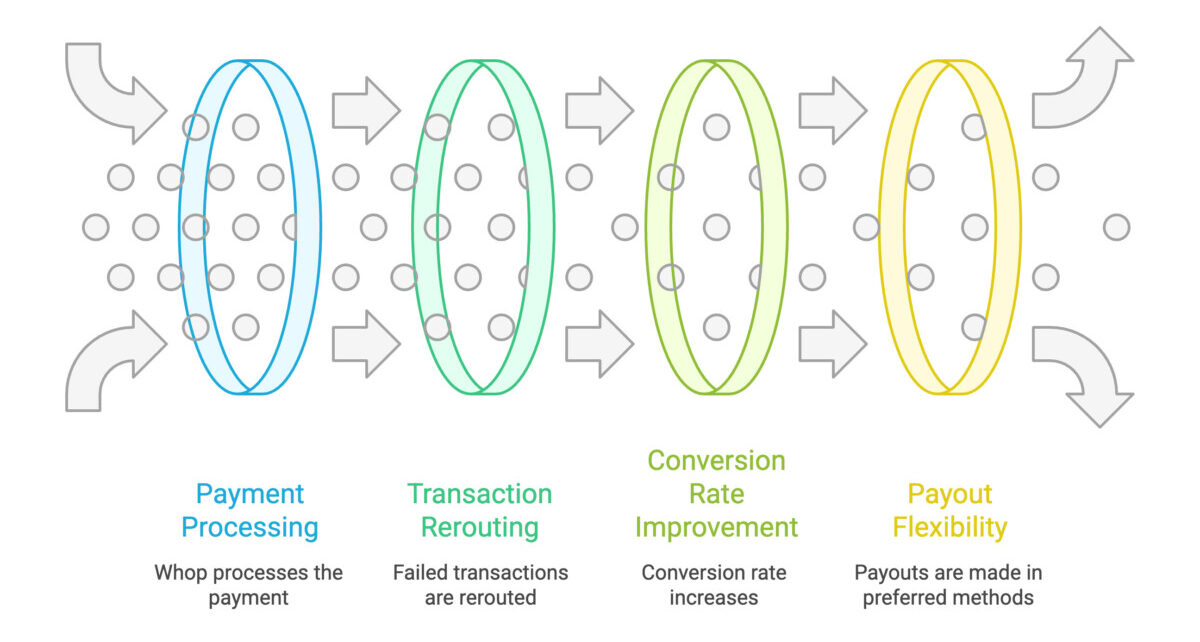

Smart Orchestration Maximizing Conversion Rate

What truly sets Whop apart is its orchestration system—a smart engine acting like an air traffic controller for payments. If a card fails, it instantly reroutes the transaction to another payment processor, ensuring customers don’t get dropped and sales don’t slip away. This orchestration can recover up to 11% of revenue lost to failed transactions, dramatically improving your conversion rate. Picture a Black Friday where your payment gateway runs with 99.9% uptime and effortless sales.

Flexible Payment Methods and Reliable Payouts Worldwide

Whop changes the rules on payouts by supporting earnings cash-out to over 241 countries and regions. With multiple payment methods available, including ACH, local bank rails, PayPal, Bitcoin, stablecoins, Venmo, CashApp, and traditional wires, sellers enjoy freedom and speed. Modern payment methods such as crypto payments and buy now pay later options create even more flexibility for today’s diverse commerce needs. Payouts are often same-day, always delivered in your preferred currency when possible.

Key payout features include:

- ACH transfers for US-based sellers with same-day potential

- Crypto payments for global, fast, and flexible withdrawals

- Local banking rails that avoid costly foreign exchange delays

- Social-friendly digital wallets like Venmo, CashApp, and PayPal

Transparent fees mean you’ll always know your costs, with flat rates and small add-ons per payment method—no surprises during reconciliation.

Simplified Integrations and APIs to Reduce Stack Complexity

Brands and creators often struggle piecing together solutions for subscriptions, affiliates, trials, customer support, and analytics. Whop streamlines this with built-in features from day one:

- Affiliate tracking without extra software

- Integrated chat, community access, and membership management

- Flexible installment plans, buy now pay later, trials, and subscriptions

- Automated tax and dispute handling so sellers can focus on growth, not admin

All these tools connect through a single backend with unified reporting and 24/7 human support, offering world-class service with sub-60 second response times in most cases. Whop’s robust APIs make integrations seamless, so growing businesses don’t lose sleep over technical complexity.

