Key Takeaways

- Outperform your competitors by turning chargeback data into a strategic advantage that protects your profit margins and scaling plans.

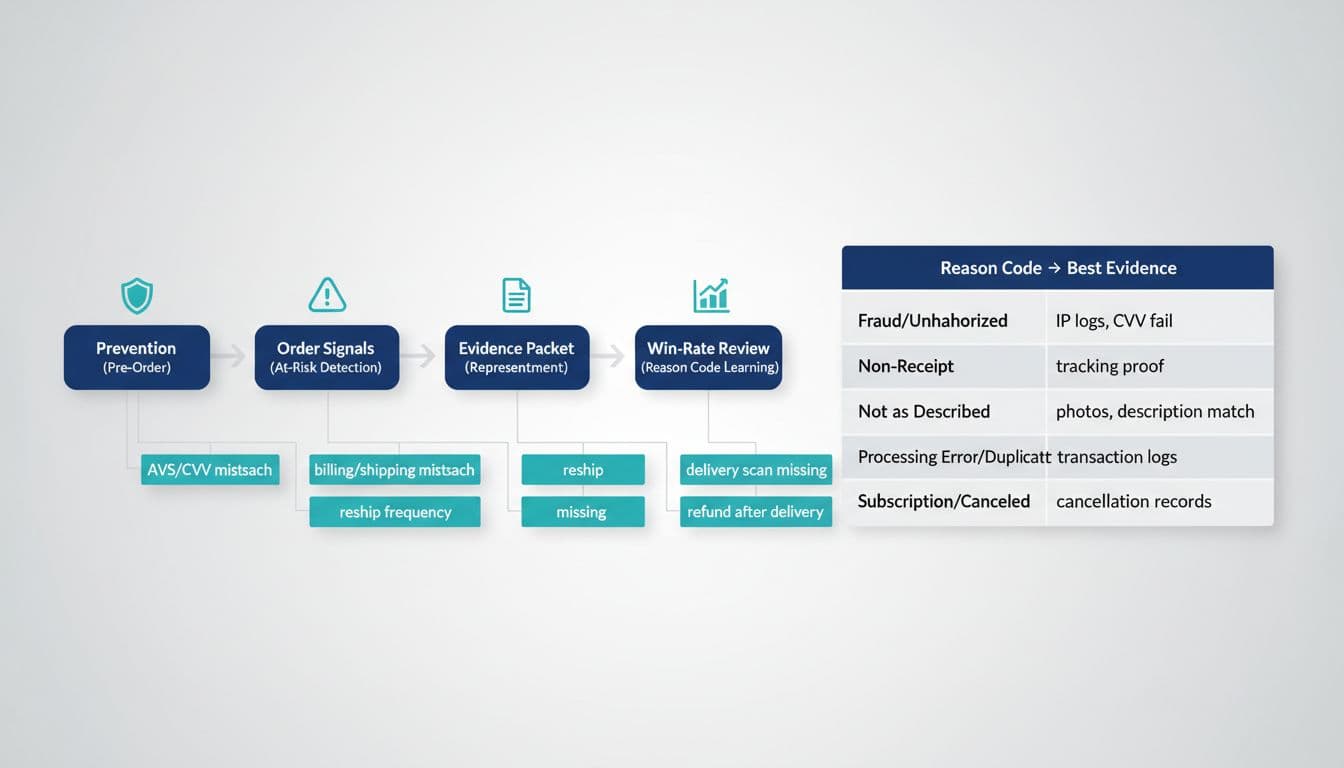

- Follow a consistent four-stage loop of prevention, risk detection, evidence collection, and result review to handle every dispute like a professional operator.

- Reduce stress for your team and customers by clarifying shipping times and return policies so confusion doesn’t turn into a bank dispute.

- Swap out generic rebuttals for specific evidence packets that give bank reviewers exactly what they need to rule in your favor instantly.

A chargeback is the kind of “small” problem that quietly turns into a big one.

It hits your margin, your ops team, your ad scaling plans, and sometimes your payment processing health.

Here’s the hard truth I’ve seen across hundreds of Shopify brands (and echoed through 400+ founder and expert conversations): most chargebacks aren’t sophisticated crime rings. They’re confusion, impatience, and process gaps that customers punish with the one button that always works, disputing the charge with their bank.

