Scaling on Shopify, Amazon, Meta, Google, Klaviyo, TikTok, and other platforms in 2026 requires more than just launching new creatives or adjusting margins by small percentages.

Reliable, unified data analytics have become crucial for making informed decisions, protecting your margins, and driving real growth. When data is scattered across platforms like Klaviyo, Meta, and your own store, this data sprawl can cloud clarity—something I’ve seen stall progress, confuse teams, and ultimately cost brands significant revenue. This review covers Triple Whale Analytics, helping you understand how this platform supports better decision-making and enhances growth performance.

Triple Whale markets itself as the go-to analytics platform for high-velocity commerce brands focused on scalable growth. Trusted by more than 45,000 brands and processing over $65 billion in annual commerce data across Shopify, Amazon, Meta, Google, Klaviyo, TikTok, and other platforms, it consolidates marketing, customer, and sales data into a single dashboard that delivers actionable insights into what truly drives performance. For DTC operators and consultants who value sustainable growth over quick fixes, understanding where Triple Whale adds leverage—and where it might fall short—is essential.

What Is Triple Whale? Platform Overview and Evolution

Let’s get straight to the point: if you’ve reached a limit with fragmented analytics or struggle to trust your blended MER, understanding the evolution of Triple Whale could be the key. This isn’t just another analytics dashboard app. The latest version of Triple Whale revolutionizes how merchants consolidate, analyze, and act on their data. Curious about what’s new in 2026 or why it’s important? Pull up a chair. Here’s the real insight.

A Unified Platform Built for Growth

Triple Whale started as a unified platform aimed at solving the challenge of siloed data—bringing every order, ad, and customer event into one seamless interface. Over time, what truly set Triple Whale apart wasn’t simply its data aggregation but the valuable insights surfaced that users can act on. The platform goes beyond generating reports; it empowers teams to make faster, smarter decisions essential for growth when scaling is non-negotiable.

At the heart of the platform is an AI-optimized data warehouse enabling:

- Real-time reporting and attribution (no more delays when quick answers are needed)

- Unlimited data history for querying information across years—not just recent months

- Over 50 integrations, including Klaviyo, Meta, Google Analytics 4, Okendo, Yotpo, and more

I’ve witnessed teams transition from juggling spreadsheets to running operations from a single source of truth—something many tools claim but few truly deliver.

The Rise of AI, Moby, and Intelligent Agents

The most significant leap in Triple Whale’s evolution is the introduction of Moby AI and its intelligent agents. This AI-powered feature is far from superficial; think of Moby as your on-demand data scientist, trained specifically on your unique context. With Moby, you can:

- Chat with your data in plain English right from your dashboard

- Generate forecasts, anomaly alerts, creative performance analysis, and deep-dive LTV models—all powered by Moby’s intelligent agents

- Build custom agents that serve as playbooks for acquisition, retention, or creative performance based on your logic

- Collaborate by sharing agent outputs or transforming chat discussions into recurring tasks

This AI intelligence enhances decision cycles for operational leaders, delivering actionable insights that help pinpoint opportunities, identify margin leaks, and spot emerging trends before they show up in your financials.

Practically, the platform now allows analysis of Klaviyo subject lines alongside outcomes or treating Shop App purchases as a unique channel. Creative teams can draw inspiration from the Meta Ads Library or even generate video briefs using AI. CMOs benefit from live benchmarks—all without leaving the platform dashboard.

Continuous Integration and Advanced Measurement Capabilities

Triple Whale’s evolution isn’t static. The platform continuously expands its integrations to cover every corner of the modern tech stack. Recent additions include Walmart Marketplace, AppLovin, LinkedIn Ads, Adroll, and emerging TikTok formats. A strong focus on cross-channel measurement blends multi-touch attribution, GA4 side-by-side metrics, and comprehensive funnel cohort analysis.

Operational teams can now activate custom events, define new metrics for Sonar Optimize, and leverage updated industry benchmarks to evaluate performance. The Summary Page update includes “Total Units Sold”—a subtle yet powerful feature providing immediate context for inventory and sales planning.

For retention-focused teams, AI-driven LTV insights, segment syncing, and automated flows enhance customer lifetime value without manual effort. This strategic stance redefines how teams play offense—not just defense—in a competitive market with rising customer acquisition costs.