Built for Today’s Sellers (and Tomorrow’s Growth)

Whop Payments isn’t limited to one market or niche—it’s already powering over 27,000 brands that have processed more than $1.6 billion in transactions. New features roll out weekly, based on what sellers truly demand: from anti-fraud machine learning, to affiliate payouts, to direct community management, Whop’s ecosystem helps you upgrade monetization without extra overhead.

If your tech stack feels like a fragile Jenga tower of apps, Whop offers more than just a payment processor—it’s a comprehensive toolkit designed for scaling without the usual headaches. The era of losing sales to failed payments or payout drama is ending. Whop provides the blueprint for fast, borderless, and creator-driven commerce.

Why Online Payments Are Broken

If you run an online business and have ever lost sleep over unexplained checkout drops or the headache of untangling failed payments, you’re not alone.

Most scaling ecommerce brands I know have stared at their dashboards and thought, “What is actually going wrong?” The truth is, payment failures rarely trace back to a single culprit—it’s death by a thousand paper cuts. Here’s where things crumble most often.

Fragmented Systems and Siloed Data

One of the biggest killers of conversion rate is the basic fact that payment data lives in silos. Most brands operate with multiple payment processors, payment gateways, banks, and software tools, but they rarely share context. For example, even popular payment processor platforms like Stripe can be part of a fragmented system. As a result, 82% of merchants can’t even pinpoint why a transaction failed. You can’t fix what you don’t track, and this leads to massive blindspots when optimizing your checkout funnel.

Disconnected systems also mean:

- Manual re-entry of data, which slows down the process and introduces errors

- No single source of truth for customer payment activity, making reconciliation tedious

- Every extra integration is another potential point of failure

High Failure Rates and Hidden Churn

Every failed payment is more than a missed sale—it’s a hit on your brand trust. The ecommerce industry average for online payment failure sits at over 10% per transaction. If that sounds small, run the math against your Q4 revenue plan. That’s an average of $31 billion lost in retail sales for a single quarter across the industry.

The catch is, most customers won’t try the transaction again. They bounce, and your LTV quietly erodes behind a wall of decline codes and unhelpful error messages. Even worse, these failures often trigger unnecessary churn in subscriptions or memberships, bleeding future revenue no one ever sees coming.

Fraud, Compliance, and False Declines

With digital payments on the rise, so is fraud—projected to hit $48 billion globally for ecommerce this year. Most fraud tools still flag legitimate transactions by mistake, meaning you bear all the fraud prevention costs while still losing good orders to “false positives.” Securing transactions without frustrating customers can be a tough balance. Add to that outdated KYC (Know Your Customer) requirements, which can frustrate real buyers and spike churn. The moving target of regulatory compliance creates even more complexity for international brands.

Solutions like payment vaulting and tokenization aim to help, but in practice, the more tools you bolt on, the more room there is for misfires.

Cost and Lack of Flexibility

It’s not just about speed and security—transaction fees add up quickly. Between card networks, payment processors, and middlemen, margins get sliced at every stage. Manual AR/AP and limited payment options also lock up working capital and block new markets. Old-school systems that only support cards or wire transfers can’t serve today’s buyers who want ACH, wallets, or crypto payouts on their terms.

Where Payment Costs Stack Up

Slow Payouts and Legacy Infrastructure

Your team hustles to deliver, but payments still move like it’s 2005. Especially in the US, multiple layers of banks, processors, and facilitators create delays. Emerging markets can pay out instantly, but many US sellers are waiting days just to access funds. Without instant settlement, your ability to react to opportunity, re-invest, or simply pay vendors hits a wall.

Most brands try to fix problems with more tools, but each layer of complexity adds delay. Political drag—like the absence of a unified national ID—also blocks innovation and slows improvements year by year.

The Takeaway for Growth-Focused Brands

If any of these pain points feel familiar, know you’re in good company. The problem isn’t just technical—it’s systemic. High failure rates, poor data visibility, and rigid old infrastructure quietly strangle growth even as your top-line numbers rise. Brands that want to move fast and win need a partner who obsesses over these details so they don’t have to.

If you’re interested in strategies that proactively fight these bottlenecks while driving better retention, I recommend looking into how dynamic friction in ecommerce can directly reduce churn and save sales at the final step.