This playbook is built for real operators. Whether you’re fighting your first ugly dispute or managing volume at 7 to 8 figures, the framework stays the same: prevent what you can, detect risk early, submit tight evidence, then learn by reason code.

Why Shopify chargebacks happen (and why “fraud” isn’t the whole story)

Chargebacks show up when a customer believes one of three things: they didn’t buy it, they didn’t get it, or it wasn’t what they expected. Sprinkle in “I canceled” and “I got charged twice,” and you’ve covered most of the inbox.

Recent industry reporting consistently points to a rising share of “friendly fraud,” where the customer received the product but disputes anyway. The SEON team summarizes the Shopify side of this problem well in their guide to chargeback protection and prevention on Shopify, including why clear policies and strong order verification do more work than most people expect.

Two stage-specific patterns to watch:

- Early-stage stores often lose disputes because they can’t produce clean records fast (tracking links, policies shown at checkout, customer comms).

- Scaling brands often lose disputes because they have too many systems, and evidence lives across email, helpdesk, 3PL portals, and ad platforms with no single “truth.”

If you want a broader baseline, this pairs well with Ecommerce Fastlane’s breakdown on preventing ecommerce fraud and chargebacks, especially the operational habits that stop disputes before they start.

The EcommerceFastlane Shopify chargeback prevention framework (4 stages)

This is the “do it Monday morning” version: Prevention (pre-order) → Order Signals (at-risk detection) → Evidence Packet (representment) → Win-Rate Review (learning loop).

Stage 1: Prevention (pre-order) that actually reduces disputes

The best dispute is the one you never receive. Prevention is mostly “boring,” which is why it works.

Focus first on these four levers:

Billing clarity: Make your statement descriptor recognizable, keep receipts and order confirmations consistent with your brand name, and reduce “I don’t recognize this” disputes. Chargebacks often start with confusion, not anger.

Shipping expectations: Put delivery timelines where customers can’t miss them (product page, cart, and post-purchase). Late deliveries create “non-receipt” disputes that are hard to unwind.

Returns and refunds that don’t feel like a fight: Your policy needs to be clear, visible, and realistic. If the customer thinks you’re ignoring them, they’ll escalate to the bank.

Risk controls that don’t crush conversion: Use Shopify’s native signals, and add friction only when risk is high (not for everyone). Shopify has also invested heavily in ML-based protections; this overview of Shopify Payments’ AI-driven fraud reduction explains how those systems can improve payment success and reduce fraud chargebacks.

If you run subscriptions, your prevention checklist expands. Most “subscription” disputes are not malicious, they’re memory and cancellation friction. Start with Ecommerce Fastlane’s guide on subscription billing chargeback prevention and audit whether customers can cancel in under 60 seconds.