The 2026 Context: Why Triple Whale’s Evolution Matters

Ecommerce complexity is increasing. As we move into 2026, higher ad costs and shrinking baskets mean success belongs to those who can leverage live data the fastest. Triple Whale’s transformation into an agent-powered platform tackles this challenge head-on.

Now, you can:

- Simulate marketing mix allocations using MMM right within Moby Chat

- Instantly test incrementality with Geolift tools

- Send activation data to any partner or ad platform via open APIs—escaping the confines of traditional reporting silos

- Receive business-context intelligence that goes beyond “what happened” to actionable recommendations on “what to do next”

From its origins as a helpful dashboard to a comprehensive operational command center, Triple Whale’s platform evolution is about building a scalable machine designed to discover and act on growth opportunities ahead of your competition.

For an in-depth look at how top-tier ecommerce leverage Triple Whale’s AI tools to drive meaningful outcomes—not just vanity metrics—check out the recent ecommerce podcast episode 395 insights.

Triple Whale Key Features and Capabilities in 2026

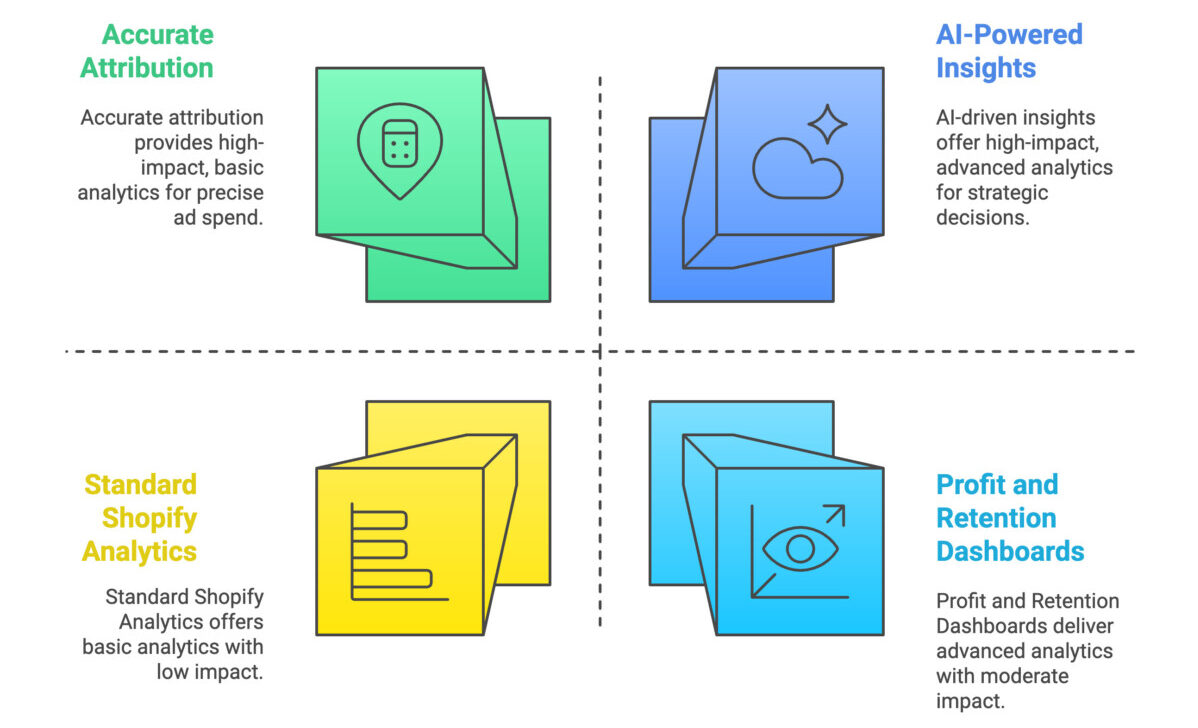

For Shopify and other ecommerce brands aiming to advance their analytics approach, Triple Whale offers more than just another platform. In 2026, success hinges on whether your tech stack can scale efficiently, deliver actionable intelligence, and protect your margins. Triple Whale Analytics shines by providing clarity, speed, and measurable impact—especially when compared to standard Shopify Analytics. Let’s dive into the standout features that set a new benchmark for operators who demand precision and performance.