Inside Whop Payments

There’s nothing more frustrating than seeing hard-won shoppers drop off at checkout or watching payouts get held hostage by outdated payment systems. Whop has flipped the script for sellers who want every transaction to go through and every dollar to land where it should—fast and on your terms. Let’s break down exactly how.

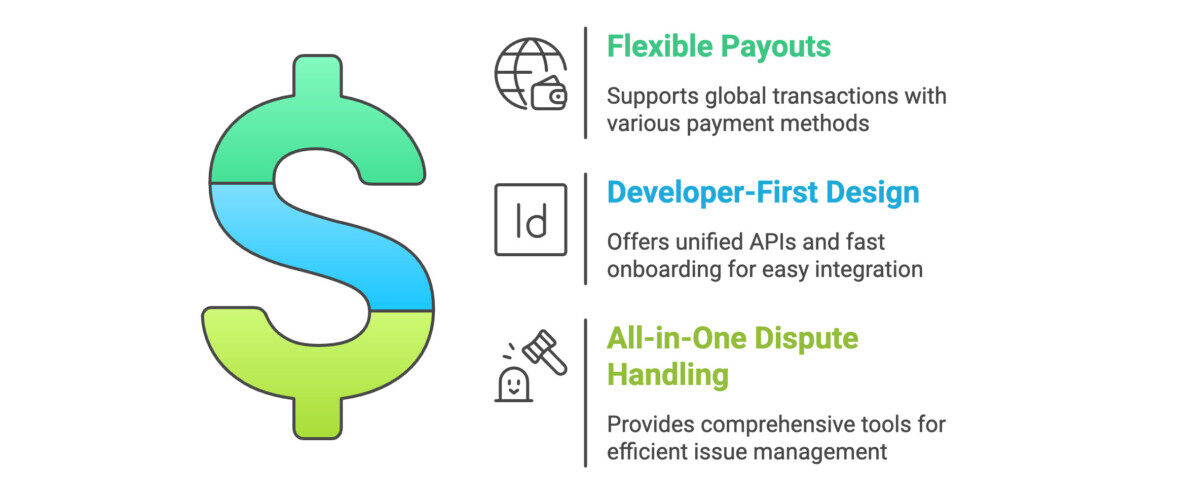

Flexible, Global Payouts for Modern Sellers

Built with the reality of global commerce in mind, this payment platform supports buyers and partners across more than 241 countries and regions. Here’s how it delivers true payout flexibility:

- Coverage in 241+ Territories: Supporting sellers from New York to Nairobi and beyond, enabling smooth global payments worldwide.

- Modern Payment Methods: Choose from local bank transfers, ACH, Venmo, Cash App, Bitcoin, and stablecoins—ensuring options that fit your operational needs without locking you in.

- Automatic Local Currency Conversion: Payments are converted automatically into your preferred currency before hitting your account, helping you avoid unexpected FX surprises.

- Withdrawal Timing and Thresholds:

- Reliable payouts become available within 1–4 business days of each sale.

- Transfers to your bank may take up to 10 business days, depending on country and method.

- Minimum withdrawal thresholds (e.g., $10) keep accounts organized.

- Recurring Withdrawals and Status Tracking: Customize your payout schedule and minimum balance, while the dashboard provides real-time withdrawal status updates—from “processing” to “in transit” with timestamps—so you always know where your money is.

This level of precision streamlines payouts, giving finance teams confidence in cash flow forecasting and eliminating “where’s my money?” support tickets.

Developer-First with a Human Touch

DTC brands need rapid integration and real support when it counts. Whop’s solution makes payments something you don’t have to babysit—or cobble together with duct tape and Zapier.

- Unified APIs: A single set of powerful, well-documented APIs manages payments, refunds, subscriptions, and payouts. No tangled code, no toggling between multiple dashboards—your team connects once and focuses on growth.

- Enterprise-Grade Account Management: For high-volume sellers, there’s direct account management, advanced fraud controls, 24/7 human support, and free access to a dedicated Slack channel, keeping you closely connected with experts familiar with your stack.

- Fast Onboarding: Native KYC setup gets you selling in minutes, not days.

This combination of reliable payouts and developer-friendly design transforms payments from a headache into a scalable growth asset.

All-in-One Approach to Payments and Dispute Handling

Beyond payout flexibility and seamless integrations, this platform also offers streamlined dispute handling to protect sellers and maintain smooth cash flow. When failure isn’t an option, these comprehensive tools ensure every transaction—and any issue that arises—is managed efficiently and transparently.