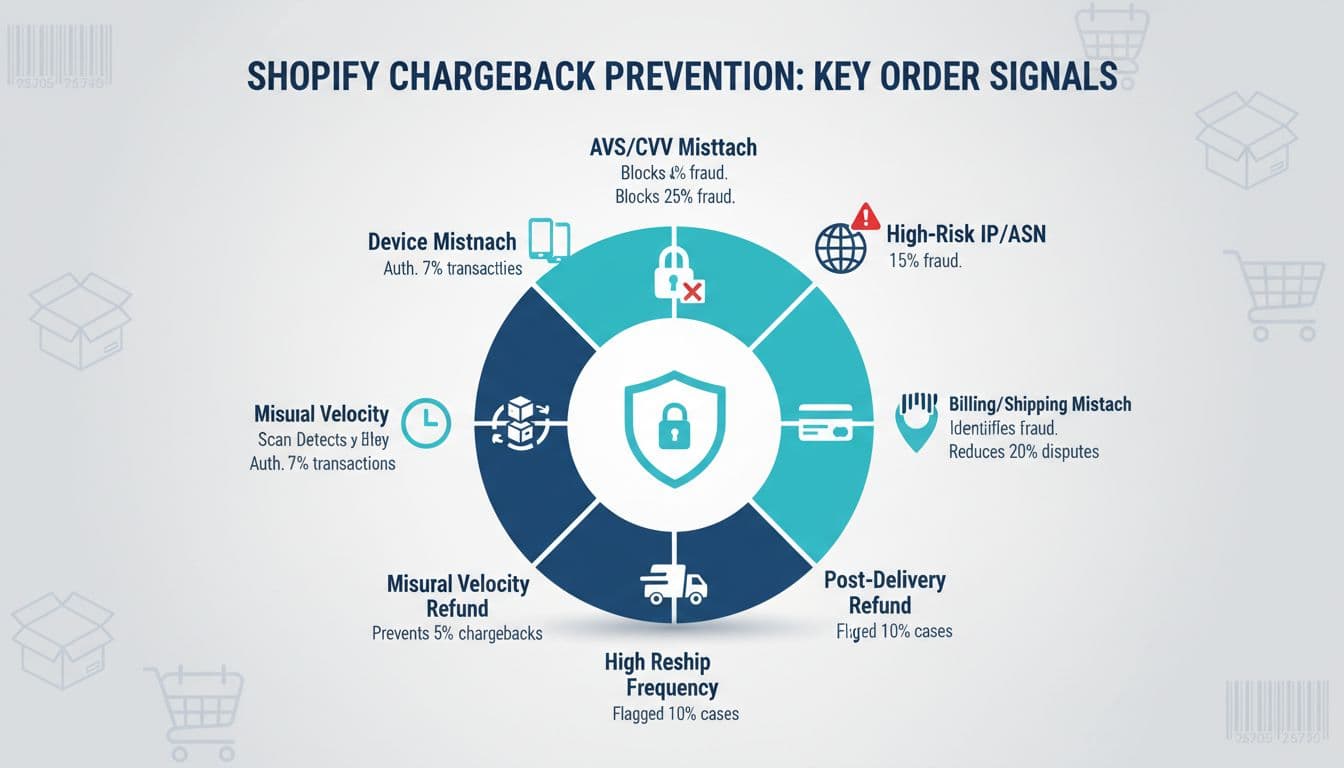

Stage 2: Order signals (at-risk detection) you should monitor daily

At-risk detection means you don’t wait for a chargeback email to tell you something went wrong. You flag risky orders early and choose the right action: approve, hold for review, request verification, or cancel and refund.

Here are order signals that consistently correlate with future disputes:

- AVS/CVV mismatch (or repeated failures)

- Billing and shipping mismatch, especially first-time buyers with high AOV

- High-risk IP/ASN or location anomalies (country, region, proxy behavior)

- Velocity spikes (many attempts, many cards, many orders in minutes)

- Reship frequency or prior “lost package” history tied to the same customer identity signals

- Delivery scan missing after your typical carrier SLA

- Refund requested right after delivery, especially with vague reasons

Quick question: do you have a written rule for what happens when a “high-risk” order comes in, or do you handle it in Slack every time? If it’s the second one, you’re paying a “chaos tax” that shows up as chargebacks later.

Evidence packets that win representment (what issuers want, not what we wish they wanted)

When you fight a dispute, you’re not arguing with your customer. You’re educating an issuer reviewer who has limited time and a checklist mindset.

Stripe’s documentation on dispute evidence best practices aligns with what I see work across Shopify brands: keep it clear, relevant to the reason code, and easy to verify.

Build one “master evidence packet,” then swap in reason-code-specific proof:

Core evidence (include almost always)

- Order confirmation and itemized receipt

- Customer identity signals (name, email, phone) and any verification results

- Timeline: order date, fulfillment date, tracking events, delivery confirmation

- Your policies (as shown at purchase), plus proof the customer had access to them

- Customer support thread (calm, factual, complete)

Add-on evidence (use based on reason code)

- Delivery signature or photo (when available)

- Product page screenshots proving what was promised

- Return/refund logs and outcomes

- Subscription cancellation or pause records

- Prior successful transactions from the same customer (where network rules allow)

If you’re serious about scaling this, look at how chargeback teams structure automation and workflows. This overview of chargeback management tools in 2025 is a useful starting point for understanding what software can and can’t do, especially as dispute timelines tighten.

Win rates by reason code: what’s easiest to win, and what’s usually uphill

There isn’t one universal win-rate chart that applies to every Shopify store. Category, shipping method, customer support quality, and evidence discipline change the outcome fast. That said, you can still predict directional win likelihood by reason-code family, based on how “provable” the claim is.