Accurate Attribution and Tracking with Triple Pixel Technology

Attribution accuracy is essential for optimizing ad spend and avoiding costly assumptions. Triple Whale’s multi-touch attribution system provides Shopify brands with transparent insights into exactly which touchpoints drive conversions, surpassing the constraints of typical Shopify Analytics.

Key highlights include:

- Triple Pixel technology fills data gaps left by traditional platform tracking like Meta and Google, ensuring your acquisition cost data remains reliable.

- Cross-channel measurement captures performance throughout the entire customer journey, even when iOS updates and privacy regulations affect legacy tracking methods.

- First-party data foundation with server-side tracking significantly minimizes signal loss by integrating browsing, order, and engagement data across devices and sessions.

- Live attribution dashboards offer real-time views of spend and return across Meta, Google, TikTok, Shop App, and email flows—removing the need for delayed exports or combined reports.

For brands investing heavily in paid channels, this level of attribution fidelity is crucial. As one rapidly scaling founder explained, “We live and die by Triple Whale’s blend of source-of-truth attribution.” When evaluating options, consider how Triple Whale compares with Northbeam and Elevar, particularly in data quality and tracking reliability.

Profit and Customer Retention Dashboards to Optimize Performance

Scaling effectively requires tracking the right metrics. Triple Whale’s profit and lifetime value (LTV) dashboard is designed for founders and operators who value profit alongside revenue—and appreciate the vital role of customer retention.

Notable features based on extensive testing include:

- Automated P&L views that deliver real-time profit insights broken down by product, marketing channel, or cohort rather than focusing solely on top-line sales.

- LTV calculations and cohort analyses that expose lifetime value differences by first purchase, creative group, or channel—enabling more strategic ad spend allocation to maximize conversions.

- Average order value (AOV) trend monitoring highlights changes in purchasing habits, helping teams optimize bundles, upsells, and offers.

- Retention dashboards with proprietary cohort tools identify churn risks early and evaluate how sticky your customer base remains before repeat purchase rates decline.

This data-driven platform empowers teams to take decisive action. For example, if True AOV is $95 but high-LTV segments average $130, you can adjust your marketing spend and email flows accordingly.

AI-Powered Insights and Automation with Moby AI Agents

Triple Whale’s Moby AI agents elevate analytics from passive watching to proactive brand intelligence. In 2026, Moby delivers sharper, faster, and highly contextual insights that go well beyond traditional tools.

Key AI-powered capabilities include:

- Proactive recommendations that spot anomalies such as spikes in CAC, drops in repeat rates, or inventory shortages before these issues impact critical seasons like Q4.

- Custom AI agents provide tailored playbooks for anomaly detection, inventory forecasting, or monitoring creative performance—significantly reducing manual analysis efforts.

- Predictive analytics enhancements allow teams to forecast demand, LTV by channel, and creative fatigue, plus run “what-if” scenarios on channel mixes and offers within minutes.

- Conversational analytics bring the “chat with your data” concept to life, letting users ask, “Which creative drove LTV in Q1?” and receive detailed, actionable answers instantly.

This transition means brands are no longer reacting late or babysitting dashboards; instead, they steer operations with real-time intelligence and reliable forecasting. For scaling brands, leveraging AI like Moby is a multiplier for brand success, not just another line item.

Triple Whale’s blend of advanced attribution, deep profitability insights, and AI-driven automation sets a standard that clearly differentiates it from platforms like Northbeam, Elevar, and native Shopify Analytics when it comes to unified data and actionable intelligence.

Pricing Breakdown: Is Triple Whale Worth the Investment?

Let’s put pricing in full daylight. If you’re reading this Triple Whale review to decide whether the numbers add up, you’re not alone. Many fast-growing Shopify brands I know focus on two core questions: “Do I get more strategic power for my spend?” and “Does it actually drive measurable profit?” What I want you to understand is this: Triple Whale’s price isn’t just another SaaS bill—it’s either a growth and profit driver or a costly distraction, and getting that calculation wrong isn’t an option.

Core Pricing Structure: What You Get for Your Money

Triple Whale offers a tiered platform designed to match the stage and ambition of your store. Whether you’re a lean DTC operator or managing a complex multi-brand portfolio, the pricing aligns with the depth of advanced analytics, AI capabilities, and support you actually need.