What Whop Payments Means for DTC Brands and the Creator Economy

The DTC world moves fast, and the creator economy changes even faster. Brands and creators want fewer headaches—especially when it comes to getting paid, running communities, and turning audience attention into profit. This solution is designed to solve those exact pain points, not by patching over old hurdles but by rebuilding the entire checkout and payout process with today’s growth-focused operators in mind.

Instant Global Payouts: Cash Flow Without Borders

Here’s a reality check: Most platforms slow you down with payment rails stuck in old banking habits. With truly efficient global payments, sellers in over 241 countries gain access to flexible payouts in their own currency, whether through ACH deposits, local bank transfers, Bitcoin, or even Venmo. No more crossing fingers on payout windows or finding out your method isn’t supported at scale.

- Withdrawal speed: Money is usually available within 1–4 business days—no waiting for a slow Thursday transfer.

- All the rails you need: ACH, crypto, Venmo, CashApp, and more, so you stay in control.

- Automatic currency conversion: That means you don’t eat FX losses or stress about international customers.

The impact? DTC operators and creators alike see a predictable cash cycle, enabling faster reinvestment into ads, inventory, or team. Your cost per acquisition (CPA) models won’t get crushed by payout lag, driving better cash flow and scalability for your online business.

Smart Checkout Routing: Every Sale Counts

Failed payments quietly kill growth. Advanced payment routing directs every transaction through the path most likely to succeed, automatically switching to an alternate payment processor if a card fails. This can translate to up to 11% higher conversion rates at checkout. For DTC brands, that’s not a rounding error—it’s real revenue you can’t afford to leave on the table during launches or Q4 sprints.

If you’ve wrangled with three or more payment plugins like Stripe, you know the pain of troubleshooting lost orders and mysterious declines. Intelligent routing removes that roadblock. Customers check out smoothly, and your team spends less time debugging and more time scaling.

Built for Product Drops, Memberships, and Community

Most brands and creators juggle a Frankenstein mix of tools: one for checkout, another for fulfillment, a third for community or subscriptions, and yet another for CRM. The platform offers one dashboard for it all:

- Product flexibility: Sell one-time purchases, subscriptions, bundles, and even modern options like buy now pay later, covering digital and physical goods—whatever fits your funnel.

- Automated fulfillment: Trigger shipping, assign digital access, or grant community roles instantly through integrations with services like Zapier.

- Built-in community tools: Use gated chat access with Discord, Telegram, or custom apps, layered right into each product. That turns every sale into a touchpoint for engagement and unlocks membership perks with zero friction.

The result: your brand looks organized and modern, and your customers enjoy a premium, connected buying experience.

Powering the Creator-Brand Playbook

The creator economy isn’t only about sponsored posts; it’s about launching your own brand, owning your conversion funnel, and building recurring revenue. Many side hustle sellers use this solution to sell digital products, courses, and memberships, seamlessly combining sales and community into one customer journey.

What’s happening at the brand level?

- Direct checkout links: Shareable through any channel—TikTok, email, SMS, or Discord—to meet your audience where they are.

- Affiliate programs: Track and auto-pay creators without relying on third-party payout systems.

- Performance data: Access real-time sales and funnel analytics to double down on what’s working without drowning in spreadsheets.

This model also fits DTC leaders working with influencers—transparency, predictable payouts, and real access to campaign data build trust on both sides. For a closer look at the mechanics behind creator-driven social selling, check out these insights on the creator economy’s evolution.

Leveling the Playing Field With Lower Fees

Legacy merchant of record payment stacks eat into your margin at every step—processing, cross-border, and platform fees all pile up. A flat, transparent fee structure makes costs predictable, so smaller creators and fast-growing DTC shops don’t get burned on the way up.

- Small business friendly: Free to start, only 3% on sales plus processor fees.

- No long onboarding: Begin testing ideas and taking sales without getting stuck in KYC red tape.

- Scales as you do: Whether your side hustle turns into a fast-growth DTC powerhouse, you won’t outgrow the platform or find yourself hunting for workarounds.

This approach lets both tomorrow’s DTC unicorn and today’s sideline creator access big-league tools without the overhead.

Solving the Real Bottlenecks for Ambitious Operators

This is where experience matters. Most payment failure issues aren’t just a Stripe webhook gone wrong—they’re systemic, built-up friction from old tools pieced together over time. This platform studied the root problems, not just the surface symptoms.