This is also why “fight everything” is a bad policy. You want to fight the disputes where your evidence is strong and the economics make sense.

| Reason-code family (plain English) | Typical win likelihood (directional) | Evidence that moves the needle most |

|---|---|---|

| Fraud / Unauthorized purchase | Medium (can be low without strong identity proof) | AVS/CVV results, IP/device signals, customer account login history, prior legit purchase history where allowed |

| Non-receipt (INR) | High when tracking shows delivery | Carrier tracking timeline, delivery scan, signature/photo, address match, support outreach attempts |

| Not as described | Low to Medium (depends on proof and product type) | Product page screenshots, specs, photos, serial numbers, QC logs, customer messages admitting use or fit issues |

| Processing error / Duplicate charge | High if it’s truly an error and you can show it | Processor logs, auth and capture IDs, refund receipt, clear timeline showing correction |

| Subscription / Canceled | Medium (swings widely) | Cancellation timestamps, renewal reminders, terms accepted at checkout, usage logs for digital/subscription access |

If you want to pressure-test your current process, it helps to understand the non-obvious factors that affect outcomes (clarity, timing, evidence relevance). Disputifier’s summary of factors that determine how often merchants win chargeback disputes is a solid checklist for where teams tend to lose points.

Conclusion: run chargebacks like a system, not a fire drill

Shopify chargeback prevention isn’t one trick. It’s a loop: reduce confusion upfront, catch risky orders early, submit issuer-friendly evidence, then review results by reason code until your weak spots stop repeating.

Your next step depends on where you are: if you’re early-stage, build your evidence packet template and tighten policies this week. If you’re scaling, assign an owner, add order-signal routing, and review win patterns monthly. Either way, treat chargebacks like ops work, not bad luck.

What’s your most common dispute reason code right now, and what do you think is causing it: fraud, shipping, product expectations, or cancellation friction?

Frequently Asked Questions

What is the most common reason Shopify merchants lose chargebacks?

Most stores lose because they submit too much “fluff” instead of the specific evidence the bank requires for a particular reason code. For example, providing a tracking number is helpful, but providing a delivery confirmation with a GPS map or a customer’s signature is what actually wins a non-receipt claim.

How do I win an “item not received” chargeback on Shopify?

To win these disputes, you must prove the package reached the exact address provided at checkout through official carrier data. Your evidence packet should include the tracking timeline, a link to the carrier’s website, and a photo of the delivery or a signature if you have one.

Does a high fraud risk score on Shopify mean I should always cancel the order?

A high-risk flag is a signal for manual review, not an automatic command to cancel. You should look for specific red flags like a billing address that is thousands of miles from the shipping location or multiple failed credit card attempts before finally getting an approval.

Can I fight a chargeback if the customer says the product was not as described?

Yes, but these are harder to win because they are subjective and require proof that you delivered exactly what was promised on your store. You can improve your win rate by including high-quality product photos, clear sizing charts, and copies of your store’s return policy that the customer accepted.

What is “friendly fraud” and how does it impact my store?

Friendly fraud happens when a customer makes a legitimate purchase but later disputes it with their bank instead of asking you for a refund. It is a major issue because it feels like a real sale initially, but it eventually hurts your profit margins and increases your payment processing fees.

How quickly should I respond to a new Shopify dispute?

You should respond as soon as you have gathered your evidence, but never rush a submission without a complete packet. Banks have strict deadlines, so setting up an internal system to handle these within 48 hours ensures you never lose a case simply because you ran out of time.

Why do banks usually side with the customer during a payment dispute?

Credit card companies are legally required to protect consumers, which often makes the process feel unfair to the business owner. You can overcome this bias by providing organized, professional proof that shows you followed every rule and communicated clearly with the buyer.

Will charging a restocking fee help me prevent future chargebacks?

Actually, hidden or high restocking fees can often trigger more disputes because customers feel cheated and turn to their bank for help. It is much better to have a simple, fair return policy that encourages customers to talk to you directly instead of filing a formal complaint.

How can a simple order signal model help me scale my business?

By scoring orders based on risk signals like IP address and shipping mismatches, you can automate your shipping for safe orders and only spend time reviewing the risky ones. This prevents your team from becoming a bottleneck as your order volume grows from hundreds to thousands of packages per month.

What should I do if my chargeback rate goes above one percent?

If your dispute rate hits one percent, you need to immediately audit your shipping times and customer service response speed. Most high chargeback rates are caused by slow shipping or a support team that is taking too long to answer simple “where is my order” emails.

Curated and synthesized by Steve Hutt | Updated January 2026

📋 Found these stats useful? Share this article or cite these stats in your work – we’d really appreciate it!