Key components that shape your cost (and value):

- Base Analytics Platform: Every plan includes real-time reporting, essential attribution, unlimited historical data, and core integrations with Shopify, Meta, Klaviyo, and Google.

- AI Capabilities: Advanced tiers unlock AI-powered forecasting, agents, inventory predictions, and other “always-on” automation features.

- Integrations and Customization: Higher plans provide extensive API access, custom events, cross-channel attribution, and granular cohort analysis.

- Support Levels: Priority onboarding and hands-on BI support are available at the enterprise level—a gamechanger for teams running eight-figure brands.

Here’s a condensed breakdown for easy scanning:

Plans adjust based on your order volume and SKUs under management. If you’re uncertain between tiers, base your choice on how many integrations and AI-driven features your operating team will unlock immediately—otherwise, start smaller and scale when the impact on growth and profit is proven.

Is Triple Whale More Expensive Than Your Current Stack?

At first glance, Triple Whale’s monthly price may seem high if you’re coming from fragmented, “budget” analytics or basic reporting tools. But here’s what stood out during my own brand reviews: most advanced Shopify teams already spend $500–$1,500 monthly on a fragmented mix of apps just to piece together attribution and core analytics. These “cheaper” stacks usually include:

- Multiple dedicated reporting dashboards and tools

- Separate cohort retention apps

- Attribution point solutions

- Data enrichment and identity tools

- Internal data warehouses or complex Google Sheets setups (plus a part-time analyst)

The true cost is more than subscription fees—consider hidden headcount, missed growth opportunities due to lagging data, and margin leaks from inconsistent reporting. Triple Whale collapses these functions into one unified stack, cutting both operating expenses and cognitive overhead.

ROI: What Real-World Gains Are Brands Seeing?

You want numbers, not just features. Here’s the pattern consistently reported in review after review:

- Brands switching to Triple Whale experience a 42% lift in new customer revenue within the first 90 days—the platform’s focus on actionable data and AI-driven optimizations drives smarter acquisition decisions, not just cleaner reporting.

- 42% average increase in new customer revenue 90 days after signing up with Triple Whale

- 22% average increase in Klaviyo flow revenue from usage of the Sonar Send feature, while Sonar Optimize increases ROAS by an average of 17%.

- During major sales events like BFCM, Triple Whale customers have unlocked over $1.2M in incremental revenue through features like Sonar Send and dynamic creative analytics.

- For high-volume stores, one of the fastest ROI wins is time saved: centralized reporting and automated cycles deliver a 30–40% efficiency increase for BI and marketing teams, according to first-party feedback from leading DTC brands.

- Smarter inventory and P&L intelligence empower operators to make decisions that improve net margin—real-time data preventing over-ordering or wasted ad spend.

Put simply, Triple Whale isn’t an “expense.” When fully implemented, it acts as a powerful growth and profit driver built into your operating system.

Strategic Takeaways: Should You Pay Up?

Forget hobby math—focus on which parts of your P&L will shift if you get this right. Triple Whale is worth the investment if:

- You’re spending meaningful ad dollars but feel uncertain about return attribution

- Your high-value customers are slipping away due to gaps in lifetime value intelligence

- Your BI or marketing teams are juggling data across too many tabs

- Automation and forecasting could free up capacity to focus on actual growth, not grunt work

A final note from experience: the fastest-growing brands I trust treat Triple Whale’s monthly spend as a ticket to strategic scale, not just another SaaS tool to cut on renewal. The speed, clarity, and “do the thinking for me” automation are becoming essential for leading DTC teams.

Pros and Cons of Triple Whale for Shopify Brands

If you’re scaling a Shopify business and want to cut through the noise around another analytics platform, this section offers a straightforward look at where Triple Whale excels—and where it might present challenges. After helping over 40 companies implement single-source analytics solutions, I can confidently say that even the best tools have trade-offs. Let’s focus on the practical, bottom-line impact of this solution.