- Checkout failure

- Slow access to funds

- Lack of modern rails

The Takeaway for Brands and Builders

The pattern is clear: DTC brands and creators are outgrowing stitched-together platforms and patchwork payment hacks. This payments solution offers a blueprint that supports instant payouts, higher conversion, and real community growth. It’s about control, trust, and building momentum that compounds month after month—bringing global reach and true scalability to your online business.

Getting Started: How to Cash Out Anytime, Anywhere

Every founder at this table has felt the old pain: earning money online only to wait days (sometimes weeks) for funds to hit your account—or worse, getting stuck when your preferred payout isn’t supported. If you’re moving at DTC speed, slow or unpredictable payouts drag on your momentum, block reinvestment, and frankly, make it tough to trust your payment partner. Modern payment processing solutions show that “getting paid” doesn’t have to mean “waiting on a mystery timeline.” Here’s exactly how to get set up and unlock instant global cashouts—no drama, no edge-case headaches.

Frictionless Onboarding: Start Selling in Minutes

Traditional payment platforms drown new sellers in KYC friction, compliance checks, and slow account approvals—costing you time and energy before you even make your first sale. This payment platform flips the script: you can set up your store, onboard with its built-in KYC flow, and get ready to accept payments in under an hour.

- No KYC bottlenecks on day one: You don’t need to slog through paperwork just to start taking sales. Full KYC kicks in only when you’re ready for payouts, letting you launch fast and scale with confidence.

- Simple, clear dashboard: The updated dashboard gives you one place to manage products, track payout status, and see high-level business insights without jumping across tabs or tracking down reports.

This setup approach means you stay laser-focused on sales, not on admin tasks. I’ve seen sellers go from “new idea” to live checkout links in a single afternoon.

Your Choice: Local Banks, Crypto, or Digital Wallets

Once the money is rolling in, the next big question is: “How do I want to get paid—today?” This platform lets you choose from a variety of payment methods that put others to shame. You can:

There’s built-in flexibility. If you’ve worked with legacy systems, you know that switching payout methods often means another compliance check, delay, or new fee structure. This solution lets you toggle payout preferences with just a few clicks—no ticket required.

Here’s the kicker: payouts can even run instantly (or same day) in many cases, while still maintaining a flat, transparent fee structure. For operators managing international teams or working with affiliate partners in multiple regions, this flexibility alone is a real growth lever.

Instant Withdrawals and Real-Time Activity Tracking

Most platforms tell you payments are “processing” but keep you in the dark on timelines. With this system, you don’t have to guess when to reinvest those funds or pay your team. Their all-new dashboard homepage pulls live payout data together, showing:

- Instant withdrawal eligibility as soon as a transaction settles.

- Real-time activity feed with updates on every sale, payout approval, and deposit.

- Automated currency conversion so you always see your true available balance, not just a USD placeholder.

You can draw down daily, weekly, or as often as your cash flow model demands. No more waiting for a random batch cycle or chasing support tickets to track payouts.

Don’t Get Tripped Up by Hidden Fees

I hear founders hesitate on payout tools because of the unpredictable cost: surprise fees for exotic currencies, hidden surcharges for “instant” withdrawals, or unclear pricing for crypto payouts. This platform acts as the merchant of record, providing flat, published pricing that anyone can check up front—eliminating the usual legal overhead.

- Small business and creator rates: 2.7% + 30¢ per transaction (enterprise down to 2.5%).

- No extra markup for digital wallets, crypto, or international banking rails.

This means you can forecast your exact take-home on every order and avoid margin erosion, even when scaling into new markets. Transparent transaction fees don’t get enough respect in the payment world—but for ambitious operators, knowing your net payout is non-negotiable.

Building a Repeatable Withdrawal Playbook

The smartest DTC leaders I know set up systems, not manual “check the dashboard every Friday” routines. With this approach, it pays to build a predictable cashout playbook:

- Set your withdrawal schedule: Weekly, daily, or based on available balance—whatever fits your cash needs.

- Assign responsibility: Delegate payouts through structured account management using dashboard roles (no worry about access sprawl).

- Automate reporting: Pull real payout data into your accounting tools via available APIs, or just schedule a Friday download of transactions for your bookkeeper.

You want your payments setup to run quietly in the background, so you can spend mental energy on campaigns and product, not wire instructions.