Key Advantages: Strategic Strengths of Triple Whale

Triple Whale isn’t just another tool—it’s built for operators who need clarity and speed in their decision-making. Here’s what truly drives results for DTC founders and growth teams:

- Centralized, Actionable Data: Aggregating data from Shopify, Meta, Klaviyo, and more, Triple Whale eliminates hours wasted on spreadsheets and juggling separate dashboards. One mid-market Shopify business saved 8–12 hours weekly, allowing their marketing lead to focus on real strategy instead of busy work.

- Real-Time Attribution: The proprietary Triple Whale pixel combined with server-side tracking fills in gaps left by Meta and Google, providing a more accurate view of where revenue and conversions originate. If conflicting CAC reports frustrate you, this feature delivers a reliable source of truth.

- AI-Powered Insights: Enabled by Moby, this isn’t your usual “cute AI.” Ask complex questions like “Which channel boosted LTV last quarter?” and receive contextual, actionable insights. This direct connection to your data goes far beyond a typical dashboard.

- Growth-Focused Reporting: Automated P&L dashboards, AOV trend lines, and customer retention analyses empower founders to identify profit leaks by cohort or segment. I’ve seen teams use these tools to quickly tighten offers and improve net profit.

- Industry Benchmarks & Creative Performance Analysis: Triple Whale allows you to compare KPIs against top-tier companies and break down creative performance by SKU, campaign, or demographic. This has revealed standout creatives that doubled ROAS.

- Plug-and-Play Integrations: Setup is fast and intuitive. For those dreading complex onboarding, this is about as frictionless as it gets—most Shopify merchants go live within a day, even with 8-10 integrations.

Here’s a quick comparison table highlighting the core strengths and their impact:

Cons: Limits and Challenges You Need to Know

Despite its advantages, Triple Whale isn’t a cure-all. It has inherent limitations—some tied to its Shopify focus, others reflecting analytics realities at scale.

- Shopify Exclusive: If you plan to expand beyond Shopify, you’ll hit a roadblock. Triple Whale doesn’t natively support platforms like WooCommerce or Magento, and migrating can be challenging.

- Steep Learning Curve for Power Users: While setup is quick, mastering advanced features like custom dashboards, logic configurations, and nuanced attribution can take two to three weeks of dedicated use. Teams without a data-driven owner might struggle to adopt fully.

- Pricing Grows with Usage: Costs increase alongside your revenue and feature needs, with larger businesses potentially paying over $4,000 per month. Higher-tier plans may also restrict features vital after your first year.

- Not Ideal for Every Business Model: Short purchase cycles, single SKU offerings, or companies relying exclusively on one channel (Google or Meta) may not benefit fully from advanced attribution or cohort tools. Those heavily focused on customer retention with specialized CRMs might find limitations.

- Occasional Reporting Discrepancies: No analytics solution is perfect. Some users report data mismatches between Triple Whale and Shopify or Meta Analytics. These usually stem from differences in attribution models or sync delays but are worth monitoring if pixel-perfect reporting matters.

- Support Can Lag: While onboarding is generally smooth, support response times may slow during peak periods like BFCM or major launches—potentially leaving you short on assistance when it counts most.

Here’s a summary based on direct testing and user feedback:

- Exclusively Shopify with no easy pivot to WooCommerce or Magento

- Requires a dedicated data driver for full adoption

- Pricing scales with revenue and feature needs

- Less suited for single-channel or impulse-buy-focused businesses

- Minor but notable reporting discrepancies occasionally occur

- Support responsiveness can wane at critical times

Should Triple Whale Be On Your Shortlist?

If your Shopify business has outgrown patchwork dashboards and you’re losing time reconciling data across systems, Triple Whale brings order, focus, and genuine operational clarity. However, it’s wise to consider your growth trajectory and team bandwidth before committing. Is your team ready to adopt a data-driven solution deeply, or are resources stretched too thin? From my experience, organizations that treat analytics as a core operating system—not just a “nice to have”—gain the most from Triple Whale.

Quick question: Do you have someone dedicated to driving adoption and consistently uncovering insights? If not, the real risk isn’t cost—it’s paying for clarity you never leverage.

Real-World Use Cases and Success Stories

The true test of any analytics offering lies not in a polished demo but in how it enables teams to overcome challenges and improve growth amid the fast-moving world of high-volume ecommerce. Around strategic discussions, we share examples where a solution pulled us out of a bind, uncovered hidden opportunities, or saved substantial effort normally spent on manual data tasks. Triple Whale has increasingly become a key part of those stories—supporting sharper decisions, measurable lifts, and hours saved from cross-referencing disjointed exports.

Let’s explore what’s happening right now with companies leveraging Triple Whale on Shopify in 2025 and 2026. These aren’t hypothetical situations; these involve real operators and tangible metrics that truly moved the needle.

Making Smarter Decisions with Unified Measurement

I’ve witnessed skilled teams eliminate marketing uncertainty once they integrate all their channels through Triple Whale’s unified measurement solution. By combining Multi-Touch Attribution (MTA), Marketing Mix Modeling (MMM), and live incrementality testing—all powered by Moby AI—operators gain a unified data perspective. This clarity ends endless debates over whether Meta or Google deserves credit, or if email is genuinely driving sustainable growth.

- Case in Point: A global DTC company executed a major giveaway. Guided by Moby AI, they adjusted their budget in real time, resulting in a record-breaking day that outperformed previous benchmarks by 35%. The system accurately tracked when organic momentum faded and when paid spend needed to fill the gap.

- Quick wins: Users report a 42% boost in new customer growth within 90 days of adopting Triple Whale’s measurement features.

This success comes from combining precise attribution with AI-driven budget recommendations and live campaign feedback delivered at the moment it matters most.

Automating Reporting and Detecting Anomalies

The most effective operators avoid spending hours manually pulling exports or stitching Shopify and Meta reports together. Instead, they rely on automated reporting capabilities to process data, spot anomalies, and streamline their review cycles seamlessly.

- Origin’s team reduced reporting time by 40% after switching to AI-driven dashboards. Their BI function shifted from bottleneck to value driver, freeing up hours each week.

- Porter Media, an agency, cut reporting time by 70%, saving over 20 hours weekly. They accelerated operations while increasing client trust and transparency, freeing resources to focus on growth initiatives.

These efficiency gains mean the difference between merely reacting and leading proactively.

- For further reading on why AI automation and analytics are essential for rapid scaling, explore our guide on essential AI skills for ecommerce.

Growth and Risk Management Through AI

Triple Whale’s AI capabilities extend beyond showing “what happened” to explaining “why,” often prompting immediate, actionable steps.

- Origin unlocked $420,000 in additional revenue within a year by deploying Sonar Send, which identified and launched high-performing email flows exactly when prospects were most likely to convert.

- LSKD prevented over $100,000 in fraudulent affiliate payouts by using Triple Whale’s fraud detection features. With a true unified view of their data, they increased Meta ROAS by 30% and net profit by 60% year-over-year.

Some of the most impactful examples happen during volatile sales seasons like Black Friday and Cyber Monday. Users tracking TikTok ad performance in real time with Triple Whale achieved a 46% ROAS improvement compared to the year before. These outcomes aren’t illusions—they come from clear, unified, and trustworthy reporting.

Data Trust and Operational Clarity

The priority isn’t just generating insights but confidently acting on trustworthy data. Teams frustrated by pixel inconsistencies or Shopify-to-Meta mismatches now turn to Sonar to enrich and correct marketing data across channels. Some have reached up to 90% reporting accuracy—even in privacy-restricted markets like the UK and EU.

For customer retention, creative development, and landing page optimization, analytics reveal revenue leaks and identify which creative assets or offers deserve more budget. I’ve heard from CMOs who replaced an entire analyst headcount, freeing resources to hire a new growth lead instead.

Where Triple Whale Fits in the Modern Shopify Stack

The bottom line: Triple Whale is the trusted source of truth for over 45,000 companies. The impact that resonates most?

- Up to 78% reduction in manual reporting cycles

- 42% average increase in new customer growth within 90 days

- Uncovered hidden discrepancies exceeding $100K from fraud and attribution issues

- Teams empowered to move forward with confidence needed to scale, not just survive

For more on optimizing your Shopify integrations for operational clarity, check out the Shopify Editions Summer 2025 highlights.

If your instincts say there’s room to tighten your data flow and unlock new growth, you’re right. The biggest successes come to operators bold enough to leverage unified, actionable analytics that drive real-world results.

Who Should (and Should Not) Use Triple Whale?