Bottom Line: Getting started with a streamlined payment system isn’t just painless—it gives your online business a real advantage over slow-moving competitors who are still stuck on the old rails. Check your next payout cycle. Is it as fast and flexible as you want? If not, that’s a high-impact quick win waiting on your table.

Summary

Whop Payments tackles the two biggest money leaks in ecommerce: failed checkouts and slow, rigid payouts. Its smart routing system retries transactions across multiple providers in real time, which can recover up to 6–11% of lost revenue during peak periods. That is real lift you can feel in Q4 and during launches. On the cash flow side, sellers can withdraw earnings in 241+ countries with options that fit how you actually run the business: local bank rails, ACH, wires, Venmo, Cash App, Bitcoin, and stablecoins. Funds are typically available within 1–4 business days, with clear timelines and flat, transparent fees, so finance teams can plan without guesswork.

What stands out is the “all-in-one” stack that reduces tool sprawl. You get checkout, subscriptions, trials, affiliate tracking, community access, and dispute handling in one place. Developers plug into unified APIs, while operators get a clean dashboard, near-instant onboarding, and 24/7 human support. The result is less maintenance and more momentum.

Practical moves for founders and marketers:

- Audit failure points: Pull last 90 days of decline codes, then compare conversion with a routed checkout; aim to claw back 6–11% of lost orders.

- Standardize payouts: Pick two default methods per team or region (e.g., local rails + ACH) and set weekly auto-withdrawals to improve cash predictability.

- Simplify the stack: Replace separate tools for affiliates, subscriptions, and community access with Whop’s built-ins to cut costs and reduce errors.

- Stress test for peak: Run a mock BFCM using Whop’s checkout links across email, SMS, and social to validate uptime and failover before it matters.

- Shareable links for creators: Give affiliates and influencers direct checkout links to remove steps, boost conversion, and track performance cleanly.

If your growth is capped by drop-offs at the finish line or by payouts that arrive too late to reinvest, this is the kind of payment infrastructure that creates a lasting edge. You’ll win more orders, free up cash faster, and focus your team on scaling, not firefighting.

Next steps:

Map your current checkout failure rate, test Whop Payments routed checkout on a single product or drop, and set a two-week pilot with clear success metrics like conversion lift, time-to-cash, and support tickets reduced.

Frequently Asked Questions

What is Whop Payments, and why does it matter for ecommerce brands?

Whop Payments is a modern payment system that reduces failed checkouts and speeds up payouts for DTC brands and creators. It matters because it can recover 6–11% of lost revenue and gives sellers fast, flexible access to cash in 241+ countries.

How does Whop’s smart routing reduce failed payments?

Smart routing retries a payment through alternate processors in real time when a card gets declined. This increases the chance the transaction goes through without the buyer noticing extra steps, lifting conversions during launches and peak sales.

What payout options does Whop support for global sellers?

You can cash out through local bank rails, ACH, wires, Venmo, Cash App, Bitcoin, and stablecoins. Funds are usually available to withdraw within 1–4 business days, with clear timelines and flat, transparent fees.

How fast can my team get paid, and how predictable are payouts?

Most sales become available for withdrawal within 1–4 business days, and bank transfers can complete in up to 10 business days depending on your country and method. The dashboard shows payout status and timing, so finance teams can plan cash flow with confidence.

Can Whop replace other tools like affiliate tracking and subscriptions?

Yes, Whop includes affiliate tracking, subscriptions, trials, community access, dispute handling, and reporting in one platform. This reduces tool sprawl, cuts integration risk, and gives operators a single source of truth.

Is crypto required to use Whop Payments?

No, crypto is optional; it’s one of several payout methods alongside ACH, local banks, and digital wallets. Sellers choose what fits their needs, and they can change methods without opening support tickets.

What are the real costs, and how do fees impact margin?

Entry pricing is a simple percentage per transaction, with no hidden markups for wallets, crypto, or international rails. Transparent, flat fees make it easier to forecast net revenue and protect margin as you expand into new markets.

What is one actionable step I can take this week to test Whop’s impact?

Run a controlled test on a high-intent product using Whop’s checkout links across email and SMS. Compare checkout conversion, decline rates, and time-to-cash versus your current setup over 14 days.

What common myth should brands ignore about payment failures?

Many teams assume most declines are “just fraud” or customer error, so they accept the loss. In reality, a large share are preventable false declines, and smart routing plus clear error handling can recover meaningful revenue without adding friction.