Triple Whale isn’t ideal for every company, and that’s actually a positive.

If you’re reading this Triple Whale Review, you want to see if it aligns with your team, brand, and scaling ambitions. I’ve observed founders achieve remarkable returns by fully embracing the platform—and I’ve also seen teams struggle by adding a complex solution when they weren’t ready to leverage it effectively. In this section, I’ll guide you on who truly benefits from Triple Whale, who might want to rethink, and why distinguishing these groups is crucial if you’re aiming to scale smarter instead of just adding more software.

Triple Whale Is a Strong Fit For…

Those who maximize value from Triple Whale tend to share several defining traits. Here’s where the platform shines:

- Established Shopify enterprises growing beyond $1M annually: At this stage, dealing with complex data becomes a costly challenge. Triple Whale turns that complexity into clear daily intelligence, tailored for Shopify’s ecosystem.

- Operators overwhelmed by data chaos, looking for a unified source: If your mornings are spent juggling multiple dashboards like Shopify and Meta, Triple Whale consolidates everything efficiently, automating much of what usually requires manual oversight—without hiring extra people.

- Marketing teams with substantial paid budgets: As acquisition costs rise, precise understanding of spend performance, live creative tracking, and cohort-level customer retention analysis become essential. Triple Whale fits perfectly for marketers handling multi-channel, multi-product efforts.

- Teams dedicated to ongoing testing and optimization: With automated anomaly detection and predictive forecasting, it serves those who constantly recalibrate budgets, run experiments, and strive to improve current outcomes rather than just reviewing past numbers.

- Groups with a committed analytics or data-driven owner: Whether it’s an ecommerce lead or a skilled partner, active management is key to unlocking AI-generated intelligence and making full use of customizable dashboards. Passive usage won’t bring the desired returns.

If your team matches any of these profiles, Triple Whale moves beyond a simple reporting tool to become your analytics co-pilot for better decision-making. Many report up to a 42% lift in new customer metrics within 90 days due to rapid actionability. To learn how other Shopify stores tap into advanced analytics, explore these hands-on use cases.

Who Should Avoid Triple Whale?

Let me be direct—Triple Whale isn’t a one-size-fits-all solution, and that honesty often gets lost in standard reviews:

- Very early-stage stores (under $500k/year, basic acquisition only): Without multi-channel complexity, this platform may feel like overkill. Most features will go unused, resulting in unnecessary spend.

- Companies outside Shopify or those planning to migrate: Triple Whale’s strength lies in its deep Shopify integration and single-source-of-truth promise. For those on WooCommerce, Magento, or seeking a platform-agnostic alternative, other analytics options are better suited.

- Teams lacking a dedicated analytics or data-driven owner: Someone must champion the platform, tailor dashboards, manage automations, and verify data quality. Without this, the platform serves only superficial purposes, diminishing ROI.

- Organizations relying heavily on specialized platforms for customer retention logic: While Triple Whale provides solid AI capabilities and retention dashboards, it doesn’t replace advanced flows, segmentation, or loyalty features found in dedicated CRM platforms like Klaviyo.

- Single-channel, single-product operations: If most income comes from one source such as Meta spend or organic traffic, advanced features like multi-touch measurement, creative performance intelligence, and forecasting won’t be fully utilized.

Teams embracing Triple Whale as their analytics co-pilot move faster and make smarter choices. Passive users often end with a recurring cost and little payoff.

Who Is (and Isn’t) a Match for Triple Whale?

Making Triple Whale Work for You

Choosing Triple Whale is a strategic move—not just adding another application to your tech stack. Those who gain the most commit to full adoption, assign a dedicated leader, and possess enough data complexity to fully leverage AI intelligence.

If your scaling depends on converting unified analytics into actionable strategy—and you have the right team to execute—Triple Whale quickly earns its place. However, if you only need simple metrics or operate a low-SKU, low-volume store, simpler solutions might be more cost-effective.

Top ecommerce professionals often consider Triple Whale Analytics the cornerstone of their Shopify tech stack once their operations hit a complexity threshold.

The Bottom Line for Shopify Operators

Triple Whale is no longer a “nice dashboard.” It’s an agent-powered analytics OS that unifies your Shopify, ad, and CRM data, then uses AI to tell you what to do next. The platform’s Moby AI Agents automate analysis, surface risks and opportunities, and cut the time your team spends reporting so you can focus on growth. This is why operators treating analytics as a core system, not a reporting add-on, see outsized returns.

What matters most in 2026

- Unified, trusted data: Triple Whale centralizes Shopify, Meta, Google, Klaviyo, and more into a single source of truth. Its Triple Pixel and identity resolution strengthen attribution when ad platform data is noisy.

- AI that does real work: Moby Agents handle creative analysis, acquisition mix, retention drivers, and conversion friction. Teams “chat with data,” run what-if scenarios, and get proactive alerts, not just static reports.

- Measurement you can act on: Unified Measurement blends MTA, MMM, and incrementality testing. You stop arguing channel credit and start moving budget to where it compounds.

- Profit-first views: Real-time P&L, LTV cohorts, AOV trends, and retention dashboards help you guard margin while scaling.

Proof it moves numbers

- New customer revenue: Brands report an average 42% lift in the first 90 days after adoption, driven by clearer attribution and faster budget shifts.

- Time back to the team: Agencies like Porter Media cut reporting time by 70% (20+ hours weekly). Many brands see 30–40% time savings across BI and marketing.

- Revenue unlocked: Sonar Send has generated $420K incremental revenue in under a year for a single brand; BFCM users report live ROAS lifts by catching winning creatives in-platform.

- Profit protection: LSKD prevented $100K+ in fraudulent affiliate payouts and increased Meta ROAS by 30% alongside a meaningful net profit lift.

Pricing and fit

- Pricing is tied to GMV and feature depth. Growth and Pro plans unlock AI agents, predictive analytics, and deeper integrations; Enterprise adds dedicated BI support. Check the live pricing page for current tiers and inclusions.

- Best fit: 7–8 figure Shopify brands running multi-channel paid, with a clear analytics owner. If you have real data complexity, Triple Whale pays for itself.

- Not ideal: Early-stage, single-channel brands; teams without a dedicated owner; non-Shopify stacks.

What to do next (practical playbook)

- Validate attribution, fast:

- Install Triple Pixel and connect Meta, Google, and Klaviyo.

- Compare Triple Whale’s source-of-truth view against ad platforms for 14 days. Shift 10–20% of budget based on coherent signals, not conflicting dashboards.

- Stand up an executive P&L view:

- Build one profit dashboard by product, channel, and cohort.

- Set a weekly ritual to review CAC, MER, contribution margin, and LTV by first product purchased. Make one budget decision every week from this page.

- Deploy two Moby Agents in week one:

- Acquisition Agent to flag wasted spend and recommend mix changes by channel/offer.

- Creative Agent to rank ads by incremental revenue and fatigue risk; refresh the bottom 20% weekly.

- Monetize retention insights:

- Use LTV cohorts to find your highest-value first-product paths.

- Launch one new flow with Sonar Send mapped to that path (browse, cart, or post-purchase) and measure 30-day payback.

- Codify anomaly response:

- Set alerts for CAC spikes, repeat rate dips, or conversion drops.

- Write a 3-step playbook for each alert so your team acts the same day, not next week.

Red flags to plan for

- Learning curve is real: Assign an owner and book two deep implementation sessions. Without ownership, adoption stalls.

- Expect minor data mismatches: Align on attribution models early; document your “source of truth” rules for the team.

- Budget for scale: As GMV and feature needs rise, so does price. Anchor the spend to time saved, ROAS lifted, and margin protected.

Summary

Triple Whale earns a spot as your Shopify command center when you have real data complexity and growth targets tied to profit. The platform unifies messy data, improves attribution clarity, and uses Moby AI Agents to shorten the time from signal to action. When teams commit to weekly rituals and assign a true owner, we see faster budget decisions, clearer creative bets, and measurable lifts in new customer revenue and ROAS. If you’re above seven figures and serious about scaling with discipline, Triple Whale is a sound, defensible move.

Next steps

- Connect Shopify, Meta, Google, and Klaviyo; enable Triple Pixel.

- Build one executive P&L dashboard and one LTV cohort view.

- Launch two Moby Agents (Acquisition and Creative) and set weekly reviews.

- Run a 14-day budget reallocation test based on Unified Measurement.